20 More Banks on Shaky Foundation While JP Morgan Profited $1B on Metals

They want you to think that it’s over, that the new facility that the Fed magically created. They want you to think that that has fixed everything. But all they ever do is change the way they account for things. And what really happens is the system gets more vulnerable because this whole thing hinges on whether or not you believe their lies. And you come here. I’m telling you the truth. And not only am I telling you the truth, but I’m giving you the tools to do your own due diligence. Don’t take my word for anything, but don’t take theirs. Because when you do that, you leave everything vulnerable and exposed. And I’m going to expose the truth. And I’m going to help you not be vulnerable.

CHAPTERS:

0:00 Introduction

1:52 SVB Balance-Sheet

6:55 CEO Stock Selloff

10:00 20 Banks Potential Securities Losses

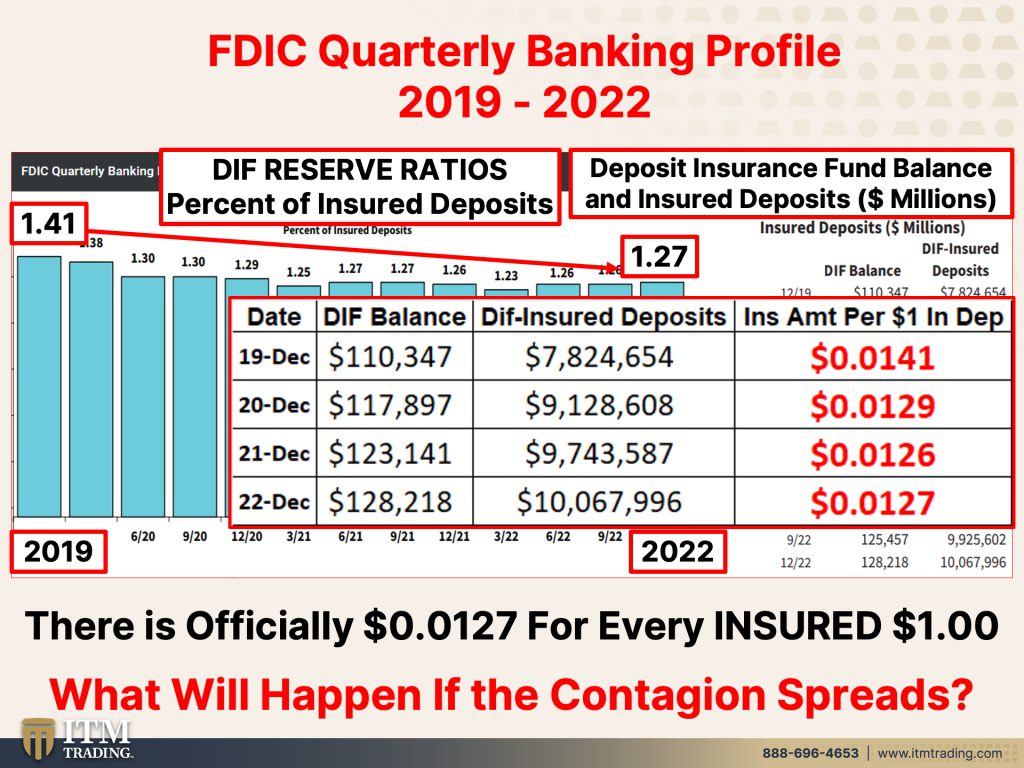

18:00 FDIC Banking Profile 2019-2022

22:08 Gold Premiums

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

They want you to think that it’s over, that the new facility that the Fed magically created, they want you to think that that has fixed everything. But all they ever do is change the way they account for things. And what really happens is the system gets more vulnerable because this whole thing hinges on whether or not you believe their lies. When you come here, I’m telling you the truth. And not only am I telling you the truth, but I’m giving you the tools to do your own due diligence. Don’t take my word for anything, but don’t take theirs because when you do that, you leave everything vulnerable and exposed. But I’m gonna expose the truth and I’m gonna help you not be vulnerable coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, and I am doing what I have been put on this planet to do and I’m getting chills already. And what I want you to know is don’t believe the lies. It is a setup. Are they gonna lose control of this? Well, what’s going to determine that is the confidence that the public gives the Fed. And a lot of people are still not paying attention. So if they can make these markets jump, if they can make these markets seem calm, then most of the people that aren’t paying attention anyway will never understand the shift that just happened or the time bomb that we’re sitting on. Let’s go right to it then.

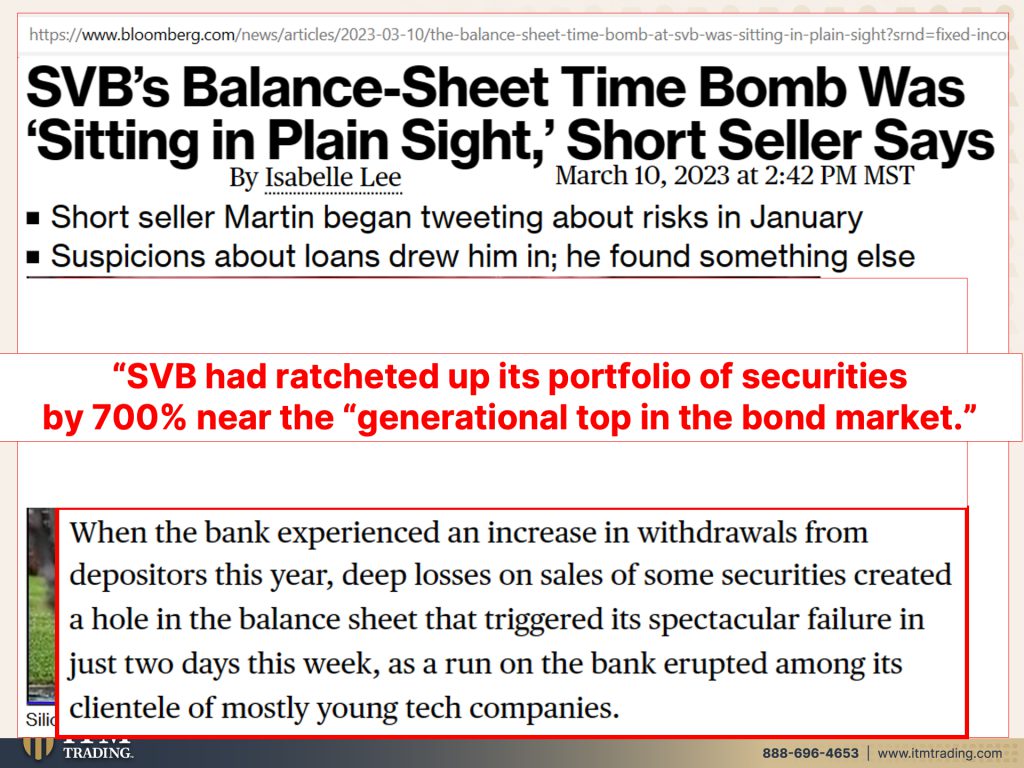

Because SVBs balance sheet time bomb was sitting in plain sight. But the reality is, is they’re not the only ones because after more than a decade of zero interest rate policy and loosening up of investor protections over time, I mean this is the same game that plays out over and over and over again mean back in the crisis with the NASDAQ crisis in 2000. And then what happened in 2001, 9/11/2001. Okay, well we were completely set up for another inflationary sprint, but the problem is, and the same thing, you know, and that’s what led to what happened in 2008 with the derivatives bubble. I mean it popped in 98, what long term capital management and then it popped again in 2007 with the subprime debacle and it will pop for a third time. I don’t think they have another inflationary push in there. I think they have used everything up and we know that because they’ve been anchored at zero and they’re trying to raise it and then something breaks. Of course it does. All of the banks balance sheets are riddled and stuffed with, with bonds and mortgage basket securities and debt that is at super low levels somewhere near zero. We’re not in a zero interest rate policy environment anymore, although they could drop it down.

But even if they do go back to zero, is that gonna fix this problem? No. We have to transition into a new system and maybe this, maybe SVB happened sooner than they had anticipated. And I hope this shows you that these guys are not gods. They’re human beings and they live in an ivory tower. Not in the real world. In the real world. There are thousands of currencies that do not exist, cannot buy you anything anymore, including some of those of the US. I mean these are all from the US. So is this, we don’t think about that, but we should because our dollar, I don’t even have a current dollar in here that’s not frankly ripped up. This one is going the way of the others as well. But let me show you this, okay?

Because SVB had ratcheted up its portfolio of securities by 700%. Near the generational top in the bond market. In other words, remember interest rates, principle value of bonds. So when those interest rates were down at zero, they were buying these very expensive bonds, they had ratcheted up their portfolio 700%. This is the reach for yield. And what they’re really doing is risking your principle for a little pickup in interest. Why would you do that? To me, that makes no sense. These are very risky operations. And when the bank experienced an increase in withdrawals from depositors this year, deep losses on sales of some of the securities created a hole in the balance sheet that triggered its spectacular failure. In just two days. As a run on the bank erupted among its clientele of mostly young tech companies, they can’t afford a run on the banks. That’s why back in 2020 you had all these central bankers trot out and tell you, don’t worry cause we can just, you don’t have to worry about getting cash, we can just go ahead and print as much money as we need to satisfy all of your cash withdrawals. But every time they do that, the value of what’s already out there goes down. So they created this facility so that you so further hidden from you is this time bomb on bank balance sheets further hidden from you. And you know they’re gonna say this is not a bailout except for one big huge thing. And that is it is the taxpayer that is ultimately responsible for any money, any new money that is created by the central bank, by the government. So it is indeed a bailout. They just wanna tweak it, but it doesn’t matter. A rose by any other name is still a rose.

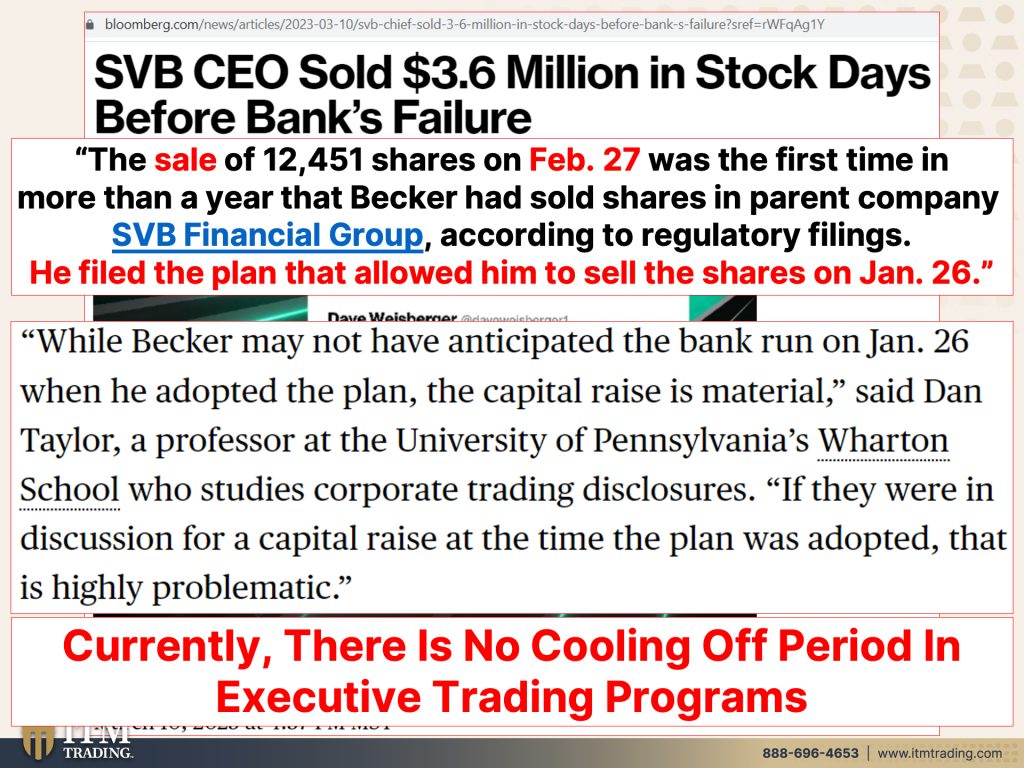

And do you think that he might have known back in January that he was running into potential problems? Do you think that these guys don’t understand how overleverage they are? But they also are counting on the central bank having their back. Does the central bank have the individual’s back? No, they don’t. They have the banks back. That is their job. The general economy is not really their job. Yes, they want price stability. But that’s so that you and I don’t ask for more money when we’re negotiating our wages so that we don’t anticipate higher inflation, which by the way came in and oh my goodness, it’s sticky meaning that inflation is here to stay and now the Fed is between a rock and a hard place. Big time obvious because we’ll see what they’re gonna do as far as raising rates and yeah, this’ll come out on Thursday. So we may or may not have that. I don’t think we’re gonna have that answer quite by then. But you know, are they gonna raise rates 25 basis points just to show us that they’re gonna keep raising? The sale of 12,451 shares on February 27th was the first time in more than a year that Becker had sold shares in parent company SVB financial group according to regulatory filings, he filed the plan to that allowed him to sell the shares on January 26th. Hmm. Isn’t that interesting, while Becker may not have anticipated the bank run on January 26th when he adopted the plan, the capital raise is material because, and the capital raise was what the bank announced that they needed to raise more capital. So the capital raises material blah blah blah. If they were in discussion for a capital raise at the time the plan was adopted, that is highly problematic. In other words, he was trading on insider information. We’ll see what this proves. But you wanna know the truth? I don’t trust any of it. I just don’t. I’m sorry. You wanna know what? I trust physical metals in my possession. That’s what I trust currently. There’s no cooling off period in executive trading programs Now that that is changing. And interestingly enough, that’s changing on April 1st, which I think is really interesting. But that means that once he filed that, that plan that allowed him to sell his shares, he could sell them anytime. He could have sold them the next day, but that would’ve been too obvious. So he sold them a month later. Hmm. What do you think he knew that you didn’t know?

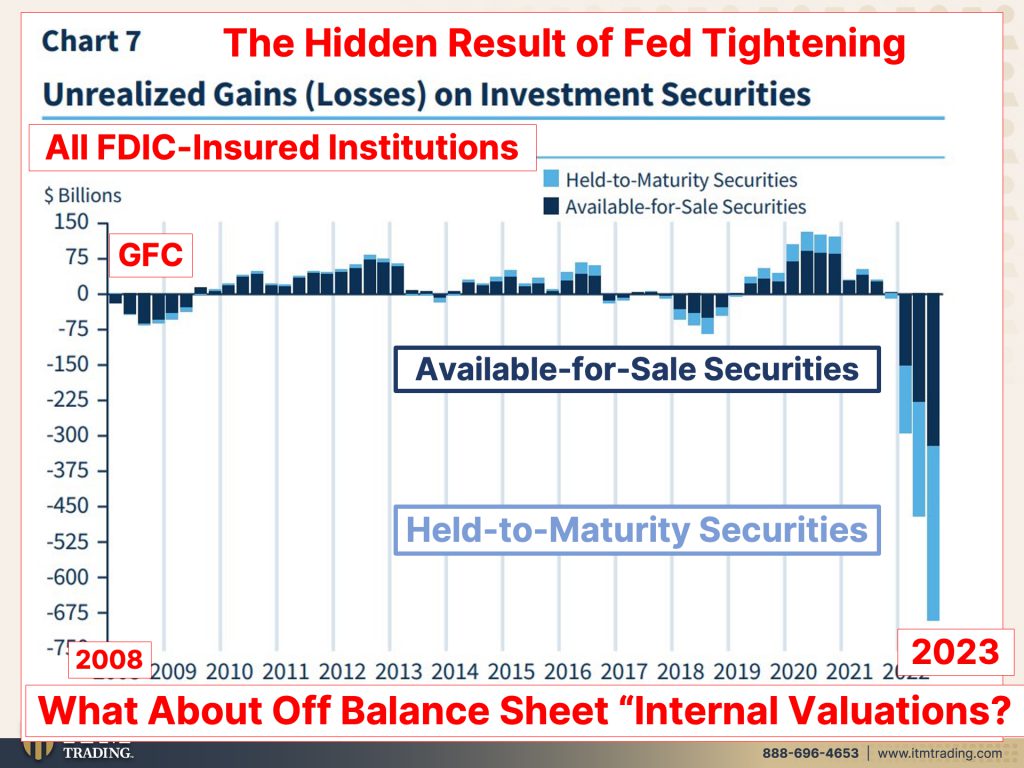

Well, guess what? 20 banks are sitting on huge potential security losses as was SVB. But I’m gonna tell you, and I’m gonna go into this in more detail next week, but they, it’s not just 20 banks, it’s all of the banks and they are sitting on huge losses. And in the derivatives arena, that opaque arena, it’s gotta be really, really bad. This could be the Black Swan event, this could be the Lehman moment. If they can calm everybody down and the public doesn’t notice, the public just kind of goes about their business. I mean it was interesting. I’m going out there. Most people are not aware of what just happened to SVB bank. That helps them, that helps the central bank. That helps the government because they’ve gotta keep your confidence. There are plenty of other banks that would face big losses if they were forced to dump securities to raise cash. So they’ve got to avoid those bank runs because that’s when this becomes obvious. Better to set up that that new facility where you won’t have to take losses on your cash on sell your, your, your losses into the market. No, just bring them here. And the Federal Reserve using taxpayer back dollars, whether they say that openly or not, cause they don’t want you to realize this is not a bail-in, this is not a bail-in, we’re not using taxpayer dollars. That’s garbage. You and I taxpayers backstop those balance sheets. But bring your under underwater securities and we’ll let you borrow as if they’re at a hundred percent. How about you take your portfolio from your stocks that are underwater and go to JP Morgan and say, well, you know, I paid this for ’em and yeah, they’re here now, but I want you to loan me money based on that. Do you think JP Morgan would do that? I’m thinking, not frankly, but just what are those unrealized losses on securities? And I am gonna be a little redundant because obviously this week coming on air more than I anticipated. But let me reveal to you what unrealized losses on securities are. Banks leverage their capital, your deposits by gathering deposits or borrowing money either to lend the money out to purchase securities. So trading <laugh>, okay? They earn the spread between their average yield on loans and investments in their average cost of funds. So whatever they’re paying you. And we all know that even though interest rates have been going up, it’s just recently the banks have started to increase what they’re paying you. But again, I’m gonna go back to you and say, why would you risk your principle for a little bit of interest? It’s not worth it. Even if they’re paying, well, they’re not paying you 5%, but even if they were, why would you risk your principle for that? Available for sale can be sold anytime and those are marked to market. So in other words, wherever the banks, wherever the current market value of those securities are up or down, okay? They’re gonna be marked to market. So all these rules are probably gonna be changing now too. Held to maturity are not marked to market so they can hold them at par value whether they’re higher or lower in the current market price. I showed you this graph yesterday, I’m gonna show it to you again because these are really the hidden result of the Fed tightening even on the Federal reserves balance sheet where they’ve been buying massive amounts of mortgage backed securities, massive amount of treasuries. And we’ve been talking about the lack of liquidity in these markets that has been erupting since 2015. So none of this is a big surprise, but it should all be telling you if this isn’t the Lehman moment, we’re near one. We’re very, very, very near one. So again, if you didn’t see yesterday, these are all FDIC insured institutions. These are not just SVB or small regional banks. These are all insured institutions. Here’s 2008 in the great financial crisis. You can see what that looks like. Now, they had a lot more securities for sale. They weren’t this little blue area. The lighter blue are held to maturity, right? So banks were forced to put up their securities for sale. Now here we are in 2023, there’s your available securities for sale. Pretty significant drop, way more than happened. What happened in 20 in 2008? And they want us to think that this is nothing like 2008. Guess what?

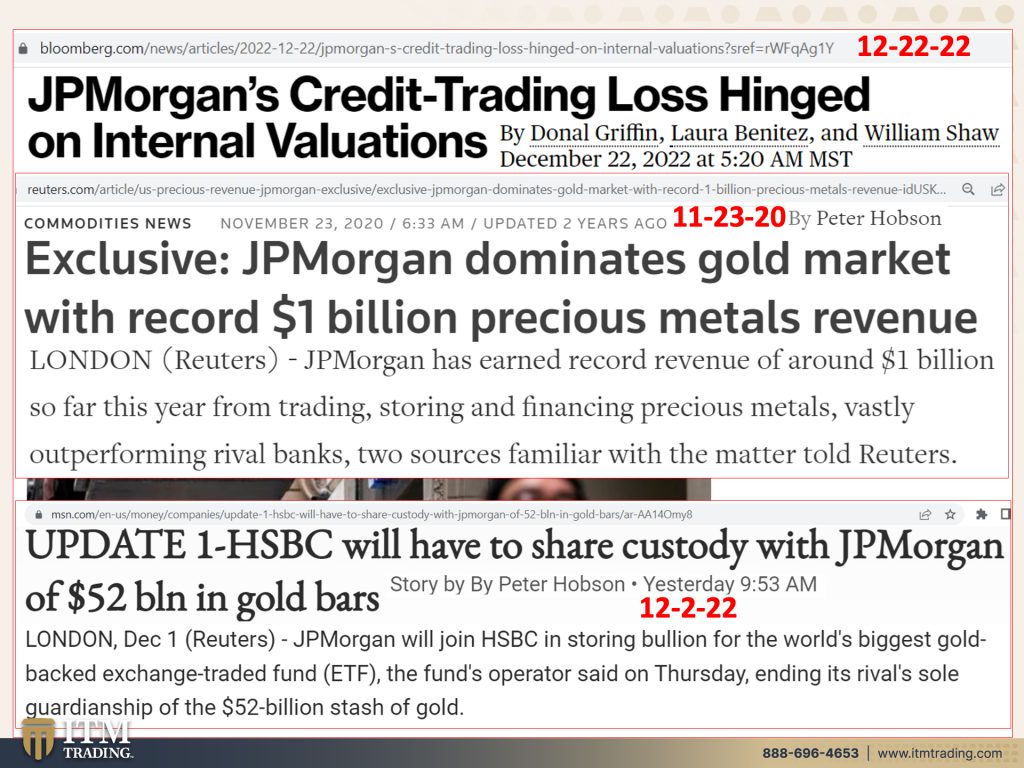

2008 was when the system died and it went on life support of all of this money, free money printing. And it reinflated all of the fiat money assets, stocks, bonds, real estate to keep those derivatives afloat. Make no mistake about what they’re doing here. Don’t look behind the curtain. You just, just just have we’ve got it. You don’t have to worry about a thing. We’ve got it under control really? Because there are so many off balance sheet and internal valuations. How do you really know what that time bomb is? I mean you might remember this JP Morgan’s credit trading loss hinged on internal valuation. Some of those valuations raised eyebrows in the broader market. You think, you think? That was just back in December, not that long ago, but back in 2020, what did JP Morgan also do? They dominate the gold market with a record of billion precious metals revenue that’s trading. By the way, that’s not buying and hold me when I buy it. I hold it JP Morgan. Hey, you could create an unlimited amount of those, of those contracts that’s trading revenue. Don’t you love that? Trading, storing and financing precious metals vastly outperforming rival banks. Now also last December, they HSBC bank has to share custody with JP Morgan of 52 billion in gold bars. And these are the kinds of bars that back exchange traded funds, ETFs. So GLD there, there are a number of them out there that are that, that are held by HSBC and JP Morgan. They’re the ones by the way, that have access to that gold. You if you buy an ETF, you just own a share in a trust. And that trust is designed specifically, and we’re gonna come back to this, but is designed specifically to mirror the or to go with exactly the trade of the spot market. So they just want to look like the spot market all the while selling off holdings to pay all their fees, but they’re the ones that have access.

I also showed you this one yesterday and I really feel both of these definitely or Monday I showed this to you. It, it is worth repeating. This is the DIF reserve ratios. These are the percent of insured deposits. So this is from the FDIC. Their most current goes through the end of 1222. And as you can see back in 2019, which is far as far back as this bar chart goes, they had 1.41% out of a hundred percent to ensure deposits. Looking at 2022 that’s gone down. They now have 1.27% to ensure a hundred percent of insured deposits. Now, what we know is that the actions that the Fed took and the government has taken so that you don’t panic, you don’t go and take money outta your bank, is that they are now going to backstop and ensure a hundred percent of all of the deposits that are out there. Oh good, well how much is there in there anyway, if we go down to here, which is December 22nd, there was 128.218 billion to ensure many trillions of all deposits. So they better not have any more bank runs because this will absolutely overwhelm that system. And everybody would know the emperor is not wearing any clothes and even of the deposits that are insured, well, as long as a whole bunch of banks don’t go out at once, I guess we’re okay, but they only have barely more than a penny to ensure your dollar. And how long is that a hundred percent backing gonna be when they did it in 2008, they went from a hundred thousand to $250K. Well that’s stuck. Is that what they’re gonna try and do now? And by the way, what they’re saying and the reason why they’re saying that this is not going to this is not a bail-in because it doesn’t because taxpayers are not gonna pay for it. Their theory is, is that they’re going to levy special taxes to banks to build up that DIF fund. That’s what they do in a crisis. Well guess what? Banks aren’t gonna be able to backstop all of that. And by the way, what does that mean for you at your bank? They’re going to increase the costs. Now maybe they won’t send you a bill directly, although you certainly get a direct bill for many things. But what they also can do is hide those costs. So just like they haven’t been raising rates, that means more profits for the banks because hey those banks, any reserves that they have parked at the Fed, they’re making a whole lot more money on that. They’re not paying you anymore. Just something to be aware of. So if this contagion spreads, we are in deep doo-doo and it would have the ability to overwhelm the federal reserve and the whole system. But don’t worry about a thing cause after all treasury secretary Yellen says, bank system remains resilient in the wake of this failure. Well, next week I’m gonna do a deeper dive into how we got to this point. So bear with me on that one. There’s only so many hours of the day and I’ve been working most of them. But can you see why public confidence is so critical? It’s what’s holding the whole thing together.

And let’s take a look at what’s happening with the premiums on just between spot gold and the gold eagles and the spot gold is the gold color of which they can create as many as they want. And then you can see the premium. And this goes back to 2017. And so you can see here the premium was not that great, but look at what happened. This is 2020. You can see what happened in 2020. We got the premium all in the premiums kind of came down. But look at where the premiums are now. Why? Because real demand of the physical metal has outstripped the availability. It’s just that simple in the physical market that is a true supply and demand equation. A true one. In the paper market they can create as much as they want. And so what they have to do since a rising gold price, is indication of a family currency is they have to suppress it. That they can easily suppress it is simply by creating as much gold and silver that does not nor ever will exist. That’s the way that they can easily suppress it. But you can see those premiums on gold eagles are growing more and more and more. Now, personally, and I want you to hear me on this, but a lot of times people don’t. But personally I do not buy gold eagles. Why? Because my history goes back long enough to when I remember that gold, I don’t remember the actual confiscation, but I know I was born in 1954 and it was illegal to hold more than five ounces of gold any other way than in, than in the pre-1933 coins. And I saw my Uncle Al with at least 3000 coins in those safes minimum. And he had them all legally. And I wanna also have the kind of gold. Doesn’t matter whether I’m right or whether I’m wrong, but let’s take a look at what is currently happening in the physical in this market. Okay? cause that’s what you’re looking at here. Well that too has been going up a whole lot more than what you see happening up here in the spot market, which is that it keeps bumping its head and it will go higher, it’ll break through. But in the physical only world, it’s already had that breakthrough. And this is the one for ultra rarities, which is even more dramatic than this level of coin because the ultra rarities, gosh, they go for like millions and millions of dollars for one ounce of gold. So as a reminder, the spot market’s an unlimited number of contracts. The the last that they reported it before they changed the accounting rules for every one ounce of physical gold, there were 62,000 ounces of paper gold according to the bank for international settlements. I’m sure that’s much higher now. But in the physical world as a true buy sell market, there is a limited amount. So it is more reflective. But these premiums up here should show you what’s actually really happening inside of the markets regardless of how they manage to manipulate them. How many times coop can you be lied to and you do not know the truth every single time, but I don’t want you to be lied to. And I’m pretty sure you don’t wanna be lied to because ignorance does not make you immune. It just leaves you vulnerable.

So I want you to stay tuned and go back. If you haven’t watched all the work I’ve done on the SVB collapse, go back and watch all these videos starting from last Friday, almost a week ago. By the way. We also launched a new Spanish channel. You wanna make sure to watch that and to share . We’ll be doing a live edition of it. Well we just did a live edition of it yesterday. And where we just kind of break it down and Fernando asks me questions. So it’s a really short and maybe a good way for you to share with your friends. They don’t have to speak Spanish, it’s in both languages. And also make sure that you go to <laugh>. This has never been more important than it is right now cause what’s the mantra? Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. And I go over those things every Monday on Mantra Mondays and you can find all of that on Beyond Gold and Silver because while this is your foundation and you’ve gotta get it set and you’ve gotta get it right cause this is real money, you need all of those other things to maintain a reasonable standard of living. So if you haven’t done so yet, make sure that you subscribe and also click that Calendly link below and get your plan in place and start to execute ASAP. Leave us a comment, give us a thumbs up and share, share, share. And remember, financial shields. They’re made of metal. Definitely not paper and promises. Oh, I wish they’d run out, That are controlled by people, that they’re not your friends. And until next we meet, please be safe out there. Bye-Bye.

SOURCES:

SVB’s Balance-Sheet Time Bomb Was ‘Sitting in Plain Sight’ (SIVB) – Bloomberg

20 banks that are sitting on huge potential securities losses—as was SVB – MarketWatch

https://www.fdic.gov/analysis/quarterly-banking-profile/qbp/2022dec/qbp.pdf#page=1

https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

Silicon Valley Bank (SIVB) Collapse: Yellen Says Bank System Remains Resilient – Bloomberg

https://www.pcgs.com/prices/coin-index/key-dates-and-rarities