Asset Classes

Strategy Explained: Good Money Assets and Fiat Money Instruments

Introduction

Welcome to the Strategy Explained webinar series. I’m Lynette Zang, Chief Market Analyst at ITM Trading. In this series, I will be sharing MY educated opinions which are based upon history, technical data and fundamentals, as well as current events.

If you’d like us to email you a resource list with links so you can do your own due diligence, just ask your precious metals consultant and they’ll get that right out to you.

[Watch The Strategy Video Title: The Great Recession of 2008 Was Just A Warning!]

A little disclaimer before we begin…

“ITM recommends that 5 to 20% of your overall investment portfolio be placed in precious metals, however the decision as to how much to allocate is strictly up to you and/or your financial adviser.â€

My opinions may or may not reflect the opinions of ITM Trading.

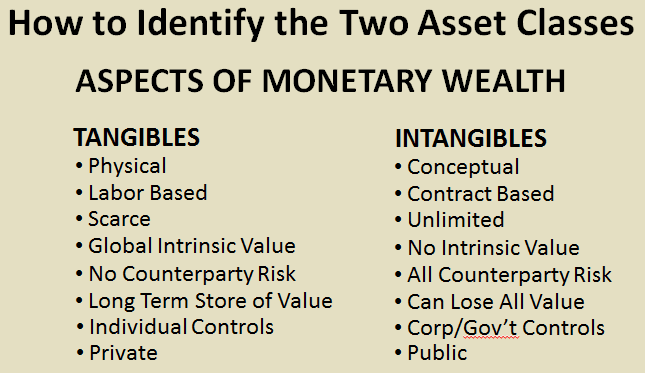

I’ve found that many people do not know how to distinguish between assets classes having been taught over a lifetime, to trust intangibles. So in today’s webinar we’ll review how to identify the two basic monetary asset classes, which are either tangible or intangible. We’ll compare some key risks of each asset class, what that means and why it matters to you. Finally, I’ll suggest some action items to consider at this time in the trend.

What are Asset Classes?

How to identify the two basic monetary asset classes.

The easiest way to identify an asset type is by listing its aspects.

Tangibles are physical, if you can hold it, own it outright and there is no fine print defining true ownership, it’s a tangible. You control tangible assets as long as they are in your possession. If there is a threat to your wealth and it is in your possession, you have the opportunity to defend or protect it.

Intangibles require confidence because they are based on contracts written by banks, hedge funds, insurance companies etc. and made legal by an abundance of laws, that few people have read or understand, yet most must abide by. It takes little effort to create but can transfer wealth through compounding fees, both hidden and visible, including the inflation fee built into the fiat money base. You have very little control if any, over intangible assets simply because they are contracts and live in cyber space. Therefore it is easier to transfer intangible wealth somewhat invisibly, with your cooperation but without your knowing.

What is Dynastic Wealth?

Dynastic Wealth

Studies have shown that dynastic wealth families understand the inherent problems with fiat money systems, and that’s why the foundation of their wealth is based in tangible assets.

You can see that the dynastic wealth stool is based on tangibles. Because generally, tangibles can survive wars, regime changes and currency resets. Gold money is the most important leg because it is indestructible, holds purchasing power, is easily portable and globally liquid. In fact, some form of gold can fit each leg of the dynastic wealth stool; mines are real estate, numismatic coins are rare collectibles and any form of physical gold is always monetary at its base and has been for 6,000 years.

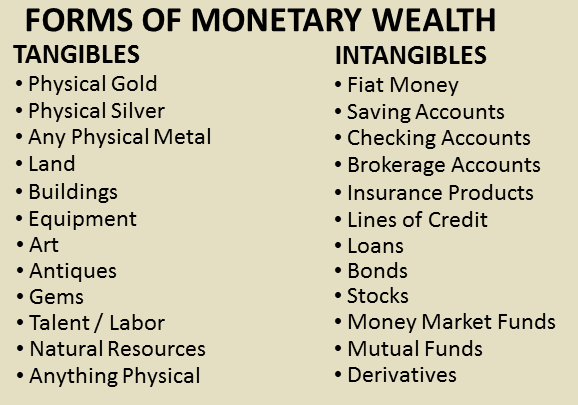

But to be clearer, let’s look at a list of tangible and intangible assets and instruments.

While this list is not conclusive, it puts names to some financial assets and products. Where does your wealth fall in this list? If it is primarily in intangibles, in my opinion, your wealth is in jeopardy. I say that because of some basic facts.

Primarily, fiat money anchors intangible assets. Historically, every fiat money system ever tried has failed and the currency has ultimately gone to zero. Fiat monetary instruments are created from, supported by and pay you back in fiat money, so if the fiat money has no value, neither does the fiat money instrument.

In addition, intangible monetary wealth is contract based and therefore, runs counterparty risk on many layers. These contracts are written by corporate lawyers for the benefit of the corporation and they know you’re not likely to read the contract. The contracts typically assign all the risk to you and many benefits to them, but bottom line is they will perform as promised as long as they can, but if they can’t, you lose because you legally loaned them your money.

This matters to you because, if this is where you hold your wealth, that too will likely go to zero, but this systemic shock is also what creates wealth building opportunities for those who hold their purchasing power in gold money.

Early in the trend cycle, this might not be as significant an issue but I believe we are in the final phase, which is discussed in another webinar in this series. But this is the phase of the final wealth transfer, when choice evaporates, so now may be your last opportunity to get positioned.

At the least, it would be wise to hold enough tangible monetary wealth to protect any wealth you might choose to leave in intangible fiat money products. Because, while you might FEEL safe in those fiat products, by design, they are really just wealth transfer tools and history shows us, they can burn up very quickly.

Though no matter what choice you make, there are always risks so let’s compare them.

» Watch The Strategy Video Title: The Great Recession of 2008 Was Just A Warning!

The Risks

Since intangibles are contract based, the list of counterparty risks dwarfs the risk list associated with tangibles. This counterparty risk is also why intangible monetary wealth can and does lose all value. Remember Enron? Greek government bonds? German Mark?

But actually, it also reflects the fact that the holder of the tangible has the most control over it, while the holder of intangibles does not. The examples just mentioned are also examples of a company, sovereign debt and fiat currency that evaporated during the end phase of their trend. If you had held your wealth in them, when would you have liked to know they were going away?

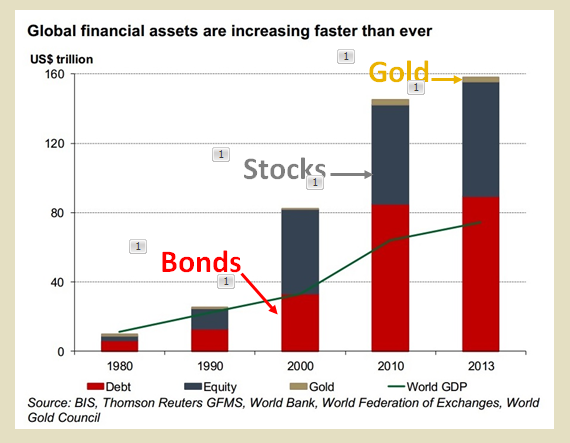

You can see in this graph that it is much easier to create an unlimited amount of fiat since lawyers create the contract and after that it is simply the push of a button. And since intangible monetary instruments exist in cyber space and can be created at will, they can also disappear simply by a push of a button.

But tangible monetary wealth is finite; you own it and hold it. It takes time, energy and effort to bring forth plus gold is indestructible.

Have I shown you enough?

Can you see the difference between tangible monetary wealth and intangible monetary wealth?

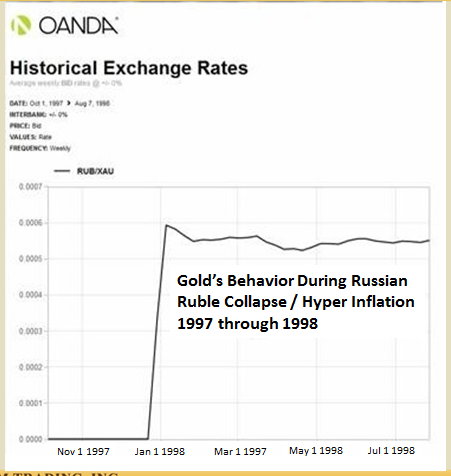

Look at what gold did during Russian Hyperinflation. This is why gold money explodes in terms of fiat money, when the fiat money dies, but really, it’s maintaining your ability to purchase, so you can buy additional assets when they are dirt cheap, like gold is now.

Today, the opportunity is in physical gold because it is severely undervalued in terms of fiat money.

Evidence shows that fiat money instruments are fiction; easily manipulated and out of your control. They last only as long as the fiat money they are created from and as such, are simply a wealth transfer tool if they can convince you to put and keep your wealth in them so when you look at an index like the Dow, Bonds or Spot Markets, you need to look a little beneath the skin of the markets and uncover the truth.

So let’s look at some action items to move forward with today.

1. Identify Your Monetary Wealth Holdings. Tangible or Intangible. Portfolio weighting.

2. Circumstance Review, Update Strategy. Call your ITM Precious Metals Consultant for conversation.

3. Reduce Counterparty Risk. Become the Legal Registered Owner of Your Intangible Wealth

4. Reduce Illiquidity Risk. Raise Cash.

The first thing you want to do is an assessment. Call your precious metals consultant to set up a time for review. How is your wealth currently positioned? I cannot tell you how many people do not understand that stocks and bonds aren’t real but are fiat money instruments. They are. And in my opinion, they are in jeopardy.

But we are in the final phase, so the most conservative choice is to reduce counterparty risk as much as possible and make sure you are the legal owner of your wealth.

If you hold your wealth in illiquid fiat markets, take it back while you still can. Raise cash and finish your strategy position.

So that’s it for today’s webinar. I’m really hoping that I’ve been able to clarify the difference between tangible assets and intangible instruments and the safest and most conservative place to hold your wealth as this trend unfolds.

Make sure to call your ITM Precious Metals Consultant at 888-696-4653 with any questions you may have, we are all here to be of service.

» Watch The Strategy Video Title: The Great Recession of 2008 Was Just A Warning!