ALERT! 2018 Pattern Shift: Has Hyperinflation Been Signaled?

Have the tax changes and repatriation finally kicked into gear?

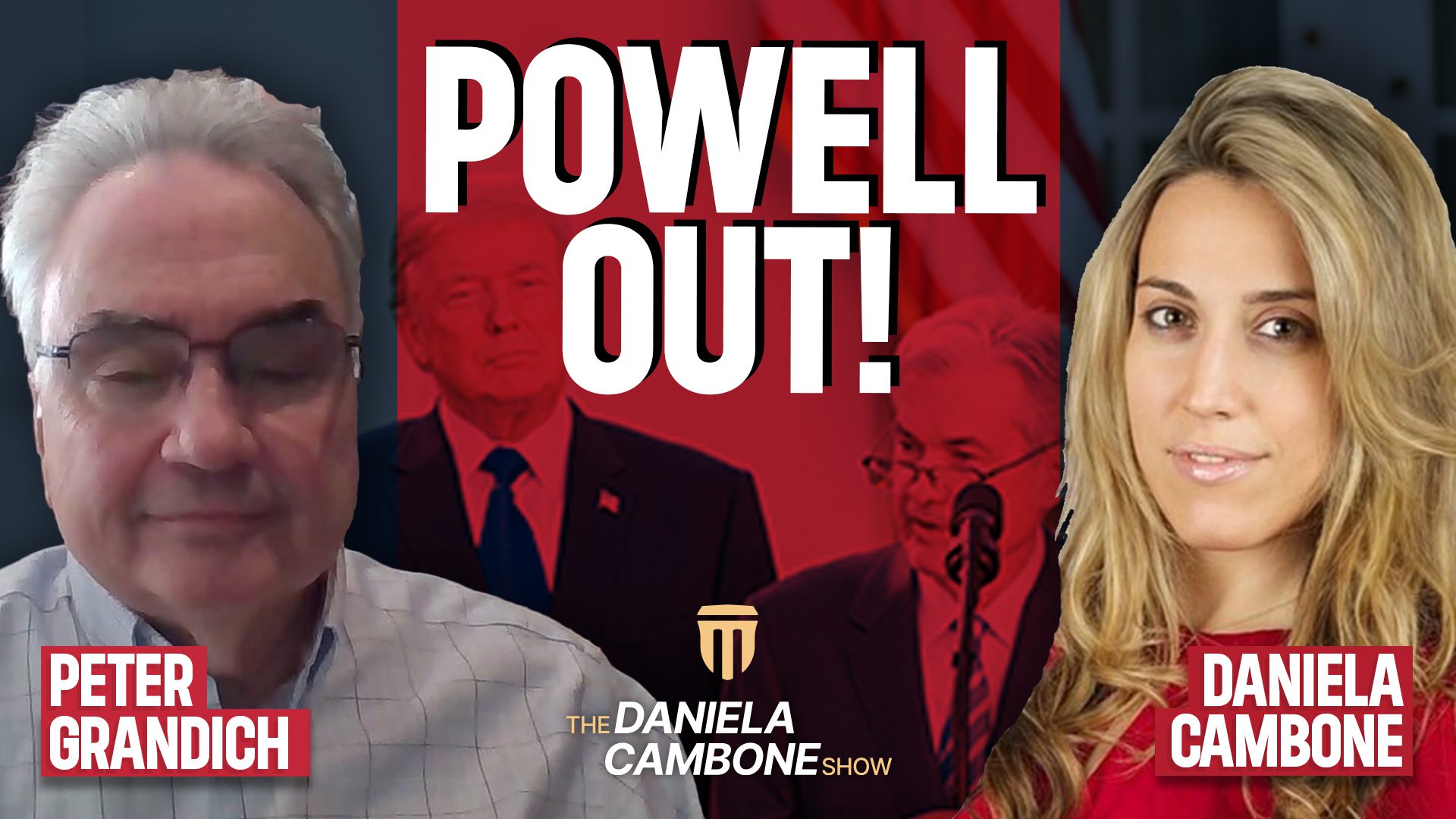

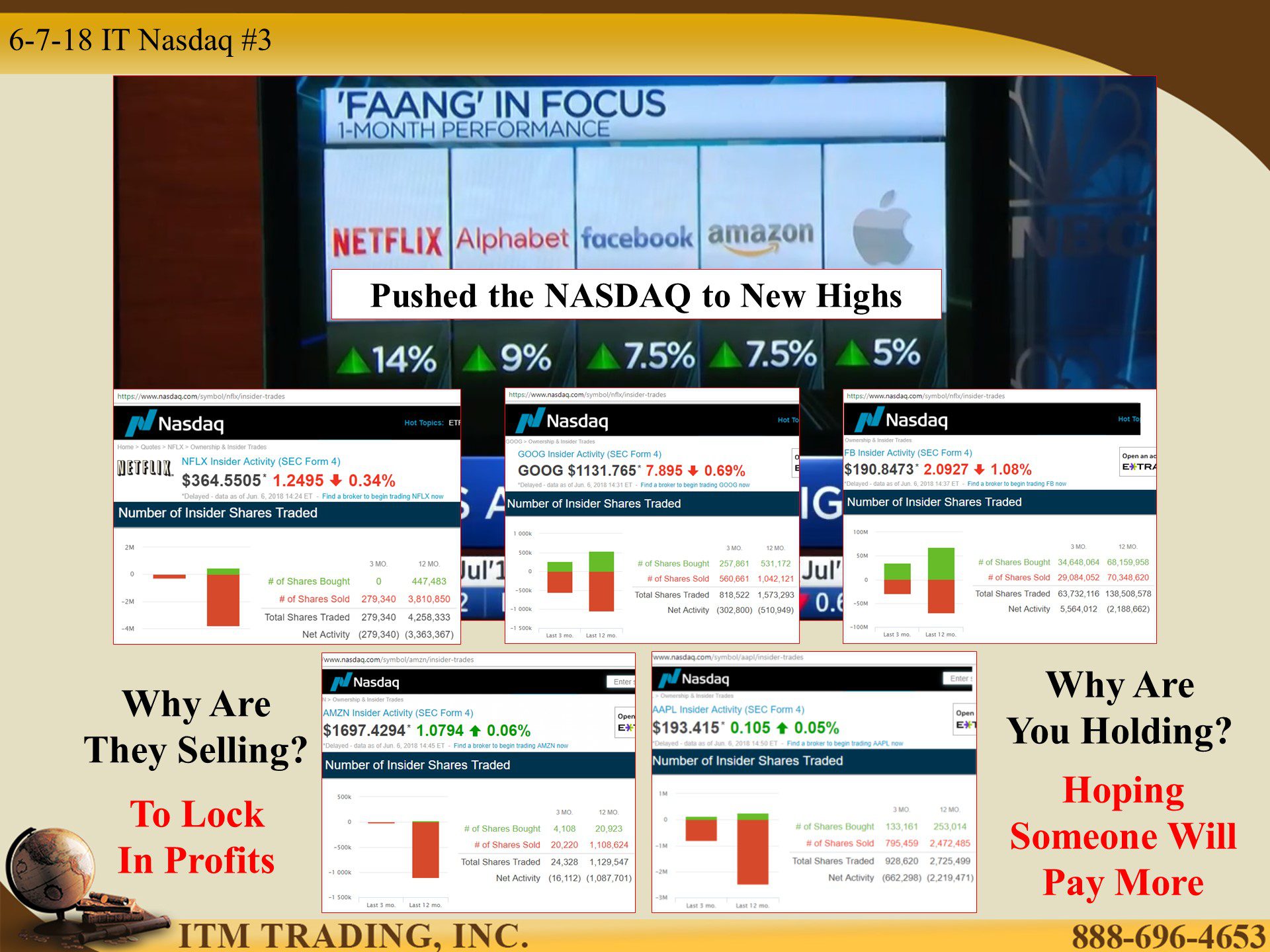

On Wednesday, the NASDAQ hit a new all-time high fueled primarily by the tech sector, who repatriated vast amounts of cash overseas. The funny thing is that the technology sector has been in the top five weekly insiders selling to buying ratios since I began tracking this data. Keep in mind that insiders are; Boards of Directors, CEOs, CFOs etc. So those that understand, better than anyone, what is really happening inside a company.

If everything is so wonderful why would they be selling? To lock in profits in the most expensive stock market in history. That’s call getting out near a top and is always what we see in the run up to a meltdown.

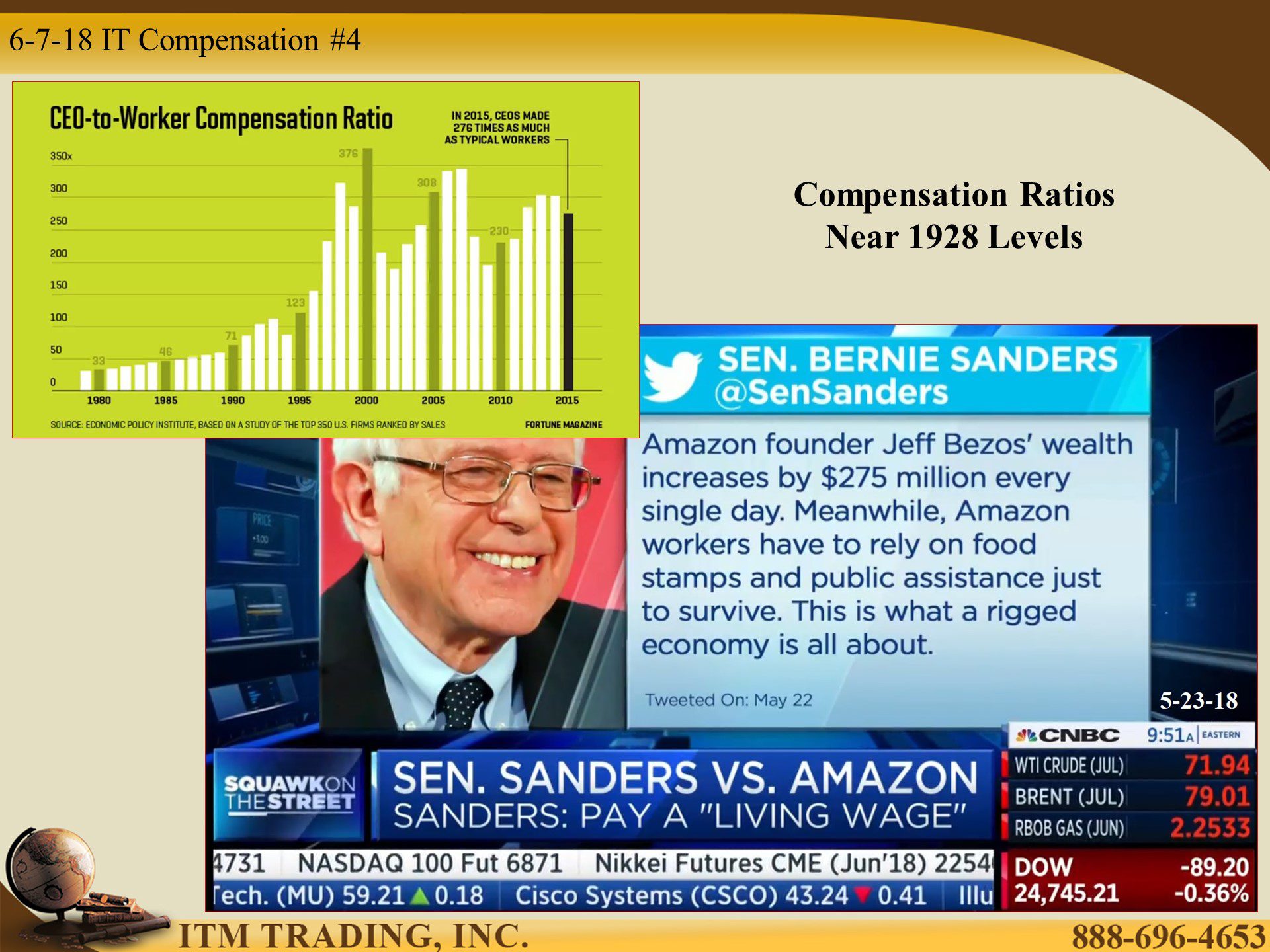

Another typical pattern can be seen in compensation. According to the Economic Policy Institute, the CEO to Worker compensation ratio is 276 times and near levels last seen in 2007, 2000 and 1928. Coincidence?

We all know what happened after those dates; markets imploded (deflationary) and recessions / depressions ensued. There is only one way to fight deflation and that is with inflation. Good thing inflation is the most important function of fiat money!

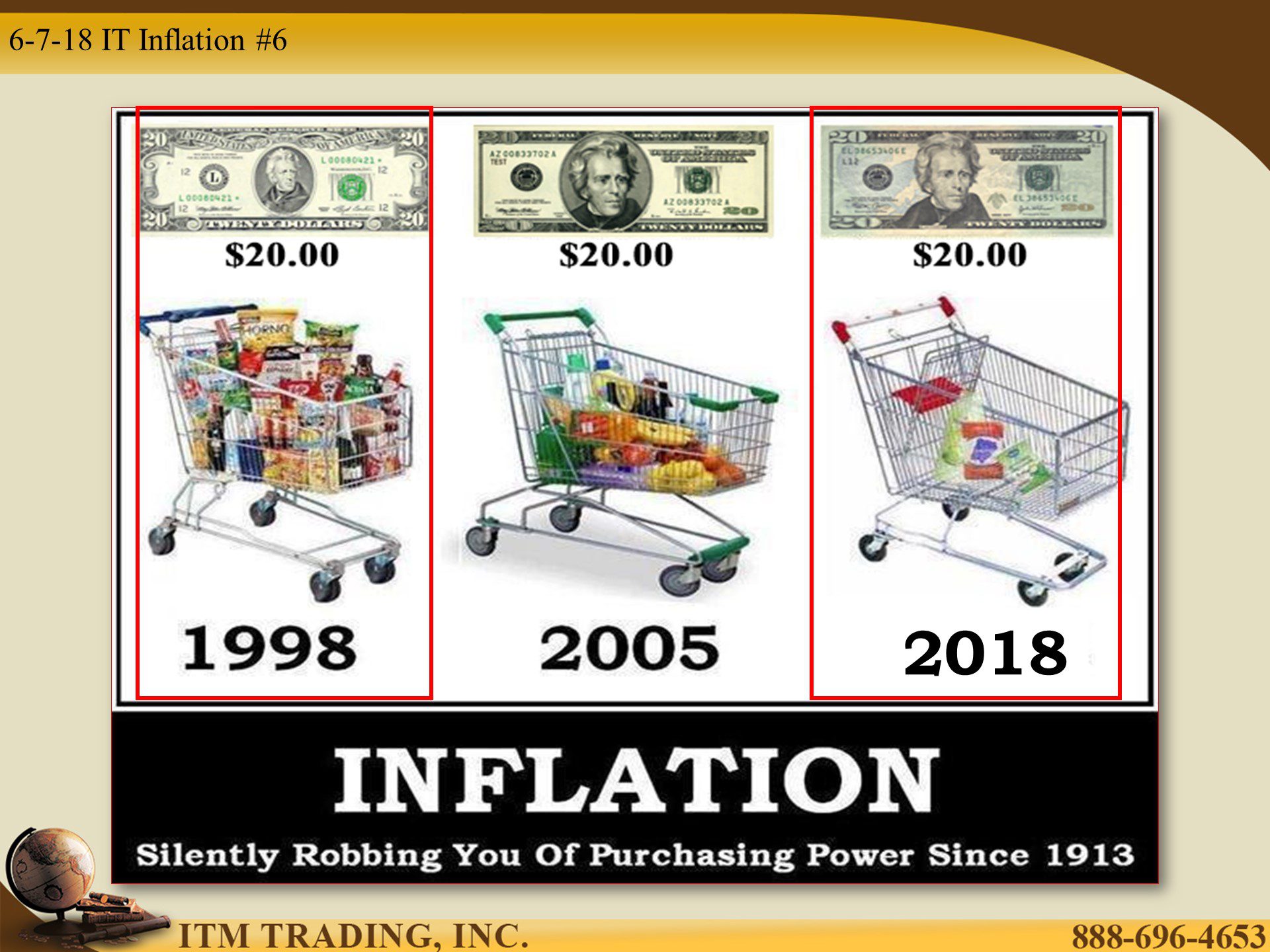

Global central banks all have inflation “targetsâ€, in the US that target is 2%. That means that the goal is for the dollar to lose 2% of it’s value every year and prices for goods and services rise by 2% every year.

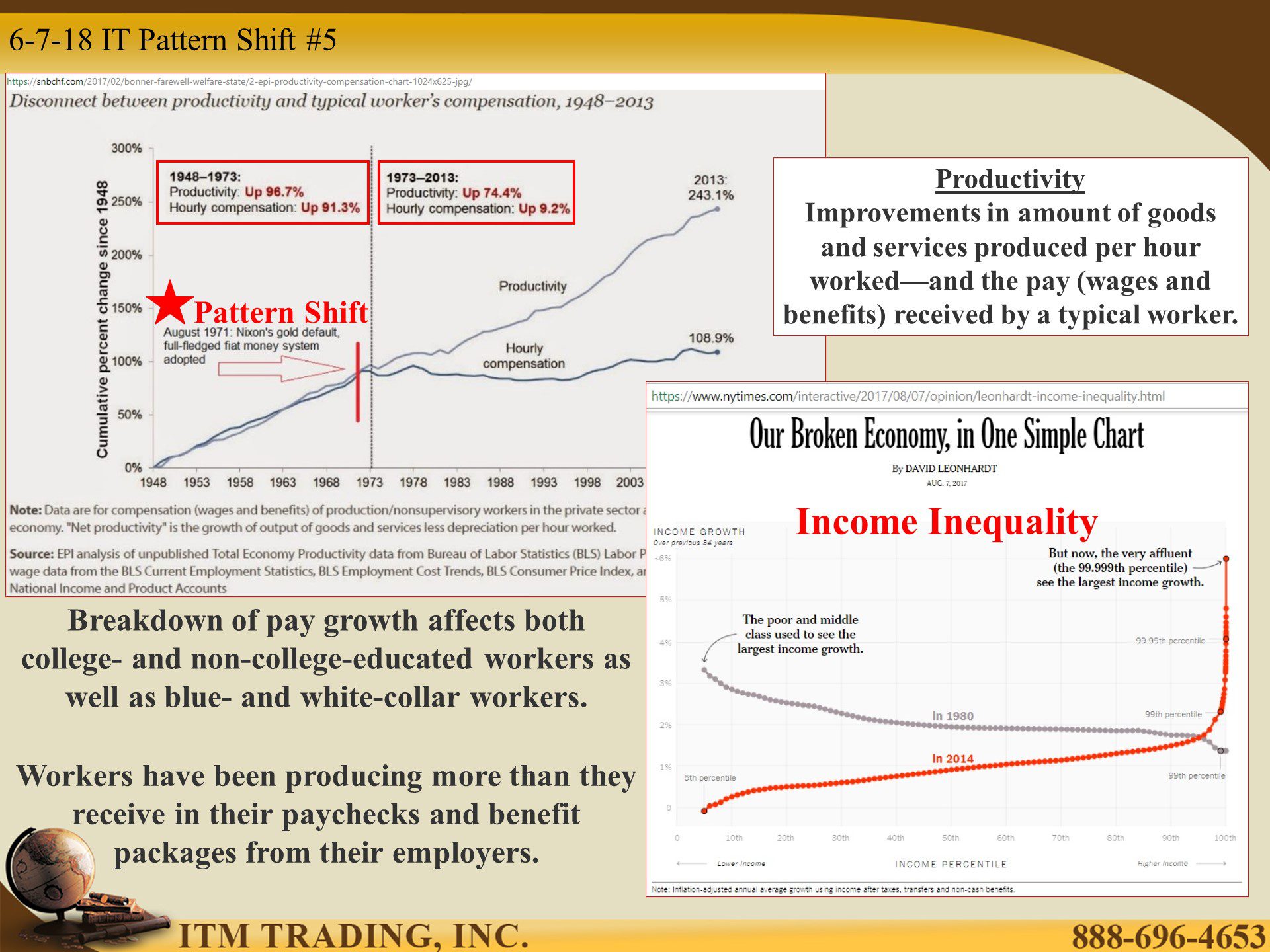

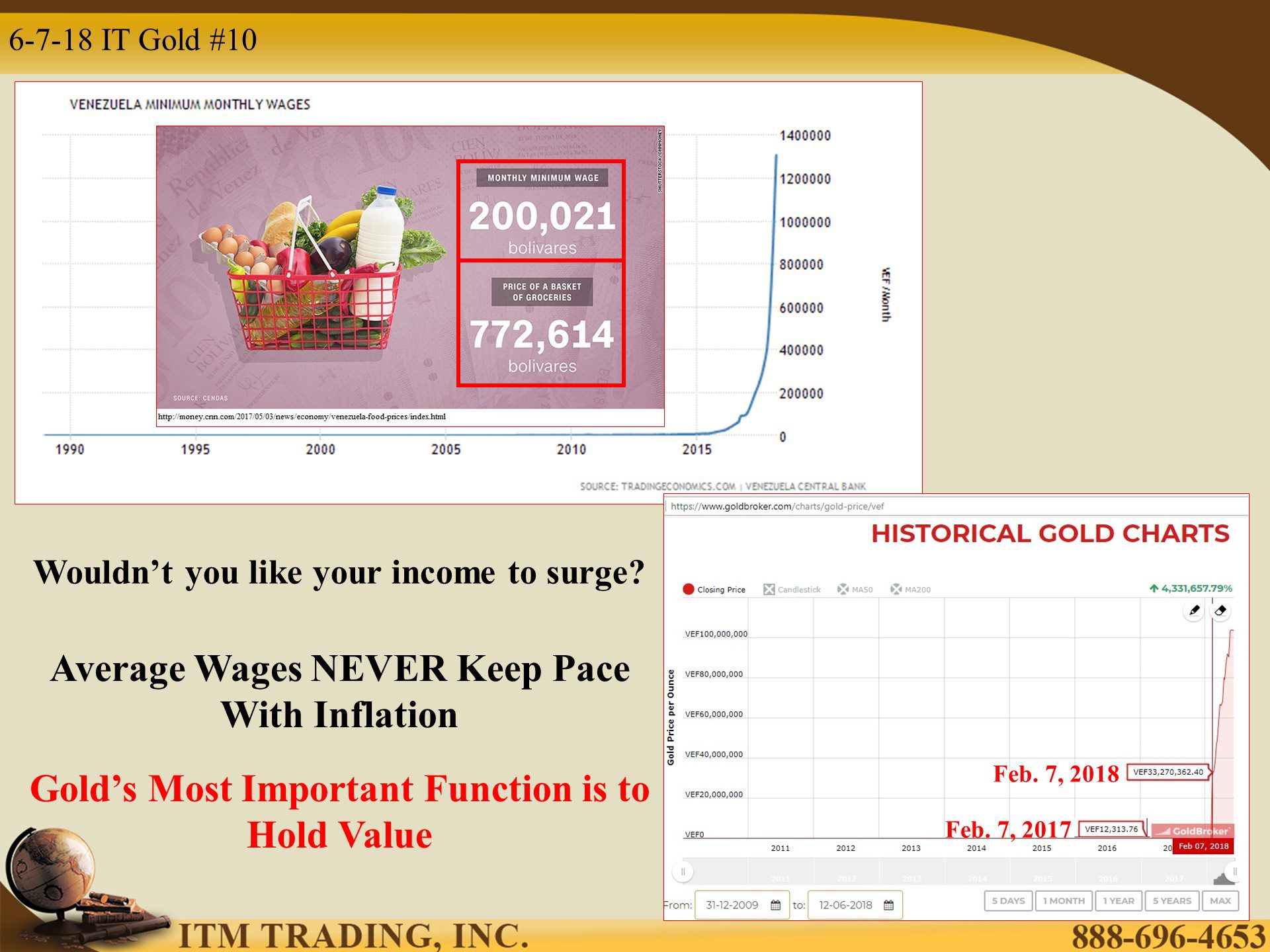

The benefit of inflation to corporations is that the average workers wage does not keep pace with inflation, but the goods and services they sell do (productivity). Between 1948 and 1973, wages did keep pace with rising productivity.

Once Nixon handed control of inflation to central bankers (when he took us off the gold standard) lots of things shifted. As example; Between 1948 and 1973 productivity was up 96.7% and workers hourly compensation was up 91.3%, but between 1973 and 2013 (most current numbers available) Productivity was up 74.4% but workers hourly compensation was only up 9.2%. Where did all that extra wealth go? To the top.

So even though it looks like the workers got more money, because of inflation, workers have been producing more than they receive in their paychecks and benefit packages from their employers.

To compensate for this loss, we now have consumer debt at the highest level in history. While interest rates were held down, you could service a higher level of debt with the same payment, but we are now in a rising interest rate environment and defaults are rising too. What the central bankers need is a good dose of wage inflation to keep pace with rising debt levels.

They may be getting their wish.

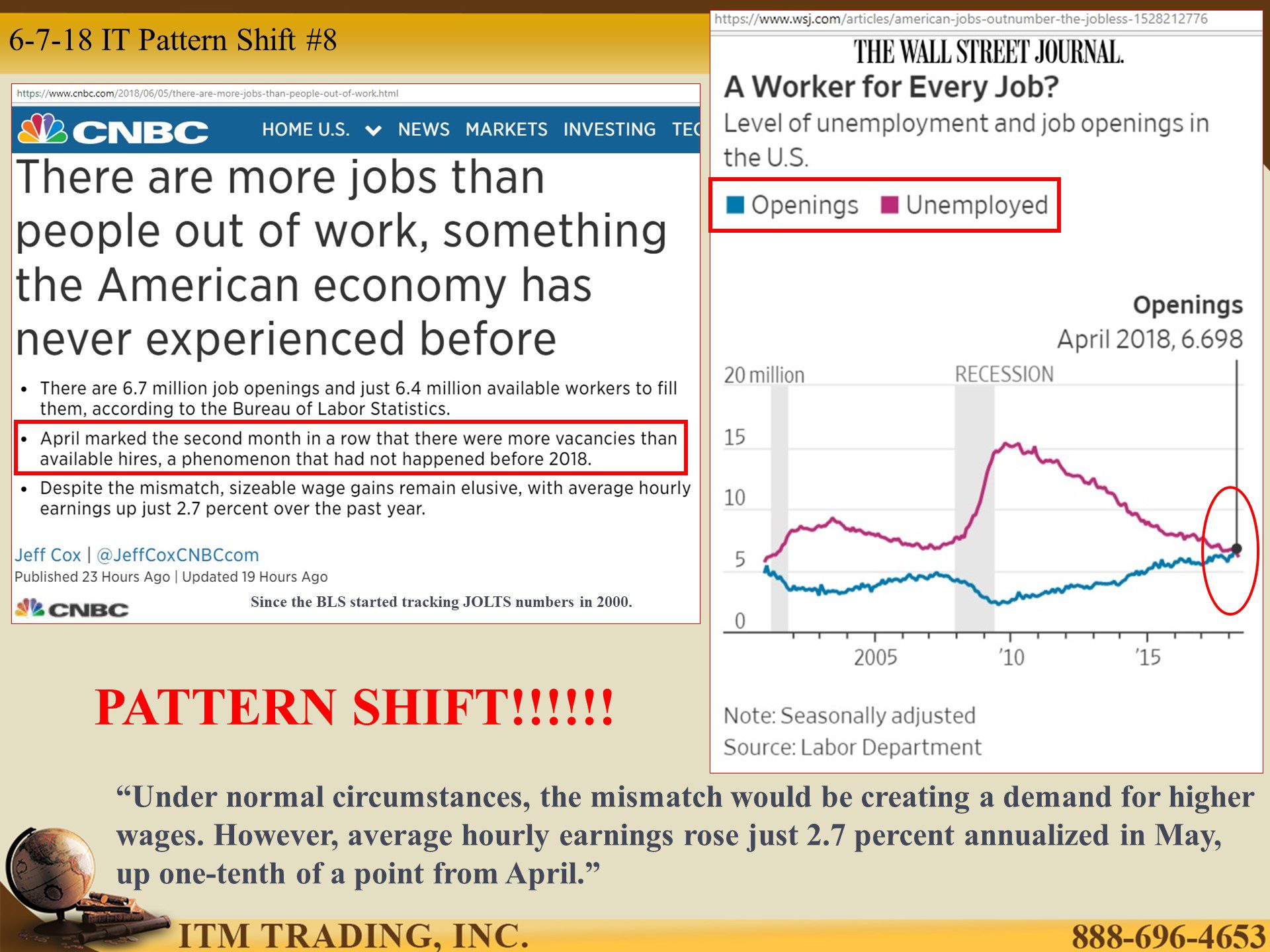

In 2000 the BLS began tracking job openings to the unemployment numbers. For the first time ever, there are now more job openings than people to fill those jobs. In theory, this should create wage inflation as companies vie for workers. So far, it has not. But it is a major pattern shift.

When you couple this with a rise in the velocity of money it could indicate that we’ve hit a tipping point and the hyperinflationary phase has begun.

Governments and central bankers want us to think global growth is in high gear and that inflation is a good thing. Inflation is certainly good for some and it can make GDP look good too. But it is also possible that they can lose control. Just like they did in Venezuela.

- https://app.hedgeye.com/insights/36953-cartoon-of-the-day-inflation-shark?type=cartoon

- http://stockcharts.com/h-sc/ui

- https://www.nasdaq.com/symbol/goog/insider-trades

https://www.nasdaq.com/symbol/nflx/insider-trades

https://www.nasdaq.com/symbol/fb/insider-trades

https://www.nasdaq.com/symbol/amzn/insider-trades

https://www.nasdaq.com/symbol/aapl/insider-trades

- http://fortune.com/2017/04/19/executive-compensation-ceo-pay/

- https://www.epi.org/publication/charting-wage-stagnation/

https://fred.stlouisfed.org/series/REVOLSL

https://fred.stlouisfed.org/series/TOTALSL

https://www.wsj.com/articles/american-jobs-outnumber-the-jobless-1528212776

https://www.cnbc.com/2018/06/01/nonfarm-payrolls-may-2018.html

https://www.bloomberg.com/view/articles/2018-02-14/inflation-s-real-threat-to-the-economy

https://tradingeconomics.com/venezuela/minimum-wages

http://money.cnn.com/2017/05/03/news/economy/venezuela-food-prices/index.html