ADMITTEDLY CORRUPT: The Truth About Where Your Money Goes

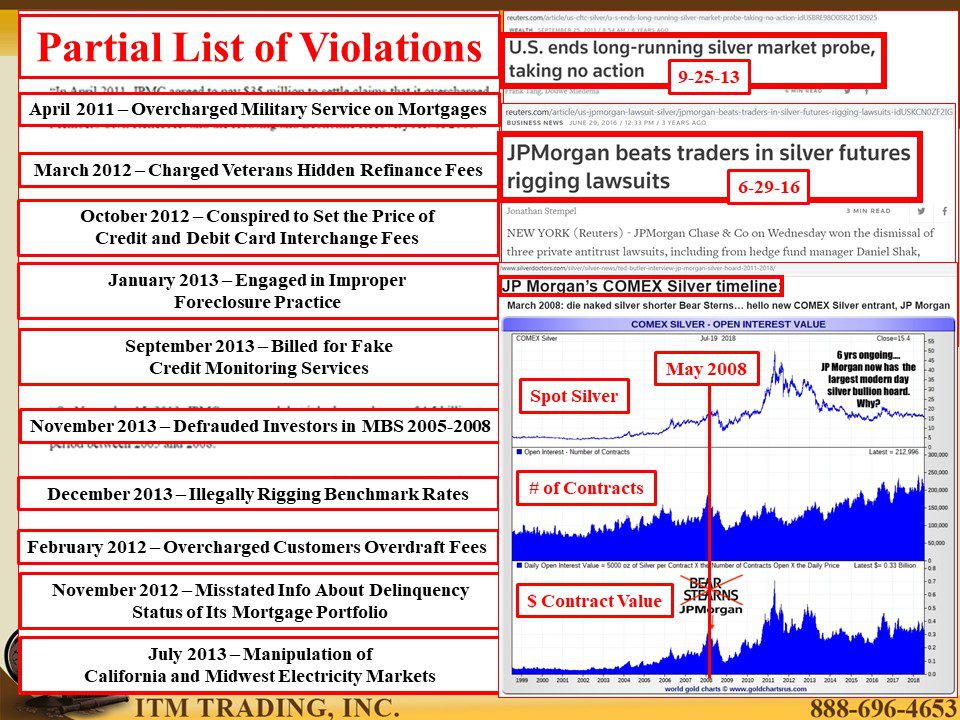

Was an unintended consequence of bailing out the big banks funding criminal activity? Why didn’t regulators (like the CFTC) recognize the signs of market manipulations? These are some questions many in the markets have been asking for many years, especially after the CFTC dismissed accusations of silver market manipulations in 2013.

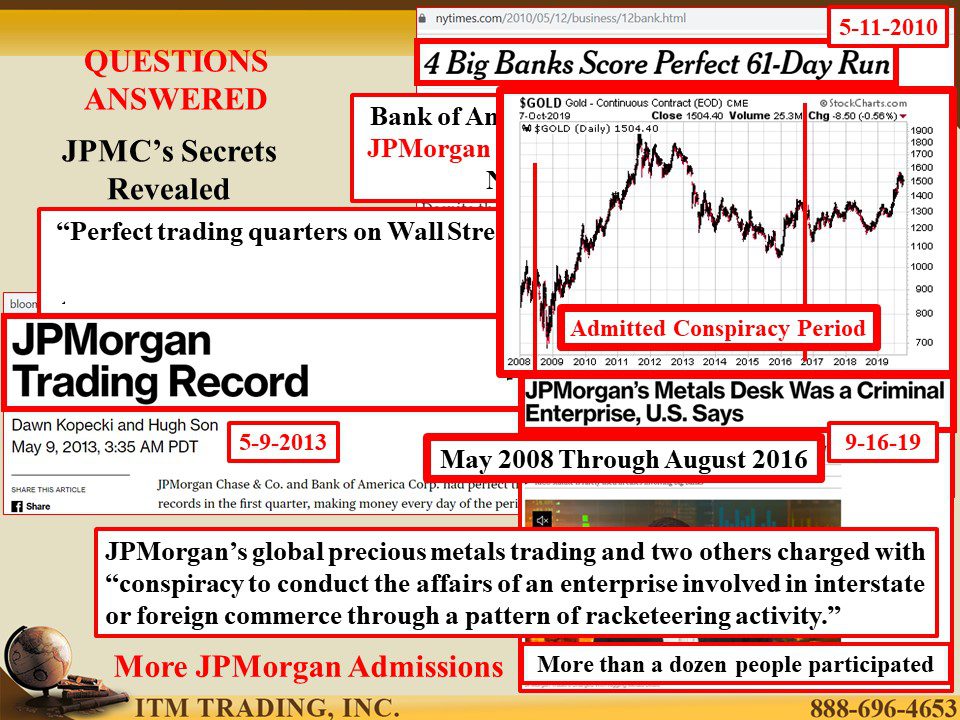

Somehow, it seemed normal that as the financial crisis roiled markets, that the big banks, including JPMorgan Chase (JPMC), had perfect quarterly trading records making money every day, 61 days in a row. Which is normally a very rare occurrence. In fact, JPMC was able to accomplish this in both 2010 and 2013.

We were led to believe that they had beyond brilliant traders, but now the Department of Justice (DOJ) has charged JPMC Metals Desk with being a “Criminal Enterprise†that manipulated the spot gold, silver and platinum markets between 2008 and 2016. I wonder why, after putting over 7,000 man hours into investigations, the CFTC saw nothing?

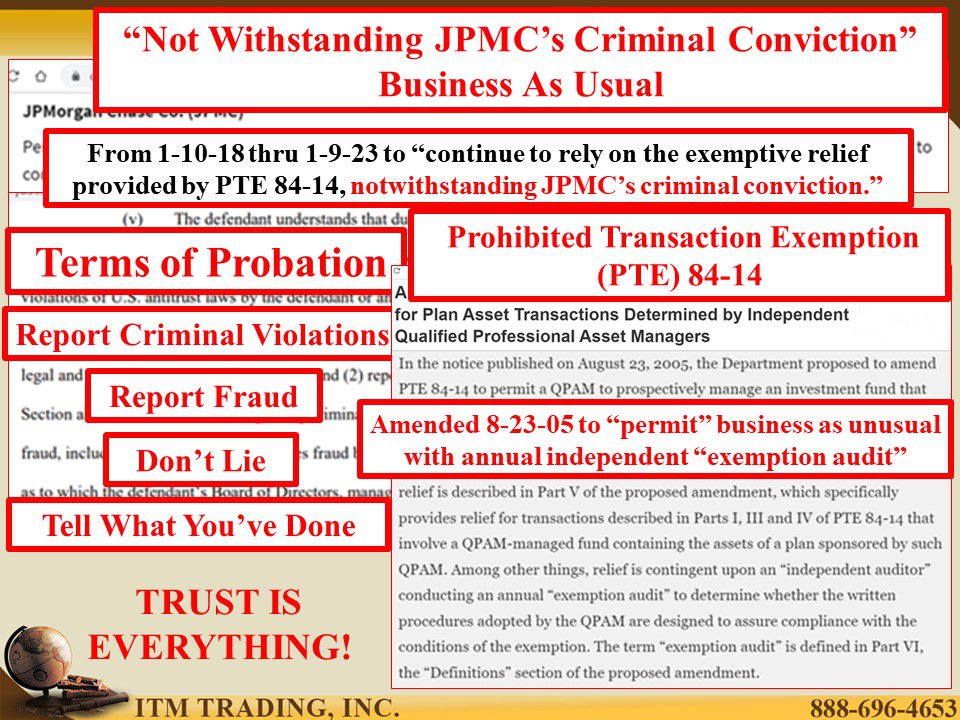

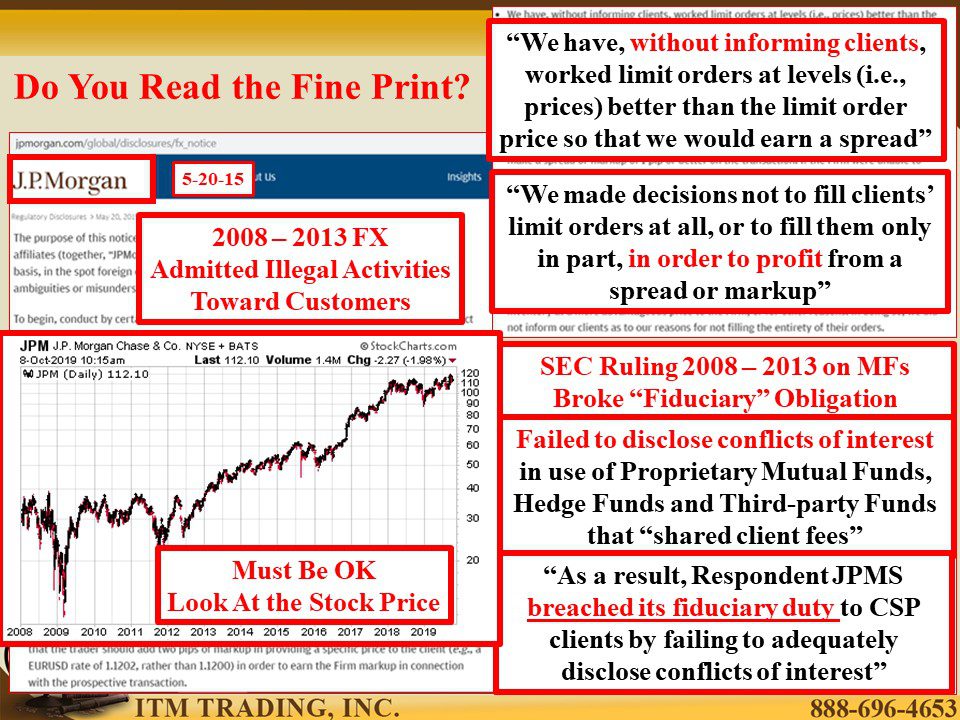

Perhaps it was because they were already on probation for manipulating foreign exchange, interest rates (LIBOR), defrauding customers and breaching fiduciary rules with failure to disclose conflicts of interest.

According to some of the probation terms JPMC was supposed to report any criminal violations or fraud. Indeed, they agreed to not lie and tell YOU what how they defrauded you by postings on their web site and perhaps a glossy insert in your mail. Do you ever read those?

If they get an “independent exemption audit†annually and keep their promised they are granted “exemptive relief†and are permitted to carry on business as usual. With the stock price near all time highs, it would seem all is well.

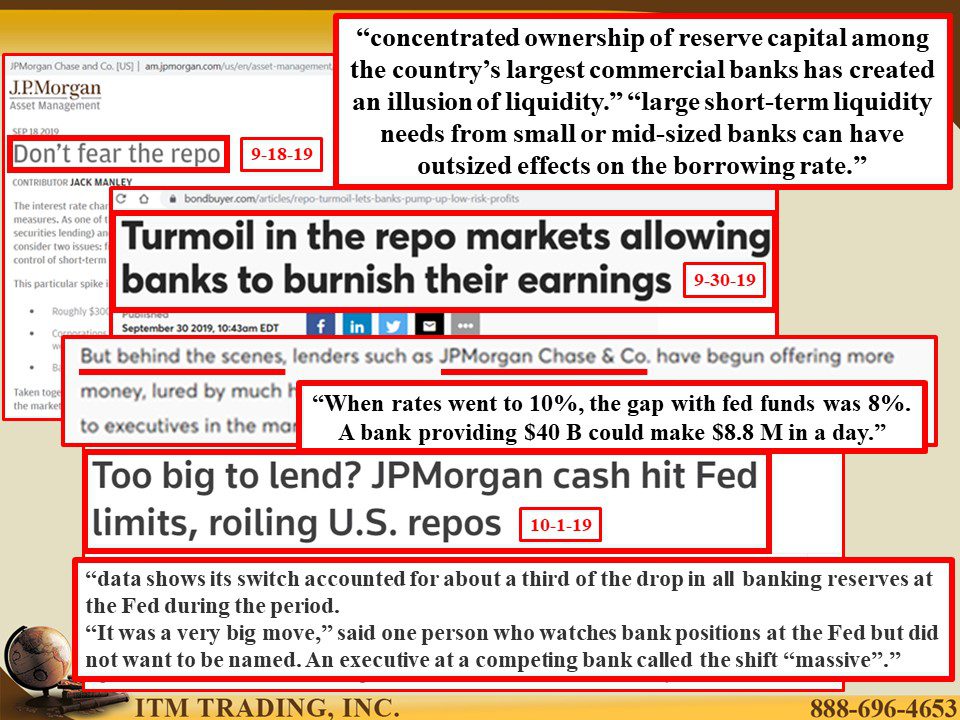

But in mid-September 2019, the repo market, where banks go to borrow short-term, began to show signs of stress as overnight interest rates were pushed to 10% as smaller banks and hedge funds scrambled to borrow for taxes. “When rates went to 10%, the gap with fed funds was 8%. A bank providing $40 billion could make $8.8 million a day. Documents show that JPMC took advantage of this interest rate spike. Smart?

Because additional data shows that JPMC had a drop in their reserves that may have caused the interest rate spike. Interesting, don’t you think?

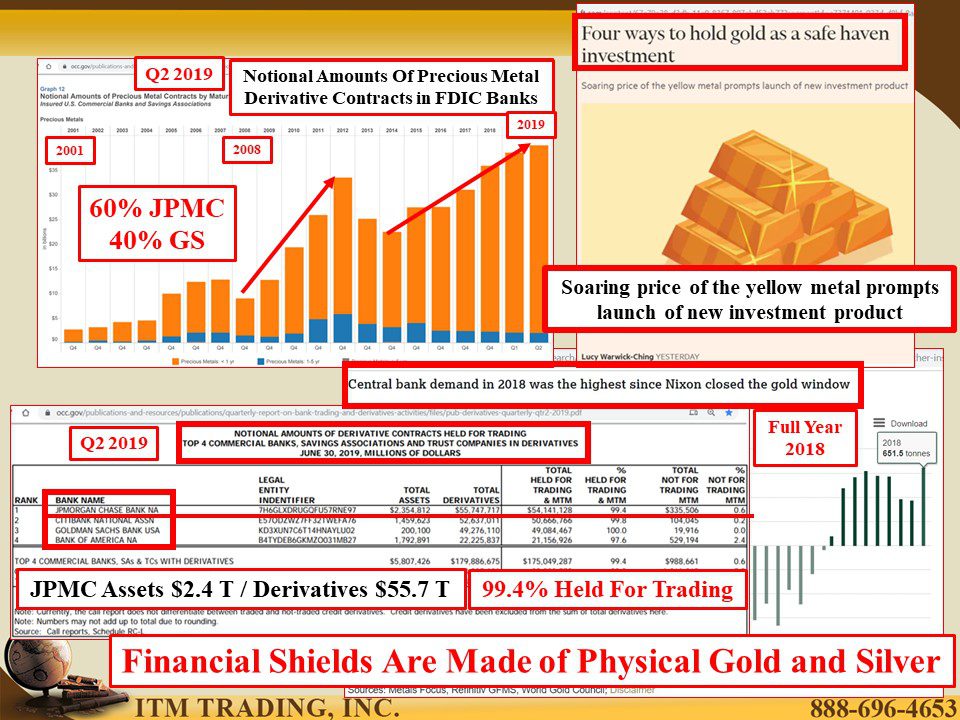

According to the Office of the Comptroller of the Currency (OCC), JPMorgan Chase and Goldman Sachs control 100% of the precious metals derivative contracts that are held in FDIC insured banks. Further, that the nominal value of those contracts are currently at the highest levels ever. And 99.4% of those contracts are held for speculative trading purposes. I’m sure they’ve changed their ways.

There are different ways to participate in the precious metals market. You could buy a gold or silver “product†created by JPMC or other wall street firms or you can become your own central banker by doing what they do for themselves, convert fiat money into good money.

Because the truth is simple: financial shields are made of physical gold and silver.

Links:

2. https://wallstreetonparade.com/2019/04/bloomberg-news-bashes-wells-fargo-while-canonizing-jpmorgan-chases-ceo-jamie-dimon-despite-3-felony-counts-at-his-bank/

https://www.justice.gov/file/440491/download

4. https://www.justice.gov/file/440491/download

https://www.jpmorgan.com/global/disclosures/fx_notice

https://www.sec.gov/litigation/admin/2015/33-9992.pdf

5. https://am.jpmorgan.com/us/en/asset-management/gim/adv/dont-fear-the-repo

https://www.bondbuyer.com/articles/repo-turmoil-lets-banks-pump-up-low-risk-profits

Was an unintended consequence of bailing out the big banks funding criminal activity? Keep in mind that the big commercial banks, like JPMorgan Chase, have been critical to flowing central bank policy through economies. Therefore, it has been critical they make money. Have regulators turned a blind eye up to now?

Do the DOJ accusations mean a crack down on the largest bank in the US?

What does this mean for the gold and silver markets? Does JPMorgan still control them?