A Great Reason To Buy Gold Now

There are many good reasons to buy gold right now. Among those reasons are failing fiat currencies, inflation, government misspending, crooked banks, and rigged markets just to name a few. In this short article, however, we will discuss a great reason to buy gold right now because this reason is a game changer.

Over the past several years I’ve written hundreds of articles for ITM Trading. Through blogs and posts, I have chronicled changes in the United States economy and economies worldwide. At ITM Trading the precious metals consultants and senior analysts pay close attention to these subjects and they are also constantly studying currencies. You may not think of gold and silver is currencies but they are. In fact, gold and silver are both currencies that don’t have counterparty risk. This means they do not rely on a government or a bank or institution to redeem them. Gold and silver are intrinsic wealth.

Conversely, the rest of the popular currencies on the planet are not intrinsic wealth. Fiat currencies are not only based on either nothing or debt, they are designed specifically to inflate away the wealth of those that use them.Lynette Zang, who is the chief market analyst at ITM Trading, has produced several short Facebook videos which are a great way to catch up not only on what is happening in the markets but also how the markets actually work. In the next few paragraphs, I will briefly explain a couple of current happenings in our economy that are not everyday events. These happenings are also reasons that you should buy gold right now.

A Great Reason To Buy Gold Now: All-Time Stock Market Highs.

If you’ve been paying attention to the stock markets recently in the United States then you know that they are continually posting new record highs. There are reasons and conjecture surrounding this. For instance, an article published by Wealth Daily quoted the CEO of TD Ameritrade. The CEO was talking to Bloomberg. In the interview, the CEO offered the position that ” The Trump rally got ahead of itself.” Apparently, sentiment in the markets is such that no one was expecting a Trump victory.

But, Trump is a businessman and an arguably successful one at that. Some seem to think that the new market highs can be attributed primarily to the man in the White House. The caveat comes in the fact that president Trump and his policies must now live up to the expectations of the markets. Many would say that any true market success that president Trump can generate has already been priced in. If this is the case, we can definitely expect downturns in the markets if Trump is unable to make any immediate or significant impacts to buoy the already inflated stock market prices.

This is just one outlook on the situation, however. At ITM Trading, Lynette Zang has a somewhat different view. In one of her Facebook videos, Lynette recently pointed out that for quite some time now major US corporations have been taking huge loans out with the Federal Reserve. They are able to acquire these loans at a near 0% interest rate. Lynette shows you how to follow the money. When you do follow the money, it is pretty apparent that many corporations have been using the 0% interest loans to buy back their own company stock. Why would a company buy back it’s own stock, you ask?

CEO And Executive Compensation.

Lynette lays out everything very clearly. Essentially CEOs and upper executives are often compensated based on rising stock prices. If the CEO wants to make a bunch of money, he better increase the stock price. In today’s twisted and incestuous economy, however, the easiest way to raise the stock price of the company is to just keep paying more and more for the stock with free money. If you don’t think that this sounds sustainable, you are right. When these artificially inflated stock markets fall, or correct, back to their true values gold will seek a number that more closely reflects its true value. This is one reason to buy gold right now.

A Great Reason To Buy Gold Now : A Teeter-Totter.

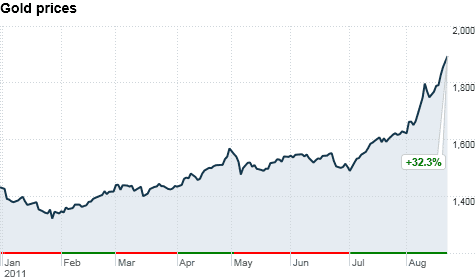

Think of a teeter-totter.The concept is very simple. When one side goes up the other side goes down. Gold and other currencies, or many other investments for that matter, are quite similar to a teeter-totter. The main difference, however, is that the relationship is not as instant nor as firm as the movement and the structure of the teeter totter. For instance, many gold bashers bring up the fact that prices failed to spike instantly during the market crash of 2008.

Gold prices did react, they just did so on a slightly longer timeline. Before the crash of 2008, a 1-ounce gold bullion coin could be had for $600-$700. By 2011 that same gold bullion coin would cost roughly $2000. This example is directly on point. If you would like to begin safeguarding your personal wealth, then you need to buy gold right now. Call ITM Trading and open an account today.