Gold Rises to $1,350 per ounce: Is it Time to Cash in?

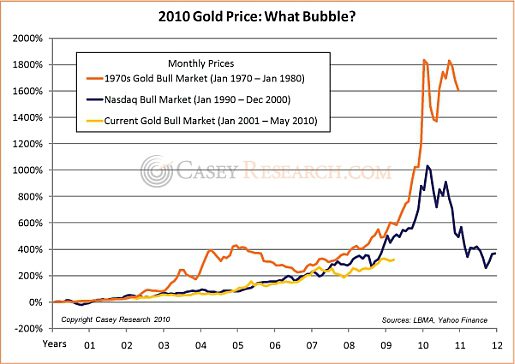

Gold is rising almost daily and has risen to all-time highs. As of the writing of this blog gold is at $1,353 per ounce, which is up over 16% since its July lows. If it closes at its current price it will set a new closing record. As gold continues to break records it spurs a lot of conversation about a bubble in gold. This is natural as people remember the dot com and real estate bubbles that occurred within the last 10 years or so. People do not want to get caught in a bubble again and lose what they have spent years building.

Everyone knows now that when the public gets in to an asset class in a big way it is time to get out. Right? So let’s look at how much gold the public is actually buying. Investors bought $7.4 billion worth of gold bullion through exchange-traded funds from January to the end of July 2010 (according to Financial Research Corp., a Boston firm which tracks the data). Of this $7.4 billion about 45% was purchased by hedge funds and mutual funds, so only about half came from the general public. So let’s say that individuals bought around $3.7 billion of paper gold.

In addition to paper gold (ETF’s) people bought around 45 metric tons of gold bullion coins and bars. This adds another $1.7 billion to the $3.7 billion bringing it to a grand total of $5.4 billion (According to GFMS, Ltd).

Now let’s look at what the public sold in gold over the first seven months of this year. It is estimated by GFMS that the public sold around 70 metric tons of gold through melting down of jewelry. Now no one knows for sure because these transactions are not recorded perfectly, but that would total around $2.7 billion sold.

So if we take the $5.4 billion that the public bought, and subtract the $2.7 billion that the public sold, that would equate to a net purchase of $2.7 billion. Do those figures amount to massive participation by the general public?

Through the end of July the public poured $22 billion into emerging market mutual funds and $155 billion into bond funds (according to FRC). That makes the amount of money that the public put into gold look minuscule. That is such a small amount of money that it could hardly be called a bubble. Compare $2.7 billion to what the general public has in retirement accounts. This number is in the trillions.

Do you know anyone that actually owns gold? Probably not since less than 3% of the public owns gold. When you start hearing all of your friends and neighbors bragging about the gold coins that they own, then you will know that we are approaching a bubble in gold.

Gold has had a great run in the past ten years but I believe the best is yet to come.