YOUR RISK JUST TRIPLED: Hidden in ETFs, Mutual Funds & Annuities by Lynette Zang

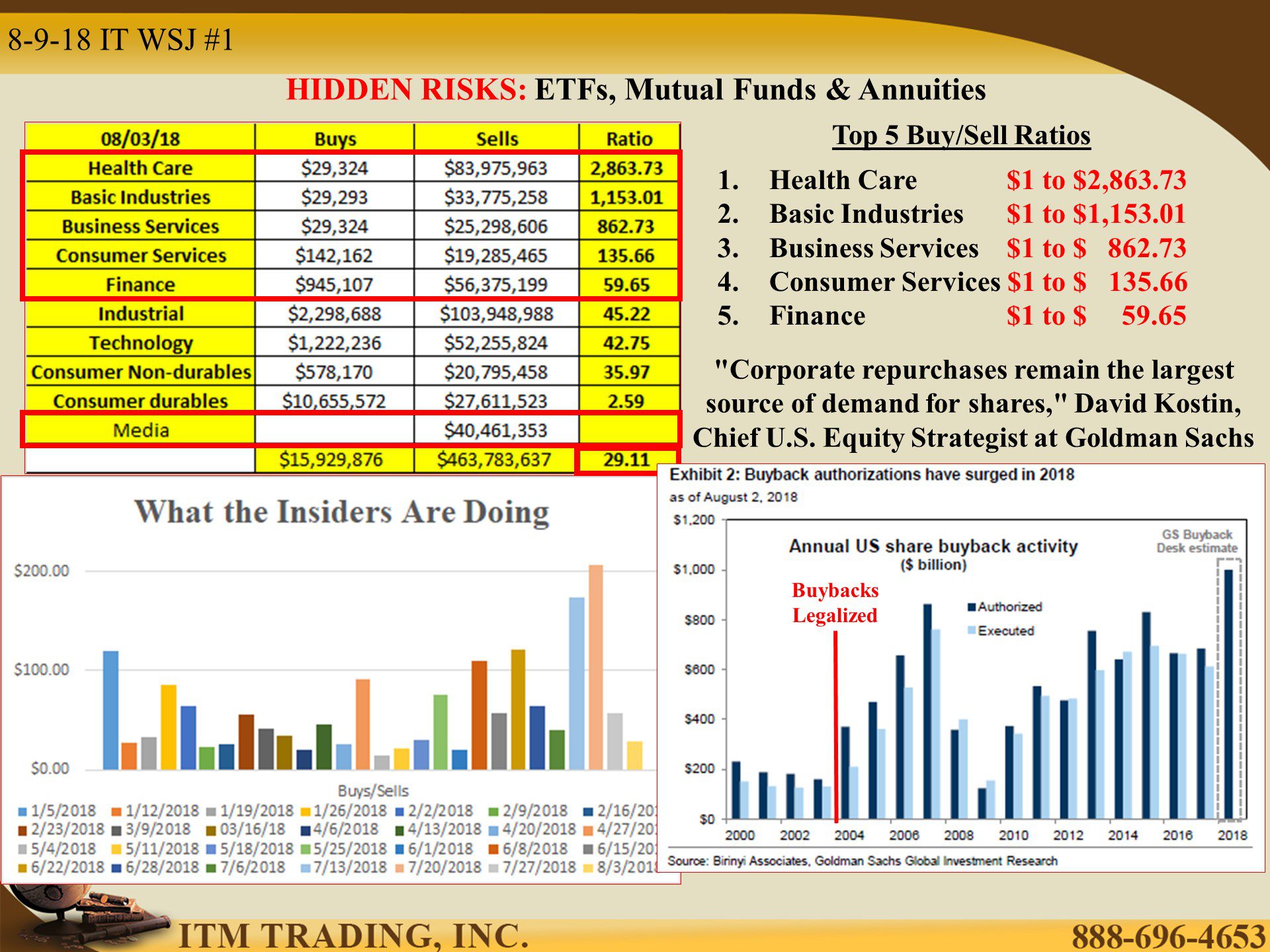

Thank goodness money from tax changes and repatriation are flooding into corporations since now, stock buybacks are a key provider of the fuel that keeps these markets going up and hides the flood of insider selling going on. Perhaps the anticipation of a higher market can entice sidelined fiat money held in money markets, or other forms of cash, back into the stock market.

Though the average person “investing†in wall street’s casino typically does so through mutual funds, ETFs or variable annuities, inside of 401Ks, IRAs etc. Somehow, they trust wall street to manage their wealth and have their best interest at heart. As long as the markets moves higher, they are confident fiat money products are the right choice. But are they?

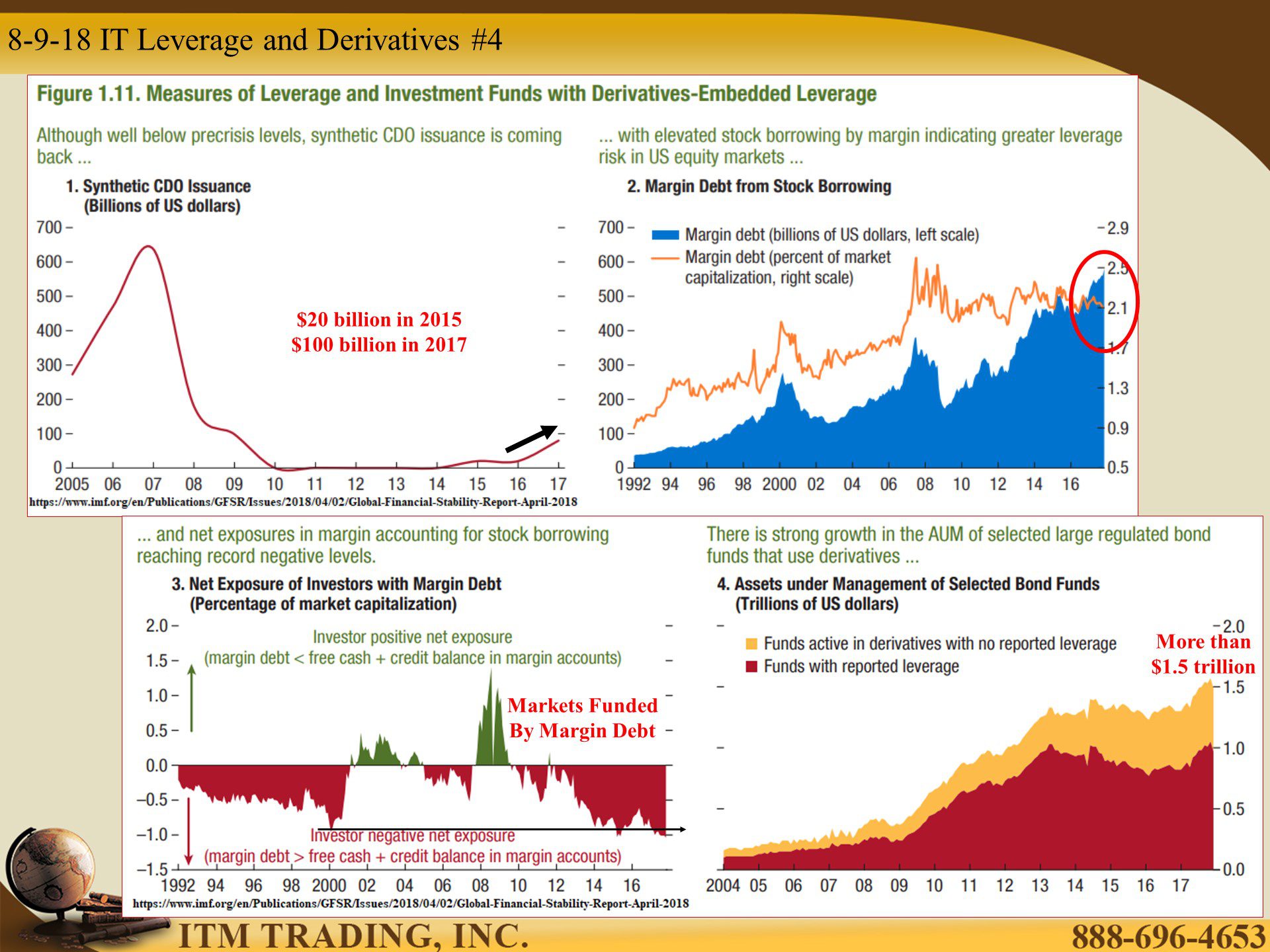

Washington and the Federal Reserve haven chosen the winners of this wall street game, unfortunately, it is not you. I say because of the explosion of leveraged derivatives now embedded through out ETFs, Mutual Funds and Variable Annuities and wall street taking advantage of a little known (to the public at any rate) “exemption†in the Investment Company Act of 1940.

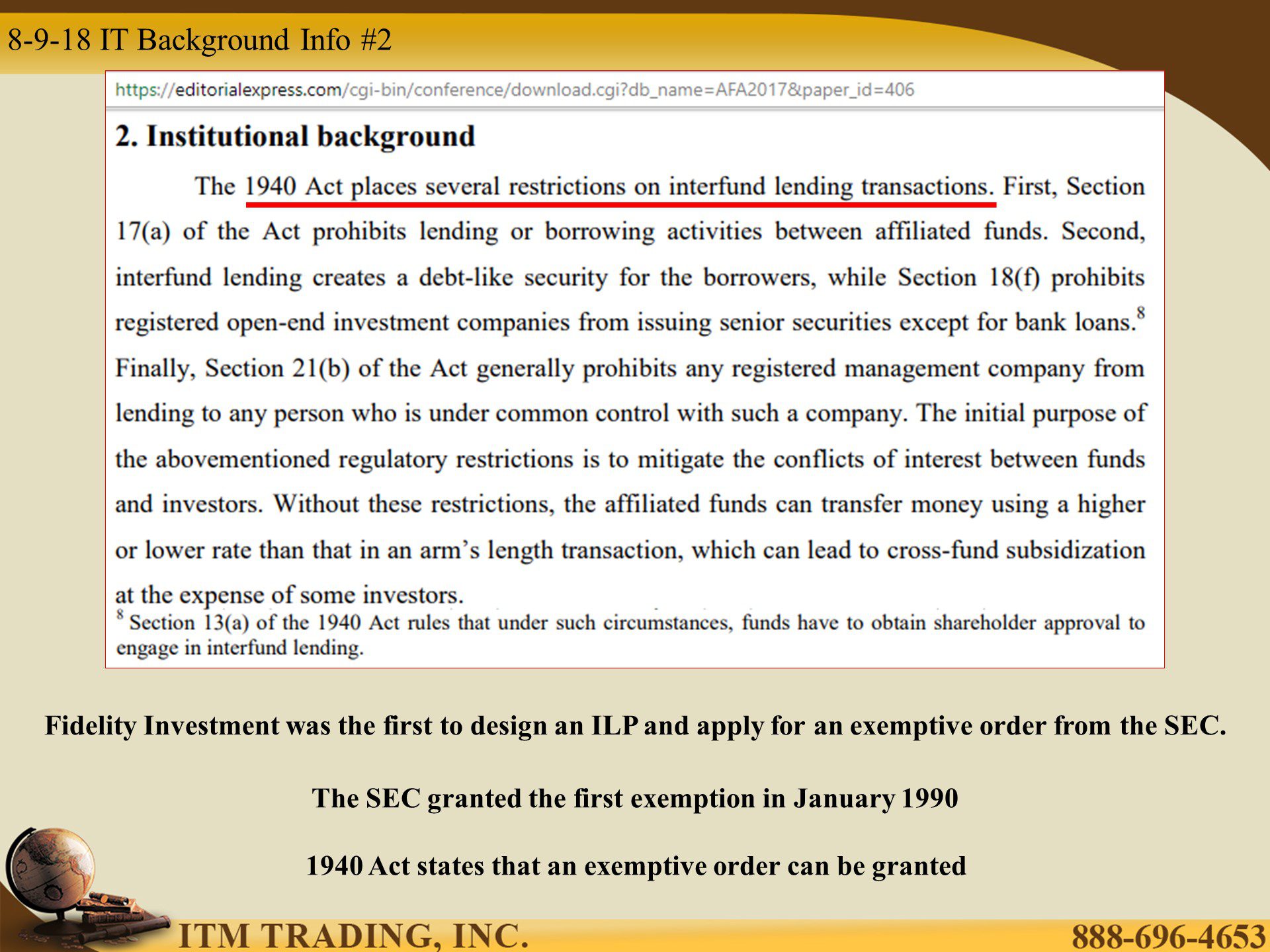

Because of the 1929 stock market crash, deposit taking banks were separated from risk taking investment banks to inspire public confidence. In 1940 the Investment Company Act restricted wall street from borrowing from one product they created, to fund another because it was a conflict of interest between those that managed the money and investors. Of course, there was a little used exemption, if granted by the SEC, that overrode those restrictions.

In 1990, Fidelity Investments was the first to design and utilize what is now known as the “Interfund Lending Programâ€, which enables any fund, within a family of funds, to borrow from another fund in the family. The benefits to the fund managers are many; cheaper borrowing costs, need to hold less cash for redemptions leaving more money available for investments, enabling fund managers to invest in illiquid products because if there is a run in one fund (so the theory goes) a fire sale would be prevented, since cash would be readily available to meet redemptions. The benefit of Interfund lending to the investor (so says the SEC) is the reduced borrowing costs. But the bottom line is this, that means that ANY ETF or mutual fund is as risky as the riskiest fund in that family.

It does not matter if you think you are safe in a short-term government money market fund, you are only as safe as the riskiest fund in that family.

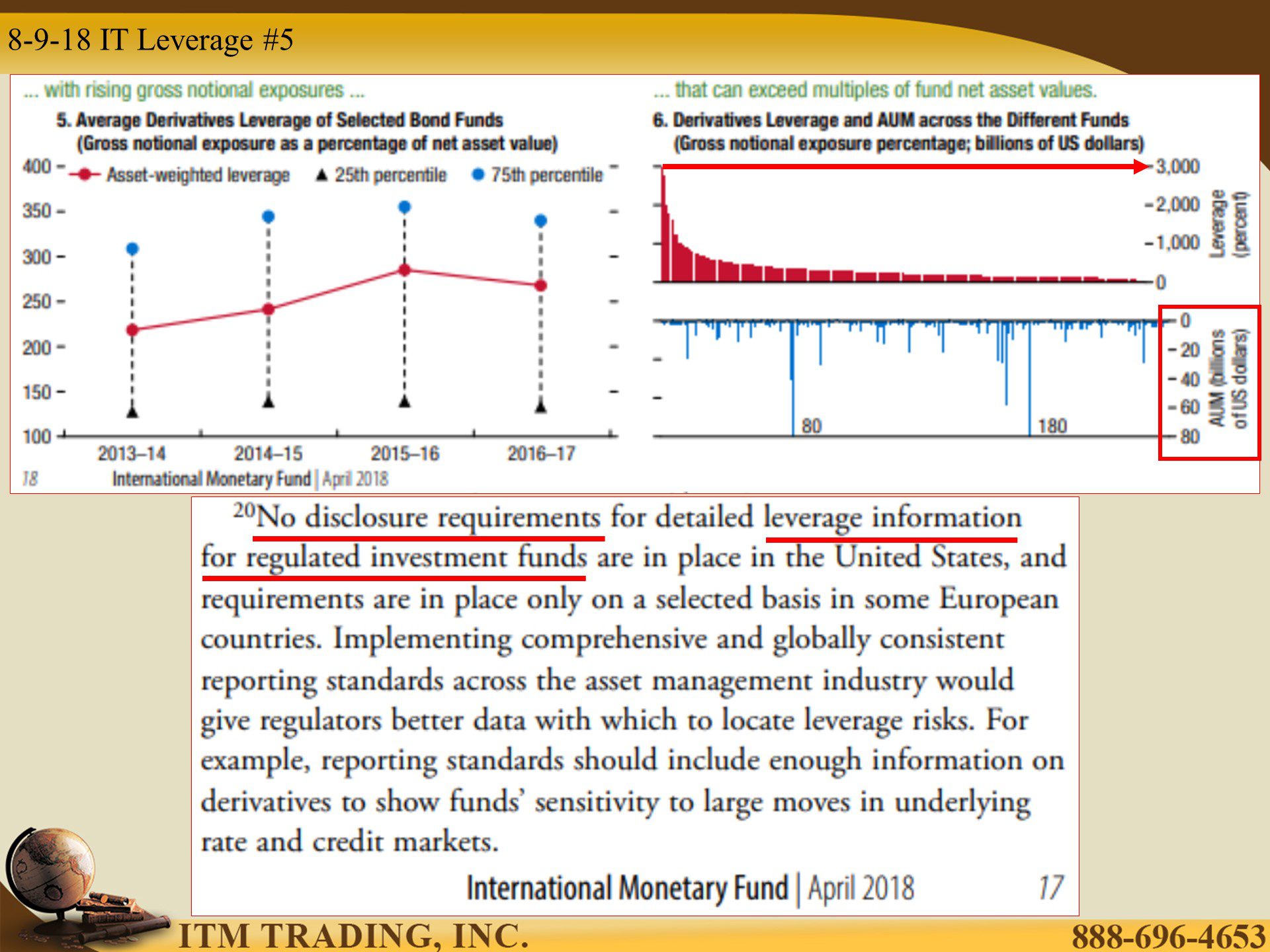

The IMF’s 2018 Financial Stability points to some very stark realities about hidden derivatives and leverage rampant in funds, with some leveraged up to 3,000% of the NAV (Net Asset Value) of the funds! They also point out that how little cash is available during the next crisis. Both issues far worse than 2008.

If you believe, as I do, that the next financial crisis is inevitable, what do you think will happen to any money you leave exposed in ANY bank or insurance company. Data suggests it will be sucked into wall streets black hole of debt because wall street products are just intangible contracts and you did not write them, nor did you read them. You don’t really know what you’ve agreed to, but they do. Simply put, if you don’t hold it, you don’t own it.

Physical gold and silver in YOUR possession is real money that you own outright, a shield to protect you in the upcoming reset. Just keep in mind that shields are made of metal…not paper.

Slides and Links:

http://www.wsj.com/mdc/public/page/2_3024-insider1.html

https://seekingalpha.com/article/4195237-strategy-based-stock-buybacks-continues-underperform

https://www.ft.com/content/00d3d748-9974-11e8-ab77-f854c65a4465

https://legcounsel.house.gov/Comps/Investment%20Company%20Act%20Of%201940.pdf

https://www.sec.gov/rules/icreleases.shtml#interfundlending

https://www.sec.gov/Archives/edgar/data/810893/000119312517215982/d380341d40appa.htm