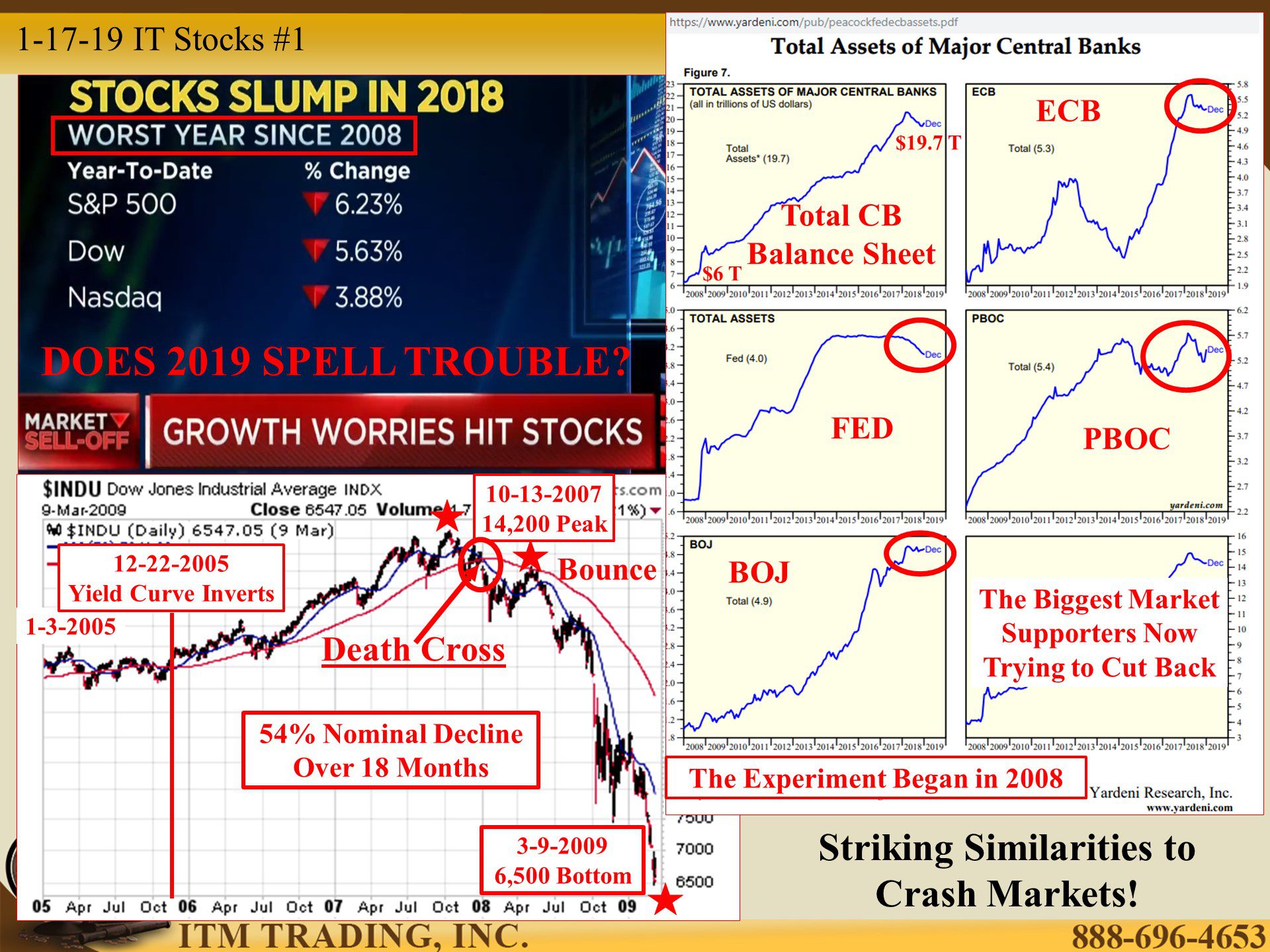

IF 2018 WAS LIKE 2008: Does 2019 Spell Trouble?

Stock markets in 2018 were compared to past fiat money crises’, from 1931 (when the fiat money experiment kicked into gear), to 2008, when the current iteration died and went on life support.

But the depth of the current crisis didn’t hit until 2009 and only bottomed then because of a tsunami of free money heroine injected into Wall Street, that reflated stocks, bonds and real estate and funded a massive expansion of new derivative products (ETFs, CLOs etc.) and the technology to trade it (computer managed algorithms). These new products are now being tested in a bear market.

How well did the 2008 test of CDO derivatives go? And derivatives were primarily held by investment banks, at that time. Today they are everywhere; from central bank balance sheets to mom and pop ETFs, and everywhere in between. And as you likely know, the global financial system is intertwined.

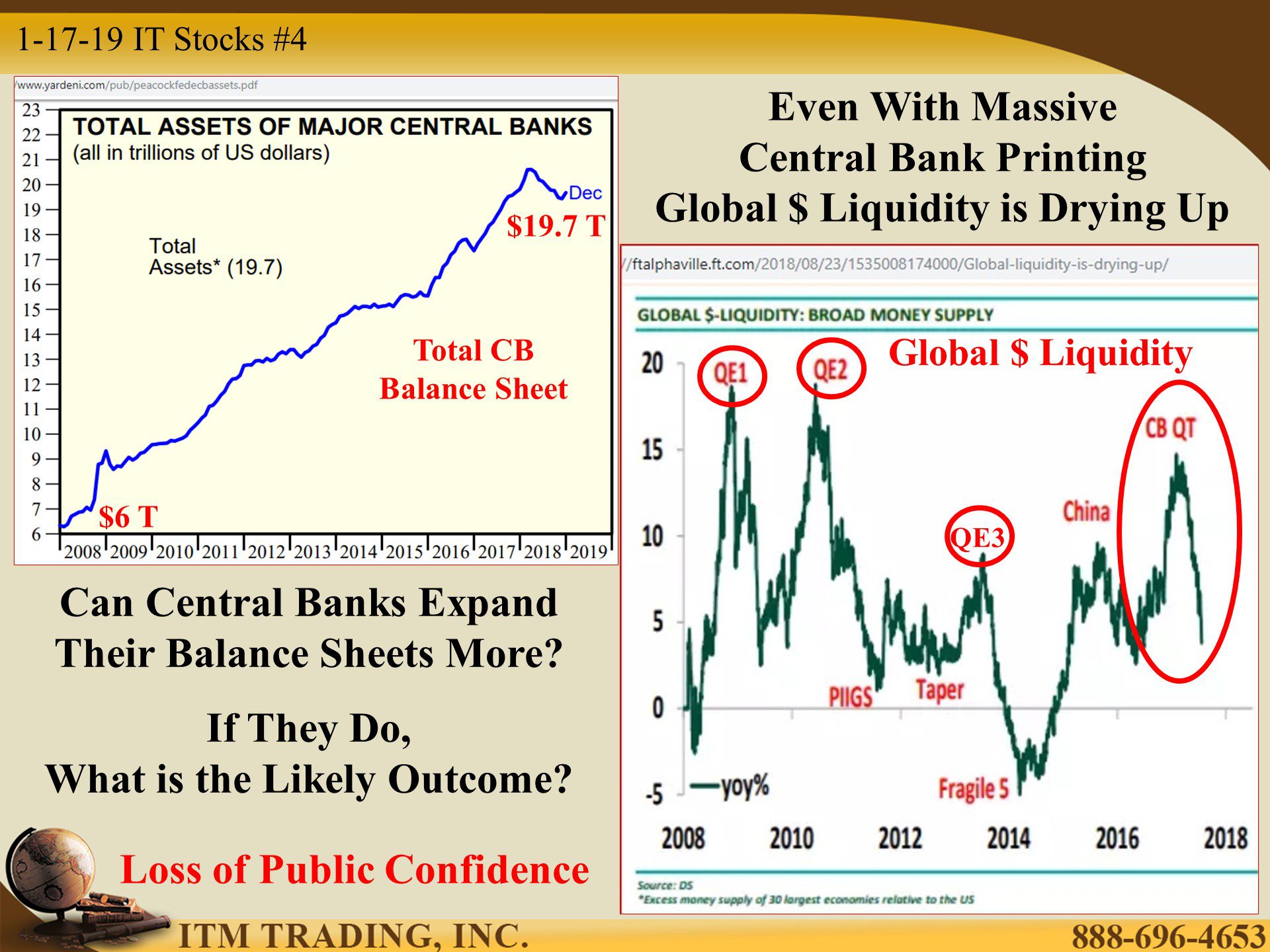

In 2008, credit froze and cut off the life blood of trading. The answer was open ended credit that ran central bank balance sheets to almost $21 Trillion from a little more than $6 Trillion. No wonder Wall Street is addicted. Can they do that in the next financial crisis?

Of course, they can and they most likely will. It’s easy when all it takes is a panicked public and a computer key stroke. But much as they tout the success of QE (easy money policy), markets merely reflect central bankers’ nominal prices. As they attempt to take the free money heroine away, markets are having withdrawals. So, they tell the markets not to worry, they’ll give markets what they need.

Do you know what keeps central bankers up at night? Populism. When governments and central banks support corporate greed above public need, people lose trust in the government and confidence in the central bank and the financial system and a run ensues. Where will they run to?

Traditionally, people fly to the safety of real money gold and silver, the only assets that I see as undervalued at this time, and that’s because it competes with fiat money. As JP Morgan said, “Gold is money, Everything else is credit.†That was true in 1912, when he said it and that’s true today.

If the financial crisis we’ve been anticipating, is now unfolding, where do you think your wealth is the safest?

https://stockcharts.com/h-sc/ui?s=$INDU

https://www.yardeni.com/pub/peacockfedecbassets.pdf

Do you know what keeps central bankers up at night? Populism. When governments and central banks support corporate greed above public need, people lose trust in the government and confidence in the central bank and the financial system and a run ensues. Where will they run to?

Traditionally, people fly to the safety of real money gold and silver, the only assets that I see as undervalued at this time, and that’s because it competes with fiat money. As JP Morgan said, “Gold is money, Everything else is credit.†That was true in 1912, when he said it and that’s true today.