CONSIDER YOURSELF WARNED… Imminent Crisis Signaled? By Lynette Zang

The abrupt Fed pivot from tightening to not, gave markets an unsustainable short-term V-shaped boost that is losing steam just as the flood of unicorn IPOs are coming to market. Why the selloff? Global growth is slowing faster than anticipated, and as the German bund retreats into negative territory, the US treasury yield curve inversion has expanded.

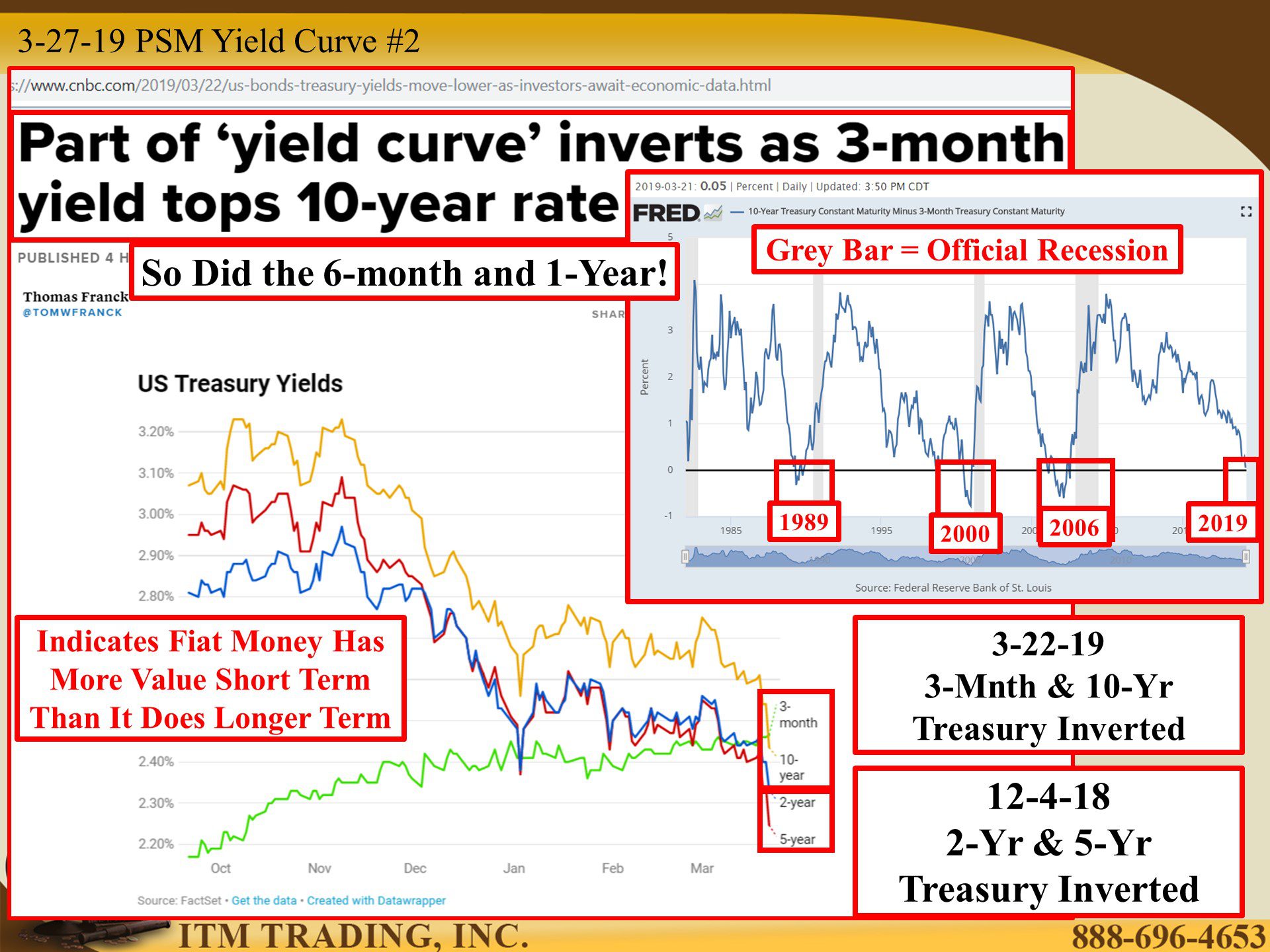

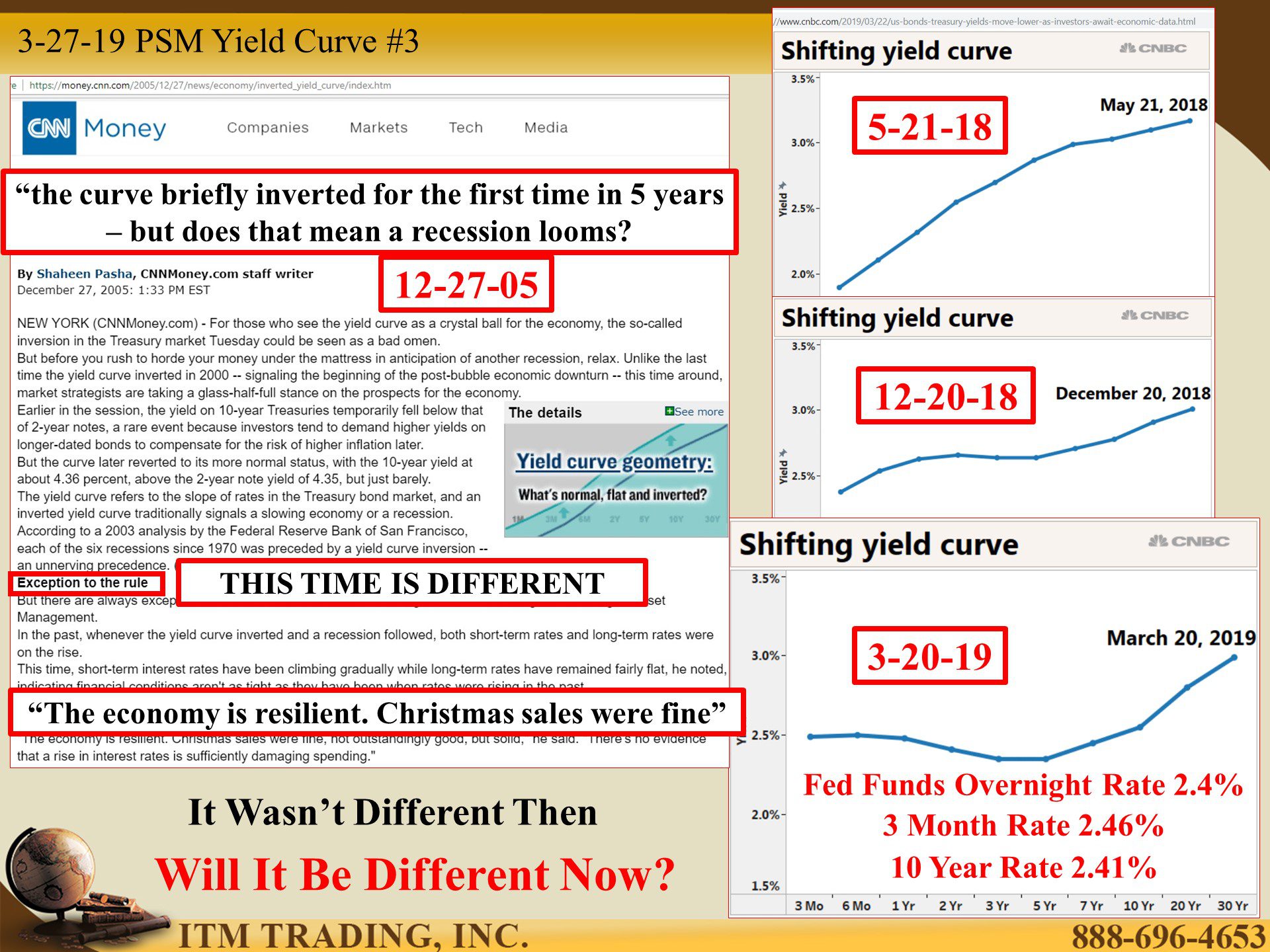

March 22, 2019 signaled red when the 3-month treasury rate paid more than the 10-year treasury (so did the 6-month and 1-year) which is considered the most accurate forecaster of a recession. The last time that happened was in 2006 and led to the “Great Recession†that became visible to all in the fall of 2008. The inability of global central bankers to reduce market support is proof that money for free merely hid the fundamental problems in the financial system, it did not fix them. Rather, like any addict, it takes more and more to maintain a high and keep the markets up.

Of course, we’re told this time is different, we’re always told that before a crisis. But central bankers are mere mortals, and while they might want to engineer a soft-landing, they never have, and most likely never will. Market professionals know this, hence the rush of IPOs providing a way for insiders to capture gains near a top.

We’re told the bull market could roar some more as long as central banks kept the QE free money punch bowl in place. They seem to forget or ignore the shrinking buyer base and the lack of new money coming in to support these bloated markets. Most likely, the recent rally from the December 24th lows is just a bull trap, designed to entice the public to “invest.†If that doesn’t happen, this IPO rush could create a volatility storm as current holdings are sold to invest in the new issues, and computer algorithms trigger herd behavior that could prove to be too much for the central bank’s current abilities.

In fact, sophisticated market participants have begun to question the central banker’s ability to bail out the next crisis. As witnessed by, at this writing, the overnight Fed Funds Rate stands at 2.4% while the 10-year treasury rate is 2.41%, making cash king. In addition, the cup formation in spot gold is a smart money accumulation pattern and is nearing conclusion as well as massive central bank gold buying.

Follow the money, because the real risk may be revealed soon. What is the real risk you ask? Loss of confidence in the central banks.

For now, sophisticated market participants question the central bankers’ abilities as they take money off the table, but what happens when the public loses confidence? Reset.

Slides and Links:

www.stockcharts.com

www.stockcharts.com

https://fred.stlouisfed.org/series/GS10

https://money.cnn.com/2005/12/27/news/economy/inverted_yield_curve/index.htm

https://fred.stlouisfed.org/series/FEDFUNDS

https://www.cnbc.com/2019/03/22/the-feds-policy-switch-may-be-too-late-to-save-the-economy.html

YouTube Short Description:

On March 22, 2019, considered the most accurate forecaster of recession signaled red when the 3-month treasury rate paid more than the 10-year treasury did (so did the 6-month and 1-year). The last time that happened was in 2006 and led to the “Great Recession†that became visible to all in the fall of 2008.

In fact, sophisticated market participants have begun to question the central banker’s ability to bail out the next crisis. As witnessed by, at this writing, the overnight Fed Funds Rate stands at 2.4% while the 10-year treasury rate is 2.41%, making cash king. In addition, the cup formation in spot gold is a smart money accumulation pattern and is nearing conclusion as well as massive central bank gold buying.

For now, sophisticated market participants question the central bankers’ abilities as they take money off the table, but what happens when the public loses confidence? Reset.