The Price of Gold

The price of gold changes on a day to day, minute by minute market action, and is reported around the world nonstop. Just as markets may close in the United States, another foreign market opens and the trading continues. What is important to realize, however, is that this “price†is generally derived from the wholesale price of a contract for 1000 ounces of un-mined gold for future delivery. What is even more peculiar is that a very, very small percentage of these contracts ever get filled.

Let’s look more closely at this. Q.  Why would anyone buy something they don’t want to actually take delivery of? A. They don’t want the gold – they want easy profits. Q. How can someone or some entity sell forward an unlimited amount of a very limited resource that doesn’t even exist in marketable terms yet? A. In most business models you can’t as it is deemed fraud. Wouldn’t selling more than you have of something that is as rare as gold skew the supply and demand basics of economics that we all learned about in high school? A. Yes – the relationship between supply and price is ruined.

Want more food for thought? Quite often the COMEX or Commodities Exchange Inc., a division of the New York Mercantile Exchange (NYMEX) comes very close to defaulting. This means though many of the paper contracts it sells to represent gold for future delivery are never redeemed for gold, the small percentage of contracts that are redeemed for real gold (quite often under 10%!) are enough to wipe out what gold reserves there are! What happens? Why don’t we hear about this? Here is why you don’t hear about this: the COMEX managers call the accounts that want to take delivery of their physical gold, and offer them a high percentage of cash above the “contract  value” of the gold to accept cash rather than take physical delivery of the yellow metal. They have to do this rather than risk defaulting on their contracts and being exposed for practices that would get most business owners thrown in jail. As long as they can pay off a few contracts with digital bank account deposits rather than deliver real gold, the secret stays covered and the public is none the wiser.

Now, knowing what you know may bring about this question; “If the price of gold is so manipulated, why should I buy it?†Here’s your two-part answer:

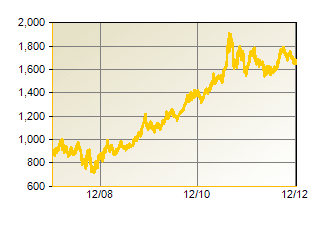

A) Even though the price of gold is highly manipulated, they can’t control it altogether simply because gold competes with not only the U.S. Dollar, but other currencies. As these currencies lose value and purchasing power, the number of Dollars ( or Euros, Pounds, etc.) it takes to purchase an ounce of gold rises simply because Gold is rooted in reality, whereas the Dollar or Euro or Pound is not. You see, Gold mines cost actual money. Paying Miners costs actual money and crushing 70 tons of Ore into Gold Ore costs money. If the cost of a loaf of bread goes from $2 to $4, the miner will want his pay doubled. You can see the relationship between work and pay. In fact, Gold has risen an average of 13.52% a year since 1999 in U.S. Dollars. Try getting a 13.52% CD! Incidentally, since 2001 even some of the most common $20 Liberty gold coins in the mint state range have appreciated an average of 20.07% per year, while gold bullion only achieved an average of 16.56% per year! Call your ITM representative at 1.888.696.4653 to participate in this market!

B) They can’t keep the charade going forever. When the house of cards falls (much like the mortgage bubble and the NASDAQ bubble in the recent past) Gold will go to it’s intrinsic value. Currency experts like Jim Rickards put the true notional value of gold somewhere between $5000 and $12000 currently. Perhaps the next thing to ponder is, “shouldn’t I be more concerned about the Value of Gold, rather than the price of gold.â€