Why Gold Prices are Not in a Bubble

As the price heats up on gold and breaks records in nominal terms more people become fearful that gold is in a bubble. These concerns are justified as people do not want to buy in at a top. Many people lost a lost of money in the dot com bubble of 1999-2000 and the real estate bubble of 2004-2006. People do not want to get caught in a bubble again. To understand that we are not at the top of the gold market yet, one must only look at the trends.

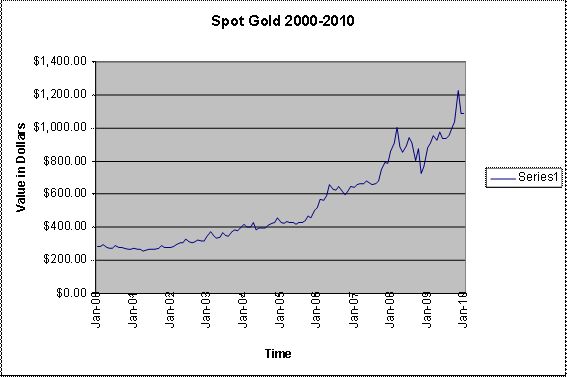

Gold has been in a 10 year bull market, starting in 1999 with a low price of $252.20. Since then the price of gold has been steadily rising building a solid foundation all along the way. Just because we have seen gold recently break a record price in nominal terms (adjusted for inflation the real all-time high is around $2,300) does not indicate a top is being formed. Typically tops come when prices rise dramatically over a short-period of time with no corrections or foundation being built along the way. If you take a look at the gold chart below you will notice many ups and downs, but if you draw a line from beginning to end the trend is steadily rising. There haven’t been any dramatic gold price run ups without a slight correction behind it.

Typically a bull market will experience three phases. The first phase is the accumulation phase where the asset will go up slowly without too much attention being paid to it. On the chart below this represents 2000 to the middle of 2005. The second phase, where we are now, is the awareness phase. In this phase prices will rise a little more dramatically than the first phase due to increased attention being paid to the asset by Wall Street and the general public. Notice that everyday gold receives more coverage on air. More commercials to buy and sell gold pop up weekly and new companies are formed to meet demand.

The third and final phase, which is probably a few years away, is the panic or speculation phase. This is where the price will rise very fast without any significant corrections. This is where bubbles are formed. This is where you want to sell. Most people make the mistake of buying too late in the third phase. In the third phase everyone will be bullish on gold. All of your friends, neighbors, waiters etc will want in. When exactly this phase will play out, in my opinion will be determined by what goes on in the economy. If governments around the world continue to print money to bail us out, gold could do well for a long time to come.