THE WALL STREET BANDITS; Tearing Down Regulations… by Lynette Zang

President Trump has begun the rollback of the Dodd-Frank bank regulations that were created after the 2008 crisis. Keep in mind that regulators have been writing this 20,000 page document since 2010 and were only 70% completed by 2016, not to mention how few regulations actually went into effect. Though the bail-in laws did.

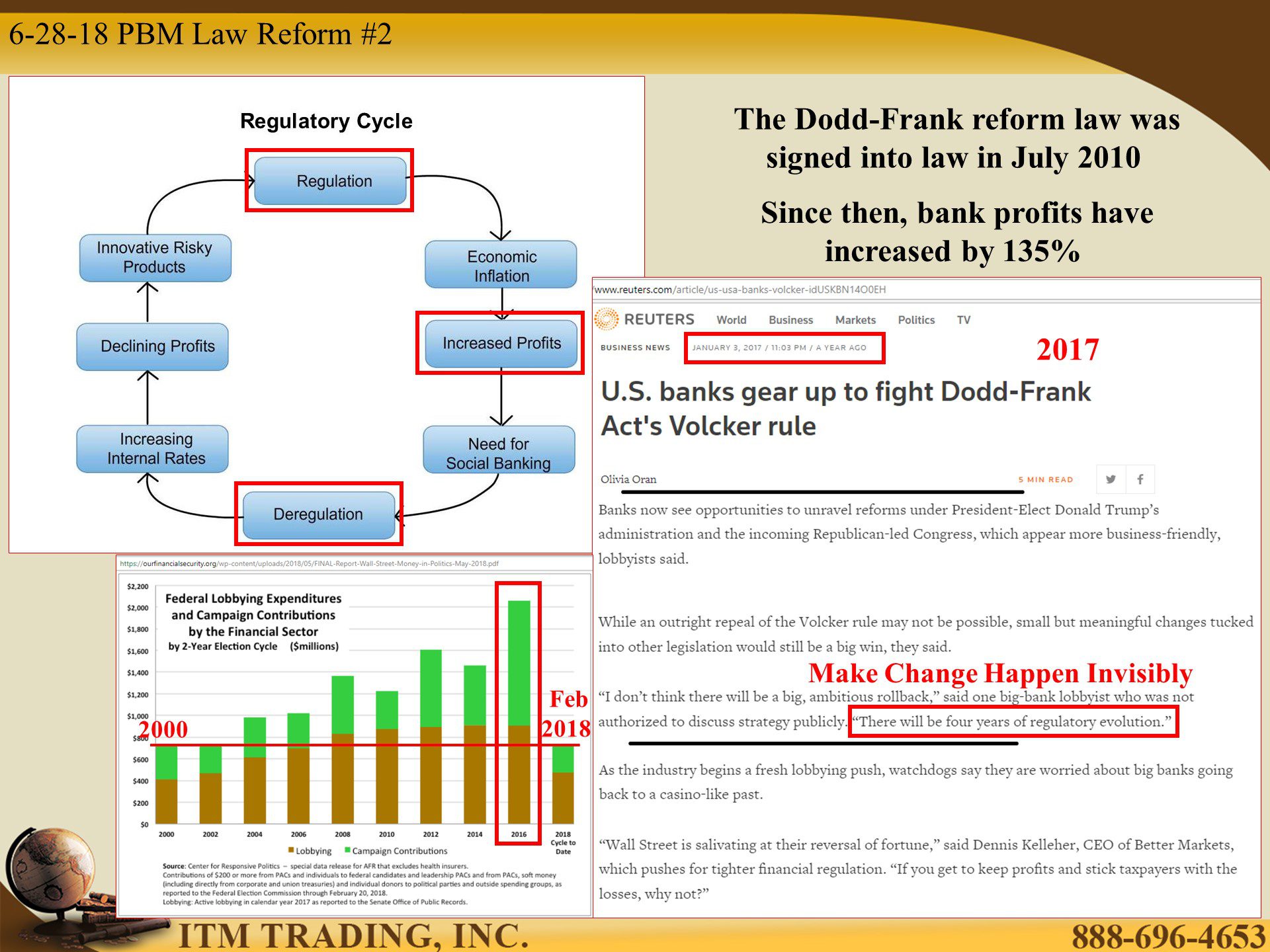

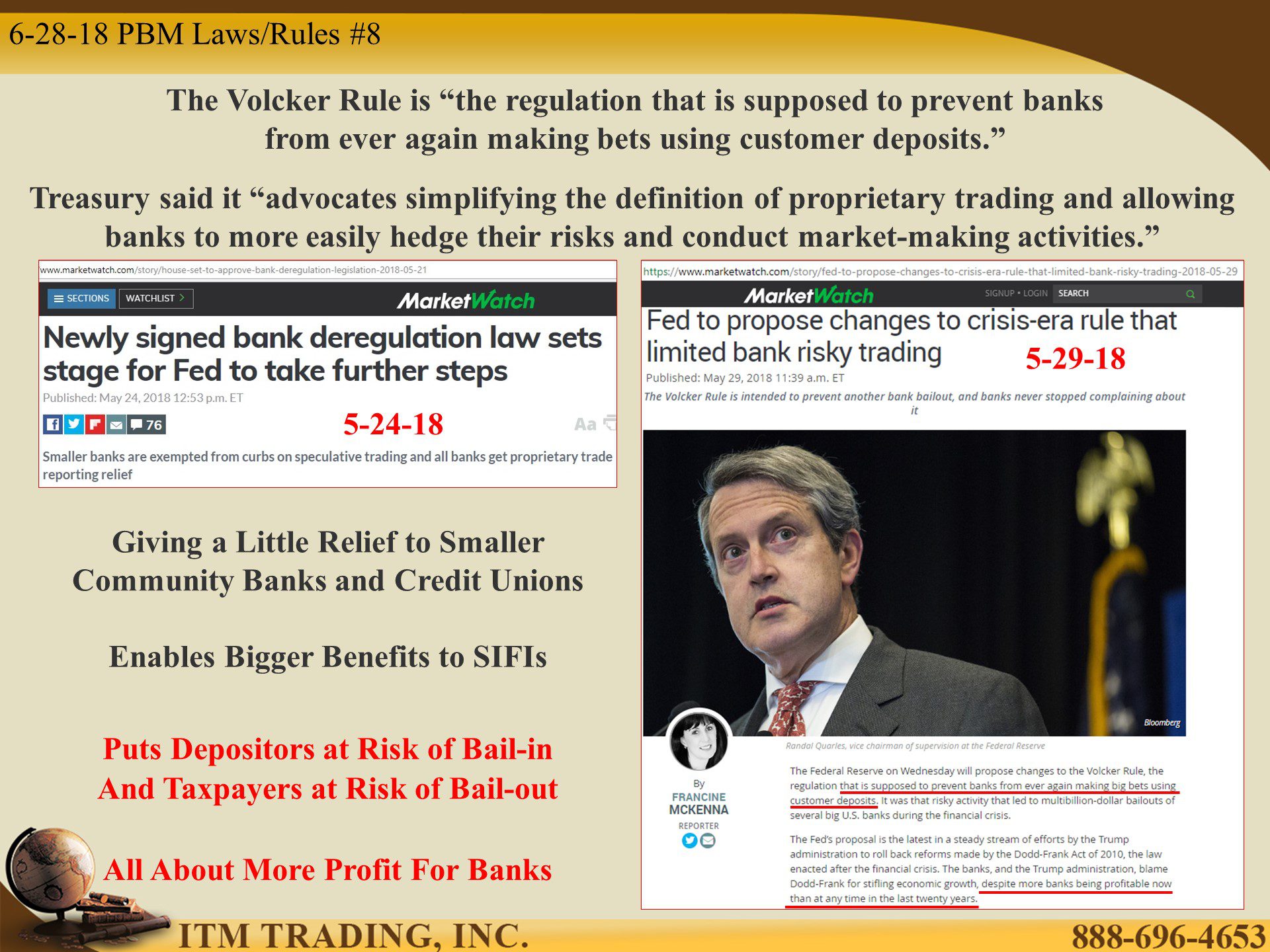

How did they decide which of those regs to rollback? Likely the massive amount spent on lobbying and campaign contributions had something to do with that. There were many things the banks wanted changed, like the SIFI (Systemically Important Financial Institution) designation that created additional oversight and higher reserve requirements, they also focused on dismantling the Volcker Rule.

Both of which have now changed.

What Are They and Why Do They Matter

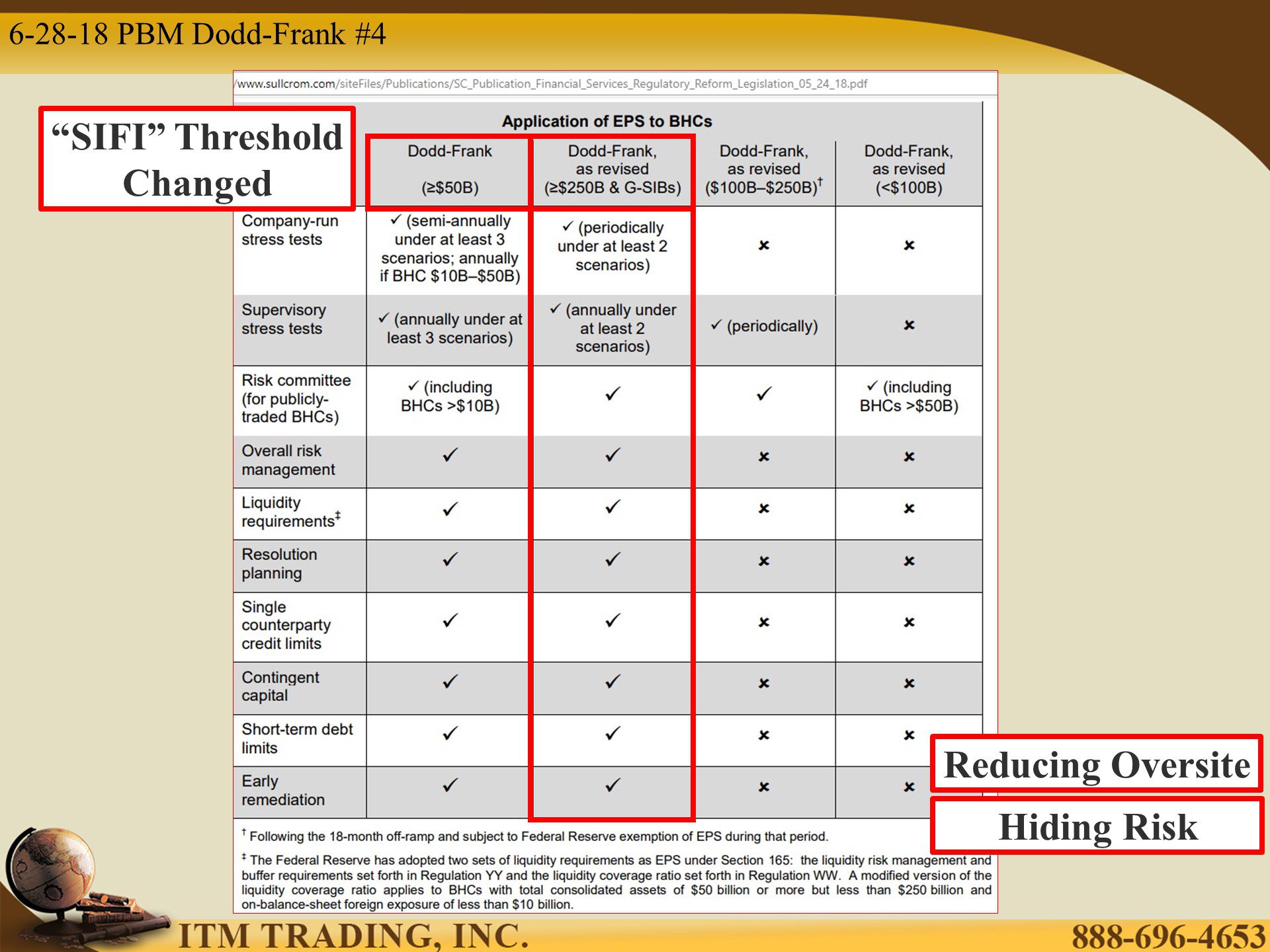

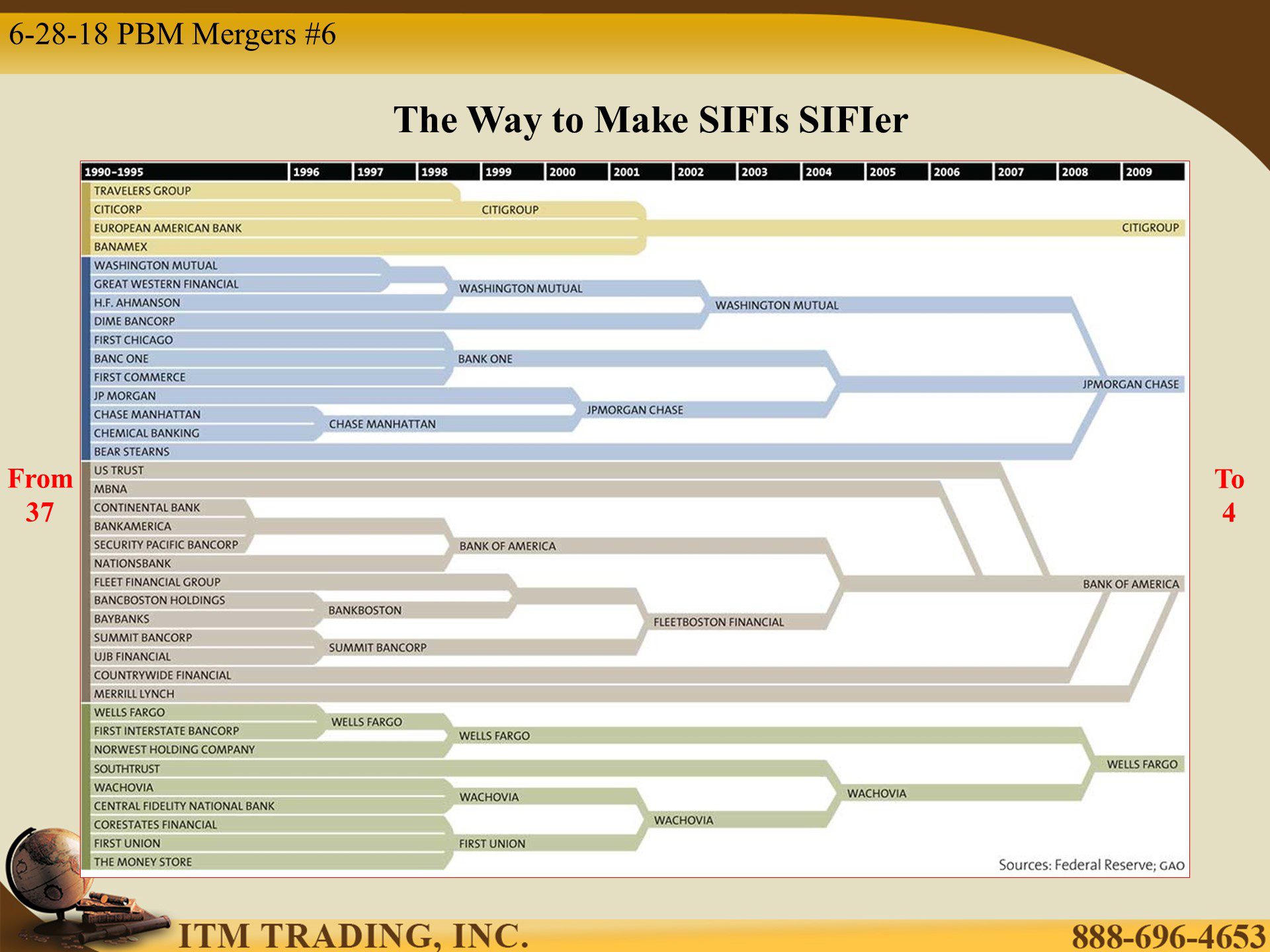

The SIFI designation was awarded to any financial institution that had at least $50Billion in assets, (which include your deposits). Now it impacts those financial institutions that hold at least $250Billion. A FIVE-FOLD INCREASE. Many believe this will spur consolidation in the banking sector, which would continue the trend that began in the mid-nineties.

This matters because these consolidations remove your choices and consolidate risk, making those banks that were too big to fail in 2008 even bigger! How much wealth do you think might be gobbled up by these globally systemic banks during the next crisis?

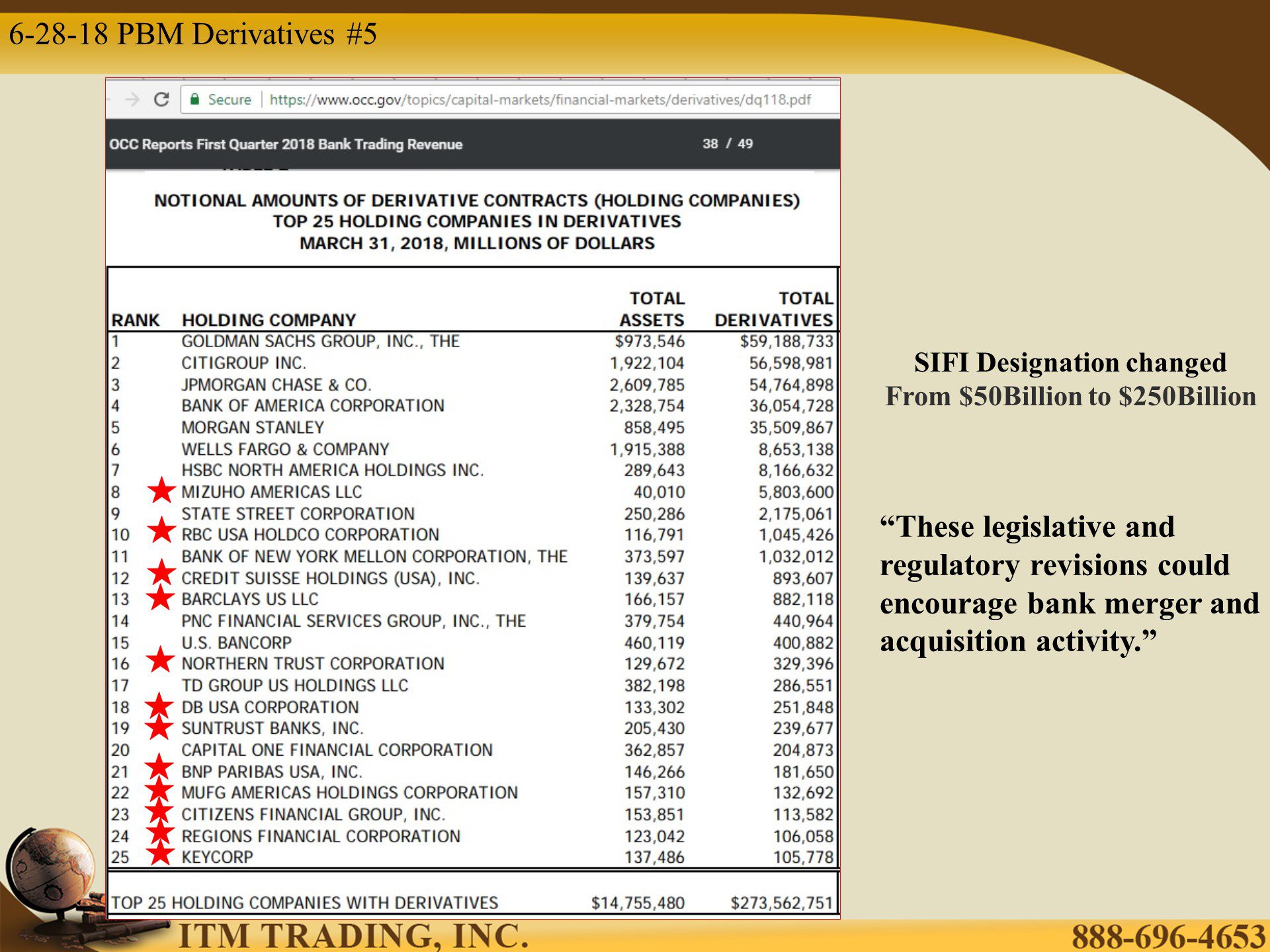

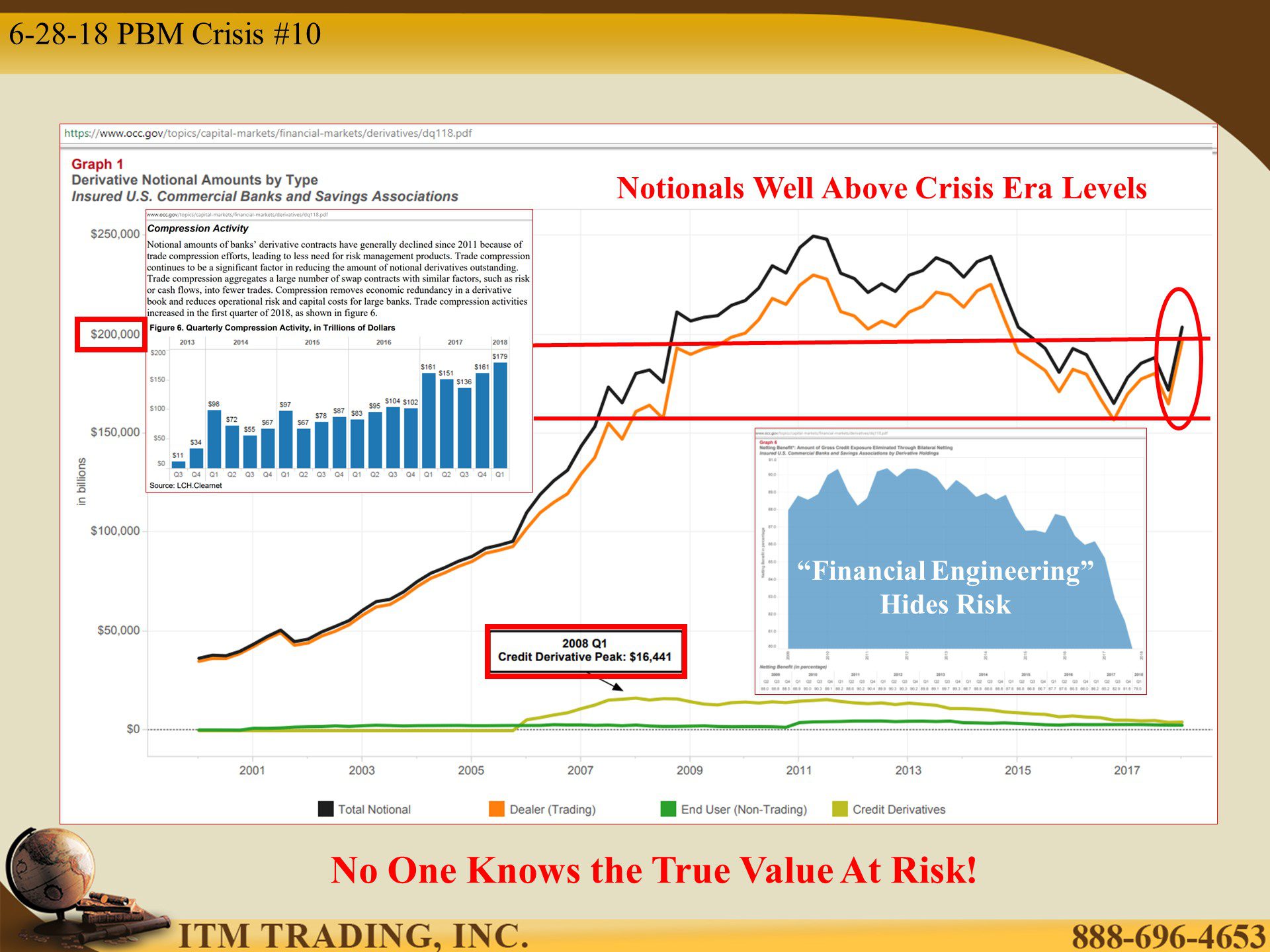

Are those banks between $50 billion and $249.9 billion no longer a risk to the system? That depends on their derivative bets.

Dismantling The Volcker Rule

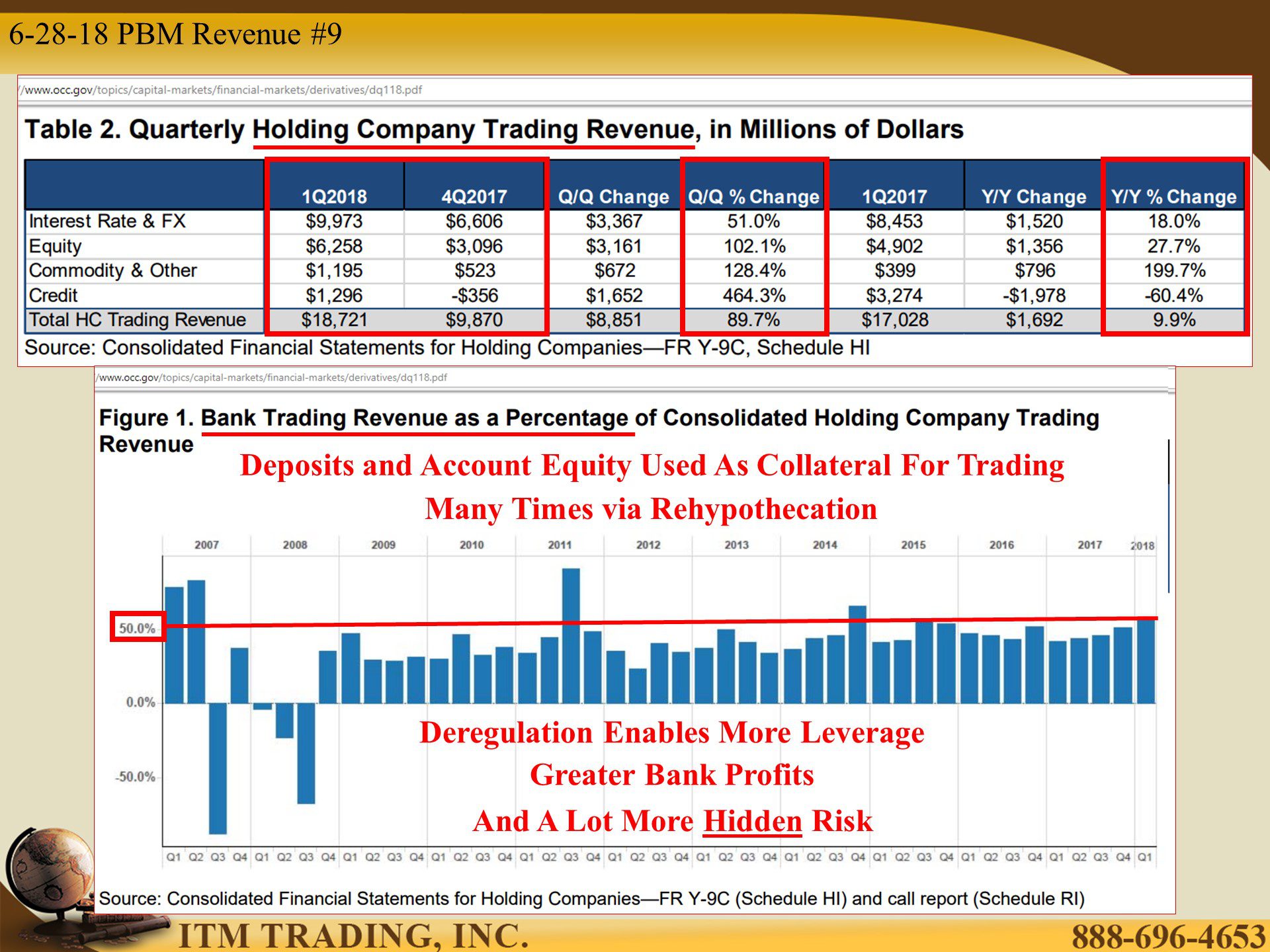

The other trend that began in the 90’s was the massive expansion of leverage.

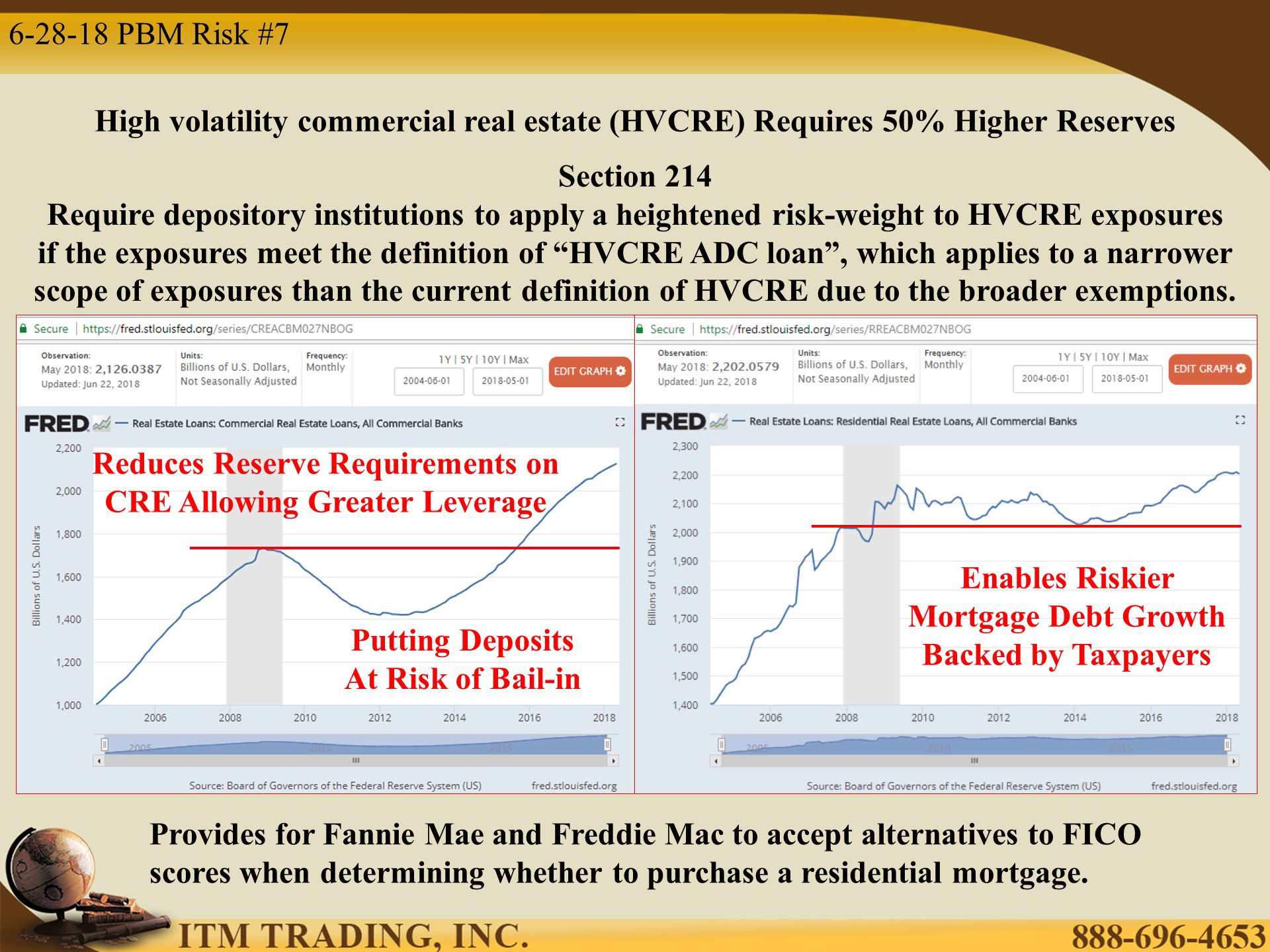

The sweep laws enacted in 1995, allowed banks to sweep your deposits into “sub†accounts, this reduced reserve requirements and provided a lot of cheap funding for proprietary trading. And what better tool to trade than speculative derivatives, adding a ton of leverage on top.

A derivative is a contract bet against price moves of an asset or instrument (stocks, bonds, real estate, other derivatives), that does not require ownership of the underlying. This avoids the normal costs of ownership (buying and reserve requirements) and does not tie up funds yet enables benefiting from price moves. At a fraction of the cost of ownership (1,000 to 1 in many cases), this is a very cheap way to make money.

This is why deposits and “street name†accounts are so valuable to banks. Not to mention how those accounts may be FDIC insured, which ultimately shifts the risk of bank failure onto depositors and taxpayers. Bail-in (Cyprus, Greece, Italy etc.) and Bail-out (TARP, TALF, QE, zero bound interest rates, etc.).

After 2008 The Volcker Rule was written into the Dodd-Frank Act. This was supposed to prevent banks from making bets using customer deposits. Though one glance at the 2018 OCC’s report on derivatives in the FDIC insured banks says that the Volcker Rule, though written, was not yet implemented. I suppose the bank lobbying might have had something to do with that.

Now it is being dismantled. After all, the most important thing for the economy is making sure banks profit. Even at the cost of the public. Think 2008.

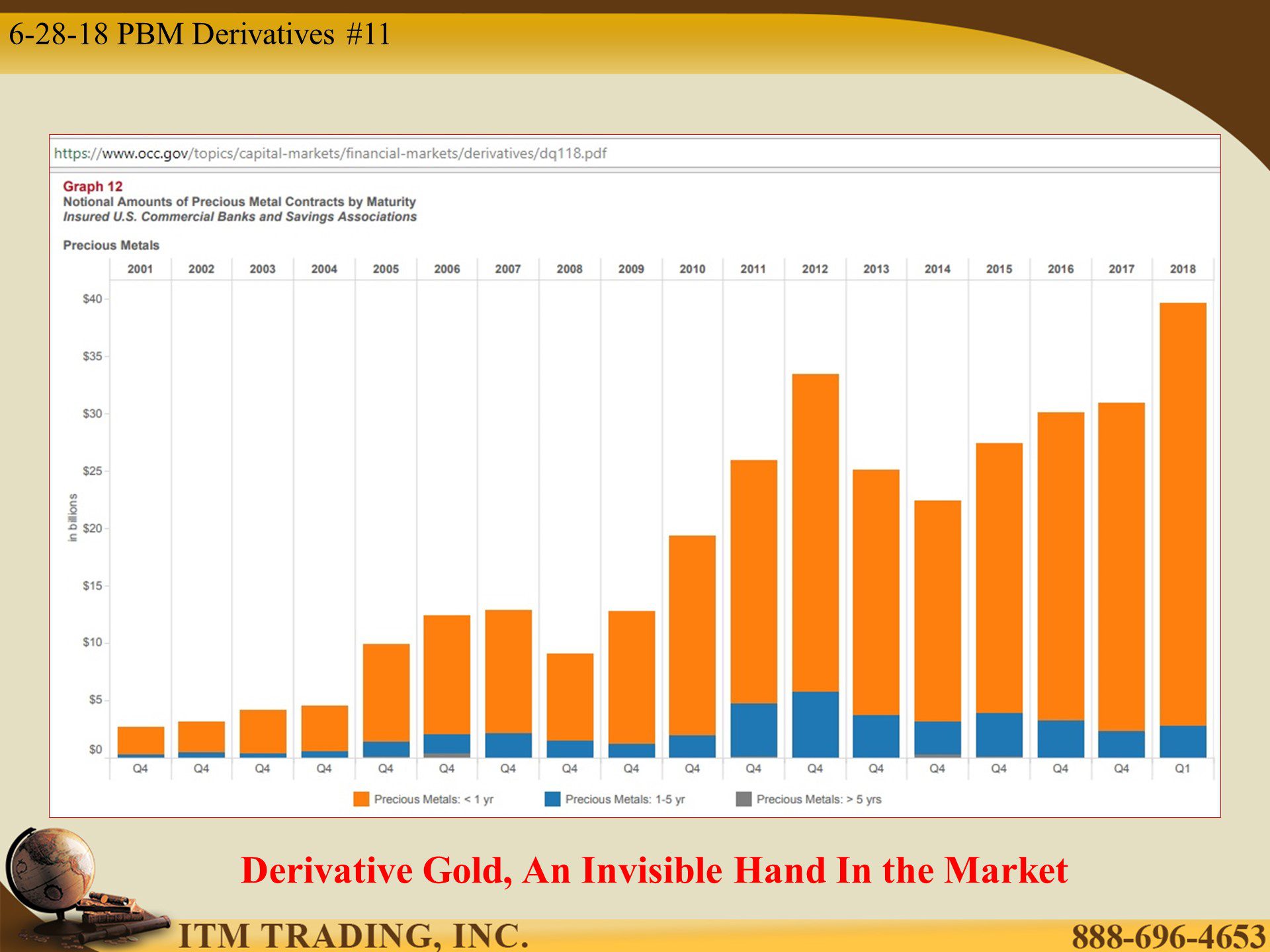

The Role of Gold Derivatives

There are many kinds of gold derivatives; futures contracts, spot markets, ETFs and derivative contracts etc. You know it’s a derivative if you do not hold physical gold in your hands. Originally created to manage the public’s perception about gold by controlling the visible price.

Since a rising gold price is an indication of a failing fiat currency, can you see how important a tool like derivatives can be to bankers and governments? That’s why they all agreed to keep you in the dark.

While the 2018 OCC report shows merely one area of gold derivative bets, the explosive growth in use, especially since 2012 as the spot gold market approached $2,000, explains the suppression and creates the opportunity. Personally, I’m taking advantage of it, just like the 1% and central banks are.

Slides and Links:

https://www.reuters.com/article/us-usa-banks-volcker-idUSKBN14O0EH

http://slideplayer.com/slide/10966927/

http://money.cnn.com/2018/05/22/investing/banks-record-profits-fdic-deregulation-bill/index.html

https://www.congress.gov/bill/115th-congress/senate-bill/2155/text

https://www.congress.gov/bill/115th-congress/senate-bill/2155

https://cei.org/blog/so-what-regulations-did-trump-eliminate

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq118.pdf

https://fred.stlouisfed.org/series/CREACBM027NBOG

https://fred.stlouisfed.org/series/RREACBM027NBOG

https://www.marketwatch.com/story/house-set-to-approve-bank-deregulation-legislation-2018-05-21

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq118.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq118.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq118.pdf