USD PLUNGES, Bursting the Strong Dollar Myth… by Lynette Zang

Many of you who’ve been accumulating gold and silver over the years, have been subject to ridicule for doing so. Friends and family members see the markets marching higher and believe that this time is different, and they can believe Wall Street’s lies. From time to time, you might even question yourself. It can be lonely being the only goldfish in the pond. I’m here to show you the truth and bust the strong dollar myth.

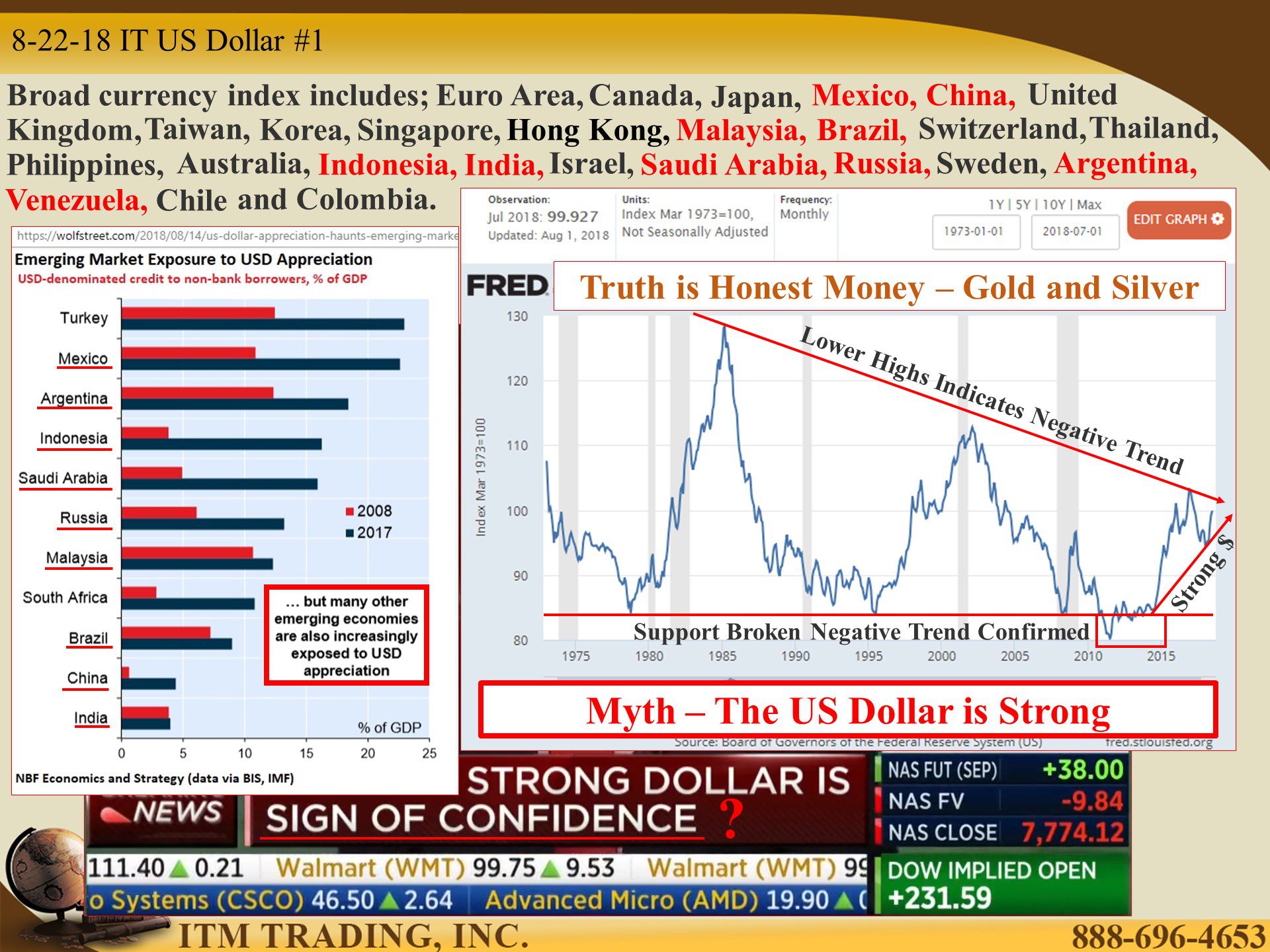

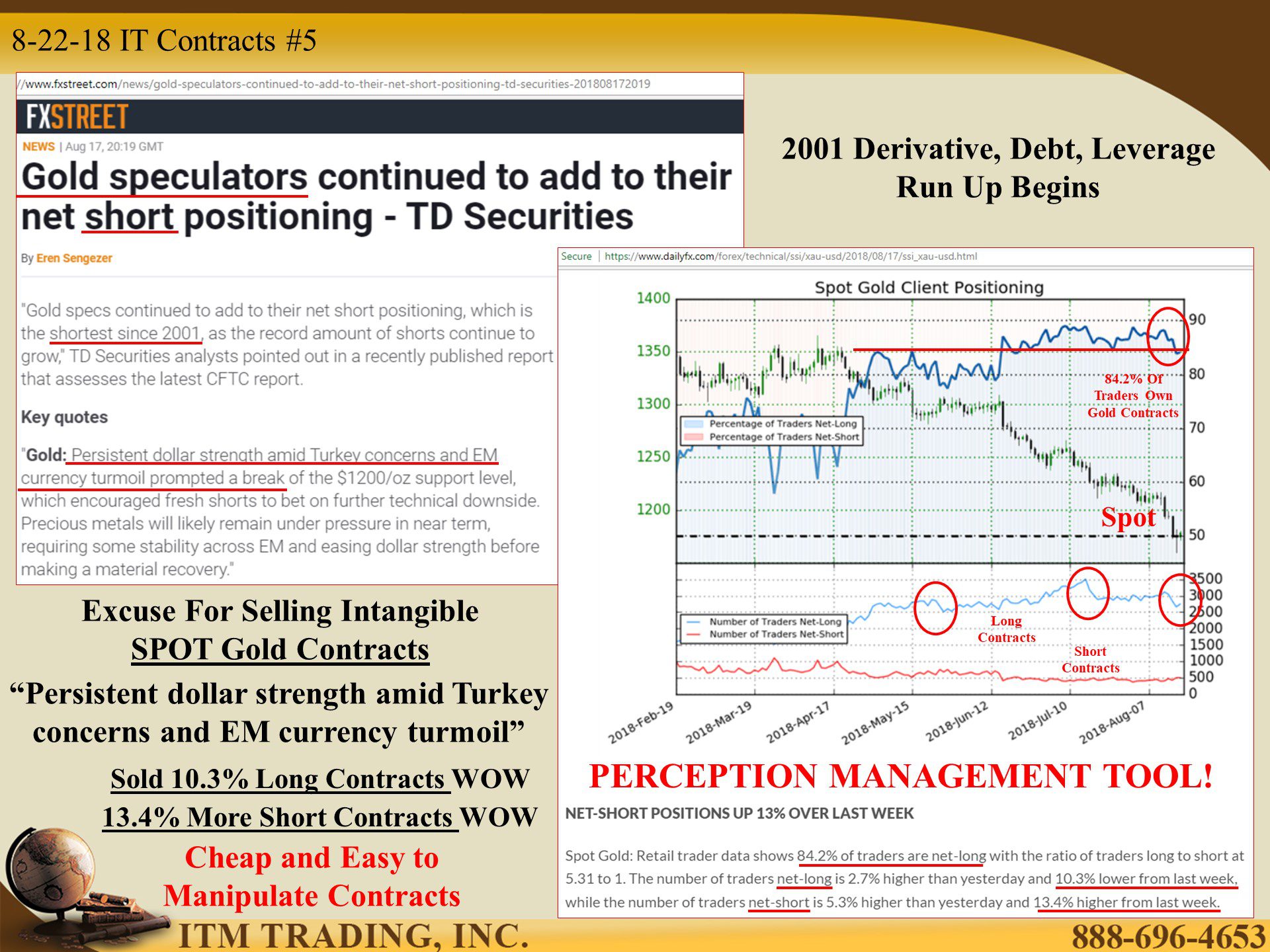

First, it’s important to understand that Wall Street refers to the strong dollar in “relative†terms. In other words, strong versus other fiat currencies. But since markets do not operate in a vacuum, for every action there is a reaction. Therefore, all the USD debt accumulated when the USD was substantially weaker, is now a lot more expensive to service as the cost of buying dollars has exploded. Will this cause defaults? Most likely. And because all financial markets are intertwined, these defaults could cause a meltdown with the potential to rip through the global financial system.

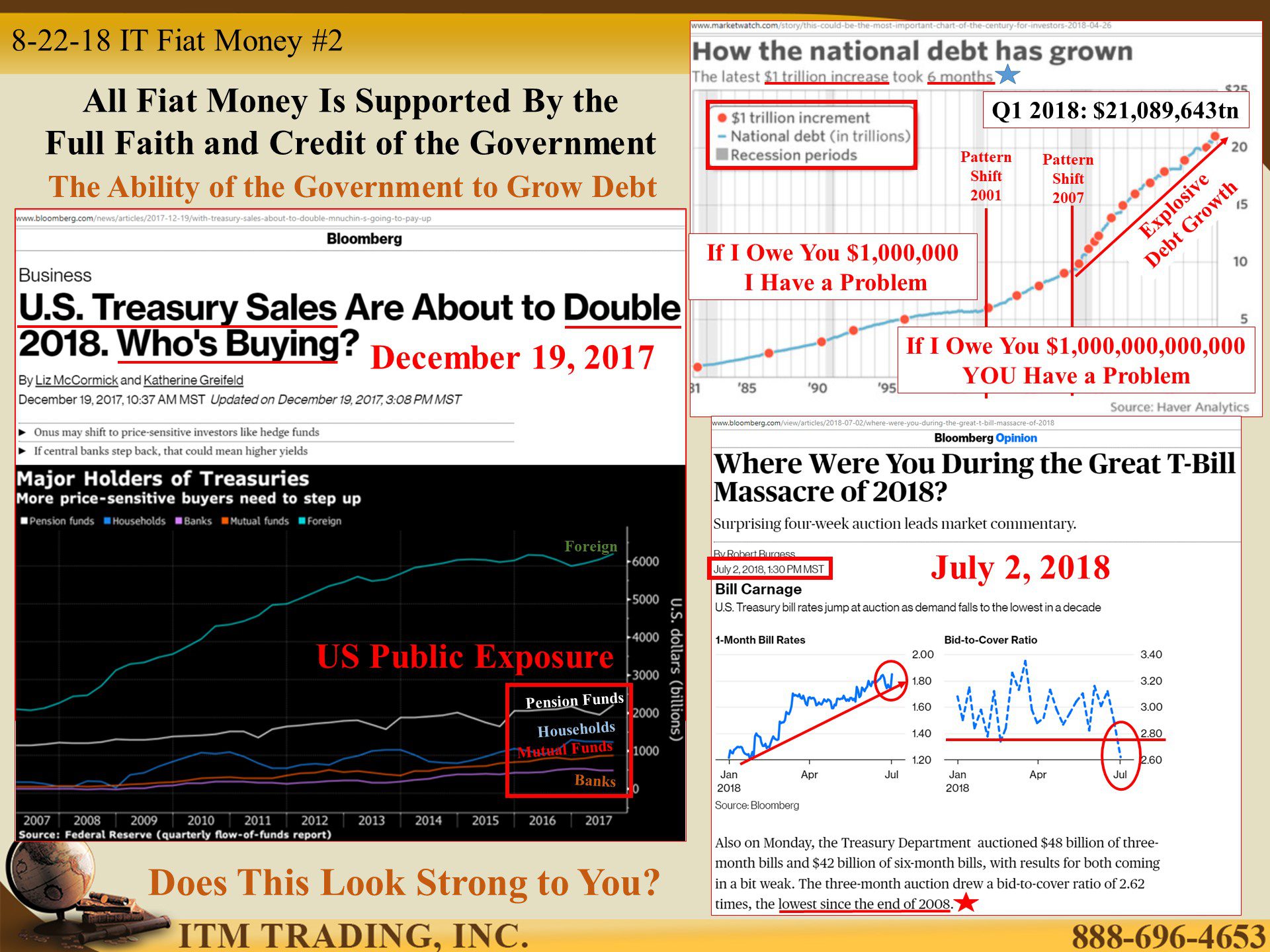

But the US has another problem, with the national debt now above $21tn and the need to fund tax cuts and infrastructure spending exploding, it seems that interest in US Treasuries is waning. We know that since the 2008 crisis, public pensions, mutual funds and ETFs have stepped up buying of treasuries as foreign sovereigns and banks have eased off. Do you think the public alone can support the weight of the government bond market? I don’t.

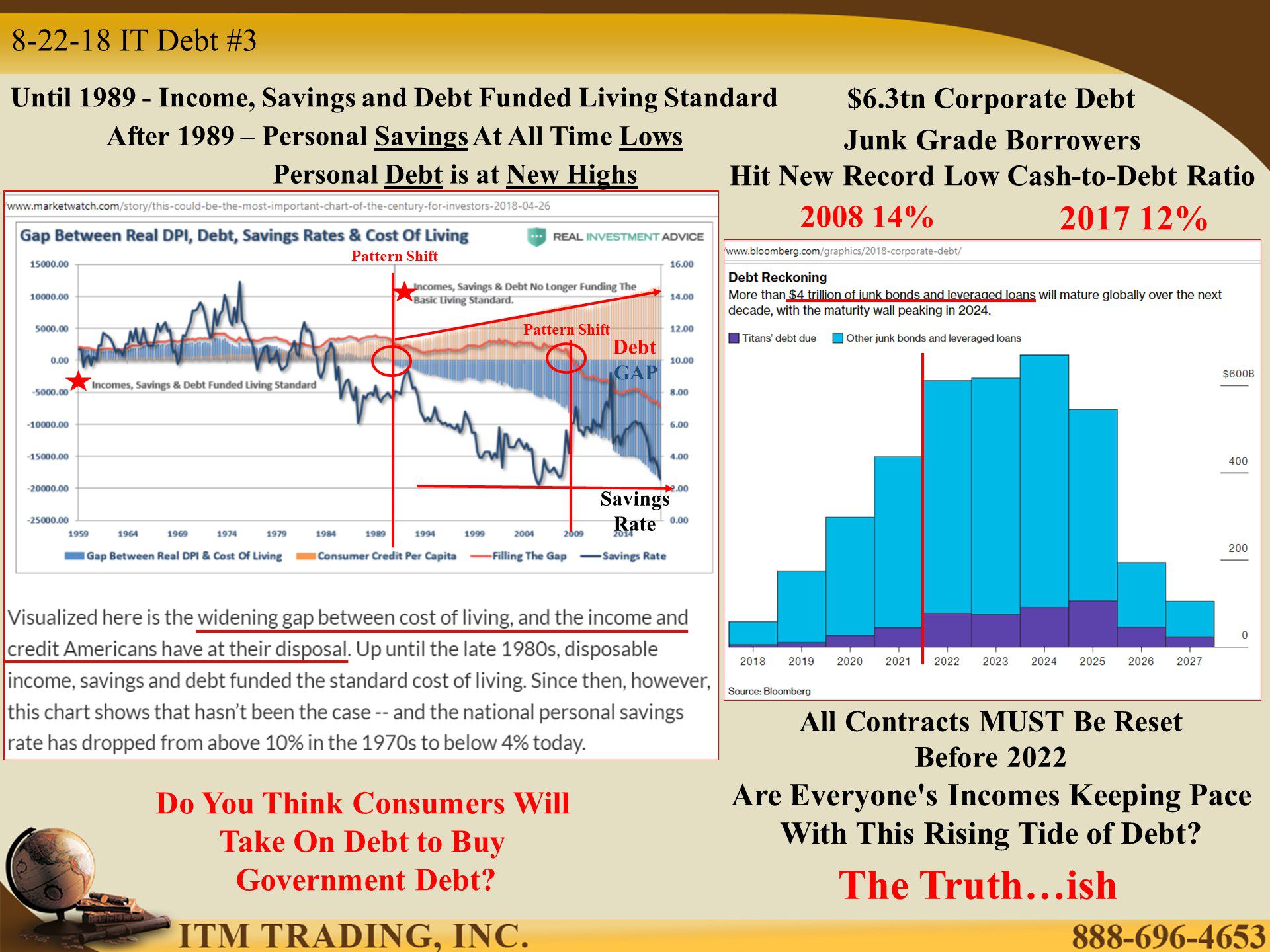

Prior to 1989, the average American was able to fund a reasonable standard of living with earned income, savings and a small amount of debt, but as inflation eroded the value of the dollar, more debt was required just to maintain that living standard. Today, savings is almost non-existent and household debt is at all time highs. What do you think might happen during the next financial crisis?

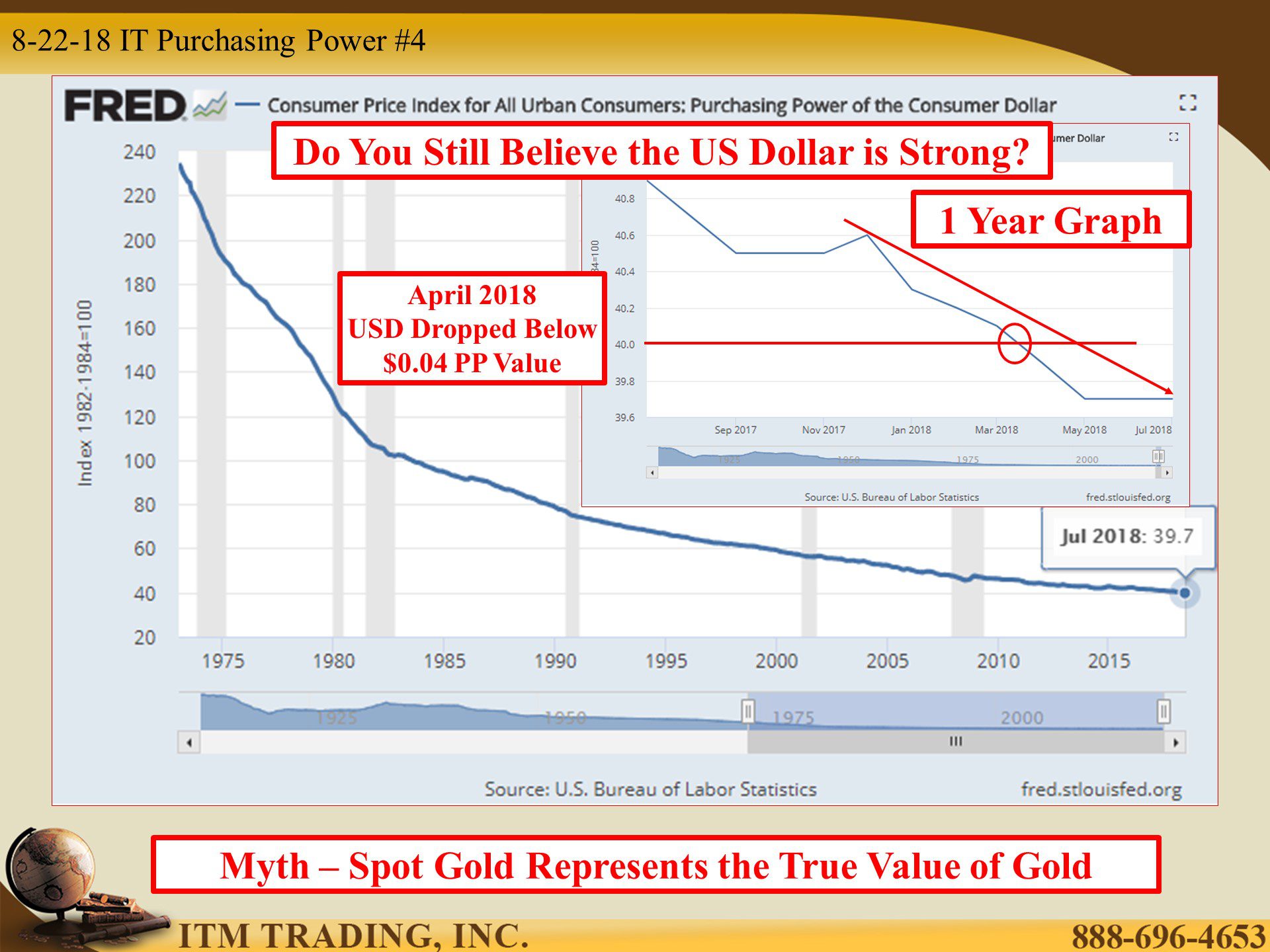

Of course, some people think we can just continue to devalue our way out, as we have over the last 105 years. In fact, as of April 2018, the value of the USD plunged below four cents and continues to lose value rapidly. What happens when we get to zero?

Central bankers plan to attack your principal via negative rates. And that’s easy to do if your wealth is held inside the fiat money system.

As J. P. Morgan said, “Gold is money. Everything else is credit.â€

Slides and Links:

https://fred.stlouisfed.org/series/TWEXBPA

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://www.treasurydirect.gov/govt/reports/pd/feddebt/feddebt.htm

https://fred.stlouisfed.org/series/GFDEBTN?cid=5

https://www.bloomberg.com/graphics/2018-corporate-debt/

https://www.cnbc.com/2018/06/27/debt-for-us-corporations-tops-6-trillion-sp-global.html

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://www.dailyfx.com/forex/technical/ssi/xau-usd/2018/08/17/ssi_xau-usd.html