TIPPING INFLATION: How Trump’s Quantitative Easing (money printing) Affects You… by Lynette Zang

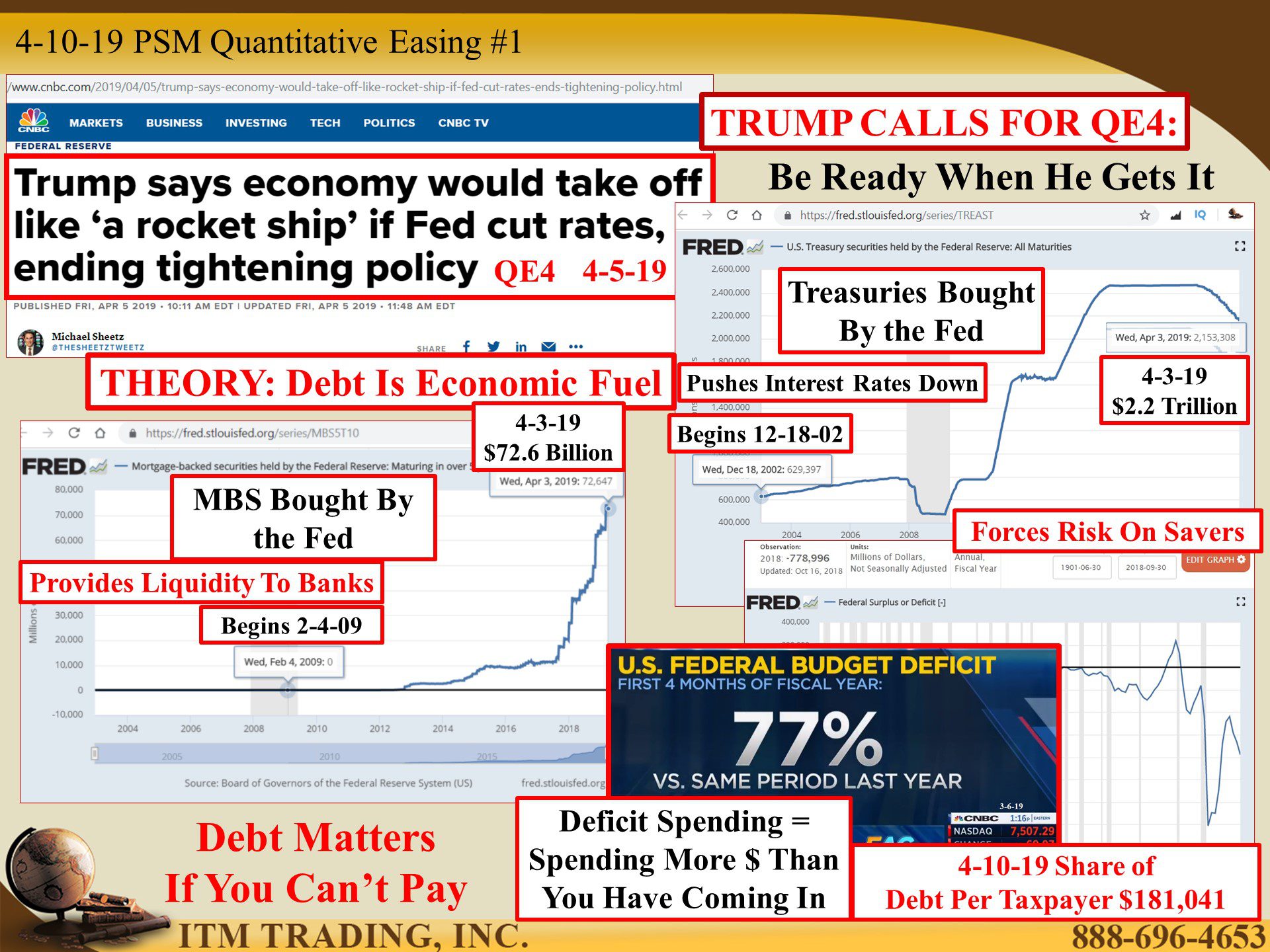

What would be the next move be in a full central bank pivot? QE4, let the free money flow.

What was once experimental and temporary, is now being demanded to keep the overvalued markets roaring. Or perhaps it’s really because everyone knows the next crisis is near and a good dose of QE money printing might just be enough to usher it in. After all, for most, if you know you’re about to declare bankruptcy and you get a new credit card in the mail, the most likely outcome would be to take advantage of any credit you’re given.

Calling for the Fed to cut rates and buy more bonds and MBS derivatives, the theory is that taking on more debt will actually encourage the economic expansion and pay for itself over time, which can be true for self-liquidating debt. But governments typically take on non-self-liquidating debt relying on growing tax receipts and inflated wages to enable governments to fund even more debt. For corporations, debt used for stock buybacks, dividends that leave the companies, does nothing to repay the debt. This is why the world is saddled with unpayable debt that inflated the markets but did not “stimulate†the global economies.

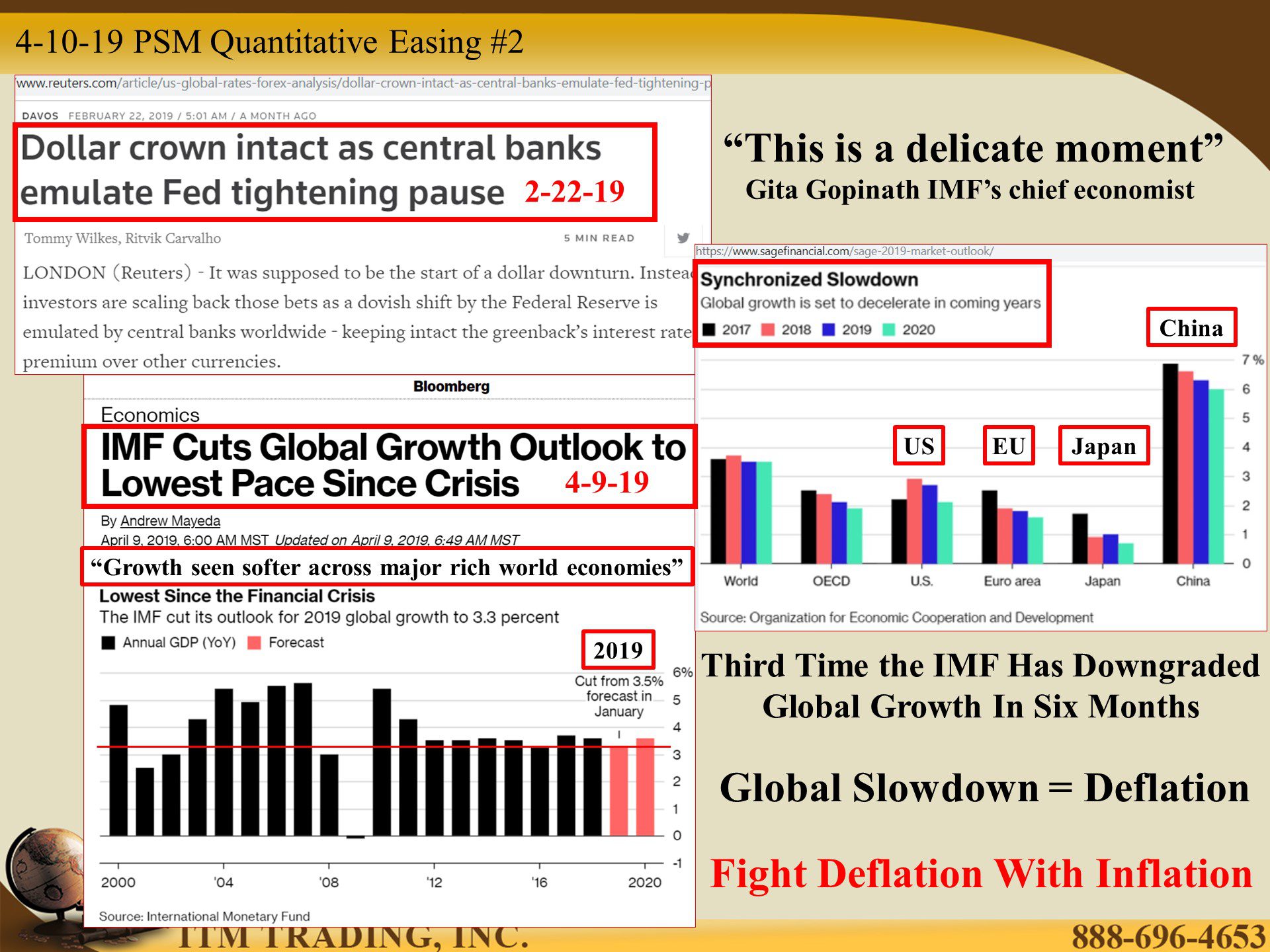

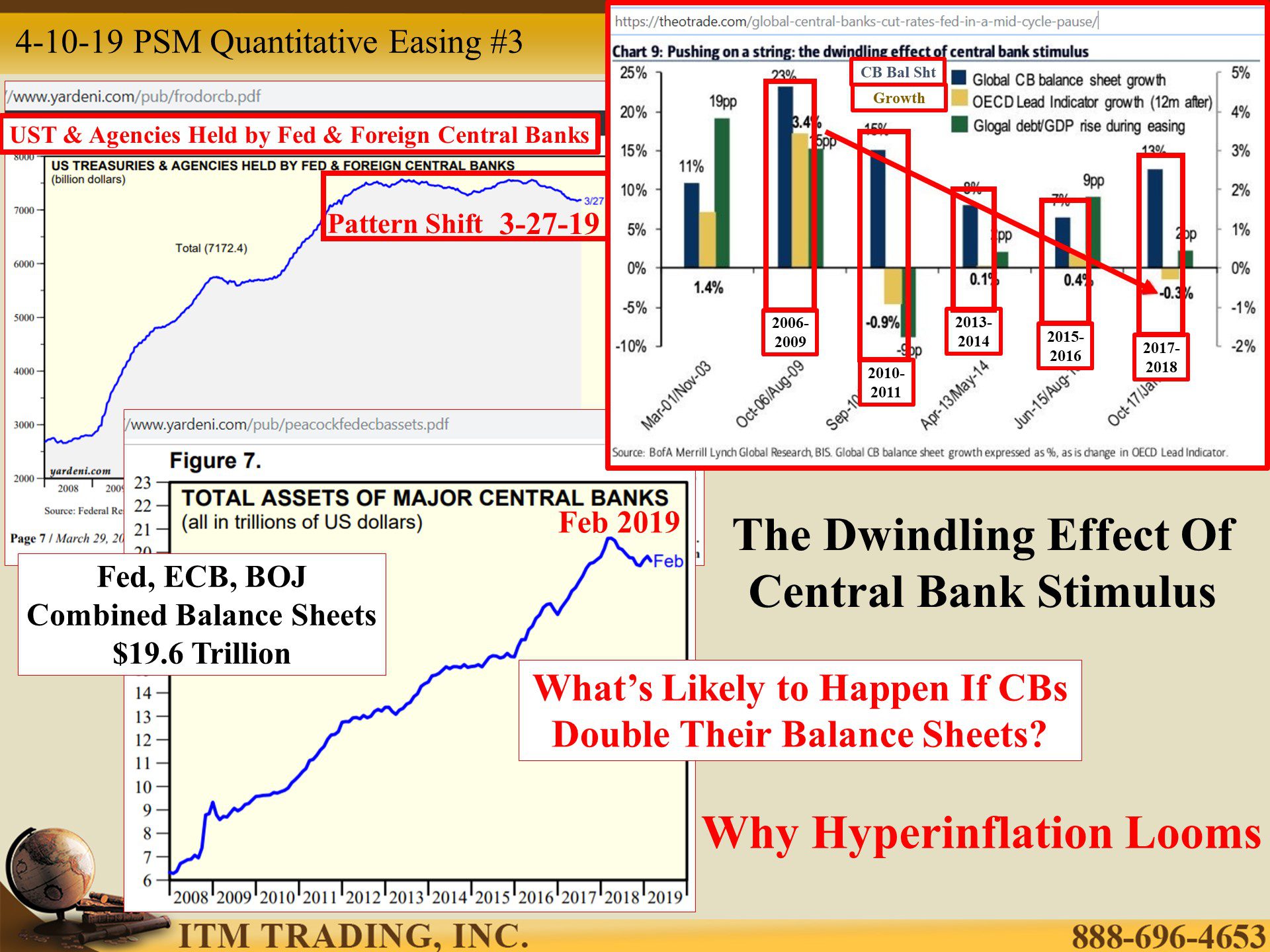

In fact, the IMF (International Monetary Fund) has lowered the global growth outlook for the third time in six months, confirming that the trillions in new debt did not have the stated outcome and did not stimulate the economy. It is critically important to understand that the global slowdown is deflationary, so is a falling market. There is only one way to fight deflation and that is with inflation, that is the long-term central bank playbook. But the problem is the dwindling effect of central bank stimulus, particularly since 2007.

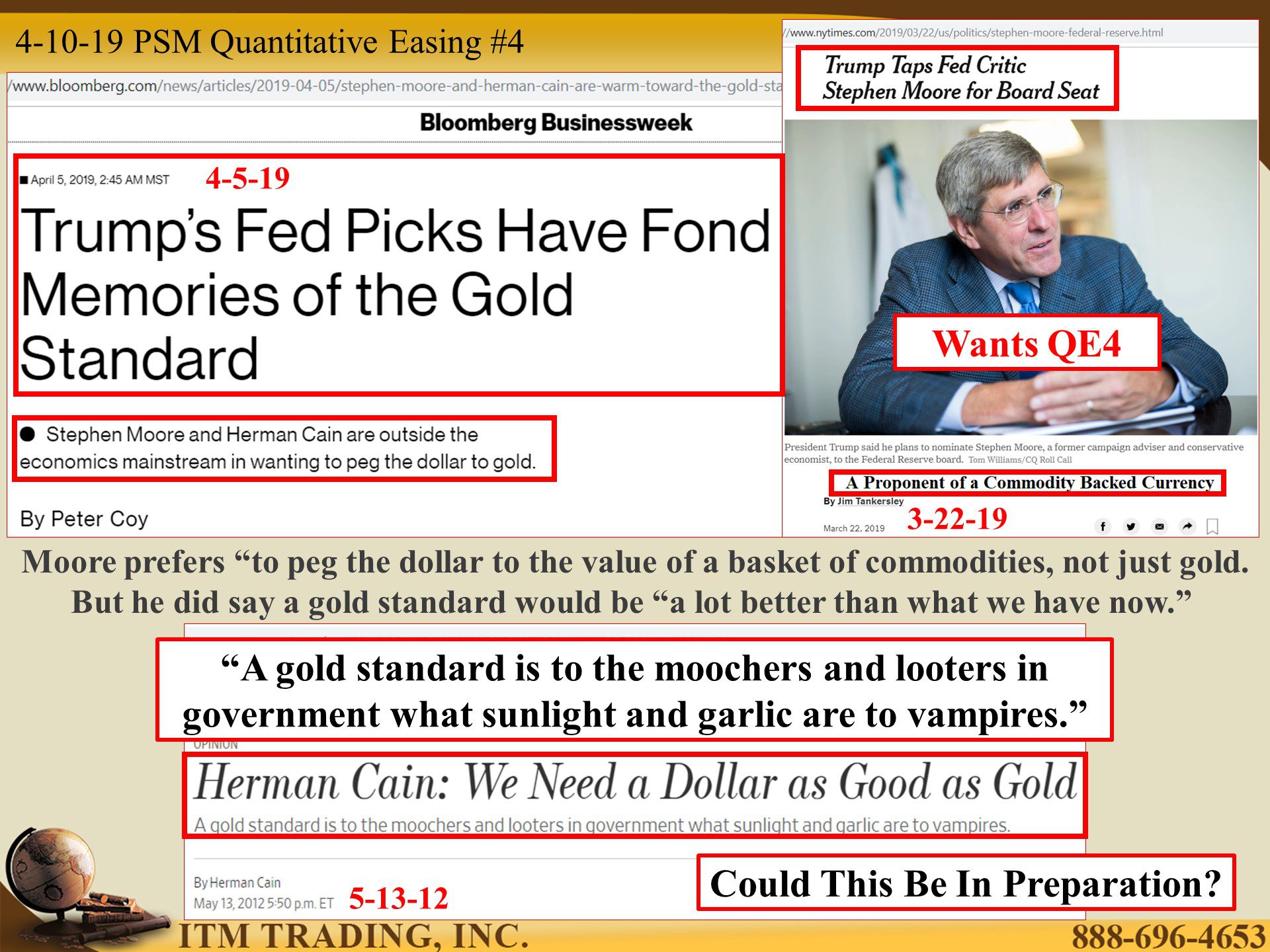

Insanity is doing the same thing and expecting different results. Is additional QE insanity or is it designed to force a global monetary reset?

If it is about forcing a monetary reset, could it make some sense to have on the Fed board, some members that understand what a savings-based money is? Could this be why President Trump nominated Stephen Moore, who supports both QE4 and a commodity backed currency, and Herman Cain, who wrote in 2012, “A gold standard is to the moochers and looters in government what sunlight and garlic are to vampires†to the Fed board? Perhaps we’ll need them to help the USD regain the confidence of the public after hyperinflation resets the unpayable debt?

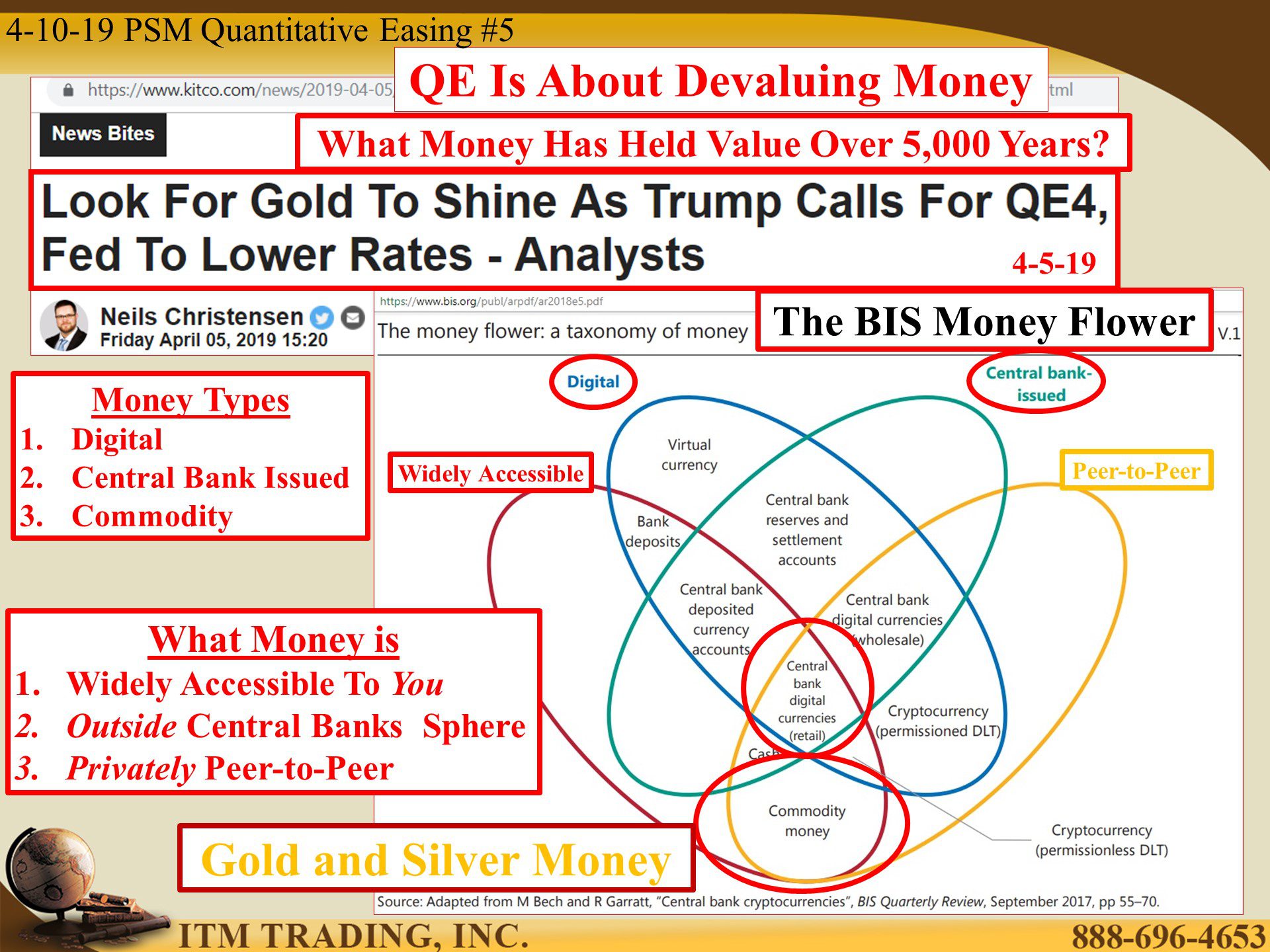

One look at the BIS (Bank for International Settlements) Money Flower tells you why gold is most likely to shine once again. It is the only money accessible to you that is widely accepted in peer-to-peer transactions AND is out of the sphere of the central banks. It is the only real, tangible money. Since QE is really about devaluing money, wouldn’t it make sense to hold the kind of money that has proven to hold value for 5,000 years?

Slides and Links:

https://stockcharts.com/h-sc/ui?s=$COMPQ

https://www.cnbc.com/2019/03/28/lyft-ipo-profitability-not-coming-soon.html

https://www.cnbc.com/2019/03/29/lyft-ipo-stock-starts-trading-on-public-market.html

YouTube Short Description:

What would be the next move be in a full central bank pivot? QE4, let the free money flow.

Insanity is doing the same thing and expecting different results. Is additional QE insanity or is it designed to force a global monetary reset?

If it is about forcing a monetary reset, could it make some sense to have on the Fed board, some members that understand what a savings-based money is?

One look at the BIS (Bank for International Settlements) Money Flower tells you why gold is most likely to shine once again. It is the only money accessible to you that is widely accepted in peer-to-peer transactions AND is out of the sphere of the central banks. It is the only real, tangible money. Since QE is really about devaluing money, wouldn’t it make sense to hold the kind of money that has proven to hold value for 5,000 years?

Unicorn and Fantasy https://www.youtube.com/watch?v=EhYLklW2T4s

The Exit Strategy: Good for the Few https://www.youtube.com/watch?v=wa2OCISG–Q

We believe that everyone deserves a properly developed strategy for financial safety.

Lynette Zang

Chief Market Analyst, ITM Trading