THE NEXT RULE CHANGE: More Loss of Investor Protections…By Lynette Zang

An interesting pattern is happening in the DJIA stock market index, the largest gap down that I’ve seen in quite some time. A gap means that on December 3rd the Dow opened roughly 250 points lower than it closed on December 2nd. Keep in mind that, at some point all gaps must get filled and an attempt was made the next day, with a small gap up, but I think it shows the strain that markets having in continuing its upward run.

Have more questions that need to get answered? Call: 844-495-6042

There are other topping signs we’re seeing, including a continuing earnings slide that make overvalued stocks even more overvalued, blank-check IPOs (investors putting money into acquisition companies that look for new companies to invest in) at the same time that wall street is saying that many of silicon valley’s unicorn companies private valuations are too high.

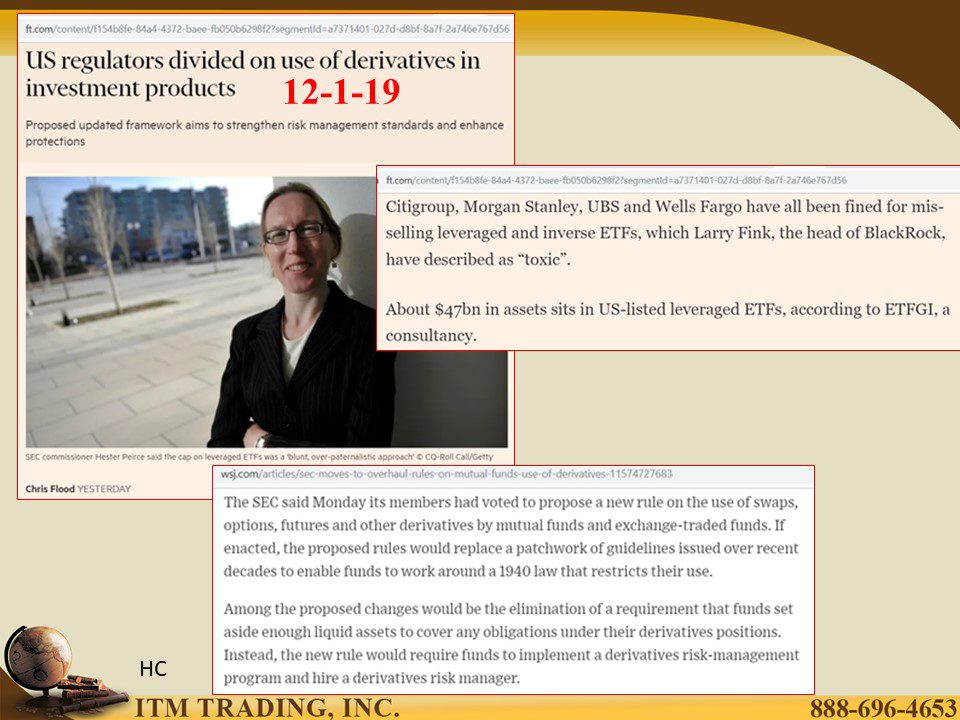

In efforts to keep markets artificially high, regulations are changing around derivatives (speculative bets) in ETFs and Mutual funds. Since 2008 their use has exploded in these investment vehicles. Proposed changes include the “elimination of a requirement that funds set aside enough liquid assets to cover any obligations under their derivatives positions.†Do you think that investors are safer without those reserves?

I don’t. Particularly given the recent Citi fine by the Bank of England for “serious†reporting failures that “left UK regulators with an incomplete picture of the financial health of one of the world’s biggest banks.†Do you think they’re the only bank to do this?

Slides and Links:

https://stockcharts.com/h-sc/ui

https://www.wsj.com/articles/blank-check-ipos-hit-new-record-11574441671

https://www.sec.gov/news/press-release/2019-242https://www.sec.gov/rules/proposed/2019/34-87607.pdf

https://www.ft.com/content/5bce03ce-103f-11ea-a225-db2f231cfeae