The Mysteries Behind First Republic Bank’s Failure and JP Morgan’s Acquisition

What is going on with the recent collapse of First Republic Bank? How you can protect yourself? With JP Morgan buying out their assets, the industry is trying to contain the situation, but the truth is that the fuse is getting smaller and smaller until the entire system implodes or explodes. This isn’t just about survival, it’s about thriving through the chaos and it’s clear that this is going to get a whole lot worse. Don’t miss out on this urgent discussion.

CHAPTERS:

0:00 First Republic Bank

1:50 Unsecured Deposits

5:14 Trading Halts

11:39 JP Morgan Receivership

17:02 Bank Deposits Fall

20:21 Gold Safety

21:57 The Thrivers Community

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

Okay, so you guys know, you probably know that First Republic is now another failed bank. And I think it’s very interesting that JP Morgan is the buyer of their assets and came in and took ’em all over. But you know what they want us to think is, okay, this is contained, this is contained, this is contained. Cause that’s just a one off, that’s a one-off that. Well, you know, when you have enough of them, it’s not a one-off anymore. The Feds raising the rates so rapidly has created distortions in all of the bank balance sheets where they were buying treasuries up here and now the value of those treasuries are down there. So what we’re seeing here is really just the fuse that’s getting smaller and smaller and smaller until the entire system implodes or explodes, whichever you prefer. But we need to talk about this and what their fixes are and how that actually puts you in much more jeopardy and what you might wanna do to make sure that this doesn’t have a major negative impact on you. Coming up,

I am Lynette Zang, Chief Market Analyst here at ITM Trading a full service physical, gold and silver dealer specializing in custom strategies, not just to help you survive. This made, dare I even say it, thrive through this.

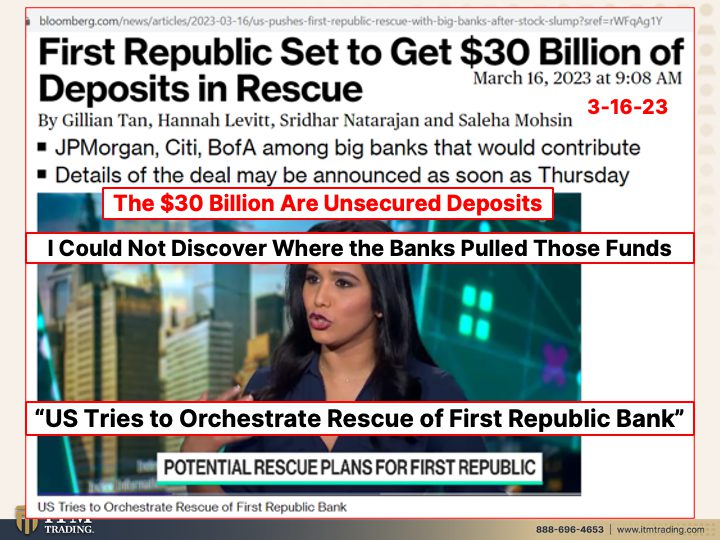

So now another, now it’s First Republic Bank has failed. And you know, interestingly enough, because all of the other big banks rushed in to protect them and bail them out by giving them 30 billion in unsecured deposits. JP Morgan, Citi, Bank of America. And that was just what mid-March. So we, they wanted us to think everything is fine, but I’ll tell you what I could not find is where all of these banks pulled those billions of dollars. Were those other depositor funds? Were those gains from all the trading that the banks do? All the speculation? But there are a lot of things that I couldn’t find out. You know what else I couldn’t find out. Now we do know that the government brokered a deal over the weekend to rescue while not rescue, but to allow JP Morgan to buy First Republic. Well, you know, they bought it at a steep discount, but the details of that arrangement has have not, at least at as of this morning anyway, have not yet been been disclosed. So you know that it had to be a bargain with a ton, a ton of guarantees. So they were unsuccessful before the 30 billion in unsecured deposits. And I couldn’t figure out where that money came from.

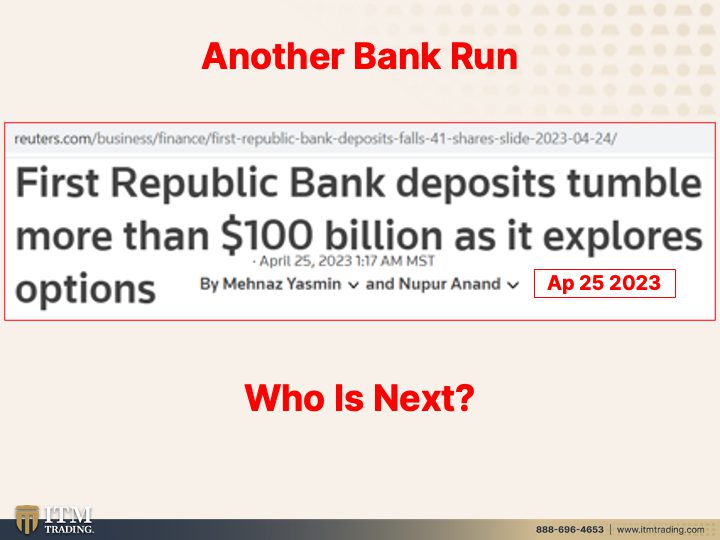

But this is another bank run. First Republic. I did this over the weekend before, before First Republic was bought by JP Morgan and what really precipitated it is another bank run. And what’s really interesting, and, and we talked about this before, but now it’s really showing up much more clearly with the ability to just push a button and withdraw your deposits. You don’t need the traditional bank runs anymore. They are absolutely happening. First Republic Bank deposits tumble more than a hundred billion as it explores its options. So that is certainly a bank run. And who’s next? I mean we’ve got all of a lot of the banks PacWest, Western Alliance, Lead Regional Bank in a stock route this morning. PacWest, Bankcorp and Western Alliance each slumped more than 25% leading this morning, leading a renewed selloff in regional lenders. As investors continue to gauge the health of the industry after the second largest US bank failure ever. Trading and shares of both banks were halted for volatility. Among the broader slide that took the KBW Regional Banking Index down as much as 6.1%, the most intra day since March 17th. And we were talking about March 16th when First Republic got bailed out again. So this isn’t over and we still aren’t seeing the iceberg. We’re still just seeing the tip. But make no mistake about it, this is gonna get a whole lot worse.

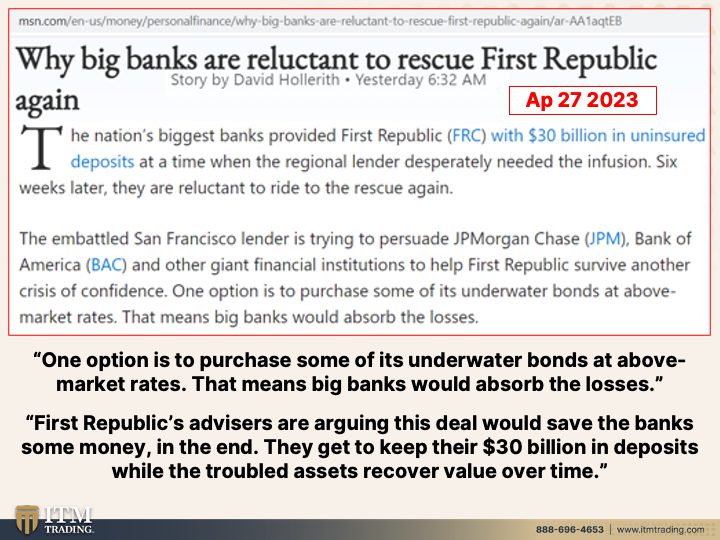

Why were big banks reluctant to rescue First Republic again? Well, the nation’s biggest banks provided them with that 30 billion in uninsured deposits. So if they at the FDIC actually took them over, then they would have to admit that they are either gonna go in and bail everybody out. And again, this is a bank that that dealt with very, very wealthy clients. The embattled San Francisco lender is trying to persuade JP Morgan, Bank of America and other giant financial institutions to help First Republic survive another crisis of confidence. Well guess who’s really, guess which bank is really going to need to survive a crisis of confidence? And that’s the central banks. And every time this happens that the public and the public notices, that’s why they can’t, that’s why they have to make sure that depositors are secure and are made whole. And that’s what happened with this. Yep. Now all of the deposits from First Republic are JP Morgan’s deposits, no haircut including that 30 billion that all those big banks deposited. No haircuts. They can have their money back, no harm, no fail, everything is fine. Nothing to see here folks. There’s lots to be seen. And this is also a consolidation of power, which is really dangerous. Fewer banks out there, greater consolidation of power. When this thing explodes, it’s taken everything with it. One option is to purchase some of its, this is what they were trying to sell. Some of its underwater bonds at above market rates. That means big banks would absorb the losses. Okey dokey. Isn’t that great? Here, I want you to buy this. It’s only worth 60 cents on the dollar. However, we want you to pay par, we want you to pay the whole dollar. Banks went, no, I’m not gonna do that. But their argument was that first Republic’s advisors are arguing this deal would save the banks some money in the end, they get to keep their 30 billion in deposits while the trouble assets recover value over time. So what they’re talking about is right now, because of the fed’s rate raises, those assets are severely undervalue. Meaning those treasury bonds and any of those contracts, so mortgages that they hold, any other debt contracts that were locked in at that lower rate when the Fed raised those rates, right? Those are all underwater. And if they have to sell them into this market, there will be huge, huge losses. But because JP Morgan went in and just basically bought the whole bank, well guess what? Then they don’t have to. Those uninsured deposits are covered. All of them covered. JP Morgan, you know that there was some very, very, very, very sweet deal and they had to change the rules in order to allow JP Morgan to get even bigger. JP Morgan, the largest bank, even bigger Now, yeah, this is a club and you and I aren’t in it.

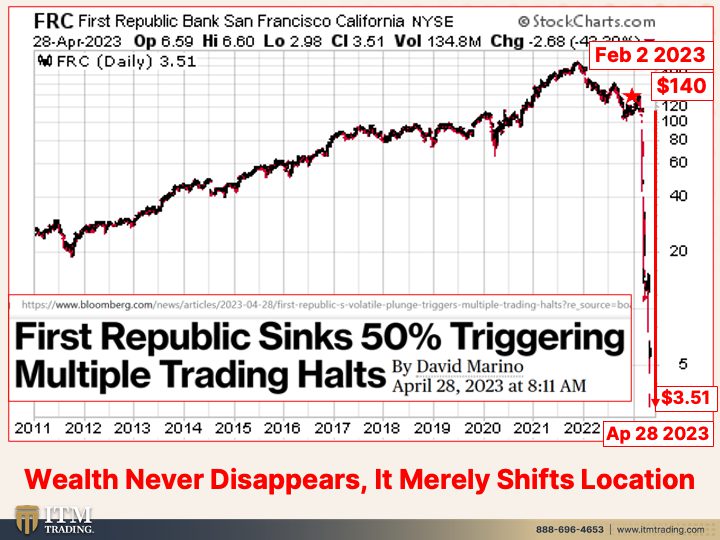

But you can see what the stock had been doing, right? At what point if you were sitting there holding this stock, you know, February 2nd it was at 140 bucks a share. Now here is perfect, perfect explanation. Wealth never disappears. It merely shifts location. So whoever sold that stock to whoever bought it at 140 bucks a share and it was much higher than that, you know, the end of 2021. But whoever sold it at 40 and whoever was still holding it when it got wiped out at, you know two dollars. Well, let’s see, what was it? Low 351 at this time. Well guess what? All of that wealth transferred to whoever sold it at 140. Wealth never disappears at merely shifts locations. So the whole goal of the strategy that we employ at ITM that I developed for myself to begin with is to have the wealth shift your way. How do you do that? Not this way. You don’t do it by losing your purchasing power, right? You do it by buying an undervalued asset that is in a long-term positive trend. How do we know that gold is in a long-term positive trend? Because the dollar and its purchasing power is in a long-term negative trend as witnessed an evidenced by inflation that is proving to be a lot more sticky than the Fed thought that it would be because they don’t understand inflation anyway. They admitted that. So this is really pretty significant because it didn’t take very long to get there and most people have hopium that things will change and things will shift. But now First Republic is gone. So they sync on Friday 50% triggering multiple trading halts. And as I just explained to you on PacWest and Western Alliances trading halts, there are no limits to how long these trading halts can last. You know, they have their parameters so maybe it’ll be a few minutes here and a few minutes there. But if they wanna close the market, you ain’t getting out. And who are you gonna, what are you gonna do? You’re gonna go bang on a door somewhere. Who are you gonna call? If you don’t hold it, you don’t own it. And your perception of ownership is irrelevant in a court of law.

No counterparty risk, you hold it, you own it outright. Just ask the Bank for International Settlements and all those central banks that have been accumulating as much gold as they could, more gold than ever because they know that they are destroying the last little vestiges of the currency of the current currency.

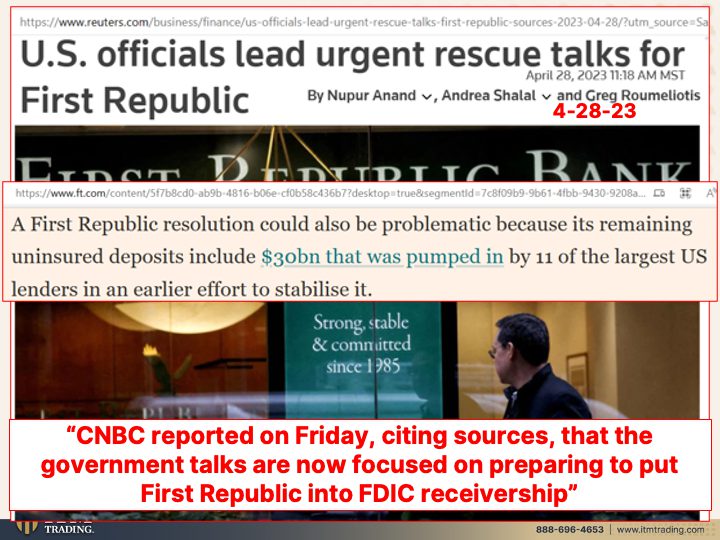

US officials lead urgent rescue talks for First Republic. The first Republic resolution could also be problematic. But see they resolved this I love it could be also be problematic because it’s remaining uninsured deposits include 30 billion that was pumped in by 11 of the largest US lenders in an earlier effort to stabilize it. So let’s do this one and then I’ll go to this the, from this morning. CNBC reported on Friday citing sources that the government talks are now focused on preparing to put First Republic into FDIC receivership. But they didn’t finalize that. They instead brokered a deal with JP Morgan, the FDIC said the deal avoids the agency having to use its emergency powers and would minimize disruption for customers because they don’t want the public to see what’s really happening. So they’ve gotta keep it hidden. It comes in the wake of the failure of Silicon Valley Bank and Signature Bank shortly thereafter under the deal. And I, again, I have not been able to find out what the terms were, but I’m gonna keep looking and I’ll let you know when I do. Under the deal. JP Morgan Chase is set to take on all of the deposits and substantially all of the assets of First Republic Bank after the Federal Deposit Insurance Corporation confirmed. So the FDIC confirmed that the trouble bank had collapsed. On Monday, JP Morgan Chase National Association submitted a bid for all of First Republic Bank’s deposits as part of the transaction. First Republic’s Bank’s 84 offices in eight states will reopen as branches of JP Morgan Chase Bank National Association. Today, during normal business hours, all depositors of First Republic Bank will become depositors of JP Morgan Chase Bank National Association and will have full access to all of their deposits.

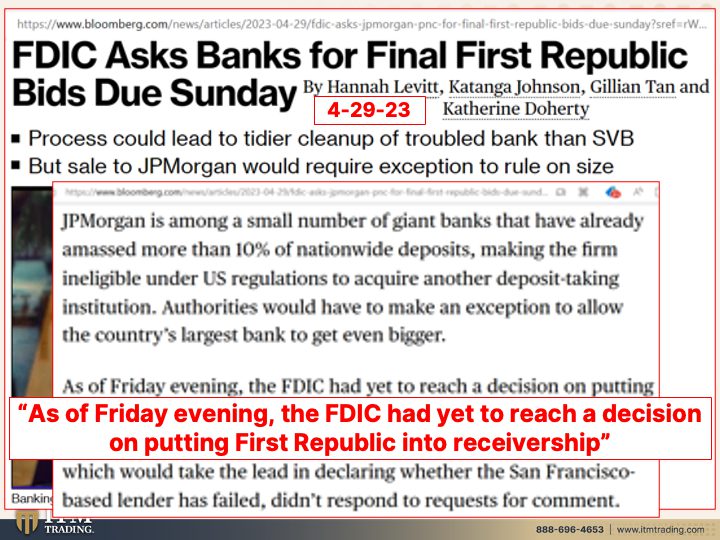

Problem solved, short-term problem solved, not long-term problem solved. That problem is still there and all they’re doing is hiding what’s really happening. So this is, you know, this is a saga that keeps going on and on and the bids were due on Sunday. So, but this is the piece. A sale to JP Morgan would require exception to rule on size. So obviously that exception was indeed made. JP Morgan is among a small number of giant banks that have already amassed more than 10% of nationwide deposits, making the firm ineligible under US regulations to acquire another deposit taking institution authorities would have to make an exception to allow the country’s largest bank to get even bigger. As of Friday evening, the FDIC had yet to reach a decision on putting first Republic to receivership. Okay, blah blah blah because we know what happened. Okay, so what happened back in 2008? JP Morgan absorbed Bear Stearns. So, and I’m gonna tell you, JP Morgan did not pay for all of their debt, their mortgages, their, their treasuries, all of the stuff they have on their loan, on their books did not buy it at par. They bought it at a steep discount. And if the discount was here, my bet is they bought it there. I’ll find out, I’ll let you know about it. But this is all to put lipstick on a pig, but it’s still a pig. We still have this problem. All they’re doing is papering over it cause that’s all they can do. But it consolidates the power.

And I’d like to remind you that those stress tests that the big banks go through, that’s not about really testing the stress. They knew they were gonna have to raise rates and they didn’t do a scenario where they raised those rates. So what kind of ons what kind of honest view are we having of the health of the banks? So we’re just supposed to believe them when Janet Yellen comes out and says, oh well the banks are safe and secure. Yeah, and oh by the way, on June 1st, the debt ceiling, they will, Janet Yellen will run out of her extraordinary accounting juggling and we’re gonna be out of money on to pay bills on June 1st, according to Janet Yellen that just came out. So we’ve got this and we’ve got the debt ceiling at the same time. Yeah, everything is just hunky dory. Yeah, well they did, they quickly put it in receivership this morning and sold it off to JP Morgan. They did that fast.

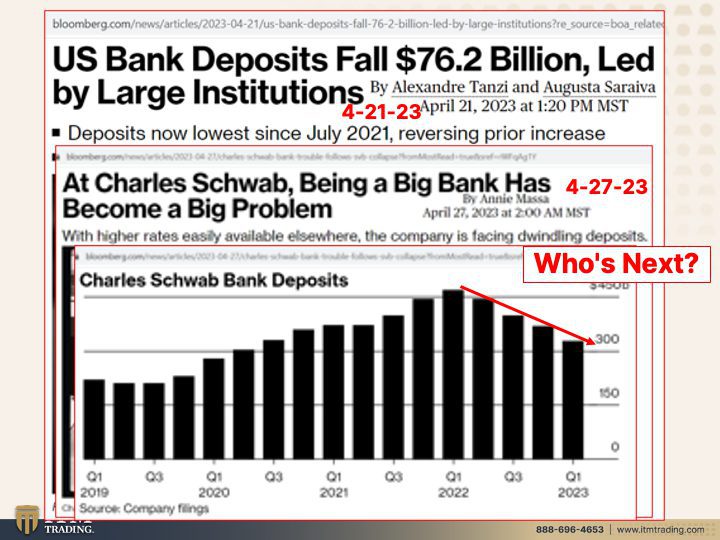

But if you think that this is it, and this is another one off like they want you to believe, US bank deposits fall 76.2 billion led by large institutions and they’re now the lowest since July, 2021. Reversing prior increase right from SVB and Signature Bank and all those deposits that went in and lending rose’s second week led by residential consumer loans. So is that people taking money out of the equity in their homes to spend to try and maintain their standard of living? And Charles Schwab, boy, I remember, I remember when they were just kicking off Charles Schwab, that’s when I was becoming, I became a stockbroker in 1986. So I remember all of the talk around this was interesting, but at Charles Schwab, now being a big bank has become a big problem with higher rates easily available elsewhere. The company is facing dwindling deposits because as the Fed has been raising the rates, which means that the banks are making more money, they have not passed that through to depositors, depositors still making nothing. While the banks were making a whole lot more money. And so that’s why we had the flight to safety or the perceived flight to safety into money market funds. But I’m telling you right now, that is simply a perceived flight to safety because if you don’t hold it, you don’t own it. You don’t create the laws and the rules around it. And as you can see, boom, easy enough to change those laws and you are SOL and there’s nothing you can do.

So part of the strategy that we employ at ITM is a certain level of cash, cause that’s still our tool of barter. So it’s a certain level of cash that is not in your bank account so that you have access to it. Next for barterability is silver, and then for wealth preservation, and there are different kinds of gold. So it depends on what you need to accomplish. Property taxes, health issues, etcetera. Maintaining a standard of living. If you’re currently getting pulling money from your fiat money assets, I mean, you know, really amongst all of us, we try to think of every single scenario so that we have you covered. If you haven’t clicked on that Calendly link and had that conversation yet, it starts with your goals, have it. Please no time to wait because we only have as much time as we have. Earnest Hemingway that when asked how we went bankrupt, he said slowly at first and then rapidly it’s becoming more rapid and they’re just trying to hide it. Who’s next? Is it PacWest? Is it, is it PacWest? Is it the western Alliance? Who knows? Who knows? Are you gonna take that chance?

And here we go, gold. They’re, they’re referring to spot, which for me is garbage because you can create as much gold that does not nor ever will exist. But gold holds or heads for second monthly rise on US banking turmoil. It is truly a safe haven asset because it is the only asset, the only financial asset that runs no counterparty Risk is a proven inflation hedge gold held at home, runs no geopolitical risk. And there’s one more which I can’t think of off the top of my head, but that’s enough. It is truly a safe haven asset dollars. You know, I mean, look, the treasury market is falling apart. These dollars, these things that are spit out, the more they do that, the less value they have. They have virtually officially no value left and they have no tools to regulate the rate and speed of that inflation. They’re trying by raising rates, but they’re raising them, they’re creating a crisis. And then what are they gonna do? They’re gonna lower ’em again and they’re gonna do this. They have no tools. That’s why I’ve been telling you this for a long time because I knew since 2008 it’s over. It’s done. The party’s over. What are you going to do to make sure that you can survive another day?

This is what I’m doing. Plus Food, Water, Energy, Security, Barterability, Wealth Preservation and Community. I have to tell you how excited I am that this past weekend we put in, or we started, started to put in the the orchards. I mean the, because that was the one piece up there that, you know, I told you how do I do it?

I look at where do I feel the most vulnerable and I try and plug that hole. So that’s where I felt the most vulnerable because I can’t tell you that, that, you know, this is, we’ve got another week or we’ve got another month, or we’ve got another year or we’ve got another whatever. I can’t tell you that because I’m not gonna know when the public gets wind of what’s happening, which is why they’re doing all of this. They don’t want the public to understand that the system is falling apart. Whether it’s the foundation of the global marketplace, the treasury bond market or the, and the banking sector that is tied to it. The system is falling apart. So I am so relieved. Have we, have we put any of those videos up in Thrivers or on BGS yet? Thrivers, we’ve put some up on Thrivers. Yes. So you get to see it. And the way that I did it and the way that we chose what we were going to plant aside from a huge variety, is that I wanted trees that were producing immediately. So we’ll have fruit from them this season. Then I wanted trees that would give me fruit in another two or three years and then fruit in another two or three years after that so that I can elongate my orchards. And we also did early, mid and late season fruiting plus I have these, I have all of the gardens down here to give me fruit. So I’m very relieved after Lindsey planting out the gardens. And she’s got a plan to go up there shortly to plant out the 35 foot geodome with food too. So that’s coming up pretty quickly and we’ll be recording that and sharing that. But that’s the piece where I felt the most vulnerable in the bug out location. So I’m super happy that I don’t feel that way anymore. Now we gotta work on water and I mean it, it’s never ending, but you know, I know it seems daunting. Just step back, think about the mantra and then say, okay, where do I feel most vulnerable? If you don’t have your foundation of gold and silver that I’m telling you right now, if you’re holding any wealth in the fiat money system, that’s where you’re the most vulnerable. Get that hole plugged as much as you can and then go on to a community. That’s why, you know, we, we did, we’ve got the Beyond Gold and Silver, we’ve got the new Thrivers community and it’s all about coming together to help each other. Not just survive this though, that’s critical, but also to thrive through this. So, you know, you need the golden silver, but you need the Food, Water, Energy, Security, Barterability, Wealth Preservation, Community and Shelter. You can download the, the app on the web at www.thriverscommunity.com or on the App store or Google Play at the Thrivers community. So if you haven’t yet to, you wanna make sure that you subscribe to this channel so I can keep you in the loop about what’s happening to enable you to make choices that put your best interest first. That’s the way it always has to be. There is no such thing as a win-lose. It is always gotta be a win-win. And you always have to put your best interest first. Doesn’t mean that you trump on everybody else because, or trump on everybody else. Because if we come together in community, we’re helping each other. And if you haven’t gotten your strategy started, get it started, get it done, click that Calendly link below, get your own strategy set up and get it executed. So if you like this, please give us a thumbs up. Make sure you leave a comment, make sure you subscribe and certainly make sure that you share, share, share cause this is your financial shield and it’s made of gold and silver in your possession. Until next we meet. Please be safe out there. Bye-Bye.

SOURCES:

https://stockcharts.com/h-sc/ui

First Republic Stock Drops 50% Triggering Multiple Trading Halts (FRC) – Bloomberg

U.S. officials lead urgent rescue talks for First Republic | Reuters

First Republic shares plunge again as survival plan fails to materialise | Financial Times (ft.com)

FDIC Asks JPMorgan, PNC for Final First Republic (FRC) Bids Sunday – Bloomberg