TGIES Thank God It’s Earnings Season

The Dow Jones Industrial Average has been in and out of bear market territory since February. Could that be why that sector had a $1 to $2,072.65 Buy / Sell ratio? Because even though the markets are no longer at the top, frankly, they are still very high.

Technology is the number two in sector selling with a ratio of $1 to $801.55. A chunk of that selling is coming from Mark Zuckerberg at Facebook. Zuckerberg just finished an appearance in front of our government regarding the breach of privacy scandal. While the stock is off its lows, technically, the moving averages are on the verge of indicating a “death cross†where the shorter 50 day moving average crosses below the longer 200 day moving average. Will it happen? Time will tell, but we are reassured that this scandal has not had a negative impact on its bottom line.

Also vulnerable in the markets is a 20-month trend where earnings season usually means the biggest stock gains. Earning season began today with bank stocks, one of the biggest beneficiaries of the new tax law. Indeed, Chase, Citi, Wells Fargo etc. have all beat earnings expectations, yet their stocks were all down. In fact, all of the major stock indexes were down today. Will this continue next week?

If it does, there will likely be more trouble ahead because it may mean that geopolitics trumps earnings. North Korea, Syria, tariffs, trade wars, China, Russia, President Trump, we are certainly living through interesting times.

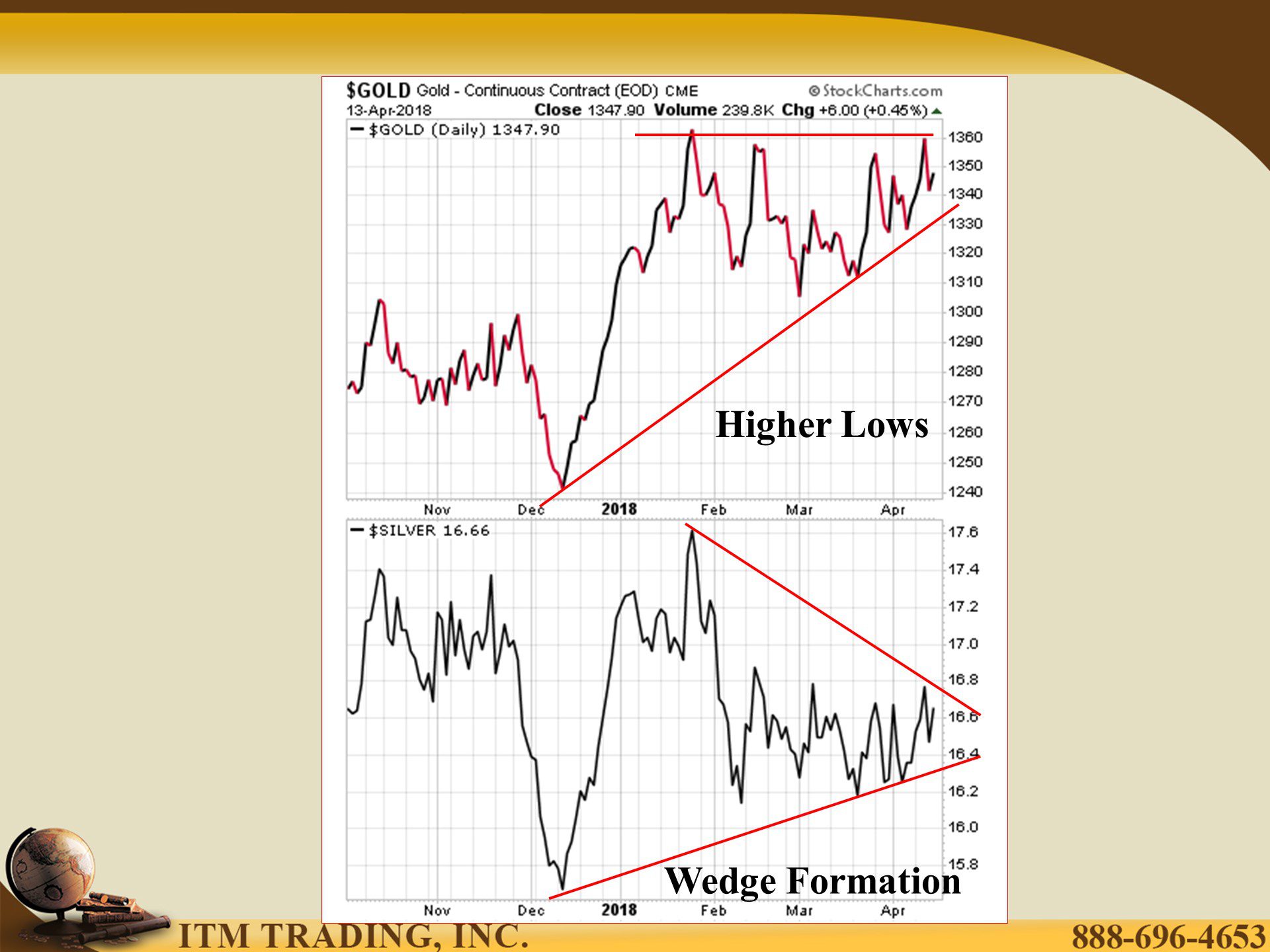

Yet through it all spot gold is quietly making higher and higher lows while bumping its head on $1,360 resistance. If we keep getting higher lows, spot gold will break through that resistance level and make higher highs. Spot silver, on the other hand, is forming a wedge. If there is a breakout above the trend line, we are most likely to see spot silver move up sharply, if it breaks below, its most likely to test some previous lows. Time will show all in this very interesting market

2. http://www.wsj.com/mdc/public/page/2_3023-insider.html

http://stockcharts.com/h-sc/ui

3. https://www.fastcompany.com/40558580/facebook-isnt-worried-about-the-impact-of-its-privacy-scandal-on-its-bottom-line

http://stockcharts.com/h-sc/ui

https://www.nasdaq.com/symbol/fb/insider-trades

4. https://www.bloomberg.com/news/articles/2018-04-12/happy-earnings-season-when-most-stock-gains-occur-since-2013

https://www2.bc.edu/matteo-iacoviello/gpr.htm

5. https://fred.stlouisfed.org/series/STLFSI