Stock Manipulation – 5-2-2017

You Tube Video

Transcription by Youtube.com

Hello Lynette Zang. Chief market analyst here at ITM trading a full-service physical precious metals brokerage house.

Stock Prices Rise On Declining Volume

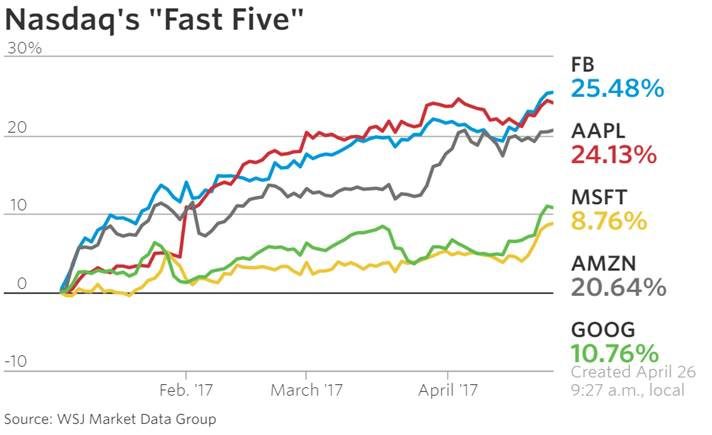

Well today we’re going to talk about how what we’ve been talking about for a while but the Nasdaq making new highs in this new high you can see that these five companies have made up over percent of the gains since January Wow okay.

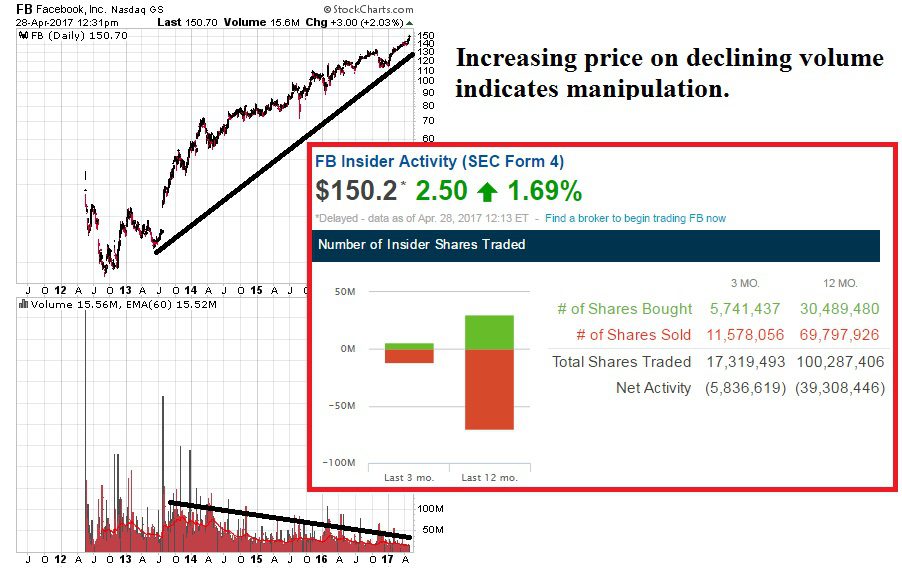

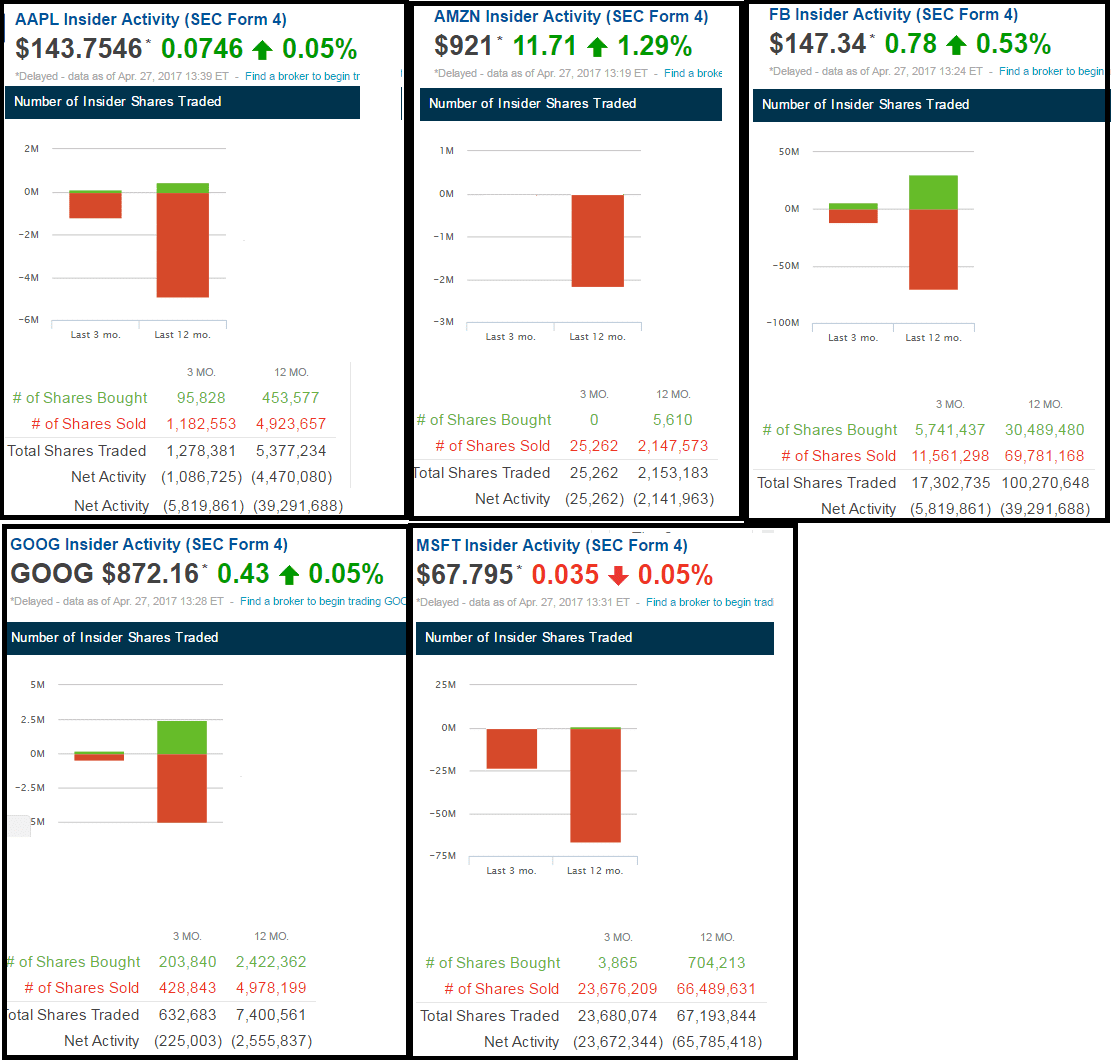

well what are the insiders doing about it okey doke here we go this is Apple you can see the stock moving up on declining volume and the insiders are selling that’s Apple there’s amazon same kind of pattern oh my goodness here’s Facebook same kind of pattern here’s Google or alphabet same kind of pattern and here is Microsoft. My goodness same kind of pattern so you might want to ask well gosh if they’re selling all of the stock how come I’m going to keeps going up good question well I’m thinking a big chunk of that is because of stock buybacks corporations buying their own stock back and pushing it up as an example.

Apple Stocks Insider trading

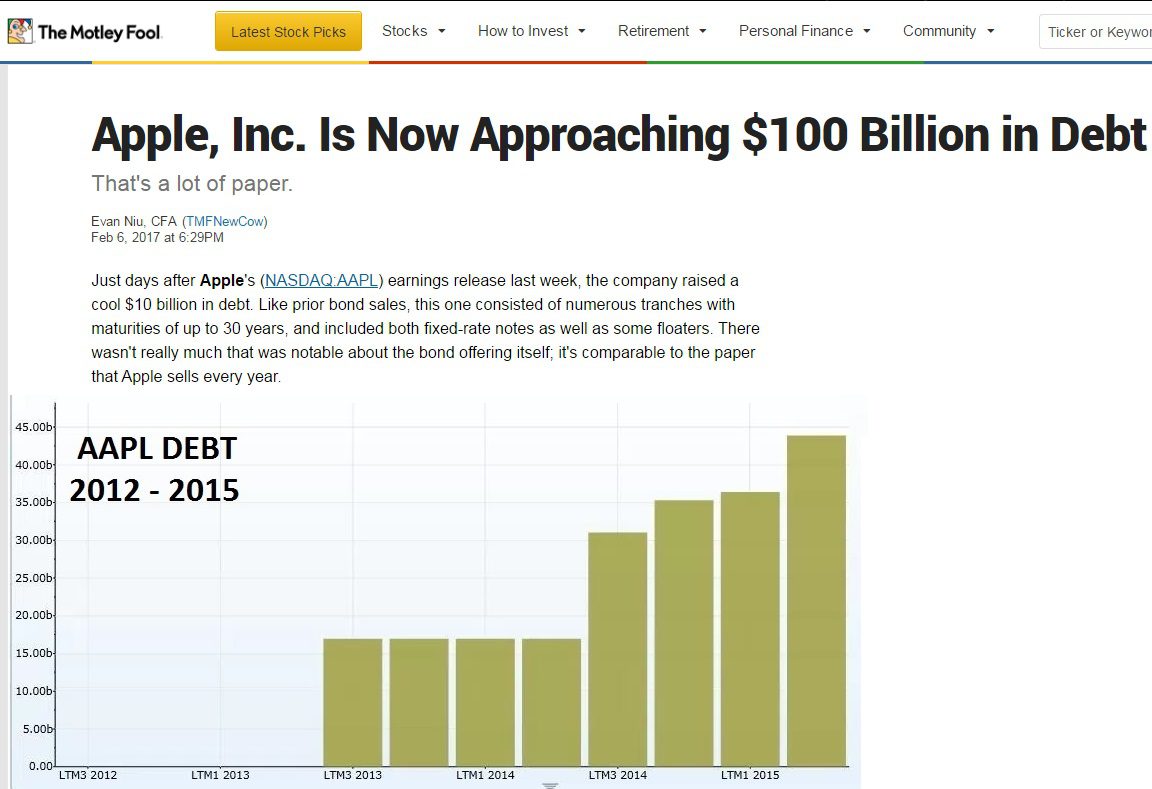

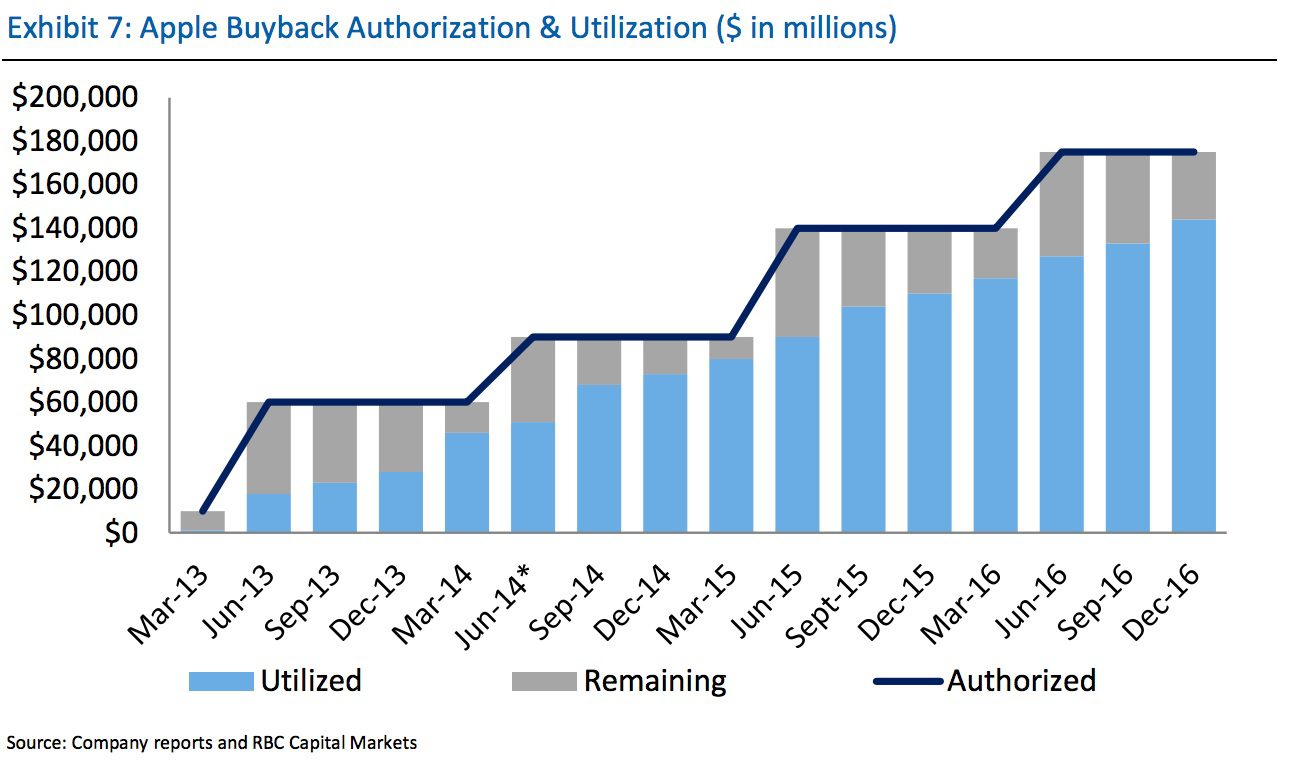

Here’s Apple these are their stock buybacks that goes through December so I couldn’t get it you know exactly to today which you can see the pattern but what’s really interesting about this pattern is this is Apple’s debt that they have taken on now this goes through starting in which is exactly when they started their share buybacks okay this is current so this I just pulled the other day so they’re close to billion in debt so yes they’re sitting on all of that cash but they’re also taking on a ton of debt and the pattern looks real similar buybacks in fact this is for the S&P as a whole and you can see this is where the crisis hit these are stock buybacks these are dividends and this is the SP can you see this pattern can you see that they all look really similar and you know we just looked at Apple where they’re getting the money for the buybacks but look let’s look a little more general to the rest of the market this is the debt so they’re taking on % of the buybacks or funded by new debt this part is cash about % of those buybacks are funded by cash so you have to wonder if they’re putting their the money and what they have access to it really cheap levels to the best use clearly it’s going to push the stock price up because as we saw let’s just do that one more time look at those buyback okay so these markets can keep going until they can no longer do it do you sit in any of these stocks if you have mutual funds if you have EPS netted you do what does the insiders know that you don’t remember you should always do with the smartest guys in the room do for themselves on any given topic I should say do for themselves you can see the insiders are getting out of these severely over values and rigid markets!!!

so that’s it for today subscribe to us on YouTube follow us on Twitter like us on Facebook and give us a call eight eight eight six nine six four six five three and share share this information with everyone be safe out there bye-bye

Images