Sentiment Seems to Be Shifting to the Negative Again

Just a few months ago it seemed like everything was rosy in the economy and things were turning around. The American public for the most part was confident and spending. As gas and food prices have risen the tide seems to be turning towards the negative. It started with protests in the Middle East which pushed oil prices higher, moved into a devastating earthquake and tsunami that devastated supply chains, and now a US lead attack on Libyan forces which is making people very nervous.

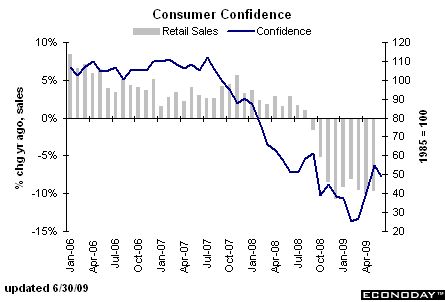

As the American public gets nervous they spend less, and we all know that our economy is dependent on our spending. In fact we hear this stat all of the time, 70% of GDP is consumer spending. Consumer confidence dropped to its lowest level since November of 2009, and when consumer confidence drops Americans tend to hold onto their money.

In addition to consumers cutting back, US businesses are likely to cut back on new investment, and as a result the growth outlook for this year has been cut to 2.8% from 3.5%.

To put rising oil prices into perspective, for every $10 rise in oil prices per barrel a corresponding $.25 per gallon rise in gasoline creates a $25 billion per year suck from the US economy (loss in spending power). It is no wonder why consumer confidence has dropped. Americans ability to spend gets cut every time gas prices rise, and on top of that food is getting more expensive simultaneously.

Oil seems to be the driving factor in the economy right now. As long as investors are nervous about rising oil/gas prices they will be less likely to spend, and gas prices are likely to remain high for the foreseeable future. The Libyan output has been cut by 75% and may move to 0% soon, and it looks as though we could see cuts in Saudi Arabian and Iranian production as tensions mount in those countries.

High oil prices in conjunction with the radiation scare shakes the very core of all consumers worldwide. All of this spells good news for precious metals. Silver is at a 31 year high and gold is sitting just off its all time high. As the public gets concerned they tend to look for safe haven investments just like the big dogs do. It seems likely that precious metals are going to continue to rise into the foreseeable future.