Precious Metals since 9/11

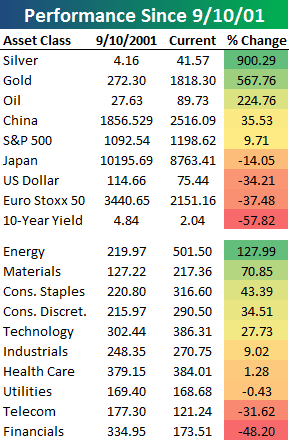

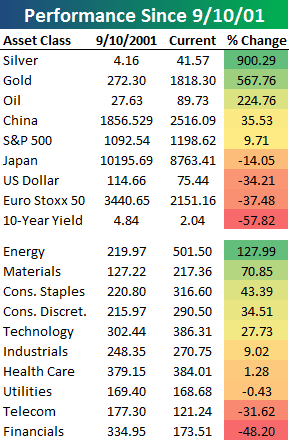

When the horrible events of September 11, 2001 occurred the world changed a bit that included the world of Precious Metals. Americans in general were a bit unsettled from that day forward. When people are unsettled financially they typically seek safe havens for their money. As a result you would expect that gold and silver would have benefited over the past ten years, and they have. Below is an interesting chart posted by Bespoke Investment Group which depicts performance of several different assets.

Had you have dumped all of your stocks and bought gold and silver you would be very happy with your decision. Silver went from $4.16/oz to where it sits today at $41.49/oz, a gain of 897%. Gold went from $272.30/oz to where it sits today at $1,846.90/oz, a gain of 578%. Meanwhile the dollar has lost 34%, stocks have been virtually flat and financials have tanked. So the traditional way of investing over the last ten years has not really paid off too well (401k’s, IRA’s, etc).

The important question to ask is: is this trend going to continue? In our opinion the answer is yes. The economy has not recovered from the collapse in 2008. Europe is suffering from a massive debt crisis with the US not far behind. So I would say that we are trending in the same direction due to increased fear and volatility. Gold and silver will probably continue to go up in value as the world continues to devalue their currencies through inflation, and as the general public begins to catch on to what is happening, their purchasing of precious metals should push gold and silver to a whole other level.

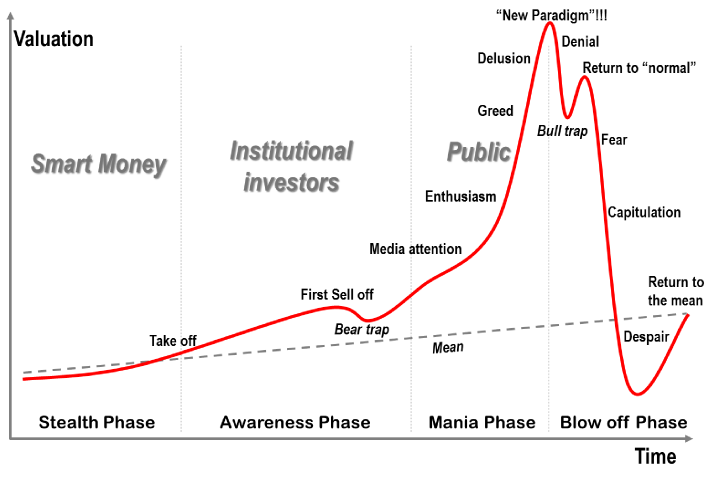

This other level being a third phase, or “mania phase†of a bull market. Look at the chart below. This chart depicts the phases of a bull market as described by Professor Dr. Jean-Paul Rodrigue at Hofstra University.

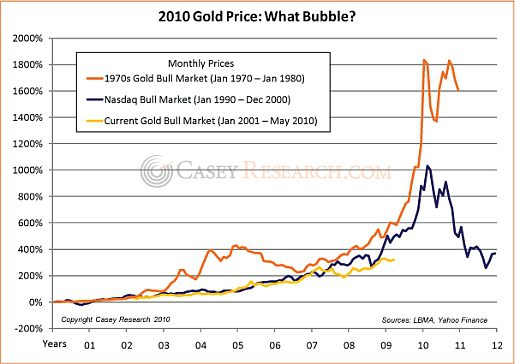

Now compare the chart above to the chart below.

This chart shows where we are in the current bull market vs. previous bull markets. Does is look like we are in a bubble to you? I would say that these charts clearly demonstrate that gold has not entered the mania phase yet. Therefore there is still time to buy gold coins. Obviously we cannot make any guarantees, but we feel that now is a great time to own gold, not only to protect assets from current economic instability but also to capitalize on the long-term trend in precious metals.