From Owning Gold To Owing Debts : An American Demise

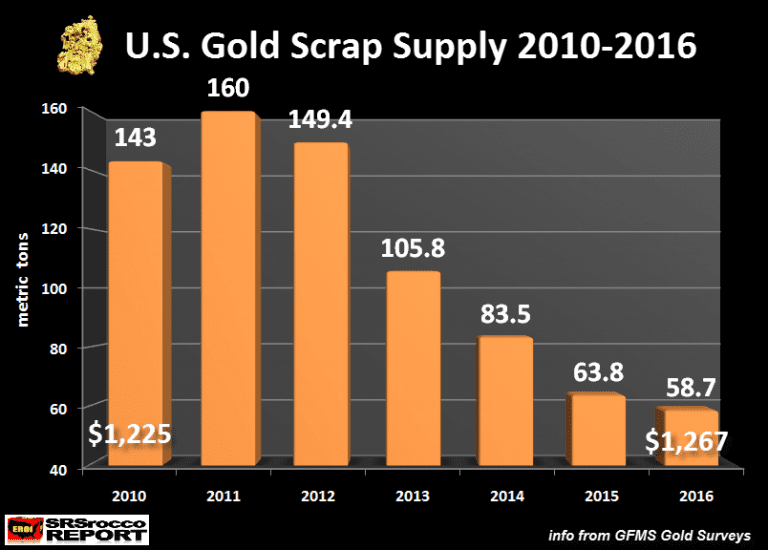

Recently I wrote an article about the fact that many Americans have turned in much of their scrap gold. The figures are pretty clear and rather startling. Times were very tough in 2008, and many Americans lost much of what they had in the way of investments and savings. But, by 2011, gold prices were at an all-time high in America. At one point, gold touched $1900 per ounce. Americans flocked to sell their gold, often at a 50% discount, however. Many scrap gold companies charge hefty fees. Following the massive scrap gold liquidations of 2011 came massive US consumer debt. The fact that US citizens pawned most of their gold to go into debt is a story of American demise and decline.

Unfortunately for all of us, the story isn’t over, it is just beginning to unfold. We live in the information age. The internet is full of insights, clues, facts, and refined research. Recently, SilverDoctors.com published an article full of facts showing that the flow of scrap gold being sold in the US has decreased dramatically.

Free Gold Information Kit – Avoid Gold Coin Buying Mistakes! Don’t Invest A Penny Without This.

Scrap gold sales consist primarily of unwanted jewelry. This jewelry is often passed down from older generations. The jewelry is often outdated.Oftentimes, this old jewelry was purchased back in the days when gold was less than a couple hundred dollars an ounce. Those days are gone. Acquiring any type of gold jewelry these days is rather expensive.

Besides offering facts regarding America’s scrap gold sales, the article referenced facts regarding growing credit card debt in the US. Sadly, the average American has more than $35,000 in credit card debt versus a median salary of $30,000 a year.

Credit cards have very high interest rates, relative to other financial products. This imbalance in income against debt is untenable. A statistic is given which says that 45% of Americans spend up to half of their monthly income just to pay credit cards and accounts. This does not include debts owed on mortgages or car payments, just credit accounts.

The American Demise Gets Worse.

If you think this news is rather sad or dire, you are also probably not surprised to hear it. A generation ago only businessmen had credit cards. American households didn’t want to acquire debt. Today, first-year college students get credit cards easier than they can get parking spaces near campus. The other part of the tale of American demise has to do with what the 55% of Americans that still have disposable income are doing with it.

If your interest is peaked, please read on.

The New American Demise : Just Get Away.

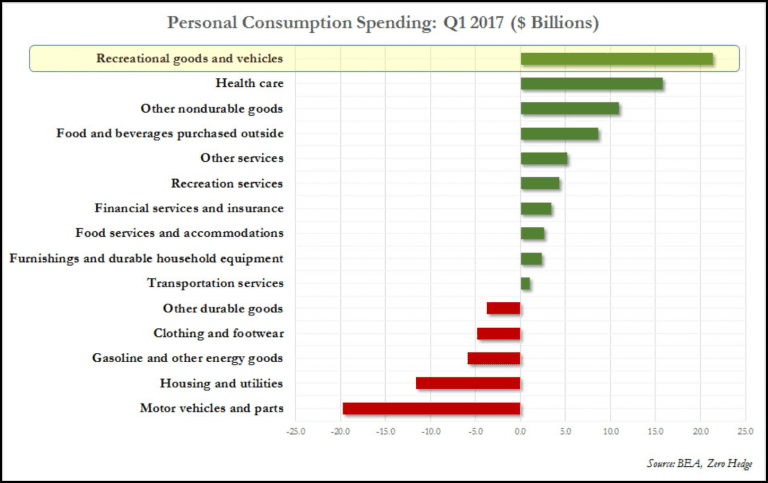

Sometimes Americans go shopping for clothes. When they do, we see a bump in retail sales. Sometimes Americans go shopping for televisions and electronics. When they do, we see a healthy increase in the furnishings and durable household equipment category. When Americans are feeling really good about their prospects, they buy a new car or a new house.

Just as reports can track how much scrap gold is sold, data is kept and compiled regarding what American’s spend their discretionary income on. Very recently, there has been a shift. In the first quarter of 2017, Americans do not want a new car. A new house is low on the list of priorities. Trips to the store for new clothes or shoes just are not important. What is important? Getting away is important. Getting away and having a nice meal is even better. If you can’t afford to get away, apparently having a nice dinner is a cheap substitute.

The American Demise : An Unsuspected Bubble?

Americans are pouring money into recreational vehicles at a furious rate. Motorhomes are popular. Especially popular are large trailers that can be pulled behind powerful gasoline or diesel trucks capable of pulling 20,000 lbs up a mountain. Some of these trailers are specialized to carry a selection of small four-wheeled ATV’s or other vehicles. In essence, it takes a lot of machinery and a lot of money to get away for a long weekend these days, but that is exactly what Americans are doing.

If this doesn’t sound like a problem to you, then may I suggest you do a little of your own due diligence. When financial bubbles pop they do so for a variety of reasons. Used car prices are already in a bubble, some reports suggest. Oil and Gasoline prices have been artificially low for quite some time now. Are these factors that could touch off another economic time bomb in the US?

In any event, whatever financial bubble pops next, the end result is likely an increase in gold and silver prices. In this case, it makes sense to be ahead of the financial curve than behind a financed RV. Make the wise and informed choice and own physical gold and silver.