The New World Reserve Currency

Lynette Zang is the Chief Market Analyst at ITM Trading. She has worked with ITM Trading since 2002. Since 1964 Lynette has been a collector and a banker and a stockbroker; Lynette has studied and worked in the markets. Lynette says she has been “groomed†for this moment in financial evolution. Her information and arguments, which she backs up with facts and data, would tend to support her claim. Recently, Lynette produced a webinar to quickly explain the new SDR currency. This article is a brief written recap of the points she made and the data she used for support in her presentation.

New World Reserve Currency

Lynette’s mission is to convert financial noise into understandable language for everyone so that they can then make educated choices. ITM Trading suggests that 5% – 20% of your assets be diversified into physical gold and silver coins and bars.

A Quick Question And Answer.

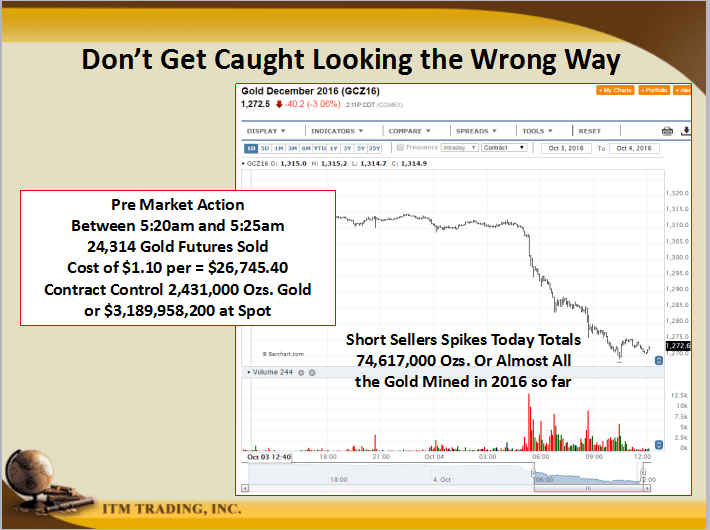

Lynette begins the webinar by answering a quick question. On the day she did the webcast, the price of spot gold had dipped by $42.00. $42.00 is a big dip in gold prices if you are not aware. People always want to know why gold goes up or particularly down in big swings.

Lynette offered that the media would link the decline in gold prices to a potential interest rate hike by the Federal Reserve. Indeed, Janet Yellen has been rumored to be considering such a move. More likely, however, Lynette sees the steep decline in trading prices more technically. Lynette sees a shift in the global financial system.

She further offers that when these shifts happen, the people behind the shift don’t want you to know the shift is taking place. In addition, those behind the shift want to distance themselves with time. They prefer the shift stay a secret as long as possible.

The graphic above which Lynette produced, shows how, through contracts, the gold price can be controlled for a mere $26,000, give or take. She also mentions that there are 542 owners for every deliverable ounce of gold in the COMEX. Consequently, this equates to a very high demand for gold.

Lynette states that this is a perfect example of gold market manipulation. The amount of gold dumped onto the market was roughly equal to all the gold mined so far this year (Oct. 2016). Lynette asks, “If you owned that much gold and wanted to sell it, would you sell it all at once if you wanted to get the best price?â€. The answer is no. You would only sell that much gold at once if you wanted to manipulate the price downward.

Jim Rickards Explains The Problem With World Reserve Currencies.

Lynette presents the writing of noted Jim Rickards as a quick gateway to understanding somewhat complicated currency truths:

- The issuer of the WRC (World Reserve Currency) must run trade deficits.

- If you run trade deficits long enough, you will go broke.

Currently, the United States dollar is the world reserve currency, and the United States is also the largest debtor nation on the planet.

The plan is to replace the US dollar with a new WRC, one that is designed to not go broke. Problem solved, maybe. Enter the SDR, or “Special Drawing Rightâ€. The SDR is a product of the International Money Fund and is given a value by mixing a “basket†of currencies. Currently, the SDR is valued by weighting the currencies of the US, Japan, Europe, China, and Russia.

The IMF is unaccountable to anyone. Lynette takes this moment to remind you that the IMF consists of unelected central bank chiefs and a consortium of bankers from countries that cannot even be audited. These bankers have and will have un-checked control.

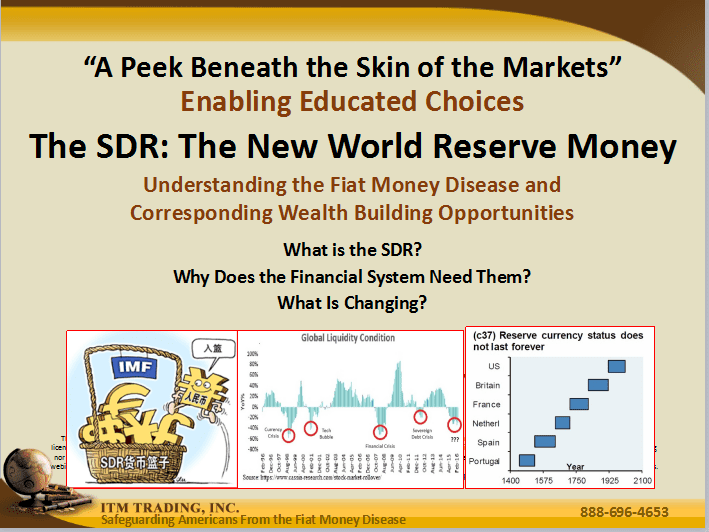

At this point in the webinar, Lynette gives the three topics she wishes to cover in the remainder of her time.

- What the SDR is and isn’t.

- Why the Global Financial System needs SDR’s now.

- What’s Changing?

New World Reserve Currency

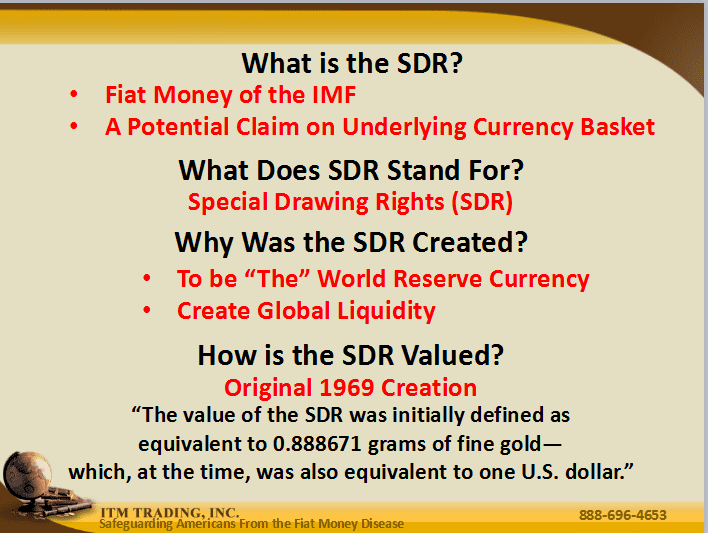

The New SDR Currency : What The SDR Is And Isn’t.

The SDR has been positioned to be the new world reserve currency, and the US dollar has lost it’s clout.

Fiat money is created from nothing, and in this case, the SDR is not seen as a claim against the IMF. In theory, the IMF cannot go broke, so the new SDR currency becomes the new “perfect†world reserve currency.

Here Lynette gives a bit of a history lesson. The SDR was created in 1969 to replace the dollar as the world reserve currency. The US was very near defaulting on the agreements made at Bretton Woods in 1944. The US was nearly out of gold and could no longer convert dollars to gold in order to create global liquidity.

Henry Kissinger developed what we call the “petrodollar†– a subject which Lynette plans on dedicating an entire webinar to – and this temporarily negated the need to institute the new SDR currency as a world reserve currency contender.

New World Reserve Currency SDR Value.

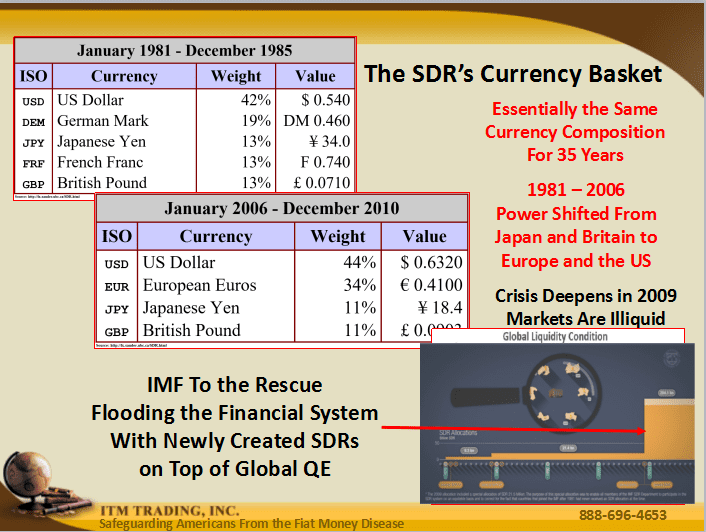

The SDR was originally valued against gold and the dollar when it was introduced. Shortly thereafter, president Nixon closed the gold window, which meant the SDR had to be valued in a different manner. The SDR then became valued by mixing a basket of more than a dozen currencies. This basket eventually was thinned down to include only five currencies.

In the above graphic, Lynette can see and comments on the power shifts apparent as the SDR weightings evolve over time.

SDR’s Are Allotted.

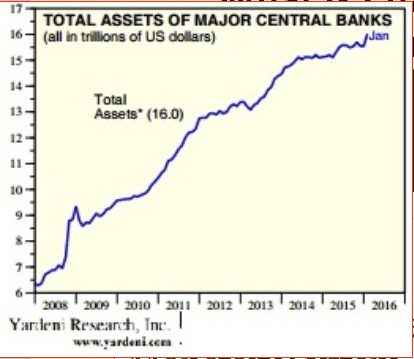

In 2009 the world was involved in a fiscal meltdown. The economic crisis had deepened and markets were illiquid. (There was no money available to be lent) Quantitative Easing – governments printing money and giving it to the banks – happened all around the world in massive amounts. This did not fix the problem.

The IMF stepped in and on three occasions “distributed†SDR’s to IMF nations in varying amounts depending on their importance and standing with the IMF. Countries never had to buy SDR’s because they were all given SDR’s.

The New SDR Currency : What Is Changing?

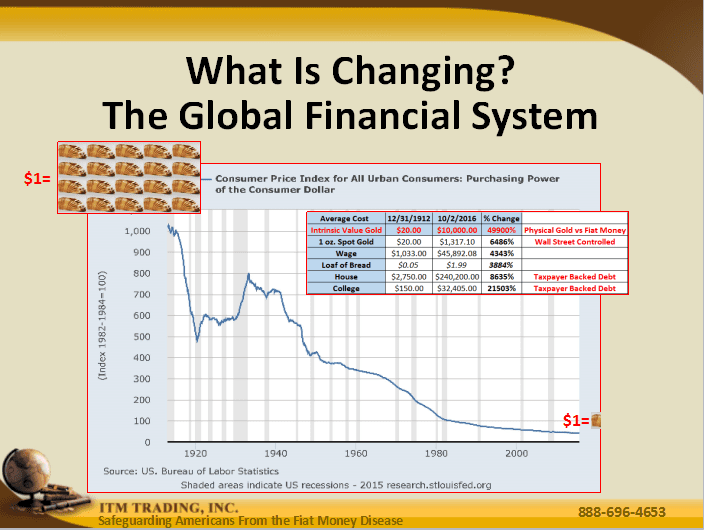

Perhaps here Lynette breaks the format of her stated presentation, but she asks and answers the question, “What is changing?â€. The entire global financial system.

Before, as Jim Rickards said, debt had to be created in order to create global liquidity. The world reserve currency will lose value over time as debts are created and grow. The price of gold must rise because central bankers need it to rise in order to erase their debts through inflation.

Lynette interjects here that student loans and real estate loans have been “financialized†or converted into investment products. Yet, ultimately the taxpayers are responsible for funding the government backstopping of these markets. Lynette finds these types of things quite interesting.

Here, I think Lynette regains the intended path of her presentation, as she begins to offer information and data to support her assertion that the central bankers are calling to begin transitioning to the new SDR currency right now.

The New SDR Currency : Why The Global Financial System Needs SDR’s Now.

In 2009 during the depths of the financial crisis China called for a reform of the global financial system. Since they were the US’s largest creditor, they could. China wanted to be more involved in world markets.

Implementing the SDR system seemed like an easy solution because the system was still in place; countries already had SDR’s since the IMF had already distributed them. This is when the SDR began to evolve into a fully convertible asset.

Most noteworthy, Lynette states here that the financial system that we knew and understood died in 2008. What we have now is the life support system for the old and dead system. The massive amounts of money printing have not worked. The Central bankers are out of ammo. This creates the opportunity to implement the SDR as an answer to the crisis.

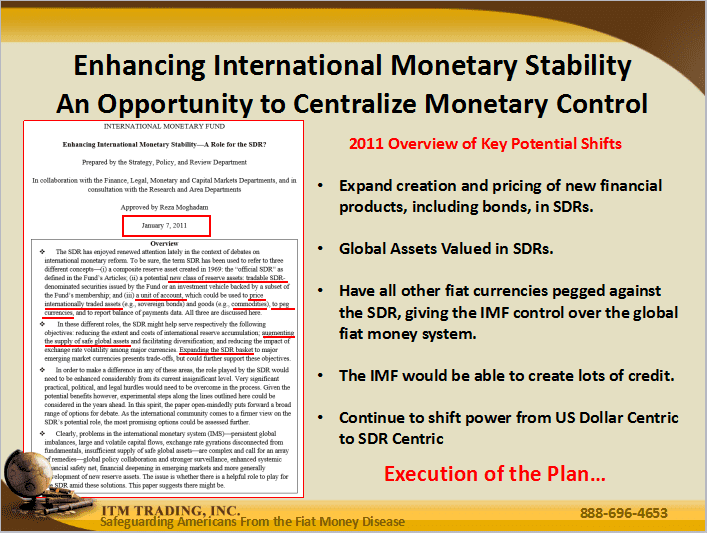

In order to fully implement the SDR, a few things needed to happen. The IMF began to push to make sure they did.

- Expand creation and pricing of bonds and financial products in SDR’s.

- Begin valuing global assets (lumber, wheat, gold) in SDR’s.

- Peg all other fiat currencies against the SDR. (This gives the control of the global money system to the IMF.)

- Allow the IMF to issue substantial amounts of credit.

- Continue to shift power from the US dollar to the SDR.

When these five items come to pass, an immense amount of power will be shifted to immune unelected and unregulated bankers.

The M-SDR.

SDR’s are for nations to trade among themselves. Individuals and corporations cannot technically own SDR’s. The M-SDR, however, is different. The M-SDR or Market-SDR is an SDR meant to be traded on markets by individuals and corporations. This is an entirely new market that is being created.

Times were that if a new market needed to be created, the US was the nation that would create, run, and profit from it. The SDR market is being initiated and developed by China.

In order to better illustrate how China is now dominating the competition in order to more control world currencies and markets, Lynette offers the following timeline:

1994 – China pegs the yuan to the US dollar. 1 dollar = 1 yuan. This effectively transfers manufacturing to China as profits are now easy to make, project, and keep. Since this time China has been buying and mining vast quantities of physical gold.

2012 – The US Treasury allows China to bypass Wall Street and purchase debt directly from the US government. No other nation can do this.

2013 – China becomes the largest trading nation in the world.

2015 – AIIB is formed (Asian Infrastructure Investment Bank) and US allies join. The US is forced to face competition from China.

2016 – March – China opens up an inter-bank market and begins offering products priced in the SDR. They have the backing of the World Bank. The market quickly becomes the second largest inter-bank market in the world.

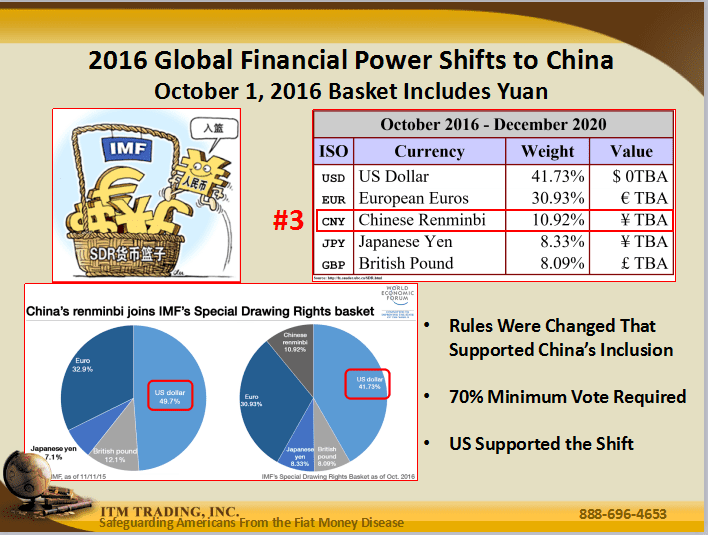

2016 – Oct 1 – The Chinese yuan is added to the IMF SDR basket of currencies, in the third most important spot, and the SDR is revalued.

The Rules Have Changed.

The US is complicit with the SDR replacing the dollar as the world reserve currency. In order to make these changes, a 70% voting majority was needed at the IMF. The US has a big say, currently, at the IMF and a 70% majority could not have been reached without US support. Now you know.

Jim Rickards has called the SDR “A cruise missile aimed at the dollar.†The new SDR has been hailed as “The new global financial architecture.†Lynette sees the SDR as a new fiat currency being created out of nothing. It takes no effort to create and has no claim against it. Does an SDR have any intrinsic value? No, Lynette sees the SDR as a bankers tool for reflation.

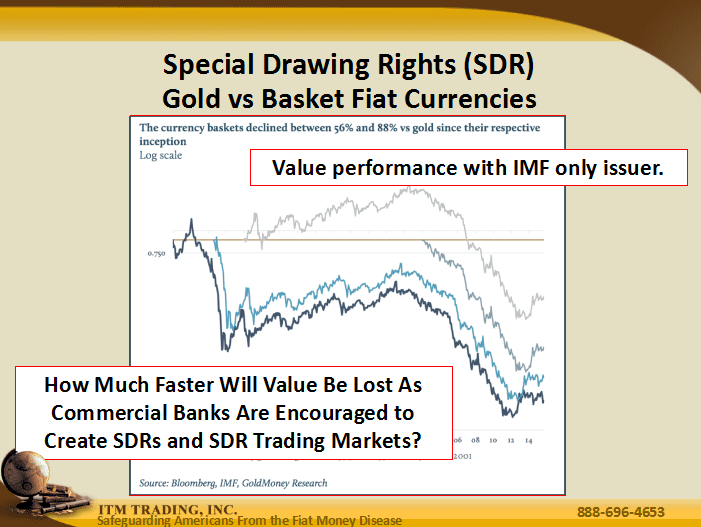

New SDR rules allow commercial banks to create SDR’s, very much the same way they create dollars when they make a loan. The amount of SDR’s in circulation can and will increase very quickly.

SDR vs. Gold.

In typical Lynette fashion, she offers data and fact to prove her point. Lynette posits that gold always outperforms fiat currencies because fiat currencies are designed to inflate and lose value.

The IMF has issued SDR’s on three occasions. The SDR has steadily declined in value. How much value will the SDR lose when all the commercial banks are creating SDR’s?

The SDR Substitution Fund.

Lynette is impressed with the simplicity of this financial gimmick. In order to make the US dollar less relevant, SDR’s need to replace dollars. Simple. In order to do this, the SDR Substitution Fund has been created. The fund basically allows bond owners, account owners, etc., to deposit their financial items into the fund, where their value will instantly be converted to SDR’s.

So, the trick here is that the dollar comprises roughly 40% of the SDR, meaning that 60% of the value of the investment is no longer dollar based, making the dollar 60% less relevant instantly. And, as a result, the SDR now becomes a very liquid instrument very quickly.

Webinar Summary.

In conclusion, Lynette offers a couple of ideas to focus on. The SDR has no claim against any entity. A limitless amount of SDR’s can be issued and the IMF will not go broke. The SDR is not a store of value.

First of all, the M-SDR is a tool to bring the new SDR currency into fiat money market products.

In addition, central bankers need new tools, and market liquidity is required.

The SDR Substitution Fund invisibly creates SDR’s. Commercial banks will also create SDR’s.

Especially relevant, the International Monetary Fund is independent of every government.

The SDR is taking over the world reserve currency role with the help and blessing of the US government, markets, and banks.

In closing, Lynette invites you to call your ITM Trading representative to discuss creating a strategy to help protect and grow your wealth during the upcoming currency shifts and currency reset. 1.888.OWN.GOLD.

If you would like to sign up to be invited to view Lynette’s informative webinars live, please email LynetteZ@ITMTrading.com.

Presented by: Lynette Zang

Chief Market Analyst, ITM Trading

Disclaimer: The information in this Webinar has been carefully compiled from sources believed to be reliable, but the accuracy of the information is not guaranteed. The author, Lynette Zang was a licensed investment advisor but no longer maintains those licenses. This broadcast is not intended as investment advice. The opinions expressed are those of the author.

Neither Lynette Zang nor ITM Trading can guarantee that any products offered by ITM will rise in value. You should be aware that prices will fluctuate and may go down as well as up. Strategies mentioned in this webinar may not be suitable for you. Past performance is never an indication of future profits.

Before purchasing coins you should read ITM’s Risk Information and Purchase Policy documents. Coins should be considered a long term hold for a portion of your investment portfolio. If you have any tax or other questions please consult a financial professional.