NAFTA, Tariffs and Trade Wars…Oh My!

Insider selling more than doubled last week, with both technology and finance in the top five selling. Industrials and business services didn’t buy even one share, though they sold quite a bit, in continuation of the pattern that began last October. Why would they be selling so much if everything is so good?

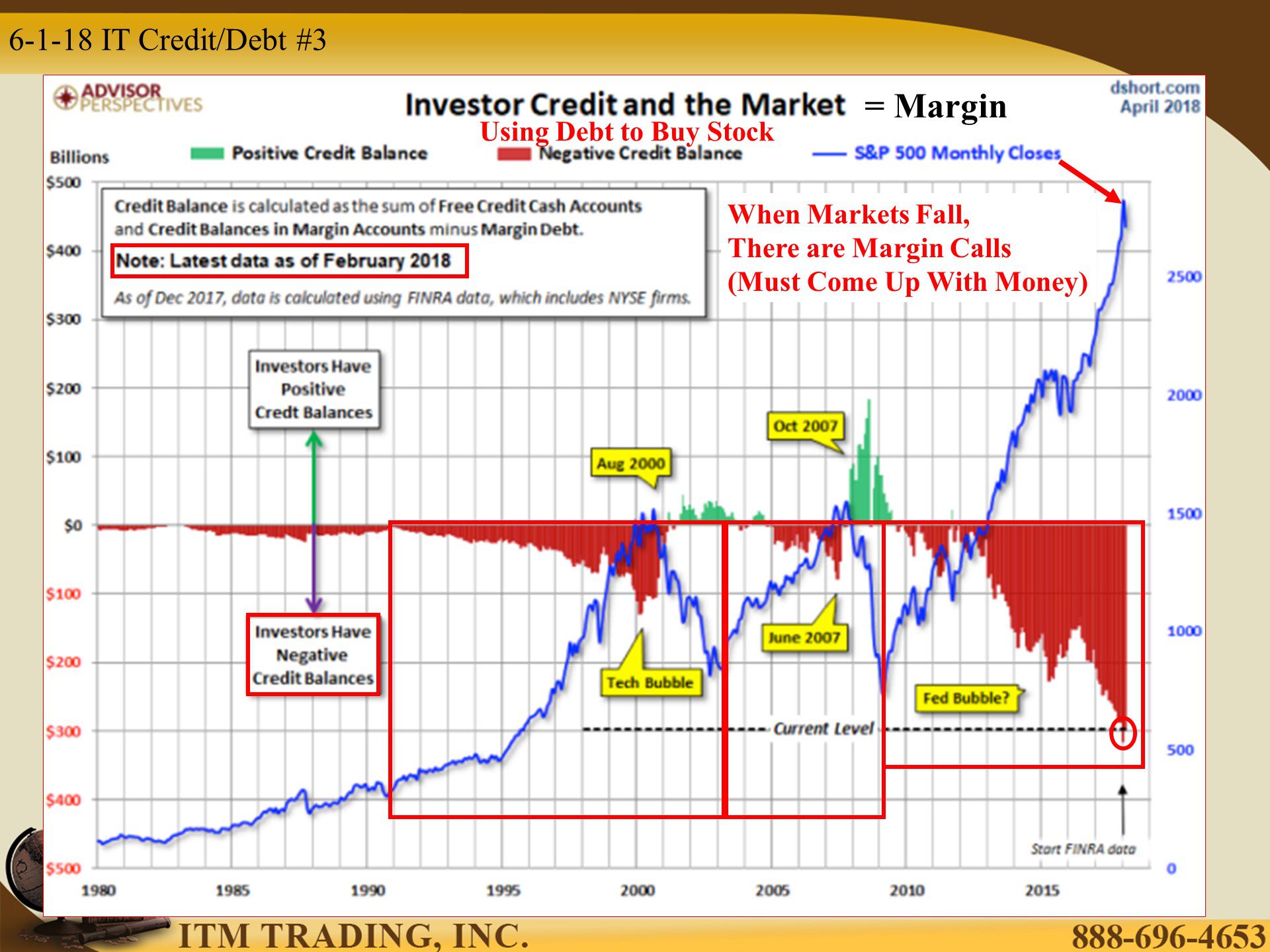

Perhaps they’re concerned that the stock market is breaking down while we have the highest level of margin debt in history. Margin levels indicate that people borrowed to buy stocks using those same stocks as collateral for the margin loan. When the stock market falls, additional collateral must be raised (margin call). This could create a doom loop where you sell stocks to pay the margin call, but then the market falls because you sold stock and now you must come up with more collateral. See the problem?

It’s one reason that the market action since February is so troubling. Geopolitical issues do not make this easier.

In January 2018 President Trump imposed tariffs on solar panels and washing machines. In March, he announced his intention to enforce a 10% tariff on aluminum and 25% tariff on steel citing section 232 of the Trade Expansion Act of 1962 “an article is being imported into the United States in such quantities or under such circumstances as to threaten or impair the national security.”

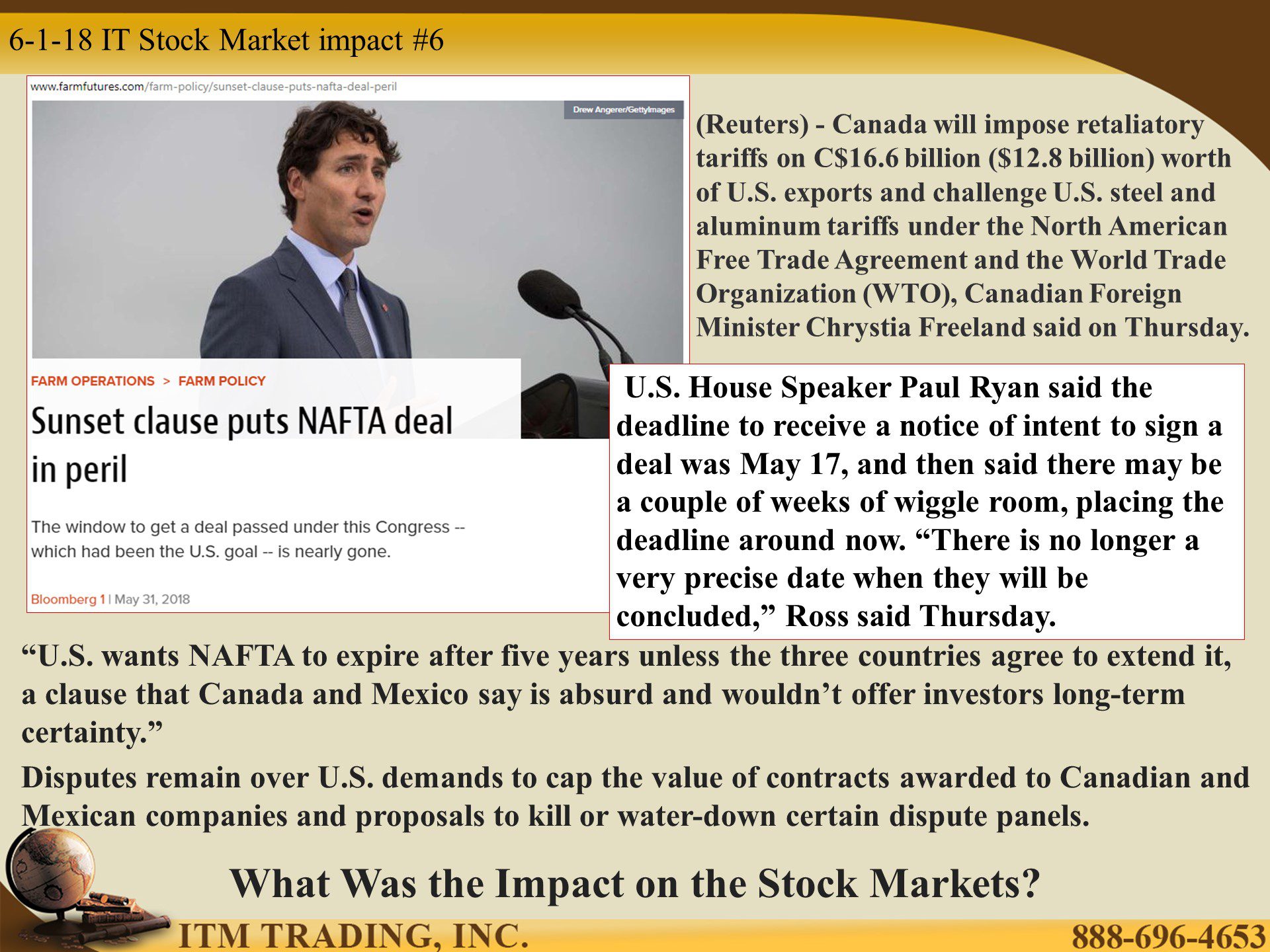

On May 31st tariffs were imposed on Canada, Mexico and the European Union. They are not happy and have struck back with dollar for dollar tariffs. In addition, they intend to trigger a dispute settlement case at the WTO (World Trade Organization).

Some say this is just a negotiating tactic, perhaps just a squabble among family…ever heard of family feud? This could turn nasty. Plus, NAFTA negotiations have broken down and I don’t really think this is helpful in resolving that issue.

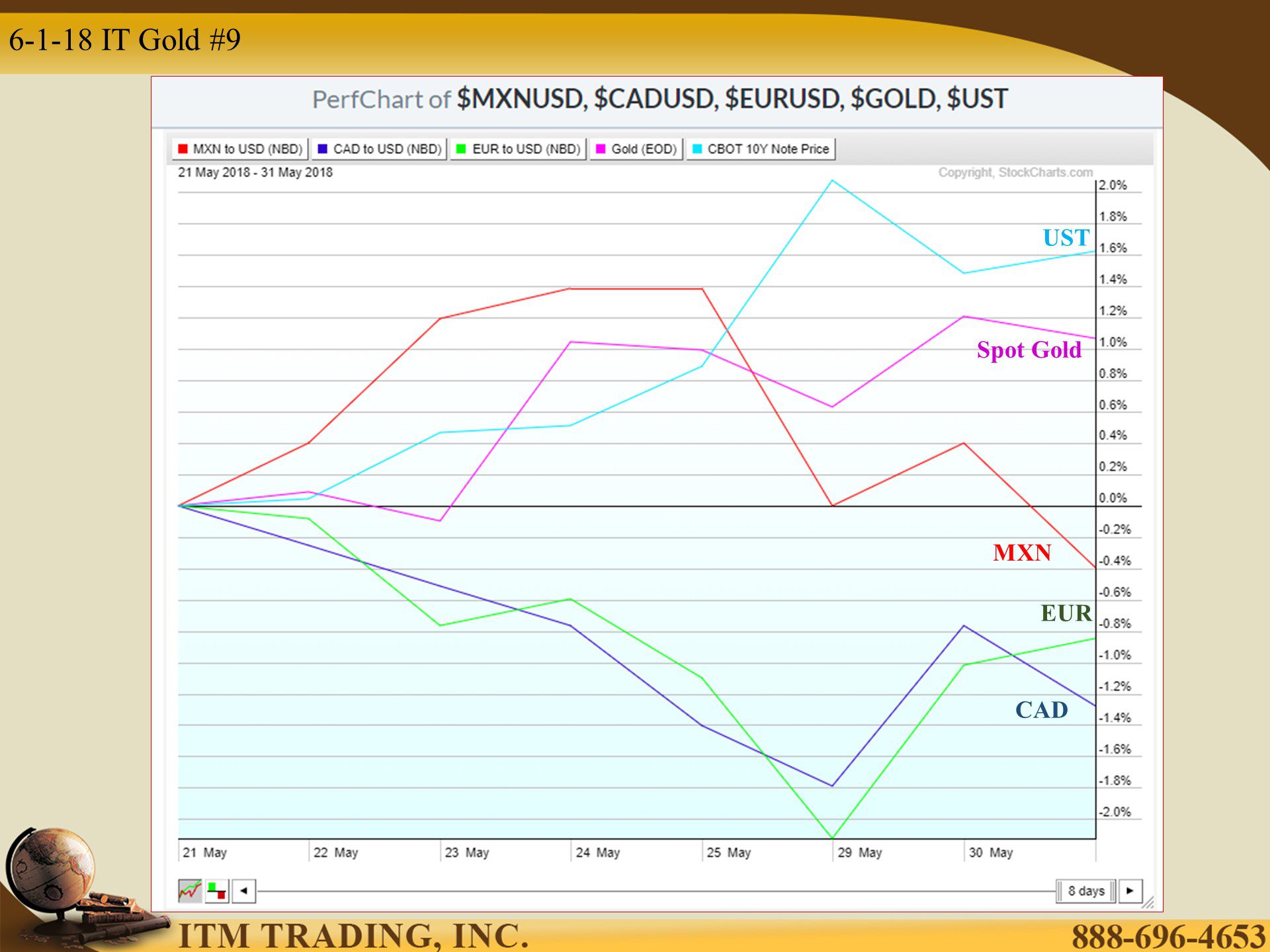

How have the markets responded? This could certainly be a factor in the market declines we’ve seen since February. As for the currency markets; the Mexican Peso, Canadian Dollar and Euro Dollar are all lower against the dollar, but even the manipulated spot gold market is higher.

The bottom line is that there are so many wild geopolitical cards flying right now. Any one issue could topple this fragile system at any time because it’s built on a mountain of debt. As long as credit is available, this insanity can continue. But I believe the insider action is telling me that the end is very near.

- cartoonistgroup.com/subject/The-Board+Of+Directors-Comics-and-Cartoons.php

- NA

- https://www.marketwatch.com/story/trillions-of-reasons-why-a-huge-storm-is-looming-for-investors-in-one-chart-2018-05-29

- https://www.bloomberg.com/news/articles/2018-05-31/u-s-metal-tariffs-hit-canada-and-mexico-pressuring-nafta-talks

- https://www.bloomberg.com/news/articles/2018-05-31/u-s-metal-tariffs-hit-canada-and-mexico-pressuring-nafta-talks

- https://www.bloomberg.com/news/articles/2018-05-31/u-s-metal-tariffs-hit-canada-and-mexico-pressuring-nafta-talks

- http://stockcharts.com/h-sc/ui?s=EWC

http://stockcharts.com/h-sc/ui?s=EWW

http://stockcharts.com/h-sc/ui?s=EZU