Mining For Metals Is Becoming Much More Difficult.

Back in the day, a potential prospector could go to work harvesting gold with as little as a gold pan, a burro, and a rifle. These days, mining for metals is becoming much more difficult. As the level of difficulty rises, so do costs. While this relationship may seem simple at first, it plays a much larger role when applied to gold mining in particular. This article will take a peek into what it now takes to capture and process metals from a mine. But first, let’s take a quick look at the relationship between mining and money.

Mining For Metals Is Becoming Much More Difficult: Old Number Seven.

Let’s go back to the old time gold prospector for a minute. Panning for gold is not easy work. However, a couple of hundred years ago walking away from a stream with some gold nuggets was much easier. Back then, the gold was sometimes just laying in the stream. Much of the US had never been explored by Americans, and the Native American Indians had absolutely no interest in gold. Therefore, gold nuggets were left to sparkle in the sun until a miner happened by to collect them.

ITM Trading Makes Gold And Silver Buying Easy – Shop Here

Over time, however, the easy nuggets were all scooped up. Prospectors had to work harder to find smaller amounts of gold. If we look at this from a profit perspective, it is easy to see that it was much more profitable for an early prospector to simply collect easy to find gold than it was to start turning up entire stream beds and building complicated sluicing equipment. The quicker the prospector could collect gold, the higher his “hourly wage†would become. This little equation still holds true today.

Mining For Metals Is Becoming Much More Difficult: Currency Metals Are A Store Of Value.

Today, mines demand very specialized machinery. They also require highly specialized engineers and technologies. Huge mining machines constantly consume the fuel necessary to run them. As the cost of these items rises, so does the price that the mine must charge for an ounce of gold in order to cover operating costs. This is the relationship between gold, labor, and scarcity that keeps the price of gold increasing along with the costs of mining. As you know, an ounce of gold that was found sitting on the side of a stream two hundred years ago is worth just as much as an ounce of gold mined today from the world’s most expensive mines. This is a case where “all ships rise with the tide†so to speak.

Mining For Metals Is Becoming Much More Difficult: Arizona And Rio Tinto.

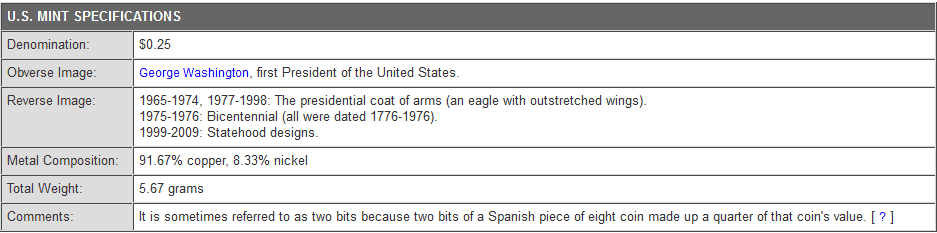

Arizona is rich in certain currency metals, copper being one of them. Copper is now primarily used in US dimes and quarters. In Superior, Arizona a mining corporation by the name of Rio Tinto is crossing into new frontiers regarding copper mining. Most of the easy to mine copper has already been mined. In order to keep up with the currency and industrial demand for the metal, accomplishments that were once deemed impossible now must be made in order to stay in business and stay profitable.

Coinflation.com Is A Great Resource For Determining The Value Of Coins And Metals.

Rio Tinto has located a huge new copper deposit. The problem is that this deposit is more than a mile underground, roughly 7000 feet underground. Temperatures in the mine reach 175 degrees Fahrenheit. Water from underground sources are constantly pouring in, flooding the mine. This water must be pumped out of the mine at the rate of 600 gallons per minute. At this rate, you could fill an average swimming pool in about seventeen minutes.

As you can imagine, humans don’t function well in 175-degree temperatures. Therefore, autonomous machinery must be designed, constructed, implemented and maintained in order to remotely mechanically mine the copper ore. Automated ore cars must carry the ore more than a mile to deliver it to the surface and the refining machinery. This all costs millions and millions of dollars. As the price and costs of producing copper rise so does the price the mining company must charge for refined, pure copper. When you look at the mining industry from this view, it is simple to see why metals prices rise over time.

What It Takes To Mine An Ounce Of Gold.

One report says that a highly productive Rio Tinto copper mine also produces just .35 grams of gold per every ton (2000 pounds) of ore mined. At this rate, Rio Tinto must locate, mine, move and refine roughly 100 tons or 200,000 pounds of ore in order to produce a single ounce of gold. Geologists and scientists agree that gold will only become more difficult and expensive to mine and refine. As new gold becomes more scarce, the gold above ground which is already mined will continue to increase in value.

Mining For Gold and Silver Is Becoming Much More Difficult: Own Gold As A Store Of Value.

ITM Trading specializes in placing physical gold coins and bars in the hands of it’s clients. All of the products ITM Trading sells are guaranteed to be authentic. ITM Trading also has a buyback policy in place. When it comes time to liquidate part of your gold holdings and realize the profits, it is as simple as sending us the gold and cashing the check that will be sent in return. ITM Trading makes owning gold easy. Nature makes mining gold very difficult.