JUST BEFORE THE CRASH: The 2 Patterns to look for! by Lynette Zang

Many of you are concerned about holding onto your money and wealth in the face of a reset. You believe, as I do, that the next stock market crash will usher it in. You want to know when the reset will happen.

HISTORY REVEALS THE CLUES

While I cannot tell you the exact date of the next financial crisis, I can tell you that historic patterns suggest we are very, very close. As a student of financial markets since 1964, I’ve lived through some of that history.

I was a new stock broker at Shearson Lehman on October 19, 1987. The morning started much like all other mornings. I went to lunch at 11, but when I got back the office was in chaos. Clients flooded in demanding to see their “financial consultantâ€, who did not have ANY ANSWERS for them! Calls from panicked investors flooded the phone lines. Where were their brokers? Literally under their desks. They never saw it coming and were just as freaked out as their clients.

They never saw it coming because they did not understand the language of the markets, that was not part of their training. It still isn’t. Then as now, their real job was to sell Wall Street products and get people to hold them “in street name†at the brokerage house. The market crash of 1987 could have led to some much-needed reforms, but, as usual, rather than changing behavior, they simply changed the rules and created the plunge protection team, to hide the truth, manage public confidence and keep the wealth transfer game going.

THE PATTERN SHOWS THE BREAKDOWN

By comparing past financial crisis patterns become obvious. But everyone learns a little differently, so the key to recognizing patterns is to understand, utilize, then trust the way you learn the best.

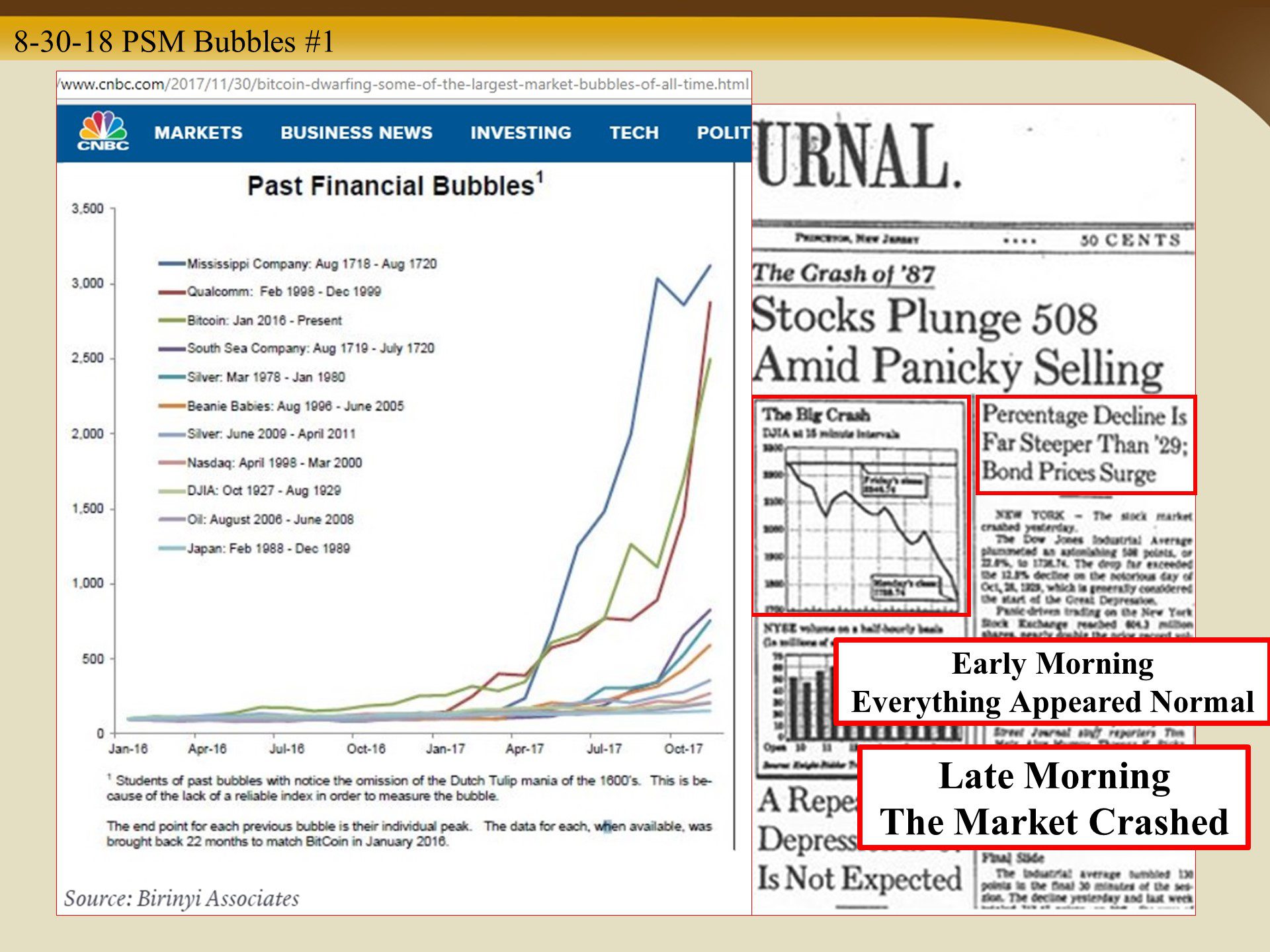

Comparison tools can be visible, such as charts and they are also auditory, found in language. Near peak highs and bottom lows you will see and hear extremes. Visually you’ll see a hockey stick and hear that prices no longer matter, and this time is different. You won’t typically see this, but most risk will have been transferred to the public.

My goal is to teach you how to recognize those patterns, so you can make independent, educated choices that supports YOUR best interest.

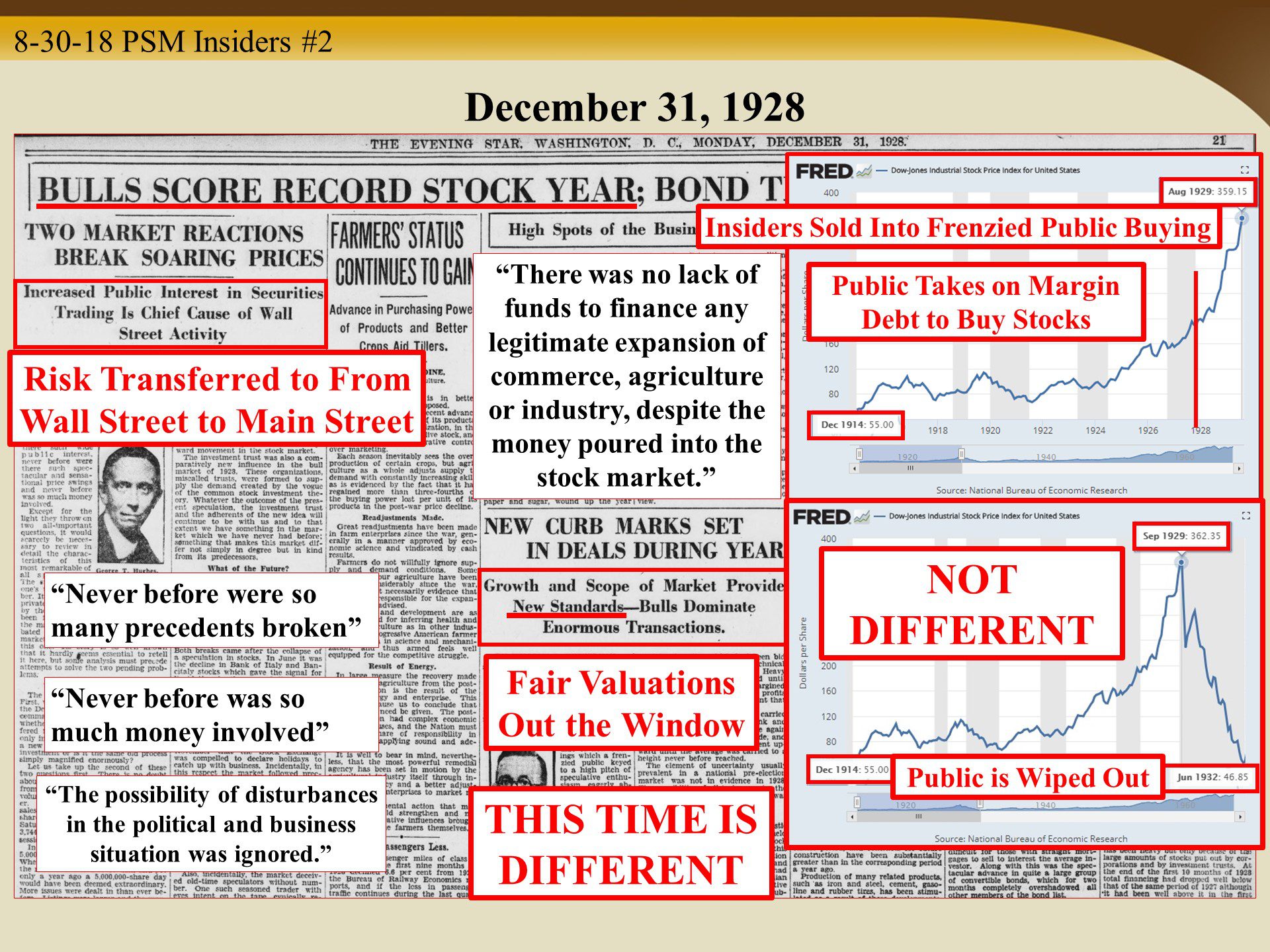

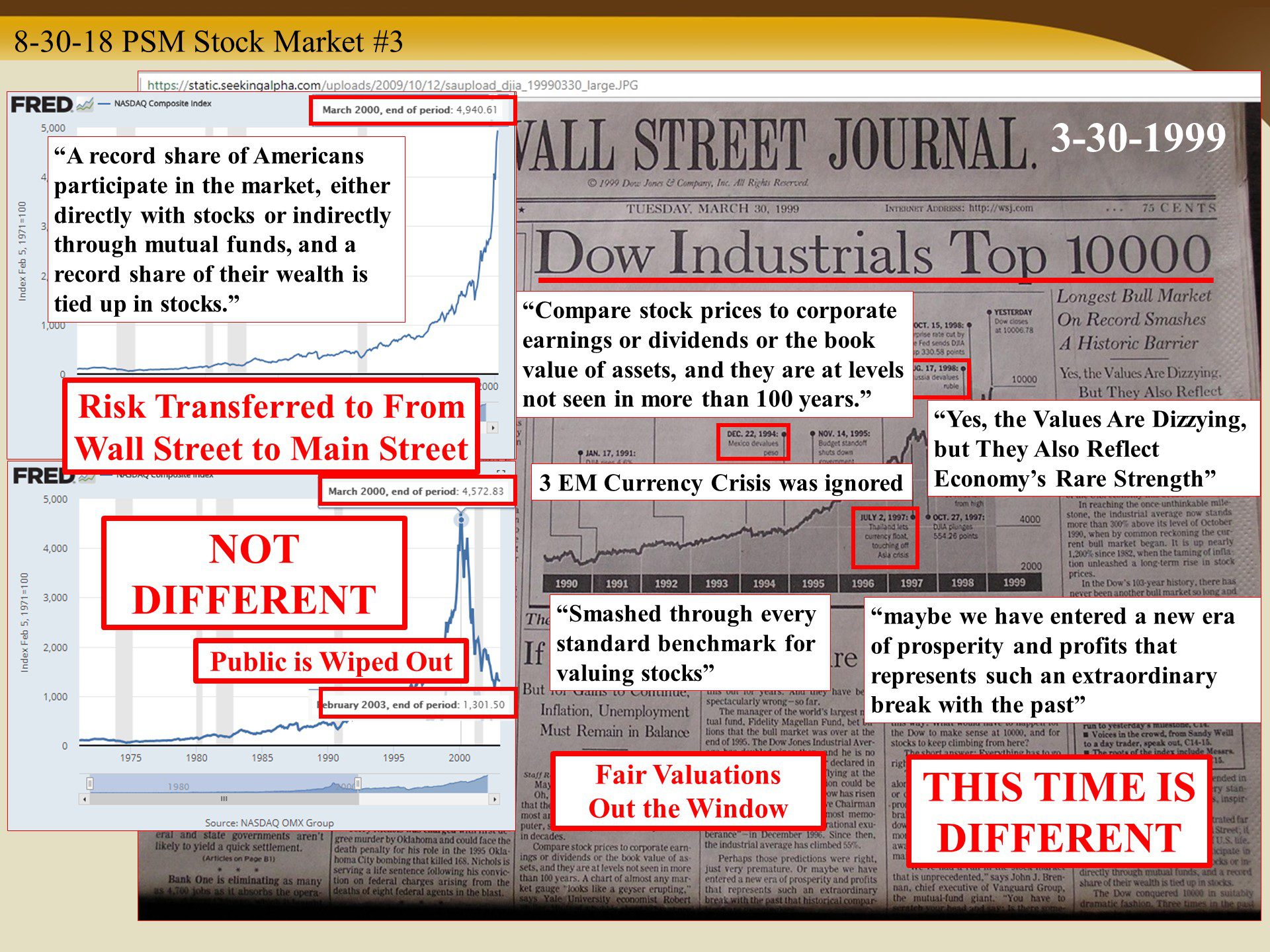

Comparing the last two fiat bull stock markets, 1929 and 1999, patterns become crystal clear; lots of easy credit (debt) creates an environment where a lot of fiat money chases a smaller amount of fiat stocks moving stock markets up, which inspires greater public participation. Fair price discovery becomes impossible, so fair valuations are thrown out the window and the market enters “melt-up†phase. Melt up hides smart money risk transfer from the elite to the public.

The cover up and manipulations will continue until;

- Enough risk has been transferred to the public

- It becomes too expensive for governments, central banks, banks and corporations to continue

What you hear is that this time is different. What you see is a hockey stick. This is where we are in 2018, you can hear it and see it, but do you believe it? I do.

How can you hold onto your money and wealth in the face of a reset? History Shows us that too.

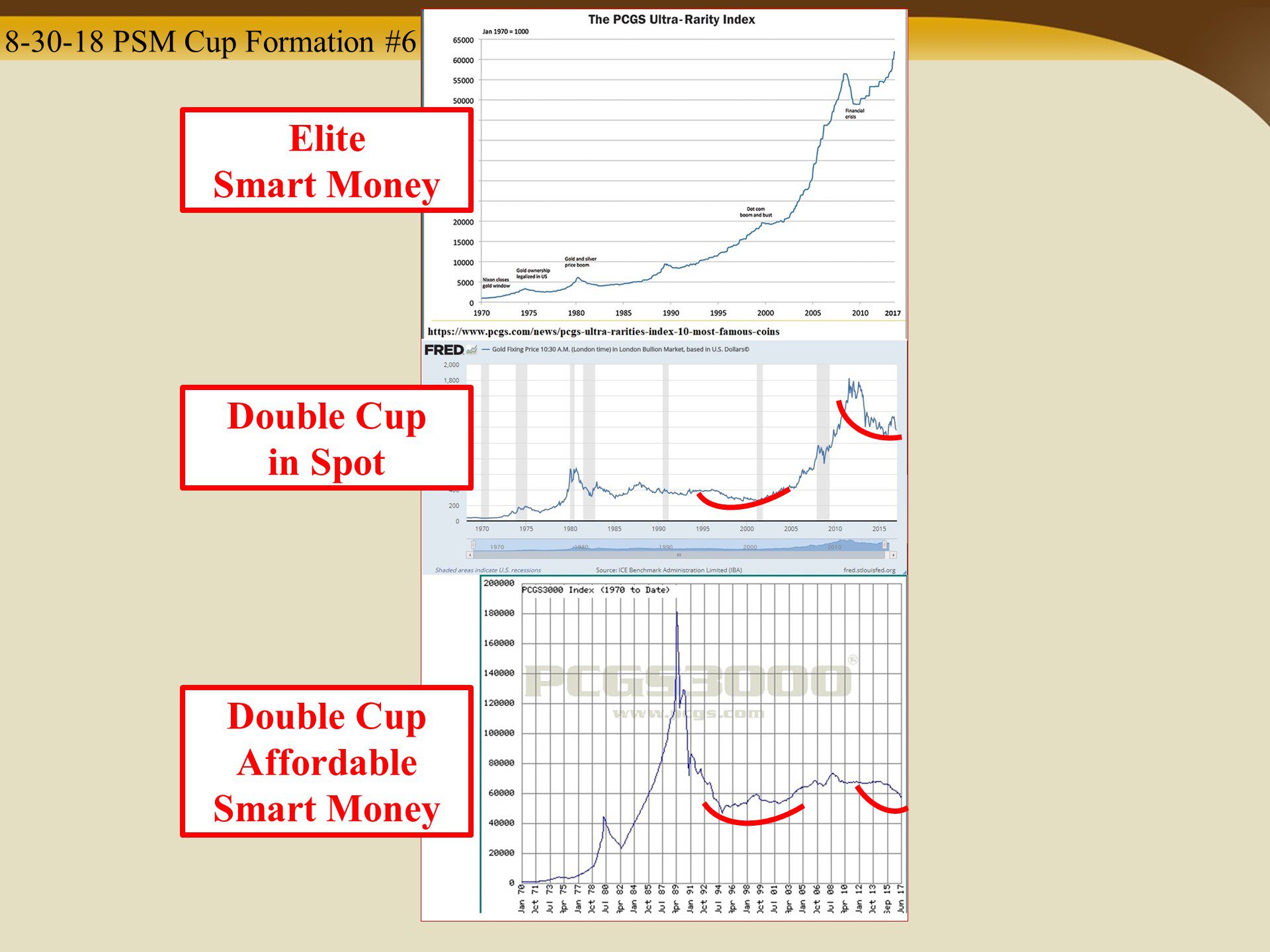

What you see in the fiat spot markets is Gold that has moved from a government fixed price of $20 per ounce to a market “manipulated†price of $1,211.50 (at the time of this writing), even as gold fundamental value is well north of $9,000.

What you hear is how gold and silver are a bad investment, but what you see is a double cup in spot gold, which is the strongest accumulation pattern I’ve ever seen. While the elite do not want you to own real money, they are accumulating it. So am I.

Slides and Links:

https://www.cnbc.com/2017/11/30/bitcoin-dwarfing-some-of-the-largest-market-bubbles-of-all-time.html

https://chroniclingamerica.loc.gov/lccn/sn83045462/1928-12-31/ed-1/seq-21/#M1109BUSM293NNBR

https://fred.stlouisfed.org/series/M1109BUSM293NNBR

https://static.seekingalpha.com/uploads/2009/10/12/saupload_djia_19990330_large.JPG

https://money.cnn.com/1999/12/31/markets/markets_newyork/

https://fred.stlouisfed.org/series/CPATAX

https://www.advisorperspectives.com/dshort/updates/2018/08/20/margin-debt-and-the-market

https://fred.stlouisfed.org/series/NASDAQCOM

https://www.cnbc.com/2017/11/30/bitcoin-dwarfing-some-of-the-largest-market-bubbles-of-all-time.html

https://www.pcgs.com/news/pcgs-ultra-rarities-index-10-most-famous-coins