ITM Market Update

August 9, 2013

Below I have chosen to share some words of wisdom from the August 8th and August 9th, Daily Remarks section of Richard Russell’s Dow Theory Letters. Russell just turned 89 and his newsletter advisory is the oldest in the business written by the same author.

When it comes to the stock market Russell is turning bearish and believes we are on the knife’s edge so to speak!

Russell also believes gold is bottoming here. Read about this in his comments on gold from his August 8th Remarks section.

Marc Faber, another old timer was on CNBC recently. Faber believes the stock market will be 20% lower by yearend.

See the Marc Faber interview here: http://www.cnbc.com/id/100950234

From Richard Russell:

August 8, 2013… One area I have been wondering about is the area of business and finance. I’ve been thinking that maybe an entirely new system of finance will have to be ushered in. This may require (Uranian again) the smashing of the old system, which in turn may require that the stock and bond markets be smashed, in order that an entirely new system be established.

Let’s say that this comes about. What are you and I to do about it? Let’s posit that the stock, bond and currency markets are to be smashed. All we can do is prepare for trouble and have faith in God. Only gold may survive as the government battles the damage with the only weapon it knows, which is printing more money. Wealth will be measured in tangible objects such as great art, diamonds, gold and collectibles.

Question — How will we know if the great wipe-out is upon us?

Answer — My only answer is that we’ll just have to watch the various indices and stock averages. The first hint of a possible great bear market will be the Dow touching 15,400. The next stage would be the Dow closing on rising volume below 15,000. And so forth — closing below 14,000, and then below 13,000 and finally breaking below 10,000. Because the public is so used to being safe and “saved” by the Fed, I think it will take the Dow breaking below 10,000 to scare the public and turn them bearish.

…………………………….

I expect any descent towards 10,000 to be slow and “unscary.” Thus the market will take the largest number of investors down with it — while the great bulk of investors sit, unmoving, while their losses build up.

In the end, I expect a new and better financial system to grow out of the ashes of the current system. The new system will be built on the natural forces of supply and demand, minus the manipulations and currency printing of a Federal Reserve.

The Federal reserve and its system of printing money and manipulating the markets have circumvented the US Constitution and effectively destroyed the great platform that our Founding Fathers bestowed on us. “We give you a republic,” said Ben Franklin, “If you can keep it.”

August 9, 2013 — The golden rule — “He who has the gold, makes the rules.” — Old Adage

………………………………….

The great Dow Theorist, George Schaefer, set up two equal-dollar amount accounts early in the fabulous bull market that started in 1949. One account consisted of blue chip stocks and the other consisted of low-priced “cats and dogs.” Schaefer told his subscribers that towards the end of the bull market his low-priced account would far outstrip his blue chip account. And sure enough, that’s exactly what happened.

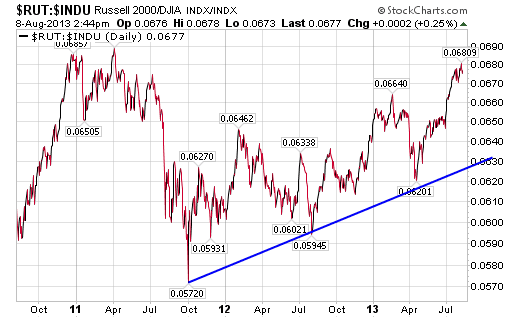

Below I show the ratio of RUT, the low-priced stock index, compared with the blue chip Dow. As you can see, the low-priced stocks are now far outpacing the blue chip Dow.

I take this chart as a warning that the stock market has become highly speculative and therefore increasingly dangerous. My subscribers should therefore be extremely cautious, and if the DIAs break below 154, sell them and move to the sidelines.

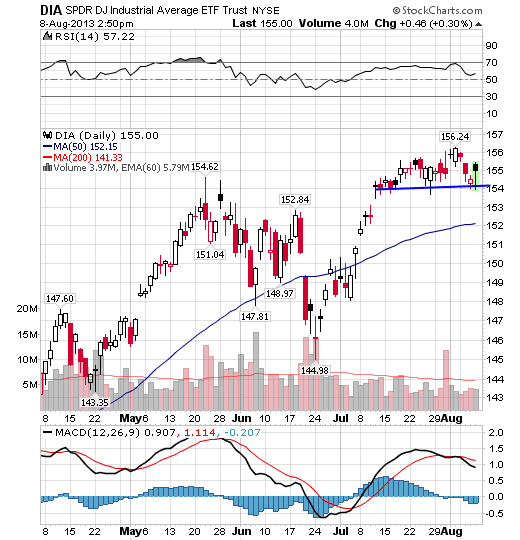

I show a chart of the DIAs below — the horizontal blue line depicts critical support at 154. Note the bearish MACD. If the DIAs break below 154, be out and on the sidelines. (Note — as I write Friday an hour after the opening, the DIAs have broken below 154).

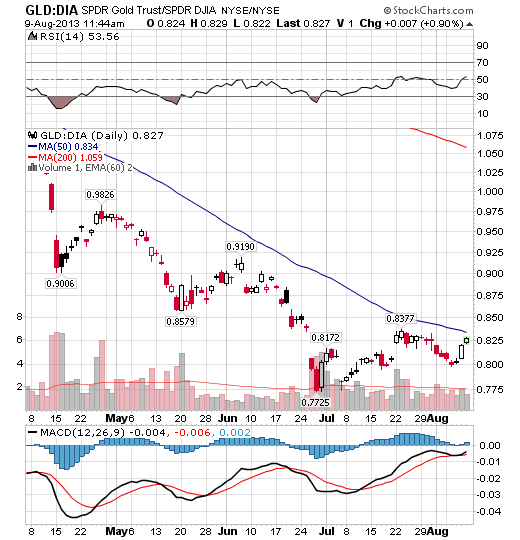

August 08 ….Below is a chart showing the ratio of gold to the Dow. What we see here are rising bottoms. It wouldn’t surprise me to see gold outpace the Dow for a time. If this ratio breaks out to a new high, the gold bull market will be back again in all its glory.

But seriously, I believe that the law of supply and demand is a natural law, and it’s a moral law given to the planet by God. The whole concept of creating money without toil or risk is an integral province of the Federal Reserve. I believe that one way or another, the Federal Reserve and all it stands for will be eliminated. The process by which this will occur worries me. I believe it will take a huge disruption of our current economic system in order to eliminate the Federal Reserve and its immoral process of money being created out of a computer and thin air.

The process of creating money from “nothing” makes a mockery of real work of all kinds. Thus, by inference, I am calling the Federal Reserve an evil institution. The more so, since it denigrates gold, which is, and has always been, true wealth, wrung out of the earth through man’s sweat and toil and risk.

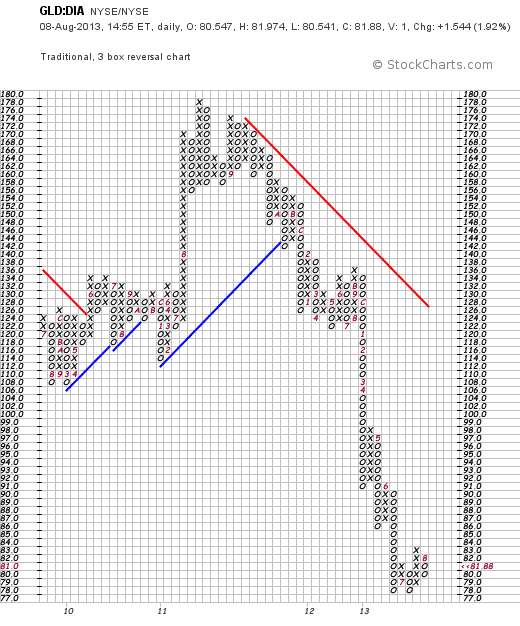

The same chart in P&F. It looks to me as though a base could be forming. If the 84 box is filled, we may see gold outperforming the Dow on a long-trend basis. I love P&F charts. They often tell you what nothing else does.

As I write two hours after the opening, the Dow has suddenly sold off. I quickly made the chart below, showing the Dow breaking down. The P&F projection or target for the Dow is 15,000. Extreme caution is now in order.

Big doings in gold. Gold was up 24.6 yesterday to 1309.9. We’ll get both a bull and a buy signal if gold can hit 1340.

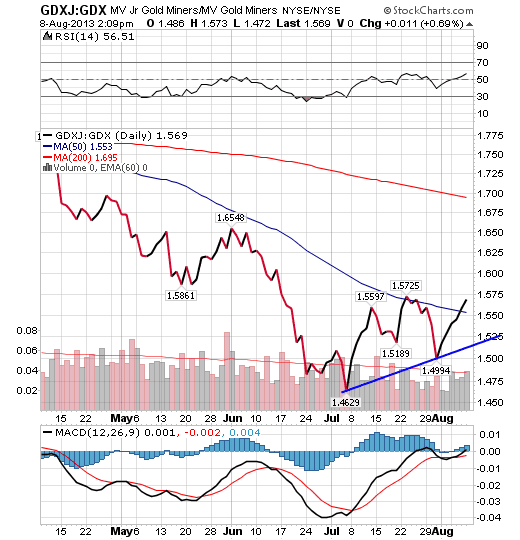

Below is a chart showing the speculative gold miners (GDXJ) as a ratio of the larger gold miners (GDX). The fact that the speculative gold miners are outpacing the staid, larger miners is bullish for the whole gold universe. I believe the bull market in gold is now resuming, and I expect it to accelerate as time goes on. Note below — RSI and MACD, which are both bullish.

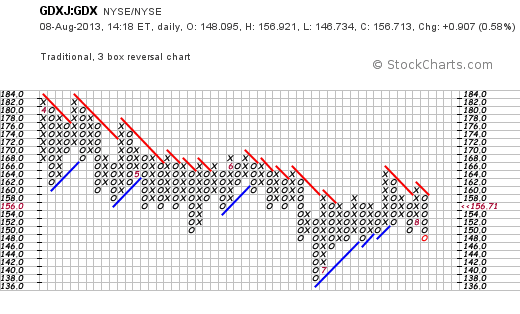

Just for good measure, I am including a P&F chart below of the same ratio as the chart above. It looks as though a base is building. Got gold?

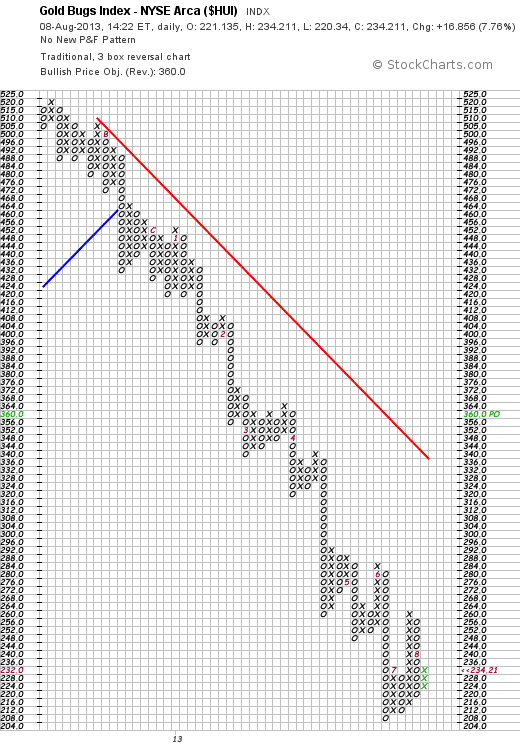

Below is a P&F chart of the NYSE “Gold Bug’s Index.” This looks to me as though it’s building a large base — just more “silent” good news about gold!

So remember, “It would be unwise to acquire gold for the short term but it would be foolish not to own some gold for the long term!”

Craig Griffin

President, ITM Trading Inc.

To receive ITM’s Exclusive Report on the Euro and the financial pressures upon it, call toll free 1 888 OWN GOLD (1 888 696 4653) and ask for your Copy of “Weathering The European Economic Storm”.

Before making a purchase please see ITM’s Purchase Policies and Risk Information Documents (link below):

http://www.itmtrading.com/purchase-policies-and-procedures/

*ITM Cannot provide assurance that our forecasts or projections regarding appreciation in the value of rare coins or bullion or the markets for rare coins or bullion will be achieved. Although we strive to provide analysis that we believe is well thought out and sincerely reflects our opinion, we cannot and do not guarantee our forecasts or projections and you and your financial advisor should conduct your own analysis of the rare coin and bullion market before purchasing coins.