IS DEUTSCHE BANK ABOUT TO IMPLODE?: Are Central Banks Setting Up The Fiat/Gold Reset?

It’s a long way down from being the second largest bank by assets, in 2007, to the walking zombie bank that Deutsche today. And while central bank QE free money and several funding rounds have enabled this zombie to keep walking, a large client hedge fund run has begun, as RenTech, one of Deutsche’s largest hedge fund clients, began pulling funds. As this run has heated up, Bloomberg reports that “clients are pulling about $1 billion per day†out of the bank. Do you think their small retail customers know this?

Typically, after the big guys get out, the average retail customer, like you and me, are left holding the bag and today, bail-in laws legalize the theft. But perhaps that reality can remain hidden for a little while longer, at least, that’s the hope of the restructuring.

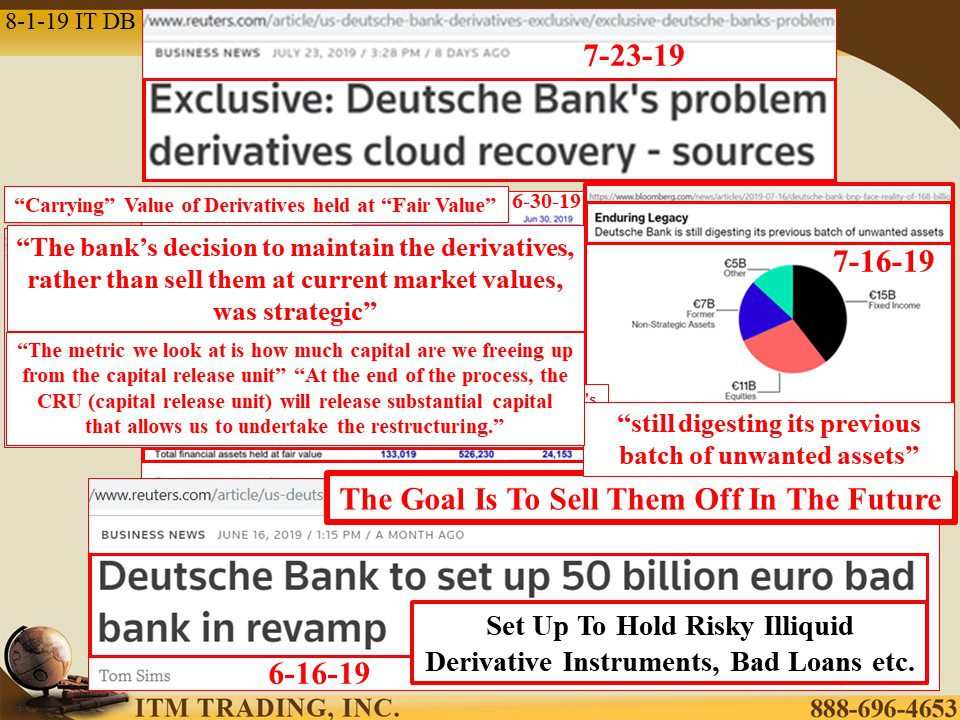

Including the creation of a “Bad Bank†to hold “assets†no longer wanted by the bank. What would those “assets†be? How about illiquid derivatives and loans, garbage that has virtually zero market value. They tried to sell them at first, but the bank decided to “maintain the derivative, rather than sell them at current market values†and have to write down these “assets†that are being held on their balance sheet at “Carrying†value, which the bank can determine in most cases.

Good thing too, because if they had to show the true value of their holdings, perhaps the truth could no longer be hidden. Though a bail-in of depositors and bond holders would surely take place.

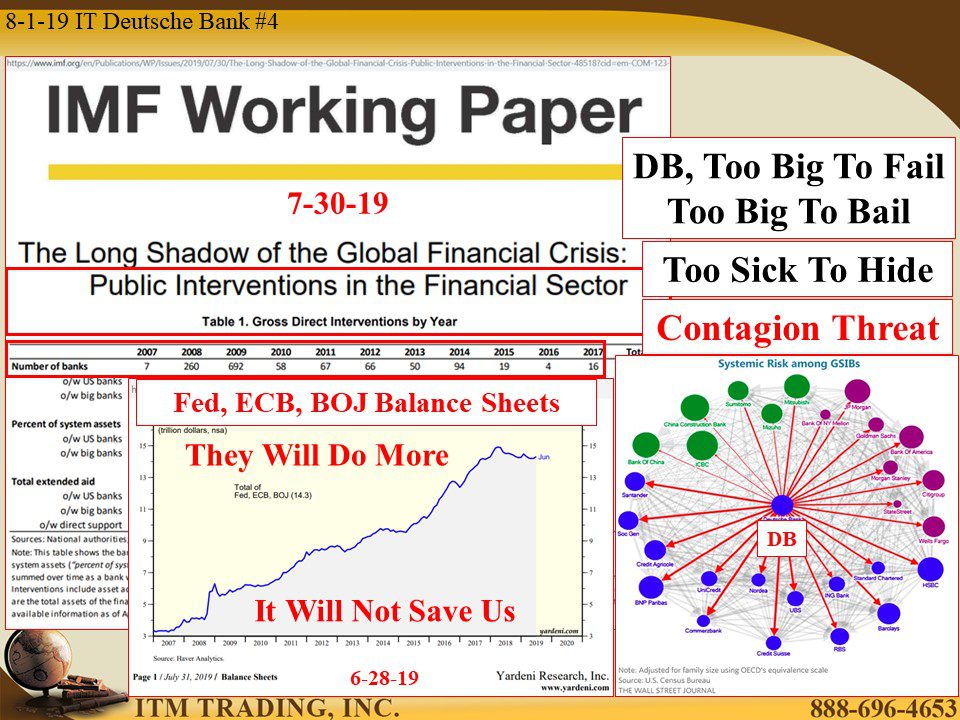

Why should you care? Because, according to the IMF (International Monetary Fund) an implosion at Deutsche Bank would quickly travel through the global financial system. This makes Deutsche Bank Too Big to Fail. And the value at risk in their derivative holdings, dwarfs the value of any real assets they hold, by a very wide margin making them Too Big to Bail.

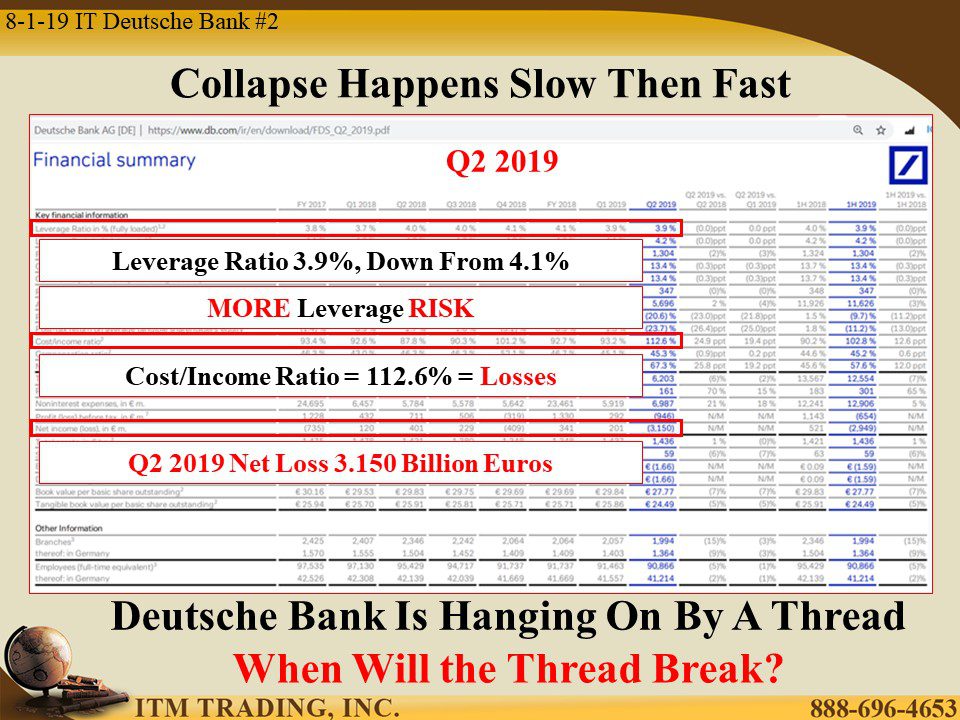

Showing the largest quarterly loss in four years and with their stock off 90% since the last financial crisis, investors have had enough, making Deutsch Bank’s financial illness too obvious to hide. But with central bank balance sheets at nose bleed level, how much more can they do?

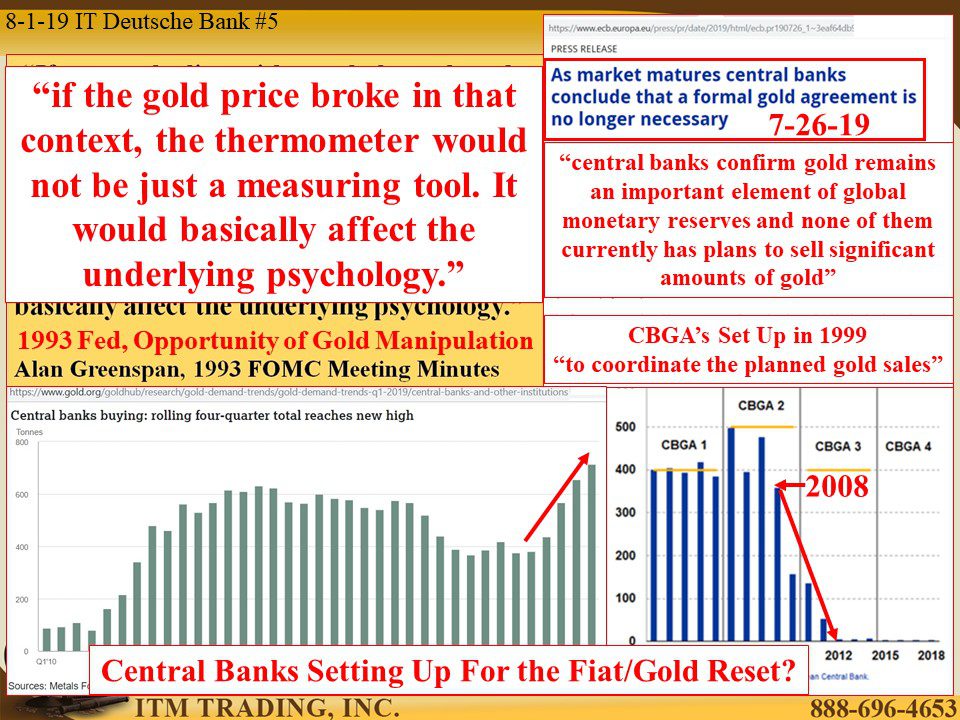

There is no saving Deutsche Bank, and it does seem that they are rapidly running out of options, so what are central bankers doing? Getting ready for the fiat/gold reset.

On July 26, 2019, the ECB (European Central Bank) announced that the CBGA (Central Bank Gold Agreement), that had first been instituted in 1999, to coordinate central bank gold sales, was no longer needed. Could central bankers be setting up gold to move toward to its fundamental value?

https://www.ft.com/content/c047a384-9e32-11e9-b8ce-8b459ed04726

- https://www.db.com/ir/en/download/FDS_Q2_2019.pdf

- https://www.reuters.com/article/us-deutsche-bank-derivatives-exclusive/exclusive-deutsche-banks-problem-derivatives-cloud-recovery-sources-idUSKCN1UI2TT

https://www.db.com/ir/en/download/DB_Interim_Report_Q2_2019.pdf

https://www.bloomberg.com/news/articles/2019-07-16/deutsche-bank-bnp-face-reality-of-168-billion-hedge-fund-deal

- https://www.imf.org/en/Publications/WP/Issues/2019/07/30/The-Long-Shadow-of-the-Global-Financial-Crisis-Public-Interventions-in-the-Financial-Sector-48518?cid=em-COM-123-39258

- https://www.ecb.europa.eu/press/pr/date/2019/html/ecb.pr190726_1~3eaf64db9d.en.html

- https://www.gold.org/goldhub/research/gold-demand-trends-q1-2019/central-banks-and-other-institutions

8-1-19 IT IS DEUTSCHE BANK ABOUT TO IMPLODE?: Are Central Banks Setting Up The Fiat/Gold Reset? By Lynette Zang

It’s a long way down from being the second largest bank by assets, in 2007, to the walking zombie bank that Deutsche today. And while central bank QE free money and several funding rounds have enabled this zombie to keep walking, a large client hedge fund run has begun, as RenTech, one of Deutsche’s largest hedge fund clients, began pulling funds. As this run has heated up, Bloomberg reports that “clients are pulling about $1 billion per day†out of the bank. Do you think their small retail customers know this?

On July 26, 2019, the ECB (European Central Bank) announced that the CBGA (Central Bank Gold Agreement), that had first been instituted in 1999, to coordinate central bank gold sales, was no longer needed. Could central bankers be setting up gold to move toward to its fundamental value?