How To Invest In Gold Coins – Part One

If you are looking for information on how to invest in gold coins, this article-blog will offer you a lot of information, starting at the very beginning. Gold has a recorded history of being money that stretches back over six thousand years. Because of this long and steady history, there is a lot of information to catch up on regarding gold coins, old gold coins, rare gold coins, gold bullion, and gold bars. If you are already a little bewildered as to what makes gold coins old, or rare, or what the difference between gold coins and gold bullion is, then read on. There will also be more information on how to invest in gold coins in part two of this article-blog.

Gold Coins, Face Value, And The U.S. Gold Standard

In the historic past, different cities and governments coined gold for use as currency, and this still happens today, though no current country intends for their gold coins to trade at face value. Face value is the amount of currency units (dollars, yen, francs, etc) that the coin bears on its face or back. This is because the U.S. was the last major economy to practice the gold standard. If you are not familiar with what the gold standard is, I’ll give you a quick breakdown of how the U.S. gold standard worked from 1933 until the early 1970’s, when President Nixon ended the gold standard, and ushered in the use of fiat currency in the United States. For more information on what a fiat currency is, and how it relates to gold coins, gold bullion, and rare gold coins, please read part three of this article-blog.

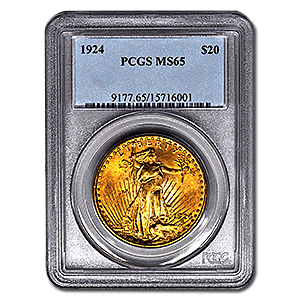

Shop for Saint Gaudens Gold Coins Online

Gold Coins And Their History In The United States

During the 1800’s the United States Mints coined silver and gold coins for use by the citizenry, and any paper notes were fully convertible (you could trade them at a bank or similar institution) for gold coins or silver coins. One ounce gold coins had a value equal to twenty one ounce silver coins or their equivalent. The values of the coins were set by government decree, and they did not change until 1933. In 1933 President Roosevelt issued Executive Order 6102 and ordered the people of the U.S. to exchange their gold coins for Federal Reserve Notes (very similar to the Federal Reserve Notes we use as money today) at approved banking institutions. Once everyone had changed their gold to silver or paper, Roosevelt changed the set value of gold from about twenty dollars per ounce to thirty five dollars per ounce. This action thereby reduced the value of the dollar by seventy five percent against gold, and those holding gold saw their gold increase against the dollar by seventy five percent. Today, the dollar has well over 95% its original gold backed value. To continue reading about how to invest in gold, and how gold coins, old gold coins, gold bullion, and rare gold gold coins function in today’s market, click here.