HEADS UP: Central Bank Dominoes Are Falling by Lynette Zang

As discussed in CONTAGION: Why Turkey Could Gobble Up the World https://www.youtube.com/watch?v=8O9UNeJlpoo&t=132s the global contagion has begun. At this writing thirteen fiat currencies are imploding. In order to “support†their currencies, central banks are using the one tool left in their arsenal. Rising interest rates, in the hopes those reaching for this higher yield will ignore the risk to principal for that extra pick up in interest.

But currency markets no longer seem to be listening to the central bankers as any intervention has a very short or no impact at all. What the globalists feared, is now coming to pass. In my opinion, we have just entered the next phase of the fiat system unraveling as confidence in emerging market central bankers evaporates.

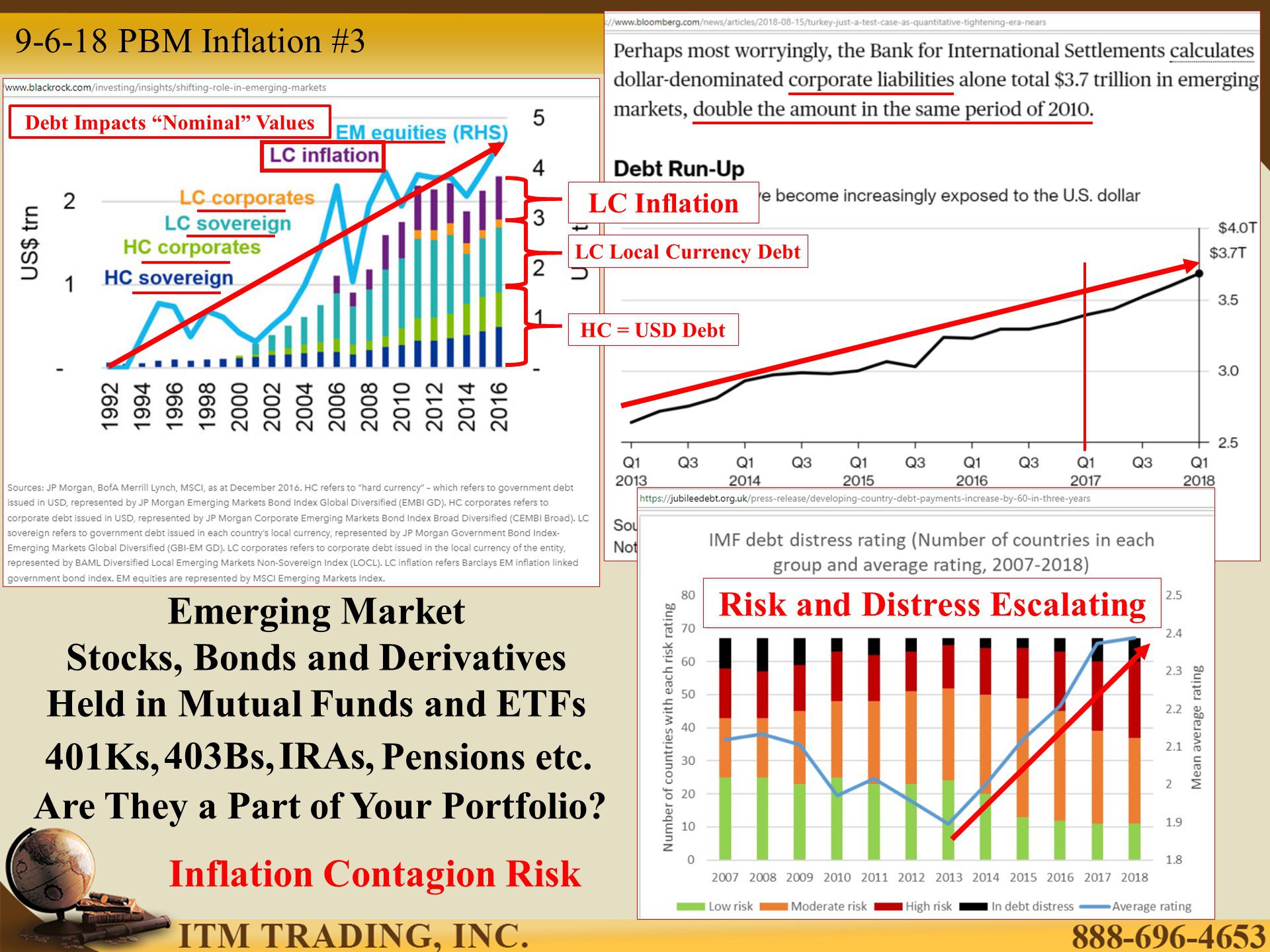

Globally, it is also reflected in emerging market stocks, most showing declines of near 20% or more since the January high, mimicking the decline in currencies.

You might think that’s their problem, but the growth of Wall Streets emerging market stock, bond and derivative products have more than doubled since the 2008 crisis and been used to goose returns and yields in mutual funds and ETFs, many of which are held in retirement and pension accounts. Which is one way that risk has been spread to Main Street. But there are even more ways as well.

In the past we’ve discussed how USD debt taken out by emerging market corporations and held by banks in Europe and US threaten cross border contamination if mass defaults occur.

In a 2017 Working Paper, the Bank For International Settlements (BIS) points to a huge additional problem, “The globalization of inflation: the growing importance of global value chains†or GVC.

Beginning in the 1980’s globalization hid a large part of inflation via currency devaluation by using the cheapest labor cost countries for production. This enabled corporations to export product deflation while enjoying exploding corporate profits. It also created a cross border dependency with emerging markets importing components and parts, then exporting the finished goods. This structure is referred to as the Global Value Chain or GVC.

As currency markets begin to unravel, the GVC that was used to hide real inflation devaluation, is now beginning to transmit that inflation first across borders, but, perhaps quite soon, globally. And as the BIS points out, this affects central banker’s ability to “manage†inflation. Especially as confidence in governments and central bankers’ wanes.

Since it is the “Full Faith and Credit†that supports the fiat system, this loss in confidence is critical. So what do governments and central bankers have confidence in? Physical gold.

They know that gold is real money with global value, that is beyond the control of any other government or central bank. They know, what J.P. Morgan knew at the start of this fiat experiment, “Gold is money. Everything else is credit.â€

Slides and Links:

https://www.bloomberg.com/news/articles/2018-05-18/why-investors-have-become-skittish-about-turkey

https://www.ft.com/content/51311230-9be7-11e8-9702-5946bae86e6d

https://www.db.com/ir/en/download/DB_Interim_Report_Q1_2018.pdf

YouTube Short Description:

The global contagion has begun. At this writing thirteen fiat currencies are imploding, and currency markets no longer seem to be listening to the central bankers as any intervention has a very short or no impact at all. What the globalists feared, is now coming to pass. In my opinion, we have just entered the next phase of the fiat system unraveling as confidence in emerging market central bankers evaporates.

Since it is the “Full Faith and Credit†that supports the fiat system, this loss in confidence is critical. So what do governments and central bankers have confidence in? Physical gold.

They know that gold is real money with global value, that is beyond the control of any other government or central bank. They know, what J.P. Morgan knew at the start of this fiat experiment, “Gold is money. Everything else is credit.â€