HEADS UP: Banks Are Falling Out by Lynette Zang

As consumer confidence nears all-time highs, three out of ten sectors with the heaviest selling to buying ratios were in the consumer markets; Consumer services and Non-Durables were in the top five, but companies in the consumer durables sector did not buy any stock, just sold a bunch. What do you think this might be telling you? Perhaps the economy is not quite as rosy as those in power would like you to think. But there’s more…

Last October we saw a major insider selling pattern emerge, as some insider sectors avoided buying stocks even as they continued heavy selling. Now that pattern shift may be evolving.

Since the start of the year, after a major selling spike, there is a bit of a lull the following week. But the last two weeks have seen huge spikes in selling without the following lull. We look at this every week, so time will tell if this is a trend escalation. But the rats seem to be jumping off the fiat sinking ship.

In May, as the markets marched higher, market volatility plunged into complacency territory. Don’t worry, be happy. At the same time, the “Smart Money Flow Index†is now at levels last seen before the bursting of the Nasdaq bubble in 1999 and the housing bubble in 2008.

So we can see that the smartest guys regarding fiat financial products as well as those running major corporations are jumping ship. But they want you to stay in.

You see, they leverage your deposits and brokerage account equity to generate revenue for themselves. If those leveraged derivative bets go bad, your equity will most likely need to be “Bailed-in†since these SIFIs (systemically important financial institutions) are critical to the global financial system. Certainly, your little bit of relative wealth is paltry compared to the global financial system. See why YOU are not too big to fail?

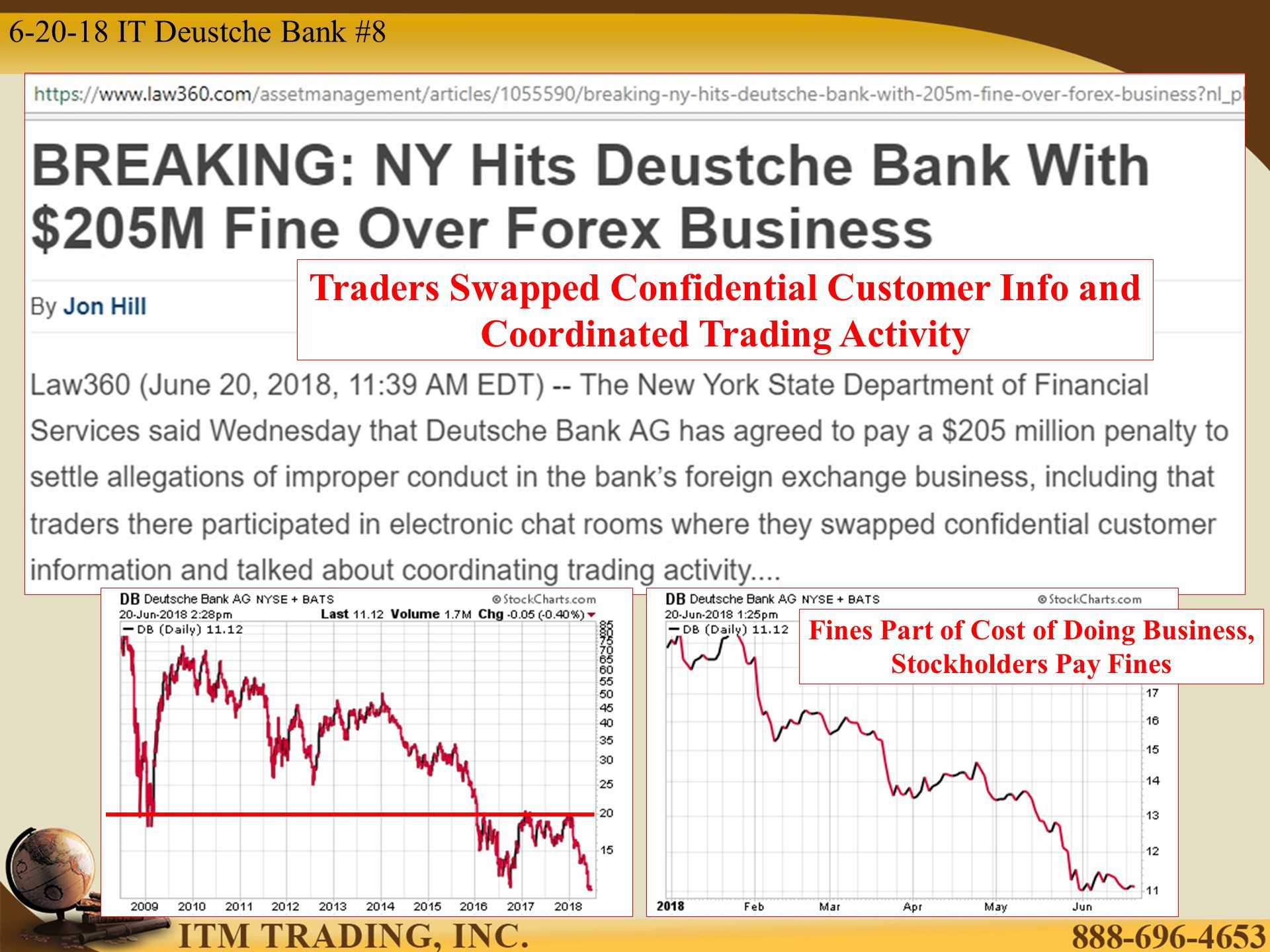

Unfortunately, they are. So even when they abuse our trust, they simply agree to pay a small fine (stock holders pay) and off they go to do it again and again, until they can’t.

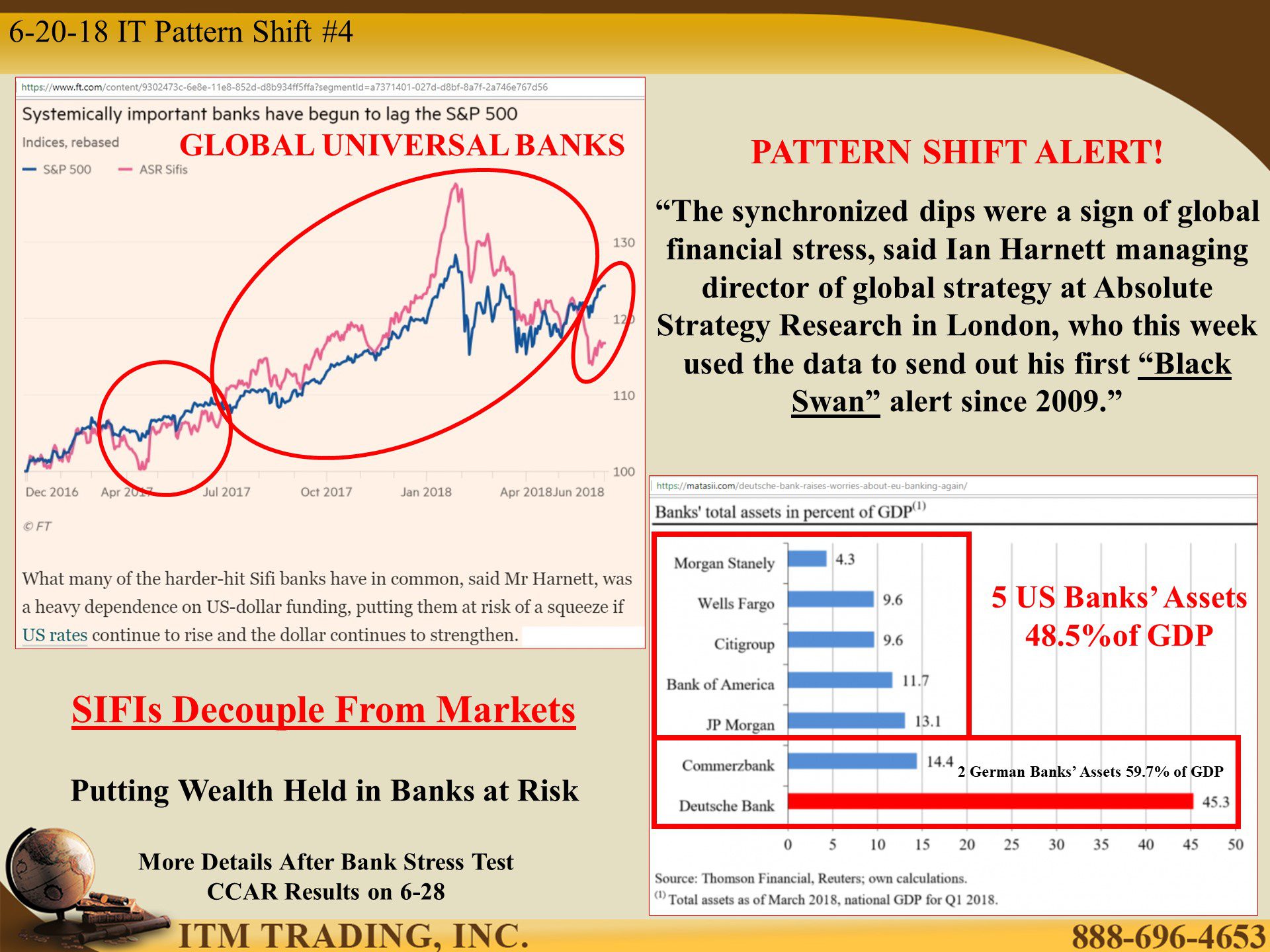

We may be fast approaching that time. In another PATTERN SHIFT ALERT, SIFIs have decoupled from the stock markets. In fact, Ian Harnett, managing director of global strategy at Absolute Strategy Research in London just sent out his first “Black Swan†alert since the crisis began, because of this pattern shift.

From silence to screaming, more IBOR news with Chase, Citi, Barclay, Goldman Sachs, Royal Bank of Scotland and Deutsche Bank paying fines for interest rate manipulations. What I find really, really interesting is that the IBOR manipulations go back to 2007, before the crisis became apparent to all!

To rebuild public confidence, Dodd-Frank regulations appeared to put some restraints on the banks. I say appeared to, because most of what actually happened was 20,000 pages of regulations, most of which were never implemented. But the bail-in laws were. Now, many of those regulations are being dismantled.

After all, we must make sure the banks profit…at all costs.

Slides and Links:

https://matasii.com/smart-money-flow-index-drops-as-fast-to-levels-not-seen-since-2000-2008/

http://stockcharts.com/h-sc/ui

https://matasii.com/deutsche-bank-raises-worries-about-eu-banking-again/

https://dealbook.nytimes.com/2011/01/25/merrill-settles-s-e-c-fraud-case/

http://stockcharts.com/h-sc/uihttps://www.nasdaq.com/symbol/bac/insider-trades

http://stockcharts.com/h-sc/uihttps://www.nasdaq.com/symbol/jpm/insider-trades

http://stockcharts.com/h-sc/ui

http://stockcharts.com/h-sc/ui