Governments and Central Banks Craft How We Think

The job of the government and Central Banks is to craft how we think, therefore how we behave. If they can get us to voluntarily participate as they want, it supports their goals to transfer our wealth their way through inflation and we don’t even know it.

The job of the government and Central Banks is to craft how we think, therefore how we behave. If they can get us to voluntarily participate as they want, it supports their goals to transfer our wealth their way through inflation and we don’t even know it.

We are taught to work hard, save money and invest in U.S. Dollar denominated assets; stocks, bonds and cash assets. This, we are told, will enable us to take care of our families and retire in comfort. However, if you are on a fixed income and the cost of living goes up due to inflation, your standard of living therefore goes down. To win in this situation, you must position your assets in a way that at least meets or better yet beats the rate of inflation.

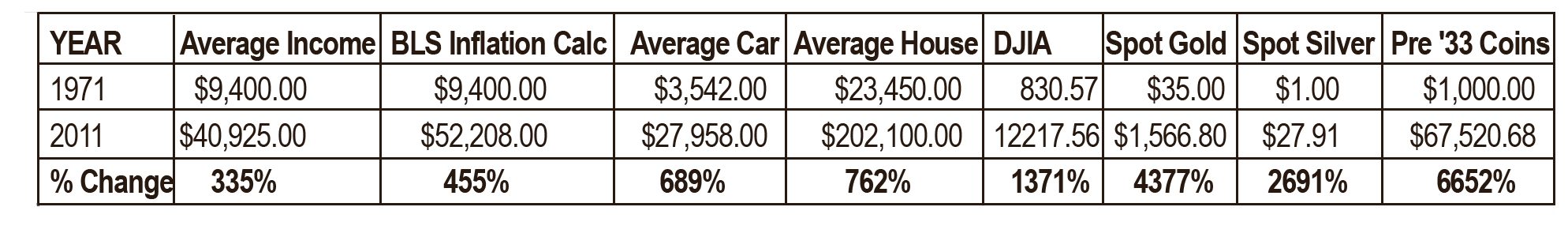

In 1971 our currency converted from gold-backed to debt based fractional reserve. The following table shows you that incomes have not kept pace with inflation and the cost of an average car and house has far surpassed average income growth and even BLS (Bureau of Labor Statistics) inflation calculations. This means that our standard of living has declined since the conversion of what backs our currency.

Had you owned stocks (the right ones that didn’t go broke) over those years, you would have kept pace with inflation. This would not have been true over the last 12 years, however, since both stocks and bonds have been basically flat. Only the currency metals have kept pace, gold and silver, appreciating as the dollar has declined.

If you have been to the grocery store you have noticed prices going up. How much did that loaf of bread cost you in 1971, or that apple, or that ounce of gold? The apple, loaf of bread or ounce of gold are the same as they have been, the number of pieces of paper that it takes to buy them that has changed, and that change has occurred because those dollars are based upon debt. Once you have debt, you have to pay interest on that debt. Therefore, everything takes more dollars to buy, and in essence since there will be will be more debt the next time you go to buy an apple, expect it to cost more since you must pay the debt interest on that apple!Our training is to have faith and confidence that the government has our best interest at heart and knows what they are doing. In this way, they take advantage of our naiveté and lull us into a false sense of security so we stay put in U.S. Dollar denominated assets while they determine how they will tax our wealth away from us, either with visible taxation or the invisible taxation of inflation.

You don’t have to accept this. You have a choice. You have the tool that has no debt attached to it that maintains your ability to purchase the same goods and services over time: Gold and silver.

My job is to show you how to look just a little below the surface so you can see the truth, regardless of what anyone says. The truth is asking you to change your paradigm, something not easy for most people.

The truth tells you that what we have been raised to believe is conservative; government bonds, stocks, cash is actually highly risky. They are risky because the foundation of those investments is debt. Does it really make any sense to buy someone else’s debt (bills) and hope you make money by holding it for them? Or, does it make more sense to buy someone else’s tangible assets with the idea of selling the assets down the line for a profit? When things go sour would you rather be holding someone else’s unpaid bill or a tangible asset you own that you can take to market?

When assets rise in terms of dollars, it is only because the dollar is going down in terms of purchasing power. Central banks know this. Currently (and for some time now) central banks are converting as much of their reserves into gold as quickly as they can. They prefer to do this as cheaply as possible. Simply because you do not have to own the physical metal in order to sell it and impact the visible price, central banks are able to control prices.

We are in a battle against a globally coordinated effort to transfer your wealth away from you and towards the banks. You are the steward of your family’s future. Your job is to form an educated opinion based upon the truth rather than believe the lies that do not serve you well. Look below the surface, see the truth and take back your power. Then protect your wealth from governments and central banks.