Gold and Silver up Big

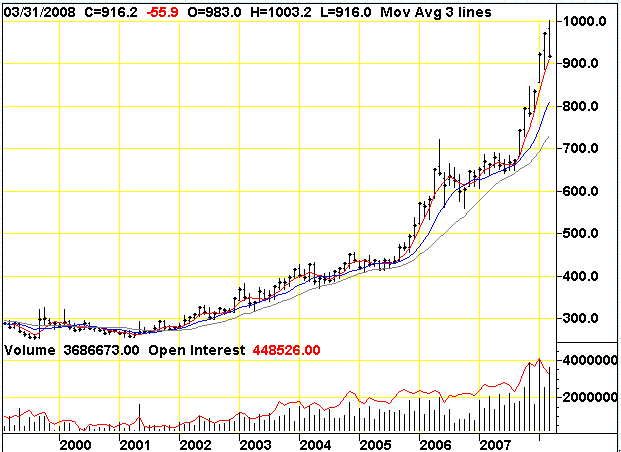

Gold and silver are rising, and rising fast. Since July 28th of this year gold is up over 21% ($1,161 to $1,408) and silver is up over 56% ($17.64 to $27.56). These numbers are not something to balk at, and if you already own some you are probably smiling right now. Gold and silver are being played as a currency hedge. In fact gold even has its own currency exchange symbol XAU. Now is the time to buy gold coins before we hit the third phase of the bull market and prices rise even more rapidly then you will believe.

The reason that gold and silver are rising like they are is due to a myriad of factors, most of which are due to bad economic conditions. But the main concern right now is the US Dollar. Money printing is beginning to spiral out of control. The Federal Reserve does not report to anyone when it makes a decision. The Fed is a private bank, there is nothing Federal about it. Because they are private they do not need to consult with Congress in order to print money. All they need to do is make an electronic debit into their account and start spending it, and this is exactly what they are doing.

For every dollar that is printed, existing dollars in the system are devalued. It is simple supply and demand, the more dollars that are printed the less valuable the ones you have in savings are worth. With the announcement of Quantitative Easing Round 2 came confirmed fear that the Fed is going to keep printing money. This sent concern around the world, and what smart money does when currencies are in question is buy gold. So it is no surprise that we are seeing records being broken almost daily.

The Fed recently stated for the first time that inflation is below its target rate and that they are going to work to increase that rate, which is also adding fuel to the fire. Inflation starts by increasing the monetary supply which will eventually lead to price inflation. Soon you will see prices on food, oil and other energy sources begin to rise, then it will trickle into other areas. When the money supply in the system increases due to the public getting rid of dollars, because they will be worth less tomorrow than they are today, then inflation will pick up at an even faster pace. It is possible that this will lead to hyperinflation and ultimate collapse of the dollar. This will send gold and silver prices up faster and higher than you can imagine. For that reason it is important to buy gold and silver now before it is too late.