THE GLOBAL SLOWDOWN: What Could Speed It Up? By Lynette Zang

Between May and October global markets had diverged, with most headed down as the US markets headed up. This is certainly not the first time this has happened. Then as now, the US market dropped to meet up with the rest of the world’s market. And main stream media has all the excuses; a

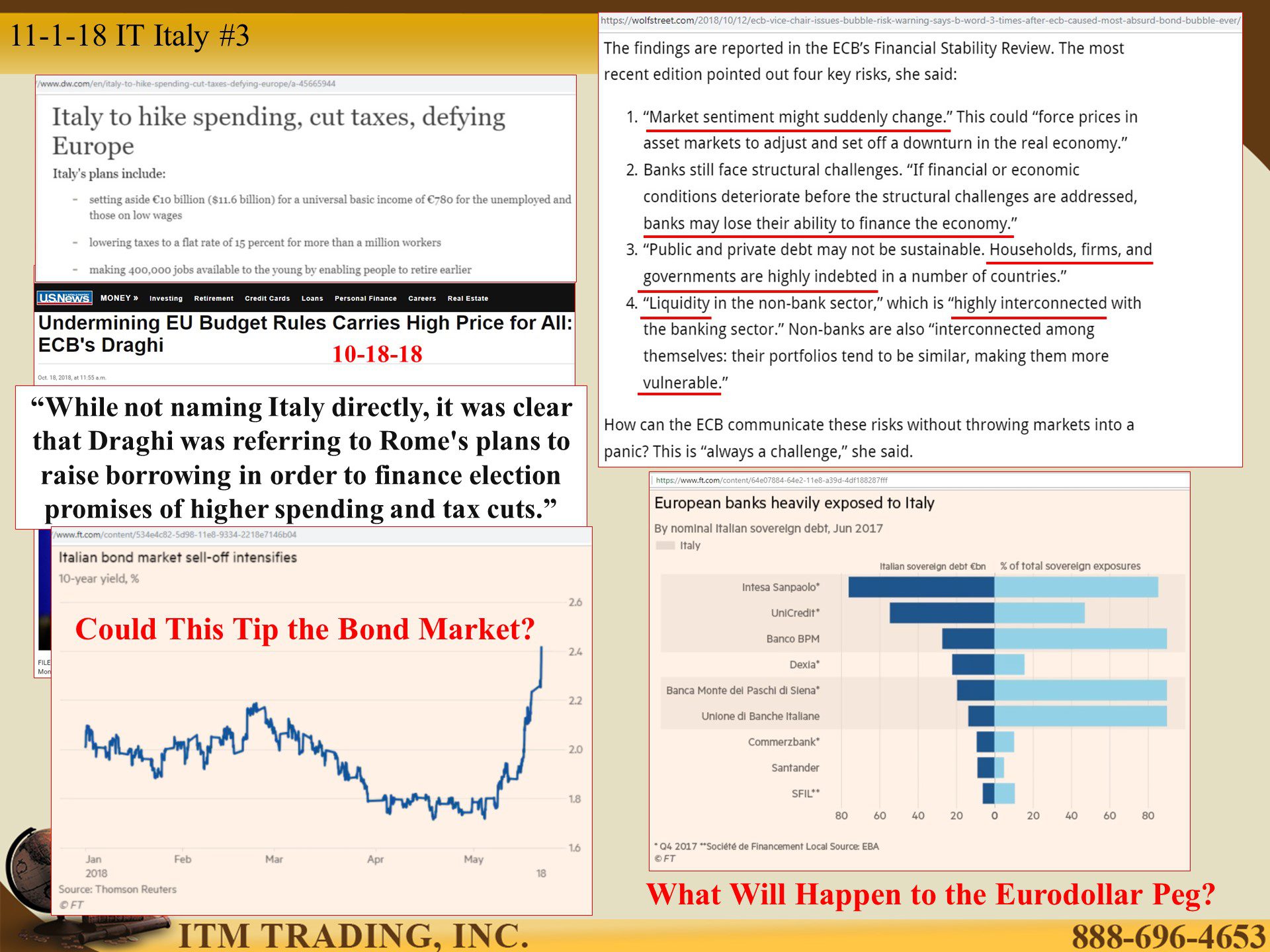

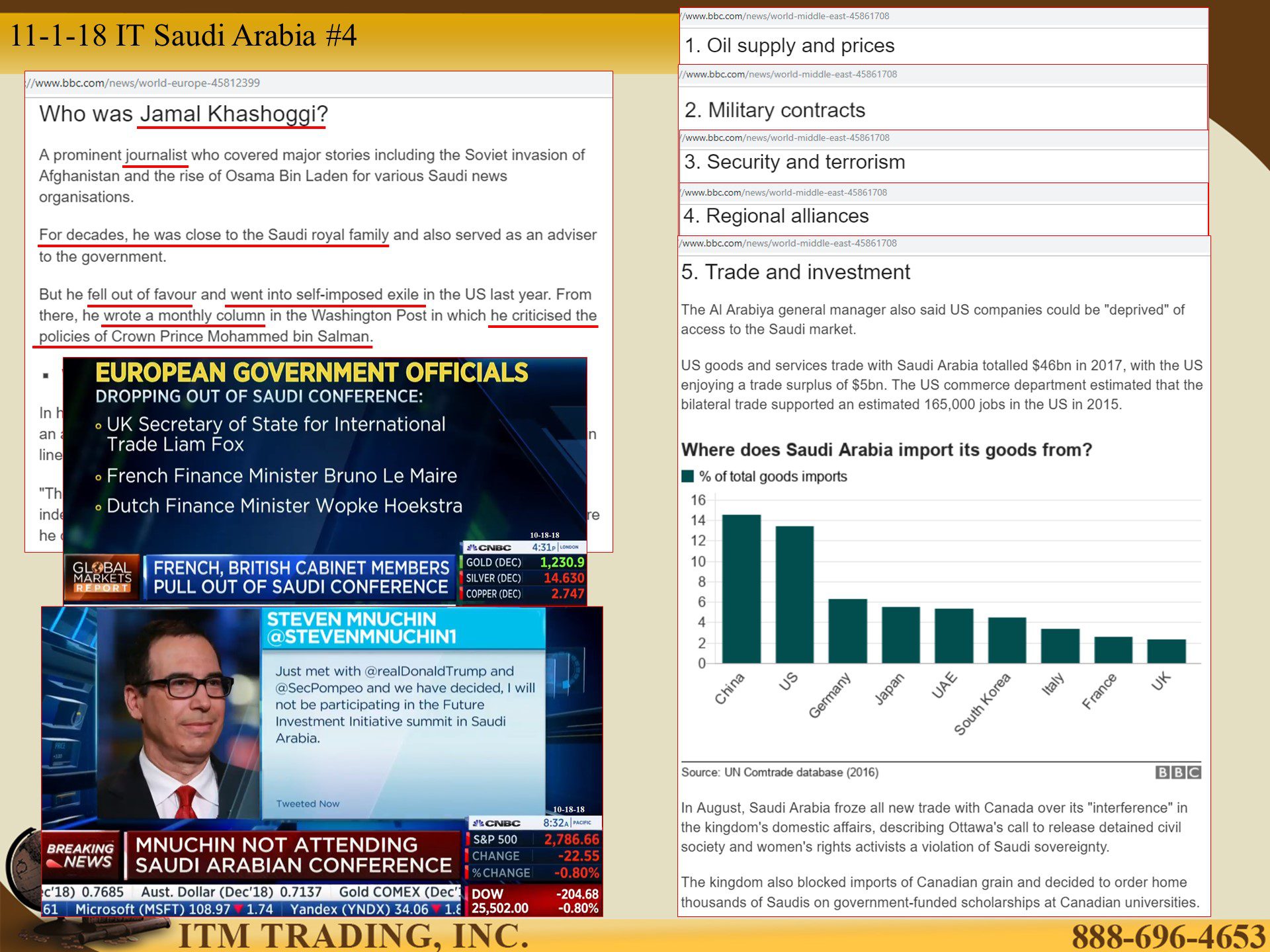

China slowdown, Italy spending and tax cutting in opposition to the EU, Saudi Arabia crimes against a journalist and, of course, Fed Chair Powell raising interest rates. All of this supposedly pushed US stocks into correction territory. But what is the real underlying threat? The real threat is to the bond market and its interconnected linkages.

Let’s look at China, a key player in the global “growth†story. China has built a huge complicated debt mountain, much of it hidden in layer of leverage AND their bond market inverted in May 2017. An inversion is where shorter term debt pays more than longer term debt and always precludes an economic slowdown. In addition, the US / China trade wars have heated up with a possible additional 25% tariff put on the remaining $257 billion US imports from China. While there are many issues that could come up from this, China’s debt surpasses 300% of it’s GDP, much of that dollar denominated. Meaning, they need US dollars to repay that debt. Exporting is one way to accumulate those dollars, but in general, this trade war with the US could hurt China’s ability to service and GROW more debt.

China is also the largest foreign holder of US treasury bonds. So, this trade war could escalate into something that could do serious damage to the global growth.

But how about the European Union? According to a recent Financial Stability report, household, firms and governments are highly indebted and interconnected and the weakest link may be Italy, whose populist party want to hike spending and cut taxes to stimulate its economy. This also means higher debt levels, much of this funding possibly coming from Italian banks, which are already some of the weakest banks in the world. Bank failures in Italy (or anywhere else frankly) undermines the EU experiment and could break the single currency peg apart.

Saudi Arabia threw a tech conference and high-ranking global players, including Steven Mnuchin US Treasury Secretary, didn’t show up. Did the world suddenly realize how the Saudi’s think about human rights or perhaps there is a power shift in the making as they restructure their economy away from its dependence on oil and the petrodollar.

And last, but certainly not least, would be President Trumps problem with Fed Chair Powell’s raising the Fed Funds rate which has had the general impact on all interest rates. Which means the money for free party is over and has an impact on all debt. If a bank is holding debt and interest rates go up, the value of the bond goes down and may require higher reserves leaving the banks with less money to generate profits. But what about all the debt that must be rolled over? Rising interest rates makes that debt a whole lot more expensive. Considering the level of debt accumulated at or near zero, some corporations may not have the ability to service the debt, unless their income rises too.

So now we are full circle. The real threat to the stock market is the debt market and the real threat of the all of the above issues is an explosion of debt that is too big to bail.

Slides and Links:

https://stockcharts.com/h-sc/ui

https://www.cnbc.com/2018/09/08/us-and-china-could-see-a-big-slowdown-in-global-economic-growth.html

https://www.wsj.com/articles/china-bonds-send-fresh-stress-signal-1494500938

https://www.ecb.europa.eu/press/key/date/2018/html/ecb.sp181012_1.en.html

https://www.dw.com/en/italy-to-hike-spending-cut-taxes-defying-europe/a-45665944

https://www.ft.com/content/3a66a12a-c6fb-11e8-ba8f-ee390057b8c9

https://www.ft.com/content/9997b832-d2e0-11e8-a9f2-7574db66bcd5

https://www.bbc.com/news/world-europe-45812399

https://www.bbc.com/news/world-middle-east-45861708

https://www.bloomberg.com/graphics/2018-global-economy-ten-years-after-lehman/

https://www.wsj.com/articles/trump-steps-up-attacks-on-fed-chairman-jerome-powell-1540338090

http://ticdata.treasury.gov/Publish/mfh.txt

https://stockcharts.com/h-sc/ui

YouTube short description:

Between May and October global markets had diverged, with most headed down as the US markets headed up. This is certainly not the first time this has happened. Then as now, the US market dropped to meet up with the rest of the world’s market. And main stream media has all the excuses; a China slowdown, Italy spending and tax cutting in opposition to the EU, Saudi Arabia crimes against a journalist and, of course, Fed Chair Powell raising interest rates. All of this supposedly pushed US stocks into correction territory. But what is the real underlying threat? The real threat is to the bond market and its interconnected linkages.

The real threat to the stock market is the debt market and the real threat of the all of the above issues is an explosion of debt that is too big to bail.