Germany Ruling

Recently A group of politicians and academics had argued that the ECB (European Central Bank) bailout payments to Greece violated the law of Germany.

By Lynette Zang:

As a result, The Bundesverfassungsgericht (Germany’s Federal Constitutional Court) met yesterday to determine the legality of the bailouts and ruled in favor of the German government and did not overturn the EFSF bailouts (European Financial Stability Facility). The court’s president, Andreas Vosskuhle, said the ruling did not represent a “blank check for additional rescue packages,†and that in order to conform to the constitution, the German parliamentary budget committee will have to agree to any future bailout packages or use of the EFSF.

Read the story here http://www.nytimes.com/2011/09/08/world/europe/08germany.html?_r=1

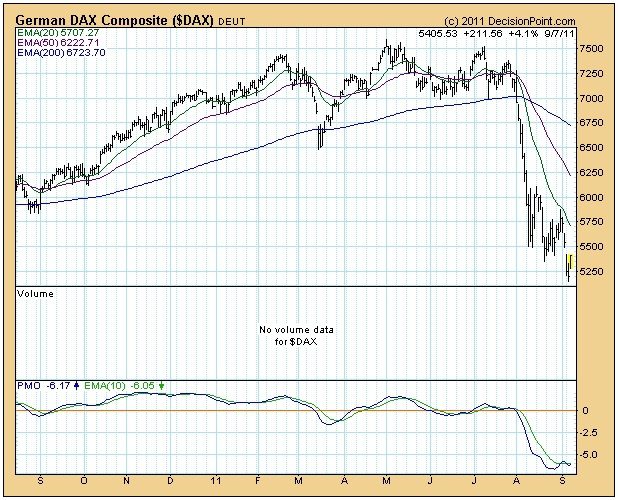

The markets liked this ruling, giving a boost to the European and US markets, as well as the Euro dollar. Though all were oversold (does not mean undervalued) and needed a bounce up anyway. The chart below depicts a 4.1% gain in the German stock market after the announcement yesterday.

In my estimation if Germany ruled against the ECB bailouts it probably would have lead to the unraveling of the Euro. So for the moment, the European Union and the euro remain intact. But in an interview with Bild, Horst Seehofer, CSU chairman, said that Greece leaving the Eurozone cannot “be ruled out.â€

At this point private sector banking participation in the Greek debt swap under the second Greek bailout has far reached the 75% mark, which is still well below the 90% threshold set by the Greek government. In this swap, banks would be rolling their current holdings of Greek debt into longer maturities with lower interest rates. In my opinion the banks are simply buying more time to shift the burden from the central banks onto the taxpayers.

Unfortunately, this is a debt crisis and someone will have to take losses. As in the US, the “Bailouts†transfer those losses from the private banking sector to taxpayers. According to Open Europe, a think tank, official sector (taxpayer-backed) loans are gradually replacing private sector exposure. “We estimate that under a second bailout, the share of Greece’s debt underwritten by foreign taxpayers (via the EU, ECB and the IMF) will go from 26% today to a massive 64% in 2014…On top of this, there are also numerous European banks which are largely taxpayer owned which have significant exposure to Greece…This makes a second Greek bail-out far more politically contentious than any of the existing rescue packages, given the likelihood of debt write-downs with taxpayers footing a huge chunk of the bill.†Sound familiar? By the way, you and I are also funding these “bailouts†via the IMF.

While Greece is muddling through, the Italian Senate is set to vote on a second austerity package targeting a zero deficit by 2013. Protests against the austerity package turned violent in a number of Italian cities.

With all of these bailouts and austerity packages, I sure wish someone in power would understand that this is a solvency issue, which means that the ability to repay debt is at issue here, not liquidity. How in the world do you solve a too much debt problem with adding more debt and then hampering the ability to repay that debt at the same time (austerity)? In addition, fiat currencies are supported by “the full faith and credit†of the governments, in other words, the governments ability to create more debt. So at some point they will not have the ability to continue this lunacy. I’m afraid that we will all be the ones to pay the price through currency devaluation (hyper inflation).

Historically, the only way to protect your assets is with the only asset class that has no debt attached to it, gold. Use this recent correction in gold prices to your advantage and convert your debt based currency into a hard savings based currency. Take a lesson from Germany.