From Treasury Outflows to Inflation and Consumer Anxiety, how far will it go?

The intricate world of the Treasury bond market, often hailed as the cornerstone of the global financial system. Despite its critical role, confidence seems to be waning, evident in the net Treasury outflows of 1.7 billion in September and the reduction of Treasury stockpiles by economic giants China and Japan. In this video, we explore the government’s and central bankers’ push for individuals to shoulder the risk for a marginal uptick in interest. We analyze the reality that even if you hold the bond to maturity and despite potential monetary expansions, the purchasing power it affords may diminish, mirroring historical trends. Stay informed and navigate the complexities of the Treasury bond market with us.

CHAPTERS:

0:00 Are We In Crisis?

00:57 Treasuries Suffer

4:48 Weak PMI Data

6:19 Employment Falling

8:16 Americans Living Paycheck to Paycheck

9:16 Anxious About Inflation

12:22 Germany Suspends Borrowing Limits

16:05 Gold Gaining

18:39 Secure Your Strategy

VIDEO TRANSCRIPT:

00:00:00:00 – 00:00:15:06

Unknown

What a year this has been. And there have been a lot of firsts and a lot of things that haven’t happened for a while when we were in crisis. Supposedly we’re not in crisis. Economy is really strong and things are great and awesome.

00:00:15:06 – 00:00:29:08

Unknown

And hey, we’re in another bull market. Well, it’s some kind of bull, but I’m not sure that the next word for me would be market. Let’s talk about everything that’s going on. Coming up.

00:00:31:22 – 00:00:46:27

Unknown

I’m Lynnette Zang, chief market analyst here at ITM Trading a full service physical, only way to own silver and gold in your possession. And that’s what we do here at ITM trading.

00:00:47:04 – 00:01:16:16

Unknown

Plus, even more important than that, we help our clients create strategies so that they can survive and thrive. The shift that should be pretty obvious that we’re in. Now I want to show you this one first because the Treasury bond market and you’ve heard me say this ad nauseum, really is the foundation of the global financial system. But people are losing confidence.

00:01:16:18 – 00:01:49:10

Unknown

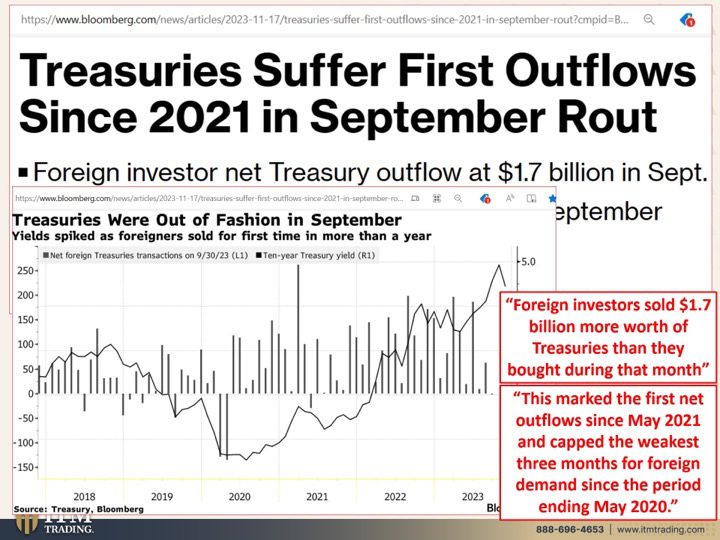

You know, the US doesn’t have that pristine triple-A rating anymore. Not that I really trust the grading services because after all, they’ve been proven to be wrong. Many, many times. And unfortunately I think they’re going to be proven wrong again, although not about the US government or any government debt, but foreign investors. Net Treasury outflows at 1.7 billion in September, China and Japan cut Treasury stockpiles.

00:01:49:13 – 00:02:18:10

Unknown

Who is going to be buying this massive issuance that our government needs to create to fund all of their spending and to push us, frankly, into deeper deficits? This Treasuries were out of fashion in September. Is that going to get even worse? We’re watching the yield spike. And what do we hear on mainstream media? by the Treasury bonds, by the long bonds.

00:02:18:10 – 00:02:45:29

Unknown

Lock in those rates. So what our government and what our central bankers want us to do is to take the risk for that little bit of pick up in interest. But the reality is, is even if you hold it to maturity and even if they print lots more money to pay off that principal, what it will buy you is far less just like it was.

00:02:46:01 – 00:03:13:13

Unknown

I mean, think about this for a minute. If we look back to 1913 and somebody had a dollar. Right. And it could even be a silver dollar, it doesn’t matter. Somebody had a dollar. And you were to say to them one of these days or that little gold dollar one of these days, you’re going to see even the spot gold market above $2,000 an ounce when it was held at $20 an ounce.

00:03:13:15 – 00:03:50:23

Unknown

They would say that you’re crazy. Well, what if I were to tell you that the spot market at 2000, wherever it happens to be at this moment in time, is severely below its true fundamental value, which is somewhere north of 15,000. It could be 30,000. It could be God only knows, because what’s going to influence it is all of the it’s not just all of this debt, the Treasury debt and all of the corporate debt, but it is also all of those derivative bets that are created on top of that.

00:03:50:26 – 00:03:53:10

Unknown

So what I want you to consider

00:03:53:10 – 00:04:16:22

Unknown

is that what we’re taught to believe as a safe haven, cash treasuries, other government debt is not a safe haven. And today you want to get to that safe haven a.s.a.p, a.s.a.p. This marked the first net outflows since May of 2021 and capped.

00:04:16:22 – 00:04:45:11

Unknown

The week is three months for foreign demand since the period ended May of 2020. In the middle of the pandemic crisis. What does this tell you? Tells you we’re in crisis right now. Whether you see it or you don’t see it, they managed to cover it up is irrelevant to what’s really happening because all we see is the manipulated tech tip of the iceberg.

00:04:45:17 – 00:05:20:02

Unknown

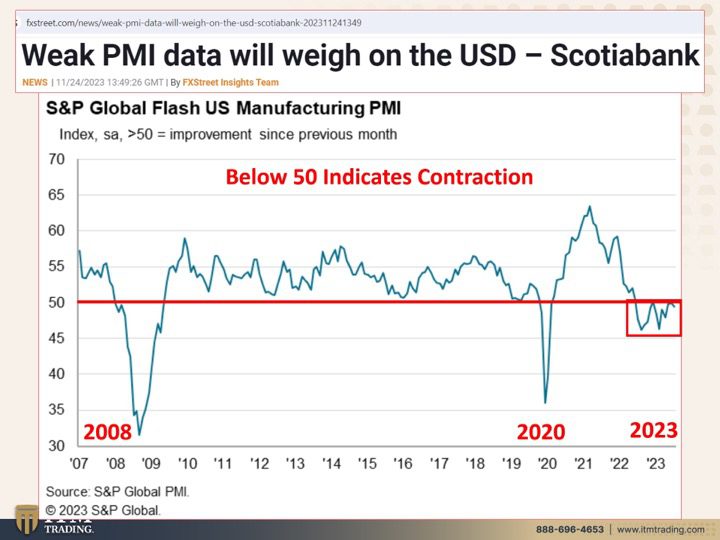

We don’t see what’s happening underneath there. And we’ve had weak PMI data and wow, that weighed on the dollar. Well, you know, I mean, look, there are all different ways we’ve talked about this to value any currency. But what matters most to you and me is what we can buy with it, not if it’s weaker or stronger against another currency, but S&P Global Flash, US Manufacturing Purchasing Manager Purchasing Manufacturing Index is below 50.

00:05:20:05 – 00:05:47:25

Unknown

Now 50 indicates contraction. So we have more issues that are coming up. And again, if you’re not looking at the underlying data, then you’re not really seeing it. But I’d like you to look at this graph and 2008 nine, the PMI was below it and also 2020 and also now today. What is it that you’re not seeing? Right.

00:05:48:02 – 00:06:18:07

Unknown

It was 2008. It was 2020 and there’s 2023. There is something that is happening. These are pattern shifts. And whenever you see these pattern shifts, you don’t necessarily have to understand exactly what they mean. You just have to recognize that it means that something is happening and when do you want to know about it before, while there’s still time to get prepared?

00:06:18:10 – 00:06:47:18

Unknown

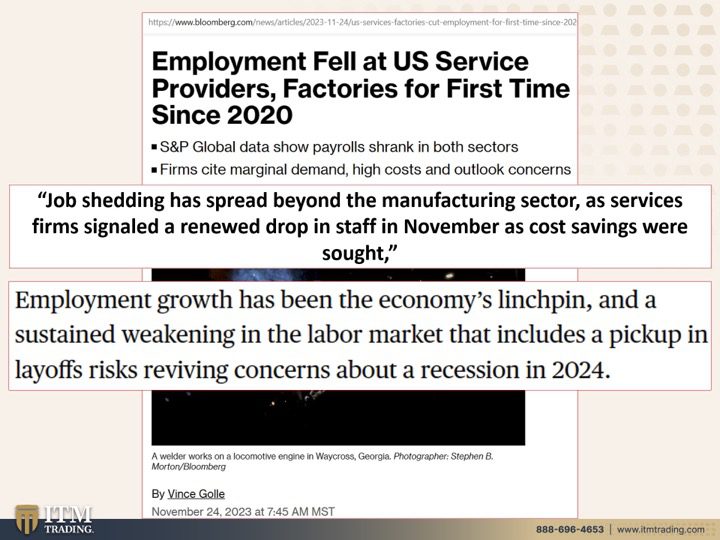

Because, look, they’re saying that the inflation is caused by the wage growth, but employment fell at US service providers and factories for the first time again since 2020. So if you notice a lot of these headlines harkened back to different crises that should be telling you something regardless of what the blah, blah, blah, mainstream media wants you to believe, or what the government or the central bankers want you to believe.

00:06:47:21 – 00:07:11:28

Unknown

Job shedding has spread beyond the manufacturing sector as services firms signal the renewed drop in staff in November as cost savings were sought. Yes, So we’ll just fire people. Some of that makes sense. Some of it really doesn’t make sense. Employment growth has been the economy’s linchpin and a sustained weakening in the labor market that includes a pickup in layoffs.

00:07:12:05 – 00:08:02:17

Unknown

Risks reviving concerns about a recession in 2024. Because we are a consumer driven economy, the consumer must have the ability to continue to consume. Having a job enables you to consume, even if you’re living paycheck to paycheck, even if you have to make choices between food on the table and a new shirt or something like that. So you need to understand that what Jay Powell and the rest of the central bankers did, because it’s not the greed inflation of corporations or the massive amounts of CEO pay and bonuses that are creating this inflation or the print or the money printing from the central bank that’s creating this this inflation.

00:08:02:19 – 00:08:32:16

Unknown

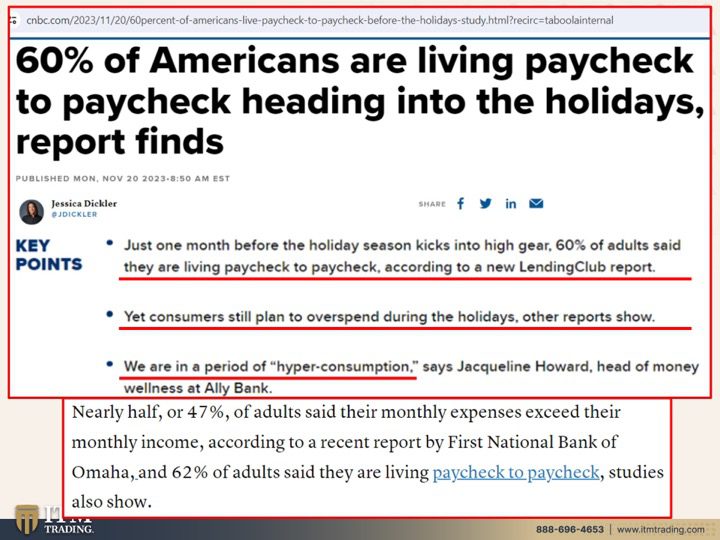

And guess what? When the Federal Reserve pivots, pivots and starts lowering interest rates, what do you think is going to happen to inflation? They’re between a rock and a hard place. They’re damned if they do and they’re damned if they don’t. And with more Americans losing paychecks and you’re already at 60% of Americans living paycheck to paycheck. But so far, the reports of spending have been, you know, pretty robust.

00:08:32:24 – 00:08:59:20

Unknown

So how are they doing it? They’re taking on debt and they’re using that buy now, pay later. More and more people are doing it. Yet consumers still plan to overspend during the holidays. We are in a period of hyper consumption. So when you know that you’re going down and you still have room on your credit cards where they even send you new credit cards.

00:08:59:27 – 00:09:25:25

Unknown

What are you likely to do? But to go out and max them out? And that’s what we’re seeing this holiday season. That doesn’t set us up for a very good new year in 2024. But nearly half or 47% of adults said their monthly expenses exceed their monthly income and 62% of adults said they are living paycheck to paycheck.

00:09:25:27 – 00:09:50:06

Unknown

That’s a problem because even as credit card debt tops a trillion, almost all or 96% of shoppers said they expect to overspend this season. Makes sense to me. What do you think? Let’s not live within our means. We got to keep I don’t know what I’d say. We got to keep up with the Joneses. That’s what it used to be.

00:09:50:13 – 00:10:15:16

Unknown

I don’t think it’s that anymore. But half of consumers plan to take on more debt to pay for holiday expenses. Isn’t that ridiculous? Only 23% have a plan to pay it off within one or two months. And what does that mean? That means that they’re paying very high interest, doesn’t it? That means they’re getting even more in debt and maybe they won’t be able to get out of it.

00:10:15:19 – 00:10:54:11

Unknown

Some 74% of Americans say they are stressed about finances. Shocker. And inflation. Rising interest rates and a lack of savings contribute to those feelings. Jay Isn’t that surprising? The CNBC survey found that 61% of Americans are living paycheck to paycheck and that was up from 58% in March. Is the consumer melting up another word? Does it matter what they spend when they know that they’re in trouble and there’s nothing they can do about it because the training is not live within your means.

00:10:54:13 – 00:11:18:00

Unknown

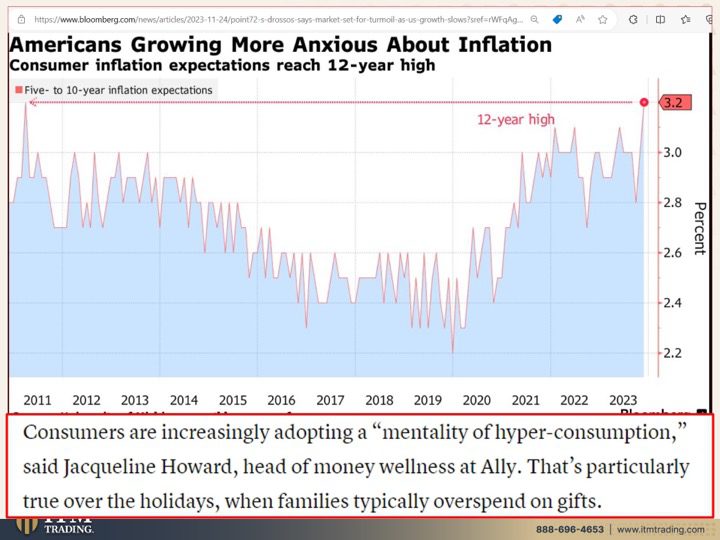

The training has been take on more debt. Here is more credit spend like there’s no tomorrow. But if you’re losing your job and you have massive bills that you have to pay back, you got a bit of a problem. I’m thinking because Americans are growing more and more anxious about inflation. But wait a minute. Hasn’t the Fed conquered that inflation?

00:11:18:03 – 00:11:49:12

Unknown

I don’t think so. Consumers are increasingly adopting a mentality of hyper consumption. That’s particularly true over the holidays, when families typically overspend on Christmas. But when you look at how anxious they are, they have not been this anxious about inflation or had this high inflation expectations. So I’m going since going back to 2011 and we started printing money for free in 2009.

00:11:49:15 – 00:12:11:13

Unknown

So that was in the depth of the crisis. That’s got to be telling you something. It’s telling me that we’re coming to an end and we don’t. We’re running out of time. All of this is telling me that we’re running out of time and Germany. Now, the reason why I bring Germany up is because everybody has heard about the hyperinflation in Germany in the twenties.

00:12:11:15 – 00:12:44:15

Unknown

And so Germany is a very conservative country when it comes to debt. But don’t worry about it, because they’ve joined that hyper consumerism, that hyper debt mode. Germany to suspend borrowing limits for fourth year after debt break Ruling. Wow. Berlin to ask Parliament declare exceptional emergency allowing it to create supplement or a 2023 budget. So it doesn’t matter who you are.

00:12:44:17 – 00:13:11:29

Unknown

France is at risk of breaching the EU’s fiscal rules. France is at risk of flouting European Union with fiscal guidance while Germany and Italy aren’t seen to be fully complying. So this union, this monetary union, was based upon certain debt limits. And guess what? They can’t do it these days because the system is at the end. It really is just that simple.

00:13:12:02 – 00:13:35:21

Unknown

We are at the end of the watch list of countries released on Tuesday forms part of the European Commission’s opinion on national budgets for 2024 a year when the bloc is set to reinstate debt and deficit rules. Since upended during the pandemic. They’re not going to be able to do it. Too many important countries are not following suit.

00:13:35:21 – 00:14:05:27

Unknown

Germany now being one of them, and they were the key. The assessment reveals how brazen some of Europe’s most indebted countries are judged to be by Brussels officials at a time of rising borrowing costs and heightened scrutiny. Scrutiny on public finances. But what crisis or more is an absolutely perfect excuse for government spending? What’s your crisis? What’s your war?

00:14:05:29 – 00:14:35:00

Unknown

Does it really make you feel better by buying things that you can’t afford and then adding more stress on your fiscal position? Better to get into a position to be ready for anything. That’s what food, water, energy, security, barter, ability, wealth preservation, community and shelter is all about. You need to get those things done. I don’t really think if you’re starting from scratch that you have enough time to get all of those done.

00:14:35:03 – 00:15:01:18

Unknown

Hence the importance of coming together in community. Because when you know that the rest of the world is going to declare bankruptcy, does even more debt change anything? If you’re already feeling stressed about the debt levels that you’re being forced to carry or that you are carrying when taking on any more debt for you really help you feel better.

00:15:01:20 – 00:15:38:01

Unknown

This stuff, this stuff, where is it? Well, that wasn’t. But this stuff, this is all based on debt. Full faith and credit of the government. So as long as you trust the government, you’ll continue to loan them money. This is all about savings. There is no debt attached. And thanks to the Bank for International Settlements, central bankers, Central Bank biggest bank in the whole universe says that gold is the only financial asset that runs no counterparty risk.

00:15:38:05 – 00:16:06:20

Unknown

Because it’s not credit, it’s not debt. You hold it, you own it outright. Now, that’s not true. If you’re doing things like ETFs and all that kind of garbage, then it’s absolutely not true. But it is true when you have the physical gold and I’ll put physical silver in that same camp in your possession runs no counterparty risk.

00:16:06:22 – 00:16:35:11

Unknown

And even with the gold prices gaining as the US dollar loses strength on Fed pours bets, Right? So that means here’s the theory. If they raise interest rates, then more people, more money will be attracted to the bonds because the bonds pay interest. Well, they have to pay interest because that’s the only way the way for you to get them to loan their money, which are bought bonds are gold.

00:16:35:17 – 00:17:07:18

Unknown

Physical gold does not have to pay you any interest because it’s the safest thing that you can do. It does not run counterparty risk. So we have to take this into consideration. However, gold is the flipside of fiat money, right? It’s the flip side. Good money versus debt. Money. And so when you’re looking at the dollar, what you’re looking at here is a relative performance chart on gold and the dollar.

00:17:07:20 – 00:17:34:21

Unknown

So over the long term, this doesn’t work anymore. But in theory, and if you’re looking on the short term, then it still appears to work where if the dollar gains in strength, spot gold weakens, if the dollar weakens in strength. Spot gold rises. But that’s still just a big fat lie because the dollar has lost over 97% of its purchasing power value.

00:17:34:27 – 00:18:05:15

Unknown

That means what you can buy with it doesn’t matter. This is 500 million bolivars. You can’t buy anything with it. Don’t be blinded by numbers. Don’t be blinded by the lies that are designed to nudge you. That’s perception management to nudge you into doing what the government and the central bankers and the corporations want you to do. Get to safety.

00:18:05:17 – 00:18:25:07

Unknown

Get to safety. That’s all I can say, because we are running out of time. Are we going to be able to have a decent holiday day? Well, probably because they want you to see that. And hey, it looks pretty busy. When I was out there looking around, not everywhere. Some places were dead and it was kind of surprising.

00:18:25:07 – 00:18:53:06

Unknown

Other places were just slammed with people buying things that perhaps they really couldn’t afford. But when you have to pay the interest on all that debt, I’m pretty sure you’re not going to be so thrilled about it. So make sure that you watch our latest video, How tech Monopolies Shape AI policies and Guard their thrones, because that’s really the ones those are even more dangerous and they’re bigger than countries.

00:18:53:07 – 00:19:21:15

Unknown

Let’s face it, their income are bigger than countries. Make sure that you also follow Daniella and Taylor. I mean, we’re putting out so much information for you to watch and all different kinds, right? I do my deep dives and talk about this. You know, Daniella has some incredible interviews with some very important and knowledgeable people, and Taylor breaks it down into easy, tiny little bite sized pieces.

00:19:21:18 – 00:19:48:06

Unknown

So we’re trying to help you in any way that we can visit them. If you haven’t done this yet. Click that Calendly link below and make a time to set up a conference call with our specialists so that you can establish your goals and get a strategy in place and then get that executed. It’s critically important. But if you haven’t done that yet, make sure you subscribe.

00:19:48:07 – 00:20:03:10

Unknown

Hit that bell will let you know when we’re going on. Leave us a comment. Give us a thumbs up. And share. Share, share. Because the truth is, is we are really all in this together.

00:20:03:12 – 00:20:21:03

Unknown

And this, my friends, is your wealth shield. So until next, we meet. Please be safe out there. Bye Bye.

SOURCES:

Treasuries Suffer First Outflows Since 2021 in September Rout – Bloomberg

https://www.pmi.spglobal.com/Public/Home/PressRelease/b72b9c19b3bd48e78027009aad143044

https://www.fxstreet.com/news/weak-pmi-data-will-weigh-on-the-usd-scotiabank-202311241349

US Services, Manufacturing Employment Fell for First Time Since 2020 – Bloomberg

https://www.cnbc.com/2023/11/15/ubs-inflation-is-ending-but-thats-little-comfort-to-households.html

US Services, Manufacturing Employment Fell for First Time Since 2020 – Bloomberg

Germany to suspend borrowing limits for fourth year after debt brake ruling

Gold prices gain as US dollar loses strength on Fed pause bets | Reuters