Friday Market Update 8/8/2011

Last weeks wrap up:

By: Lynette Zang

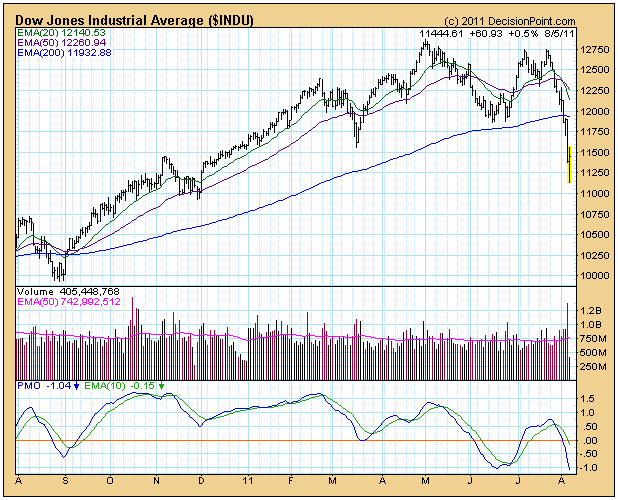

This week felt like Mr. Toad’s wild ride! First let’s look at the Dow which opened at 12,143.34 this Monday and closed at 11,444.61 today, posting its biggest loss since March 2009, which is when the Federal Reserve began Quantitative Easing.

You can see the spike in volume during Thursday’s 508 point sell off. In fact, insiders have been selling at the fastest pace since they began gathering that data in the 1970’s!

http://www.marketwatch.com/story/insiders-selling-at-unusually-fast-pace-2011-07-28?link=MW_latest_news

Between the Dow and the Transportation averages, we have now entered a Dow Theory confirmation. That means that the next most likely outcome is that the stock markets will continue down. Though this drop has happened rather quickly, so at this time the market is oversold and we should get some kind of a bounce. In the mean time, the money raised from selling stocks must go some place and it appears that the flight to safety has been to T-Bills, sending them into a negative yield. This means that you are paying to loan the government money. What a concept! The global sovereign debt issues continue to roil the global stock markets, see any similarities?

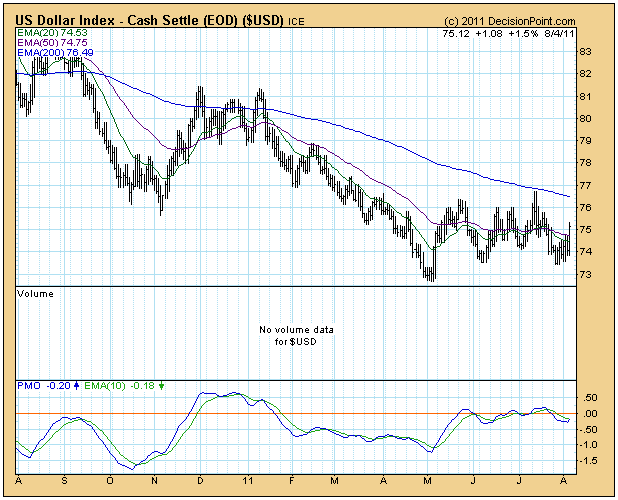

The stock market sell-off also helped boost the US Dollar. Remember, when something gets sold, that money must go someplace. There are only 4 asset classes; Stocks, Bonds, Cash and Tangibles. So if stocks get sold; those funds must transfer into another asset class.

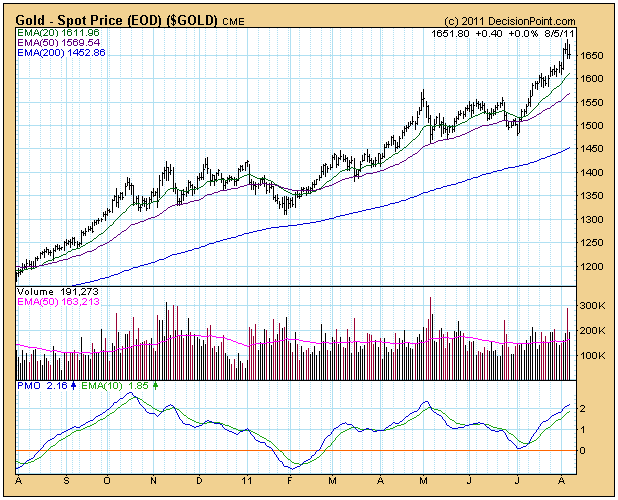

In addition, we should expect some short covering (buying back stocks that you sold that you didn’t own) and some margin call action (if you borrowed to buy stocks and the stocks went down, you have to come up with cash). Frankly, I would have expected gold and silver to have corrected more as traders needed to raise cash to meet those margin calls and even though we had a bit of a correction yesterday, we are still trading the spot market at $1,715.80 on gold and $39.34 on silver. Personally, I am quite pleased with the strength I am seeing, with gold up 2.76% for the week and trading at new highs. We can see the flight to the safety of gold from the gold chart.

There are so many things influencing all of the markets, you could really take your pick. But if you scrape away all of the noise, it really boils down to one fact: Governments have grown more debt than their economies can service. Gold is the primary currency metal and has no debt attached. The paradigm shift toward the safety of gold is escalating as the world goes through a massive deleveraging.