Friday Market Update 1/6/2012

Good news. The US added 200,000 jobs last month and official unemployment is now at 8.5%. It was the 6th straight month that over 100,000 jobs were added. With more people working, more people are spending and using credit too.

Don’t worry, be happy. During the third quarter of 2011 US consumers added $17 billion in new credit card debt. According to a study done by Card Hub, the amount of new credit card debt during Q3 was 154% higher than what was added Q3 2010.

Can the European Union and the Eurozone be saved? Mass rating downgrades, looming defaults and higher costs to borrow will continue to stress global markets. In fact the Forex Industry (currency trading platform) quietly prepares for a Euro break-up which many think could happen this year.

Solving too much debt with more debt According to Barclays Capital, Eurozone countries will need to issue $1.032 trillion of sovereign debt in 2012, with total global issuance that could reach $7.6 trillion. It is likely that interest rates will continue to rise on sovereign debt in order to attract buyers other than the ECB and Federal Reserve.

In addition to their own debt rollovers, European banks need to raise approximately $147.12 billion of capital to repair balance sheets devastated by the sovereign debt crisis. UniCredit, Italy’s largest bank announced a rights issue (the right to buy new shares) to its current share holders in an effort to raise capital. It was an abysmal failure. According to CNBC, only 24% of current shareholders were willing to participate and only at a hefty 43% discount to Tuesday’s closing price. UniCredit’s woes spread throughout European banks as share prices dropped dramatically.

Surprise, Italy’s 10 year bond is over 7% again. Spain’s government passed an austerity budget package of $19 billion worth of tax increases and spending cuts. Let’s see how that impacts their official 22.9% unemployment rate, which is the highest in Europe.

Hungary’s new government has made a constitutional change that gives more power to the government and could position them to leave the European Union.

Dashed Hopes The approximately $625 billion 3 year loans that Eurozone banks borrowed from the ECB last month have been deposited back at the ECB in a sign that they intend to use the ECB loans to make up for their shrinking funding base and a lack of trust in their fellow banks. This dashes the ECB’s hopes of that money going into more sovereign debt.

Soft or hard default – either is most likely to hurt. But the big issue that could force the breakup and oh so many other challenges is Greek debt. The deal that was initially struck with Greek government bond holders taking a 50% haircut, rolling over to a 50 year maturity and accepting below market interest will be discussed on Monday. It is likely they will kick the can down the road on this but the problem is that the end of the road is March 2012. If not sooner, at that time we will know how the $30 trillion CDS (Collateral Debt Swaps) market will respond to a Greek default and what dominoes will fall in its wake.

Let’s see how this week impacted the markets

Stocks The following chart on the DJIA shows a break out above resistance and a positive cross of the 50 day moving average above the 200 day moving average. We need to see if this action is pervasive, but my guess is that the Santa Claus rally should continue, barring any surprises out of Europe’s Monday meeting. Because of what lies ahead near term, if I still owned stocks, I would make sure I had all protective stop losses in place.

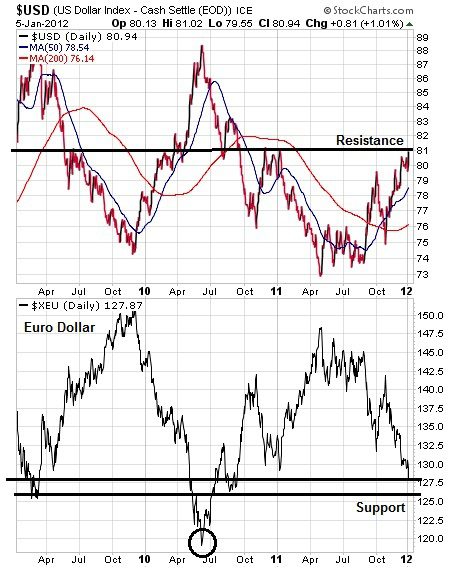

US Dollar vs Euro Dollar The following is a 3 year chart of the US dollar versus the Euro Dollar. You can see that the Euro is trading at a one year low versus the dollar and will likely go lower before finding any support. In the meantime the dollar is bumping its head against resistance. If the euro drops further, the dollar will continue this rally but that does not mean that all is well. Currencies are supported by government’s ability to create more debt. In this regard all currencies are in trouble and the strength you see is against other indebted currencies.

Spot Gold and Silver Spot gold is testing resistance on the top. Let’s see if it can break above. You can see from the chart below that support is at $1550 and the chart is clearly positive with higher lows. Spot silver is in a trading range between $27.25 on the bottom and $29.98 on the top. Our wholesalers’ report that this week has been extremely busy with lots more buyers of both metals than sellers. Availability and delivery remain good.

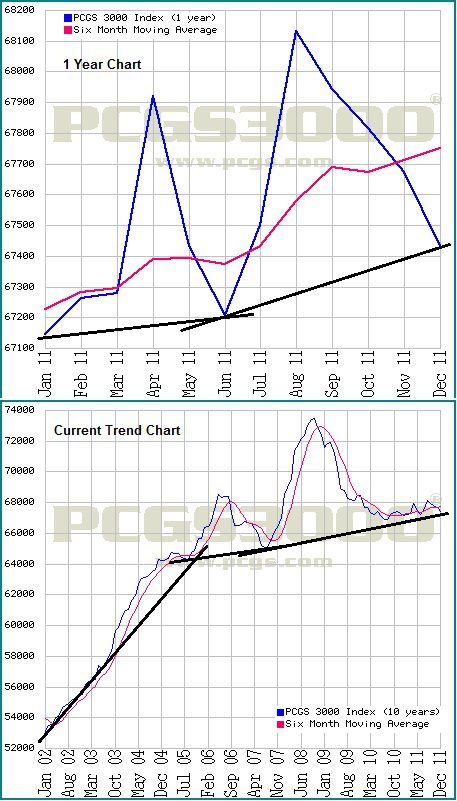

Physical Metals This week I get to report year end on the numismatic market. You can see from the chart below that numismatic coins ended year over year, up. In addition, the accumulation pattern that began in 2008 continues to evolve laying a strong foundation when the flight to safety out of paper assets, into hard assets occurs. This is the opportunity to dollar cost average while we can.

That wraps up the wrap up This upcoming week could be quite volatile based on what comes out of Monday’s meeting in Europe. I expect 2012 to be an extremely interesting year. Most people do not realize that the world we grew up in is no more. They hold on to old paradigms when they no longer work. The masses do not make the rules but we have to live by the rules those in power created. Well, the gig is up and as they frantically try to hold it together, it continues to fall apart. Think about it, can you fix a problem of too much debt by taking on even more? Neither can governments. As long as it was easy to create more debt they could hide the game.

What we are witnessing is history in the making and we are all participating, like it or not. I encourage you to choose how you will participate by protecting your purchasing power with physical gold and silver. We have only as much time to get into position as we have, and no one knows how much that is. Let’s make this a good year.

We are here when you need us.

Lynette