Friday Market Update 12/23/2011

We at ITM Trading would like to wish everyone out there a very happy and healthy holiday season. And because we know your focus is on family right now, I’ll do my best to keep today’s wrap up short and sweet. So let’s start with some good news for many.

The payroll tax cut has been extended for 2 months and unemployment benefits are extended to 99 weeks, almost 2 years. It is interesting to watch our government in action as they whittle away at the public confidence with bickering and indecision only to have to deal with the same issue when they come back from vacation. They best think about what backs our dollar “The full faith and credit†of the government.

In more can kicking news, additional “extraordinary†measures are being called for and the ECB has opened the money printing spigots by allowing European banks to take out 3 year loans from the new money they are printing. The previous length was 1 year and much of that is coming due in the first quarter. In addition, they lowered the required quality and expanded what they would accept as collateral and issued this new debt at 1%. Goody, the banks now have the borrowed funds to pay off the borrowed funds and they get reduced interest rates too.

The expectation was for an issuance of up to $455bn. The hope is that banks borrow this money and turn around and buy government bonds; interesting, insolvent banks borrowing money to buy debt from insolvent governments. The results were much bigger than expected 523 banks borrowed $635.7bn. At first, the markets liked it. Why? Because once money is created it has to go someplace and they are thinking it will go into bonds and stocks. It is likely that the central banks expectation was that this euphoria would last past Christmas, it did not. In fact it didn’t even last one day. While European markets rallied initially, they all closed lower on the day. Why? It could be that the European banks have roughly $800bn in debt coming due next year and will likely hold onto those funds even though the ECB plans on another loan offering in February. If you add that to the $52.7bn taken out in the recent helicopter “liquidity swaps†which was also more than 5 times the expected subscription, it could suggest the crisis in the banking sector is actually much worse than thought.

So how will we deal with all of this debt? By even more debt! IMF to the rescue as they approved the next loans to Ireland $3.9bn, Portugal $2.9bn and Greece $2.2bn even though none of them met the “required†criteria. Keep in mind that 17% or $1.53bn of those additional loans came from US taxpayers. In addition, the final approval of an unprecedented doubling of SDR’s quotas from SDR 238.4 billion to approximately SDR 476.8 billion and a significant realignment of quota shares with China becoming the 3rd largest member of the IMF is now completed. This is what they’ve been working toward, now we shall see when they change the composition of the SDR, the IMF currency, to include the Chinese Yuan. This also potentially puts the IMF into a better position to “help†the world in this debt crisis though the cost of that help is likely to be quite dear.

One other interesting note. In the US after the 1929 stock market crash the Glass-Stegal Act separated the banks that took deposits from the banks that issued securities. That act was repealed in 1999 and the world is dealing with the abuse from that choice. This issue was not dealt with in the Dodd-Frank bill, but in England the British government is now restructuring their banking system separating those two types of banks. At least someone seems to have learned something from 2008.

Because Christmas falls on Sunday, most of the markets close at their normal time, but we are closing early. Consequently, the charts will probably not reflect the close but here we go.

The following chart reflects the stock market action over the past year. The hope is for the Dow to close higher, and they do have a shot in this Santa Claus rally, and at least our government representatives could agree on something so Merry Christmas to all.

What about the debt based US Dollar? The chart below shows a strengthening dollar against a weakening Euro Dollar. We need to watch the Euro for a close below 130, that is likely to create too strong a dollar and we are likely to see some additional money printing at that point. I’ll keep you posted. In addition, just because one debt based currency strengthens against another debt based currency when both of them have too much debt, it doesn’t mean all is well.

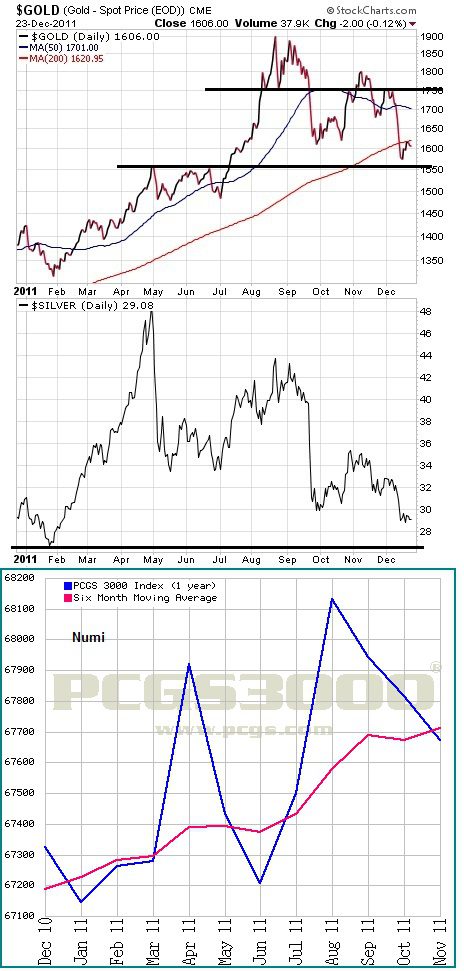

So let’s look at gold and silver. The following chart reflects what is happening in the digital markets. You can see that spot gold has support at roughly 1550 and resistance at around 1750, the 50 day moving average is well above the 200 day moving average. You can also see that the 200 day moving average is in a nice upward trajectory. All very bullish signals. You can also see that gold will very likely close positive for the 11th year in a row.

Now look at the spot silver chart. You see support around $26. The next week will tell us if it will close higher for the year as it has 8 out of the last 11 years. Of course part of what moves silver is the global economy, therefore, silver is a lot more volatile than gold.

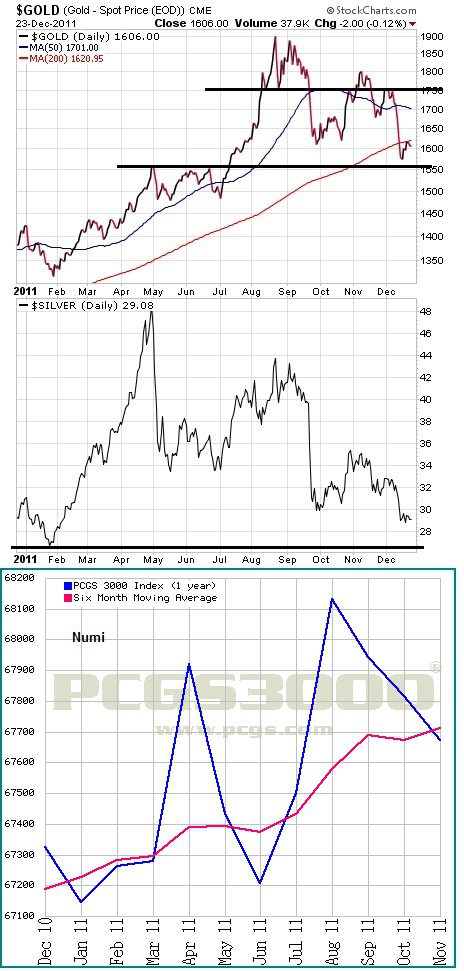

The chart above shows us what is happening in the purely physical numismatic market. We will get the year end chart in 2 weeks, but the most likely scenario is that the numismatic coins will close higher on the year. It is clear by looking at the chart that the 6 month moving average’s trajectory is growing steeper. This could be the accumulation pattern that has been developing since 2008 coming to conclusion. This is a very good thing. In addition, normally during December prices decline because any inventory in house on January 1st is a taxable event. This is the first year that I can recall this not happening.

In conversation with our wholesalers the December surprise continues. I’m told that there were definitely a lot more buyers this week than sellers and the bullion and semi numismatic inventory is quite low in gold. In silver, there is a shortage in junk silver bags but plenty of Silver Eagles.

If you are a gold producer, since there is a finite amount of gold left in the ground, in order to grow reserves, larger producers buy up smaller producers. To that end, Eldorado Gold says it will buy European Goldfields. This deal is currently valued at $2.4bn. More importantly, since taking physical delivery of large amounts is becoming more challenging through the secondary markets, many large private buyers are going directly to the miners. This is something we will keep an eye on.

The article below is from King World News and is about the physical metals. The first part is about silver but there is a lot of discussion on gold as well. This article is a must read and my gift to you.

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/12/21_London_Trader_-_There_are_Tremendous_Silver_Shortages.html

So that wraps up the wrap up for this week. Please know that all of us here at ITM Trading appreciate the trust you’ve put in us, were it not for you we would not need to be here. May you have abundance in all aspects of your life. When you need us, please know we are here for you.