Friday Market Update 12/2/2011

On Monday there was a globally coordinated effort to inflate because of a broad based disruption in the financial markets which could have been brought about by S&P cutting credit ratings on 15 big banks, mostly in Europe and the US. Reportedly, the epicenter was Deutsche Bank, and with reported assets of $3.08 trillion, is the second largest bank in the world. However, it is very thinly capitalized and according to the financial statements from the Federal Reserve, see statement here: http://www.ffiec.gov/nicpubweb/NICDataCache/FRY9C/FRY9C_2816906_20110930.PDF

Their American holding company (Taunus Corp.) has a leverage ratio (total assets divided by equity) of almost 78 to 1, and this does not take into account any of their derivative exposure (see page 4 of the report). Deutsche Bank’s Taunus Corp. is one the US’s four biggest securitization trustees, (holders of derivatives on mortgage). Between that mess and the exposure to European Sovereign debt, it is easy to see how they could easily trigger the global banking melt down, since the banking system is so incestuous.

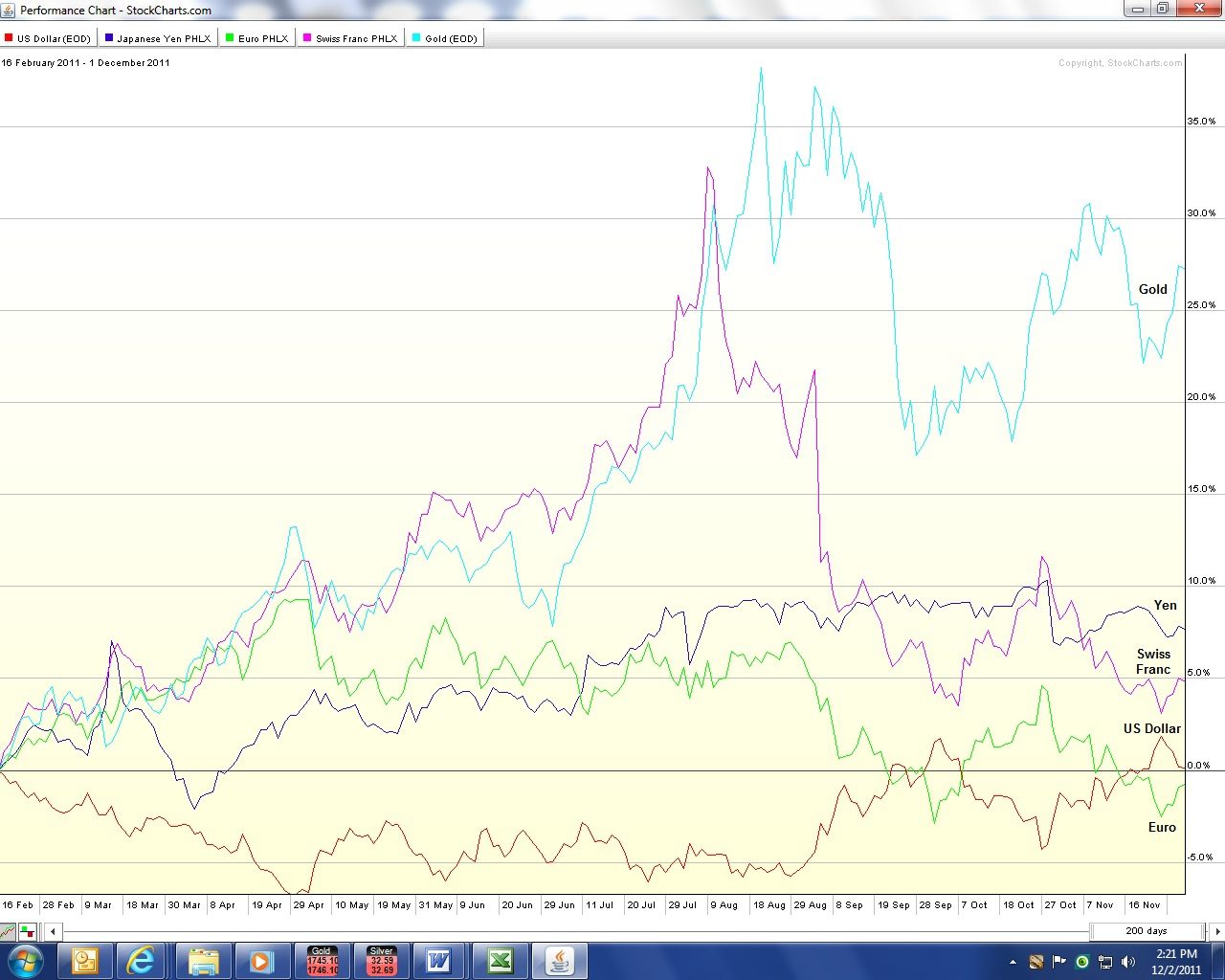

So what did the Central Banks do? In a globally coordinated effort, to avoid bank closures, they made available to the European banking system, an unlimited supply of US dollars and any other currency they might need. This is called “Liquidity Swaps” and only came into being in 2007 to avoid bank and money market runs here in the US. It was supposed to be temporary and short term. I guess they changed their mind. But the bottom line is money is created out of thin air and this is highly inflationary. In my opinion, this is a game changer and shows us how close we are to collapse. If you’d like to determine if this action was effective, watch sovereign debt yields. But the following chart shows you the initial impact on those fiat currencies versus the hard currency of gold. Every currency is down against gold.

As the Italian government struggled to borrow, British ministers warned their diplomats on the European continent, to prepare contingency planning for a collapse of the Euro. They were told to plan for extreme scenarios including rioting and social unrest. They were also told to plan to assist British citizens living on the continent in case banks were closed and they did not have access to money. Read the article here:

http://www.telegraph.co.uk/news/politics/8917077/Prepare-for-riots-in-euro-collapse-Foreign-Office-warns.html

Since politicians don’t seem to make preemptive moves but rather wait until a crisis, the super committee couldn’t find any place to cut the budget. No worries though, we still have our AAA rating. It’s like a family who has grown accustom to a certain standard of living and doesn’t want to cut back on spending even though their income can’t cover it and the debt continues to grow at the fastest rate ever. At some point, they will have no choice (Think Greece) and neither will we.

But, in the mean time, our hats are most definitely off to those powers that be, consumer confidence increased more than any economist expected and kicked off the start of the holiday buying season in a very big way. Good thing too, since consumer buying is 70% of our economy. The results of black Friday, Saturday and Monday certainly show that people are spending big time and most of that spending is with credit cards versus debit cards, which is a shift.

So where is this spending coming from? Well for one thing, unemployment is reportedly at 8.6%. Of course that number is really a mixed bag since many have given up looking for work and dropped off the unemployment roles, and they always revise numbers months after the initial report but the most likely reason in our new squatters’ economy. The average loan in foreclosure in judicial states is 631 days delinquent and overall foreclosure inventory is at an all time high of 4.29% of all active loans. Those people who are not paying their mortgages have money to shop and ’tis the season.

But not everybody is out shopping. The “Occupy” movement is under pressure as more raids on camps occurred in Los Angeles and Philadelphia followed the raids on NYC and other places. Since this has been a peaceful yet growing protest, I wonder what they are so worried about.

Could it be civil unrest? Perhaps that can be controlled with the passage of the National Defense Authorization Act (FY 2012) sections 1031 and 1032 redefines the US homeland as a “battlefield”. With wording so vague, any US citizen can be considered a “terrorist” and can be detained indefinitely. Read the bill here:

http://www.gpo.gov/fdsys/pkg/BILLS-112hr1540rh/pdf/BILLS-112hr1540rh.pdf

Now let’s look at the markets.

The following chart shows us the Dow. You might notice that big 500 point jump on Monday. Why did the markets like the central banks move? Because with the commitment of unlimited money coming into being, that money will go into one of the four asset classes; Stocks, Bonds, Cash, or Tangibles and the markets expect lots of money coming their way. Of course they are inflated dollars and these are not investors, they are traders, but that is a key reason for that move. They are hoping this will kick off the “Santa Claus Rally” and keep people feeling happy enough to spend, spend, and spend. The 50 day moving average is close to crossing the 200 day moving average and if it does so in a pervasive way, they will get their wish. I will keep you posted.

Now let’s look at the central banks impact of the promise of an unlimited supply of new dollars (which taxpayers will pay for) into the global system almost for free. The following chart shows the sharp drop in the US Dollar on Monday, since the world knows that the more dollars that are created, the less purchasing power they have.

Let’s see how gold and silver reacted to the central bank move with the following chart. The top two charts show the spot (digital) market and both gold and silver moved up. In addition, there is a wedge forming on both. You can see a series of higher lows and lower highs. It is possible to see the breakout above or breakdown below by next Friday. I’ll keep you posted. But both responded positively to the commitment by the central banks to create global inflation without limits.

The chart above reflects the numismatic market through the close of November and clearly shows the positive trend with higher lows and higher highs.

Availability of gold and silver are good right across the board at this time. You might want to take advantage of ITM’s holiday offer; when you purchase a dated numismatic coin, we gift you with a silver American eagle.