Friday Market Update 11/11/11

First of all, we wish to thank all veterans for their service, not just today, but every day. You have made the ultimate sacrifice by putting your home life on hold and risking everything. We owe you more than can ever be repaid.

Oh good, we now have a technocrat as Prime Minister of Greece, Lucas Papademos, the former Vice President of the European Central Bank. The definition of a technocrat is one who is an expert an area (central banker) and makes decisions without regard for public opinion. His mission is to do what it takes to insure the next round of “bailout†funding. In Italy, the most likely candidate to take over for Silvio Berlusconi is Mario Monti, a technocrat (economist) and international advisor to Goldman Sachs. In the Italian newspaper La Repubblica, suggests that, “should he be appointed as the next Italian Prime Minister, Mario Monti would aim for a slim cabinet with only twelve ministers.†He would have to include some politicians if he wants parliament support. The markets are happy with this; after all, bankers understand the importance of paying your debts.

As interesting as all of the above is, the problems continue to escalate and contagion is clearly spreading. You want to keep an eye on the government bond markets. On Tuesday, the 10 year Italian bond yields reached 6.77%, a Euro era high, just shy of the 7% that pushed Greece, Ireland and Portugal to seek bailouts. On Wednesday, that same bond hit 7.5%. The global stock markets reacted violently, with many dropping 2%-4%. On Thursday, the ECB went on an Italian Bond buying spree, pushing rates below that critical 7% level. In fact, many believe that the ECB should supply unlimited funding for all the countries of the EU. To read more, click this link http://www.bloomberg.com/news/2011-11-11/ecb-as-lender-of-last-resort-will-resolve-debt-crisis-for-portugal-s-silva.html

I feel as if I’m watching a juggling act and the juggler dropped a ball. When he went to pick up that ball, another one dropped. Now that the ECB has pushed Italian rates below 7%, French bond rates spiked, hitting their euro era highs of 3.56%, as the euro zone’s second-largest economy now has the highest yields among its Triple-A rated peers.

A very interesting catch 22 has evolved between the European banks and sovereign debt. In the past, domestic banks filled the gap when foreign demand for government bonds slipped. But now, as governments call for bank recapitalizations and force mark to market accounting (showing market value on books) and investors punish European banks and global hedge funds for holding PIIGS debt, those same buyers of that market, have become sellers. This is pushing yields up as more sovereign debt comes onto the market from those sales in addition to the issuance of new debt, which is negating the efforts to get this crisis under control.

Amongst all of this turmoil, the UK government has drawn up contingency plans for a euro zone breakup. In addition, it has been reported that France and Germany are looking at ways to allow a country to opt out of the Euro zone and still remain a member of the EU.

And now the next shoe to fall. Deposits in China’s banks rose the least in almost four years in the third quarter according to the People’s Bank of China. This is because banks are paying 3.5% but official inflation stands at 6.1%, which forces savers to take bigger risks as they seek higher yields. In addition, Forbes reports that residential property prices are collapsing in China as developers race to meet revenue targets in a quickly deteriorating market; you can read more about that here: http://www.forbes.com/sites/gordonchang/2011/11/06/property-prices-collapse-in-china-is-this-a-crash/

Here in the US, Mary Schapiro, US Securities and Exchange Commission Chairman is set on revamping Money Market Funds. One of the proposals is to have a free floating NAV (net asset value), so the price you see on your statement might be higher or lower than $1. The concern is that they pay $1 for every $1 you put in, but the underlying investments might not be worth $1. Of course, this is what makes people think of money market funds like a savings account. One of the tools being proposed are capital buffers to handle funds when they do break the buck (go below $1) and restrictions on redemptions making it harder to liquidate.

This could spell trouble for variable annuities, which have grown to roughly an $800 billion market since they were created in the 1990’s. USA Today reports that 98% of the money market funds in annuity contracts have lost money over the past 3 years, 26% show losses for 5 years and 12% have losses for 10 years. This is because of low interest rates, management fees and annuity fees. If the above passes, these funds would break the buck (go below $1 per share) and make a lot of annuity holders very unhappy. Read that article here http://www.usatoday.com/money/perfi/funds/story/2011-11-09/losing-money-in-a-money-fund/51143222/1

The fallout from MF Global continues. The entire workforce has been let go, most clients cannot access their accounts (read story here http://www.bloomberg.com/news/2011-11-11/mf-global-clients-frustrated-as-bankruptcy-keeps-assets-and-options-frozen.html ) and federal regulators have ordered a review of all 120 US futures trading firms after millions of dollars in client funds went missing.

So let’s see how the markets have responded to this crazy week.

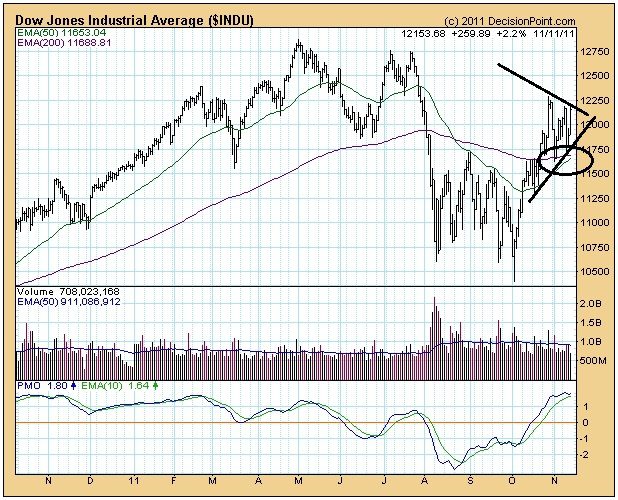

The chart below shows you that the Dow opened this week at 11,983.24 and closed at 12,153.68, tons of volatility but overall relatively flat week for stocks. It appears that there is a wedge formation in the works, with higher lows and lower highs. We’ll see what next week brings. You might also notice that the 50 day moving average is waving at the 200 day moving average. Will it cross above in a pervasive way? Time will tell, and you will know. Does this mean that everything is hunky dory? Not by a long shot, but the markets love quantitative easing, thank you ECB.

Let’s see what the dollar did this week. You can see in the following chart that the dollar started the week at $76.67 and ended at 77.74, so all of the turmoil in the Euro zone has boosted the dollar this week, though I find it very interesting that with all the turmoil in Europe, the euro is still stronger than the dollar, as witnessed by the relative performance chart under the dollar chart below. Remember, there are two ways to value a currency, one is against another fractional reserve currency and the other is against gold.

And now on to gold and silver, both physical and digital, let’s start with the spot (digital) markets. The following chart shows you that the metal complex had a pretty good week. Spot gold started the week at $1756.10 and closed at $1788.10 and is sitting 12% above its 200 day moving average, so a very nice move on the week. With regard to paper gold, Bloomberg reports that gold ETF’s rose within 1 percent of the record set almost three months ago. You can read the article here http://www.bloomberg.com/news/2011-11-11/gold-traders-most-bullish-since-2004-on-deepening-debt-crisis-commodities.html but if you want to understand paper gold better, read the blog I did on it here: http://www.itmtrading.com/blog/index.php/2011/08/gld-vs-physical-gold/

On the physical side of things, our bullion wholesalers report good availability across the metals complex, with the big movers in the fractional (less than an ounce) arena. On the numismatic side, the wholesaler states that they were able to buy across the quality levels this week, but that the premiums were holding steady, particularly on the rarer coins, so good availability.

Spot silver started the week at $34.08 and closed at $34.68, so flat for the week. Though you can not see it on the chart below, the 50 day moving average has crossed below the 200 day moving average. Technically, in the spot market, the next move is to see if this is going to be pervasive. If it is, I would expect the spot market to correct down. However, activity in the physical market looks a bit different, our wholesaler tells me that there was a nice increase in activity in junk bags and the supply/demand dynamic made for a nice increase in premiums. Overall sales are good and availability is good.

To give you a better picture of how the four asset classes are looking, the following is a relative performance chart showing you stocks, bonds, cash and gold. I’ll let you draw your own conclusions.

For anyone watching, we have a ring side seat to history in the making. What we are seeing is something that has never before happened in the history of man. Yes, no debt based currency has ever with stood the test of time, but this is the first time when every currency has been debt based at the same time. This cannot end well. I now understand why it is the middle class that has the greatest shift in their standard of living, because they do not yet feel the pain. I’m afraid we all will in time.