Friday Market Update 10/7/2011

“You can’t spend your way to prosperity and you can’t borrow your way out of debt”

Frankly, this is such an interesting period of time in the markets. This past week has seen a major European bank failure (Dexia), almost every key leader in the US, England and Europe as well as heads of the IMF and World bank come out with dire forecasts about the global economy. Plus, there are additional government bond downgrades and increasing global protests.

Here in the US, Ben Bernanke head of the Federal Reserve, warned that the US economic recovery was “close to faltering.†The move of buying long-term treasury bonds to push longer term rates down is intended to stimulate borrowing and indeed the 30 year mortgage rate fell below 4% today, the lowest it has ever been. But of course, the banks have to lend, which is something they have been hesitant to do.

Treasury Secretary Tim Geithner stated the “The crisis in Europe presents a very significant risk to global recovery.” He urged the ECB to recapitalize the banking system there like we have done here. The markets liked that European Finance Ministers are now singing that same tune. There is some conflict as to weather this should be done on a country by country basis or on an EU basis. What it really means is a transfer of wealth from the taxpayer to the banking system.

In England Sir Mervin King stated “This is the most serious financial crisis we’ve seen, at least since the 1930s, if not ever.†They are now implementing another round of Quantitative Easing in an attempt to jump start the economy. It didn’t work here, and in my opinion, it isn’t going to work there. You cannot fix a debt problem with more debt.

The Eurozone financial crisis took several turns for the worse with the downgrading of Italian and Spanish debt and Portugal coming out to say they are not likely to meet the IMF requirements for the next round of bailout funds. Dexia bank collapsed and will be split into a bad bank and a good bank, with French and Belgium government backstops (taxpayer). The next installment of the Greek rescue package has been postponed until November. Not to worry though, the Russian government (taxpayer) has stepped in with a bridge loan until the next “bailout†payment can be made.

I am disappointed to say that the Icelandic government has buckled to demands from the IMF and EU. This has angered the population who are crisis weary and pelted lawmakers, dignitaries and the President with yogurt and eggs as they walked to the traditional start-of-term Mass. Their economy imploded November 2008 as their banking system collapsed.

With all of the doubt around sovereign debt (government bonds) and weakness in the banking system, credit default swap insurance has surged to levels not seen since the financial crisis of 2008. That means that credit is being switched off around the world.

In addition, World Bank chief Zoellick said “Since August we’ve seen bond spreads for emerging markets increase, their equity markets have declined like developed markets and capital flows have declined sharply. Europe, Japan, and the United States must act to address their big economic problems before they become bigger problems for the rest of the world.” Not to do so would be “irresponsible,†he said adding, “In 2008 many people said they did not see the turbulence coming. Leaders have no such excuse now.”

More of the masses are getting verbal with major protests globally. I’d like to think that we are finally taking back our power. They may not be able to fully articulate what is happening, which is death of the global currency system, but they seem to realize that the division between the have’s and have not’s has grown so wide and so blatant, that it can no longer be ignored, at least by some. In my personal experience, many still choose to bury their heads. But my guess is that will change.

In the US the “Occupy Wall Street†protest will enter its third week on Monday. This grass roots movement is gathering quite a bit of national support and begrudgingly main stream media is now talking about it; though they treat it as a fringe movement of no consequence.

Demonstrators across the country showed their anger over the crippled economy and corporate greed by marching on the Federal Reserve banks, Brooklyn Bridge and camping out in parks from Los Angeles to Portland, Maine and lots of cities in between. Could the masses finally be waking up?

The powers that be are trying to fix a dying monetary system with the same virus that made the system sick to begin with, debt. Please understand that bottom line, fiat currencies are created from debt (government bonds) and supported by the ability to create more debt (full faith and credit). The world is losing “Faith†that these governments will have the ability to repay their debts and therefore “Credit†is beginning to be withheld. All of this debt creation has an impact on currency’s purchasing power. This is why we all need the protection of physical gold and silver in our possession.

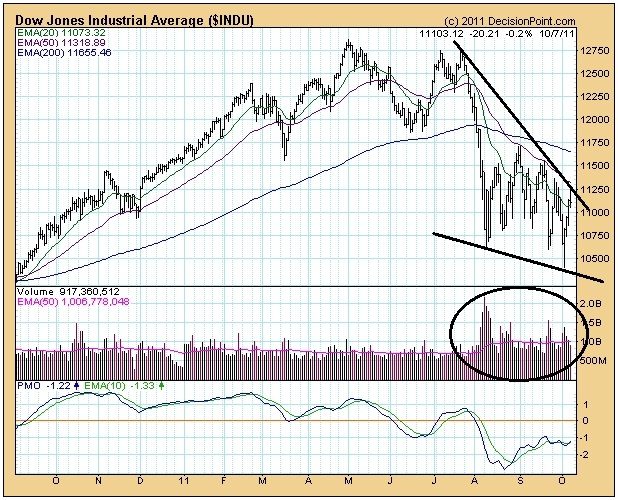

The Dow started the week at 10,913.38 and ended at 11,103.12, basically flat but still in bearish territory. It seems challenging to gain much traction with so much negative information coming out daily. You can see from the chart below that there is a clear series of lower highs, which shows a continued pattern of deterioration. You might also notice the pick up in volume into this deterioration pattern.

The dollar has also had a pretty flat week, starting the week at 78.03 and closing at 78.63. The chart below shows the dollar is in process of testing a top resistance level. If it can break above that level, it is most likely to go higher. Remember, this strength is against other paper currencies, and all of them are racing to debase.

Now on to gold. I checked with our wholesaler and the physical market remains tight with delivery out 2 to 4 weeks on bullion. Availability in the numismatic coin world is much better. Our wholesalers just got back from a buying trip, so if you are looking to fill a hole in your portfolio, this might be a good time to do so.

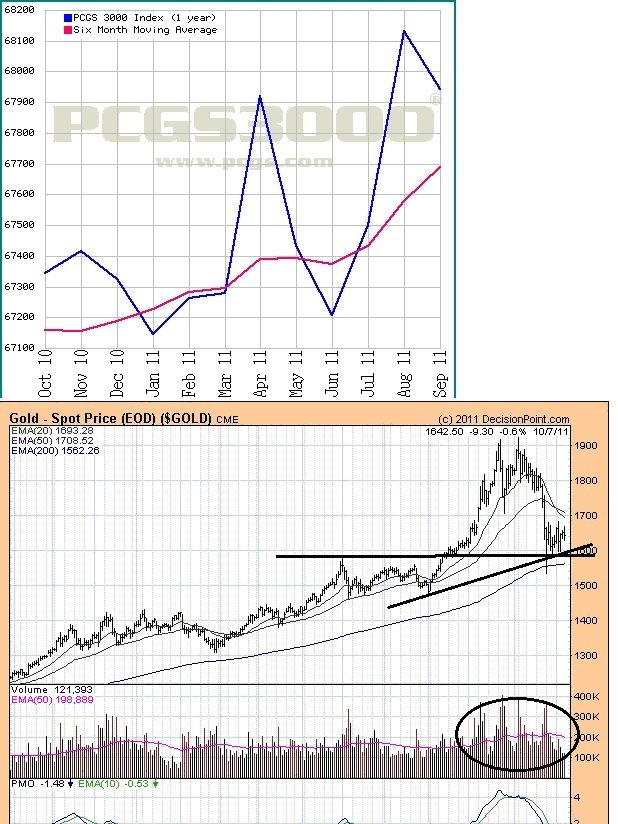

The chart below shows numismatics through the end of September. You can clearly see that the year long trend continues upward with the coins consolidating nicely above the 6 month moving average. On any pull back in either the numismatic or bullion market it would be a wise move to buy the dips while we can. At some point, that will change

The chart above reflects the spot market, which is primarily digital with a component in physical. Gold began the week at $1,622.30 and ended at $1,642.50 so up a bit for the week. Volume has increased into this consolidation, showing nice support just under $1,600. The chart remains neutral bullish.

This week wealth shifted from the dollar and bonds and went to stocks and gold. Remember wealth never disappears, it merely shifts location. The central banks and governments want it to shift it their way, and they’re doing a darn good job of it. But we want it to shift our way or at the least, keep what we have. You can do that with gold and silver.