Friday Market Update 10/21/2011

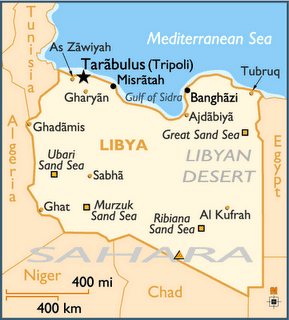

Ding dong the witch is dead! Moammar Gadhafi, the Lybian leader whose regime was overthrown last February, was captured and killed this past week. The killing fueled anti-government rallies across Syria as protesters sought the removal of President Bashar al-Assad, who inherited power from his late father in 2000. The unrest in the Middle East and northern Africa continues, so keep your eye on oil, which has experienced a moderate pull back during this global slow down.

While the US and Europe has led the slow down, the Chinese dragon seems to be losing his fire as the Chinese economy grows at the slowest pace in 2 years. In addition, as inflation (currency devaluation) has picked up there, the government raised interest rates, putting further pressure on their economic growth. The big challenge for them is to support the growth of their own middle class consumer so they are not as reliant on outside buyers of their goods.

In addition, you might recall that China wants to be part of the SDR, the currency issued by the IMF. In order for this to happen, the renminbi needs to be a more globally accepted currency. This past week, China has taken a giant step in that direction as Hong Kong completed the roll out of the first renminbi denominated gold contract. Chinese Gold and Silver Exchange president Haywood Cheung said, this could “truly help promote the internationalization of the renminbi, and attract overseas and local gold dealers” because this creates a new trading platform where gold contracts can now be settled with renminbi.

This is very important, because here in the US, the CFTC (The Commodity Futures Trading Commission) voted in a 3-2 decision on Tuesday to put tighter limits how many commodity positions can be held. Since they classify gold as a commodity (it is really a currency) this has put some downward pressure on the spot (digital) market, because traders and hedge funds might have needed to sell off some positions to meet these new requirements. Many think that these new limits will force this trading off shore and now China is ready to handle these new contracts.

A little bit of good news for those on Social Security, you are getting a 3.7% cost of living increase. The average amount is $43 per month. Yeah! Of course the government giveth and the government taketh away, since about 10 million Americans will pay more into Social Security next year as the cap on the amount of income subject to payroll tax will increase to $110,100 from the current $106,800.

I hope that does not impact their ability to pay their student loans since the amount of total student loans outstanding will exceed $1 trillion for the first time ever, this year. Americans now owe more on student loans than credit cards, according to the Federal Reserve Bank of New York. This debt cannot be shed in bankruptcy and therefore must be serviced. This is a very big challenge since unemployment is stubbornly high and local governments, which were once a source of employment during tough economic times, have shed 535,000 positions since September 2008, and are continuing this trend as their budgets remained strained, I am not sure how this issue will play out. We will just have to watch and see.

Speaking of too much debt, the drama in Europe continues to roil the markets. It seems as if every Greek citizen came out to protest the latest round of “Austerity†voted through in the Greek Parliament; Job cuts, pay cuts, pension cuts and no more collective bargaining. What do the Greeks get in return? They get to take on more debt to the tune of an 8 billion Euro loan from the EU and IMF that enables them to avoid the appearance of default. But their bonds are already trading at prices that anticipate default, so it is really about the European Union attempting to create a soft default so the public does not know that, unlike the private for profit banks, they are not too big to fail and will pay the price of debt debauchery. In truth, all of us are and will pay that price through currency devaluation.

Has the world finally had enough debt? Here in the US we use Quantitative Easing (buying back our own debt) because we do not have enough buyers, but this past week in Europe Germany, France, Italy and Spain all had dismal demand for the new debt they issued. This, of course, sent bond yields higher as Moody’s downgraded Spain’s debt and put France on credit watch for a downgrade.

So let’s see how all of this has impacted these crazy markets this week.

The chart below tells the story of the Dow, which started the week at 11,644.49 and finished the week at 11,808.79. So up a little on the week, but more importantly, the Dow broke resistance at 11,760. We have to see if this move is pervasive and we also have to see what happens with the EU meeting over this weekend, but since the 50 day moving average remains below the 200 day moving average, the DJIA remains bearish (negative), continuing to make lower highs, though it would be neutral bearish at this time.

What about the dollar? It began the week at 77.00 and closed at 76.97, so while there were lots of ups and downs, this was basically a flat week, though the chart below shows a potential head and shoulders pattern forming. If so, then the dollar will have to fall further to complete the pattern. For the moment though, you can see that the dollar remains in a narrow trading range. I’ll keep you posted.

And of course, we must talk about the metals. First we’ll discuss the spot markets. The chart below shows you both spot gold and spot silver. Spot gold began the week at $1,683.00 and ended at $1,643.00 for a 2% loss on the week. However, with the 50 day moving average above the 200 day moving average, spot gold continues in its long term positive trend despite the efforts of the CME raising margin requirements and now the CFTC putting caps on the number of contracts one entity can hold. That is of course, unless the treasury makes you exempt. I will publish a blog on this early next week.

The bottom of the chart above shows you the spot silver price. As you can see, both are behaving in a similar pattern at this time, both moving inside of a narrow trading range. Now of course the above chart represents the digital market. Therefore, those moves by the CME, CFTC, hedge funds, and bank trading desks can have a big impact on the digital price, since there are really no limits on the amount that can be created or destroyed. Not so with the physical market.

The numismatic chart only gets updated once a month, but the index value is updated daily. Last week it closed at $67,795.53 and $67,812.48, up a little bit. According to our wholesaler most of the numismatic action this week has been in MS63, 64 and 65 with the most popular in the MS65’s. They are also seeing more action in fractionals (smaller than 1 ounce) and foreign coins. In the bullion market our wholesalers report that demand on larger bullion bars of gold and silver as well as foreign coins, are getting harder to come by and premiums are going up. Domestic gold and silver has good availability.

Well that wraps up the week. Our goal is to keep you informed, therefore we actually want you to understand what is happening. If you have any questions at all, please contact your ITM representative or send us an email. We are here to be of service.