FIAT MONEY WEALTH: How It Returns to Intrinsic Value

In 1971 the global financial system transitioned to a pure debt system. This was also when Wall Street went on a campaign to

- “Dematerialize†assets so they could be in a central location controlled by them

- Supports hypothecation (use of client equity) and leverage

- Enables opaque fee structures that benefit Wall Street

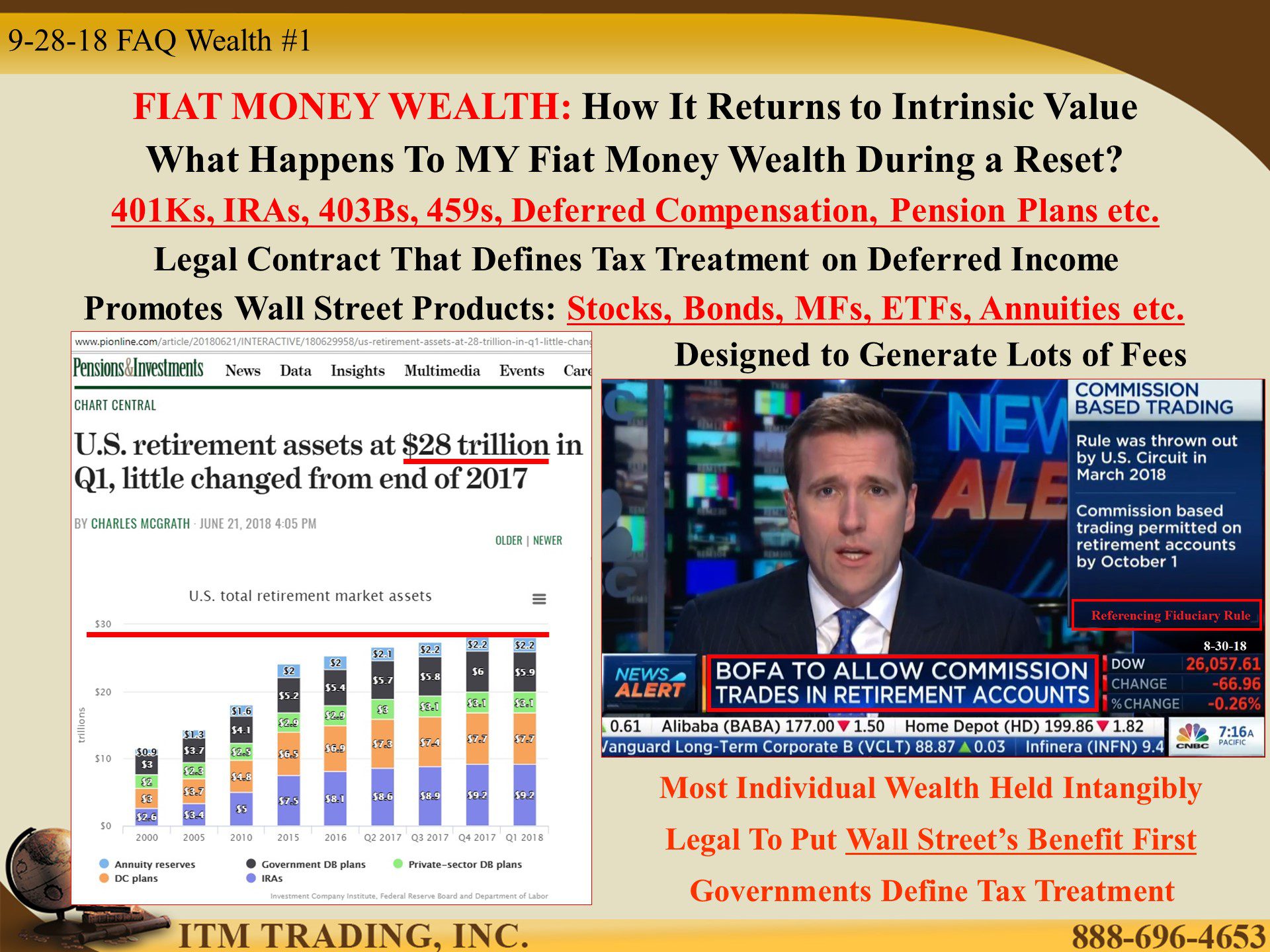

- Transfer corporate risk (DB Plans) to the individual (DC Plans) via IRAs, 401Ks et al.

- Supports higher corporate profits

- Enables the rise of income inequality

Today, most individual wealth is held as intangible fiat money wealth, particularly in retirement plans, where $28 trillion in fiat money wealth sits.

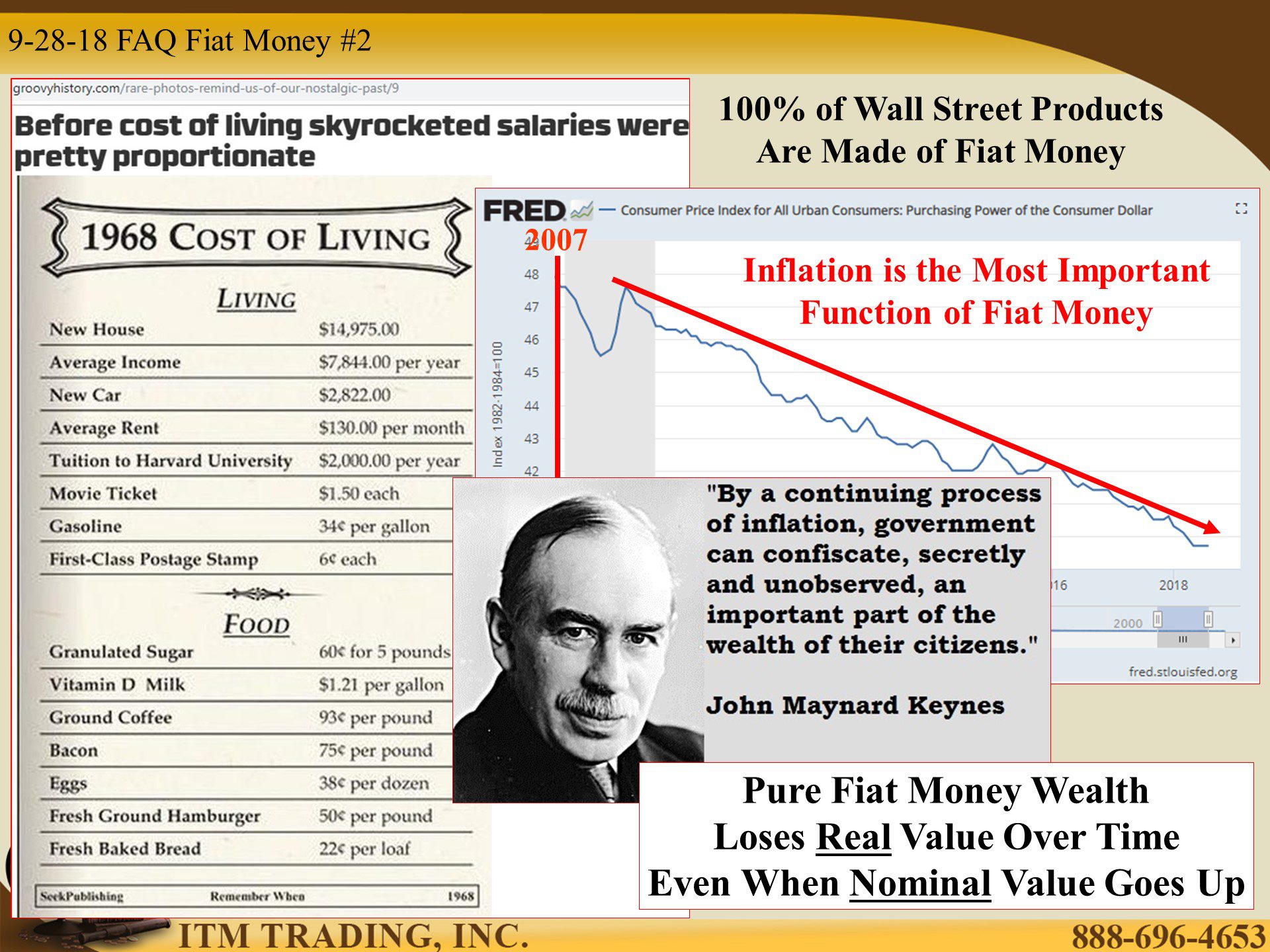

Over time we’ve been taught, through perception management, that this is our only choice. And in some ways, there right. Afterall, inflation is the most important function of fiat money, so the longer you hold principal, the less value it has.

On the flip side, inflation means that it takes more fiat money to buy the same goods and services which makes corporate revenue climb in terms of numbers. Higher revenues (or wages) supports the ability to take on more debt and keep this debt-based fiat system growing.

- GOVERNMENTS Generates higher tax revenues

- CORPORATIONS Generates higher profit revenues

- INDIVIDUALS Generates higher nominal wages

- Supports higher debt levels

People want to believe in the current system. They are counting on that wealth for their current and future financial security. If numbers go up it makes them feel richer, even though most now have this gut feeling that something is just not quite right. I would say, TRUST YOUR GUT.

Because the most important function of fiat markets is to blind you with nominal confusion, so you voluntarily hold your wealth in the system they created to benefit themselves in the form of hidden fees. It also makes wealth transfer via crisis, a whole lot easier.

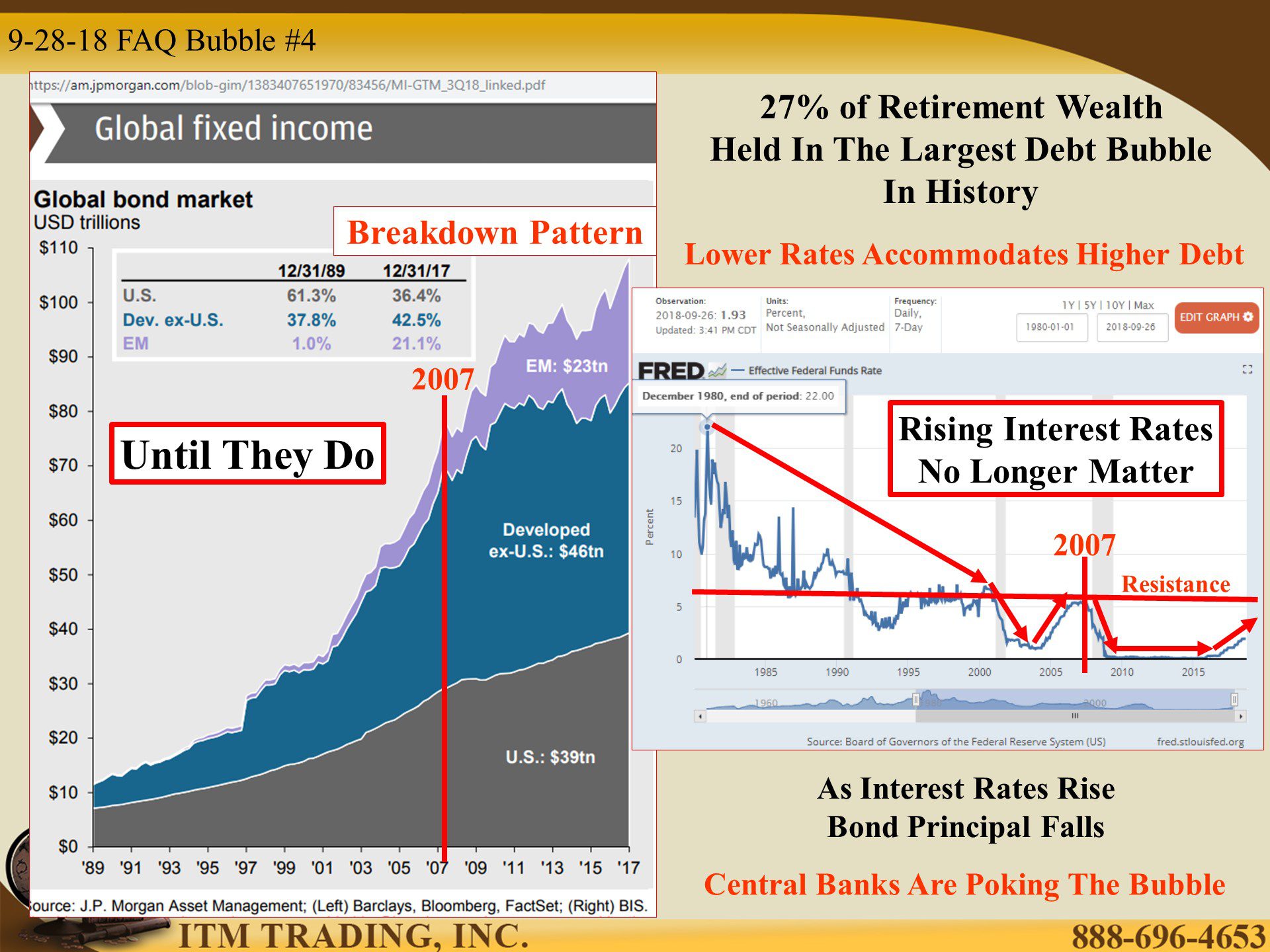

We all know that another financial crisis is inevitable, and all the components are in place.

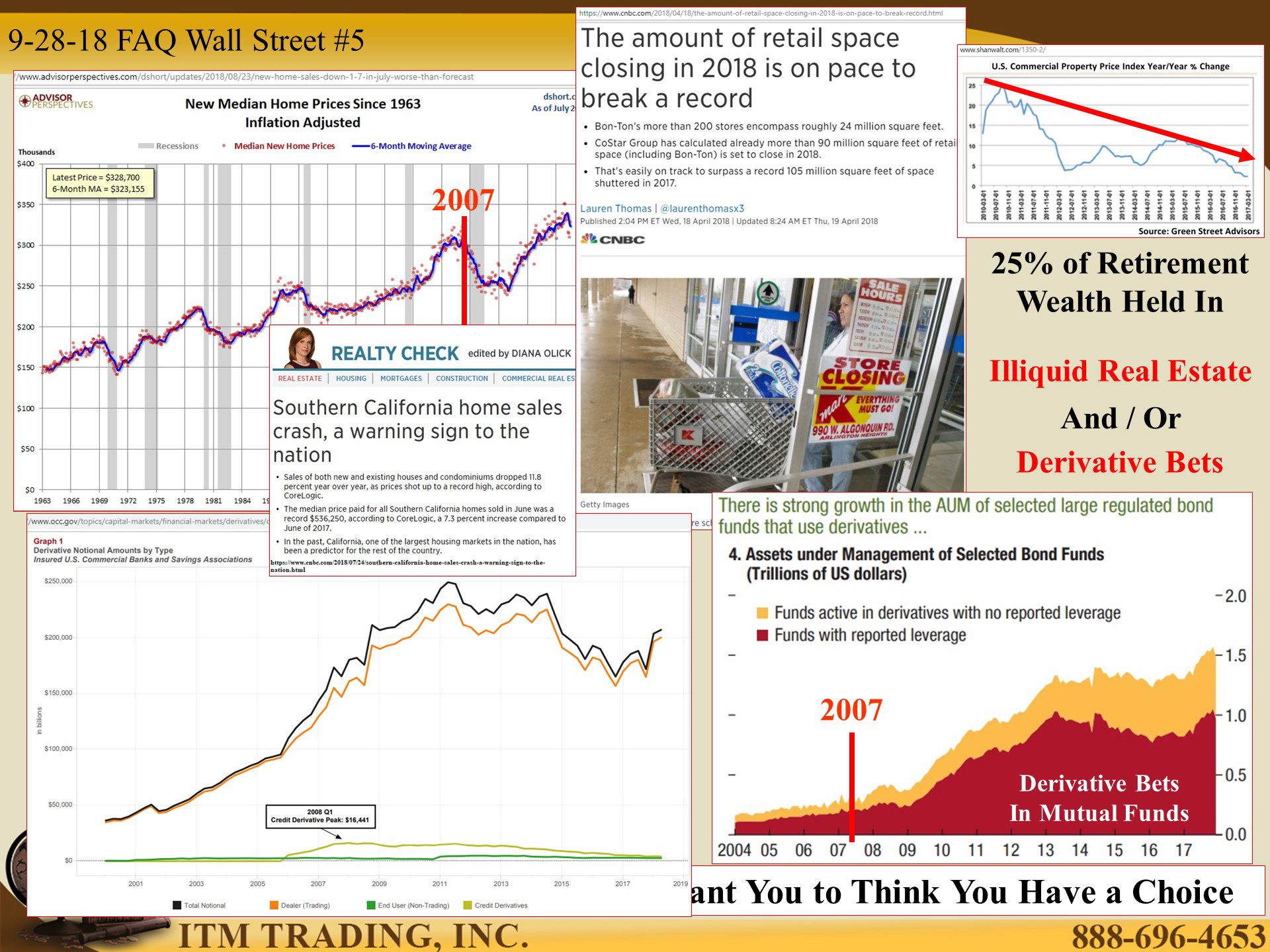

- If you hold stocks (individual, ETFs, MFs, variable annuities) you are in the most expensive stock market in history at a time when corporate insiders are selling out in droves.

- If you hold bonds (individual, ETFs, MFs) you are participating in the bursting of the biggest debt bubble in history.

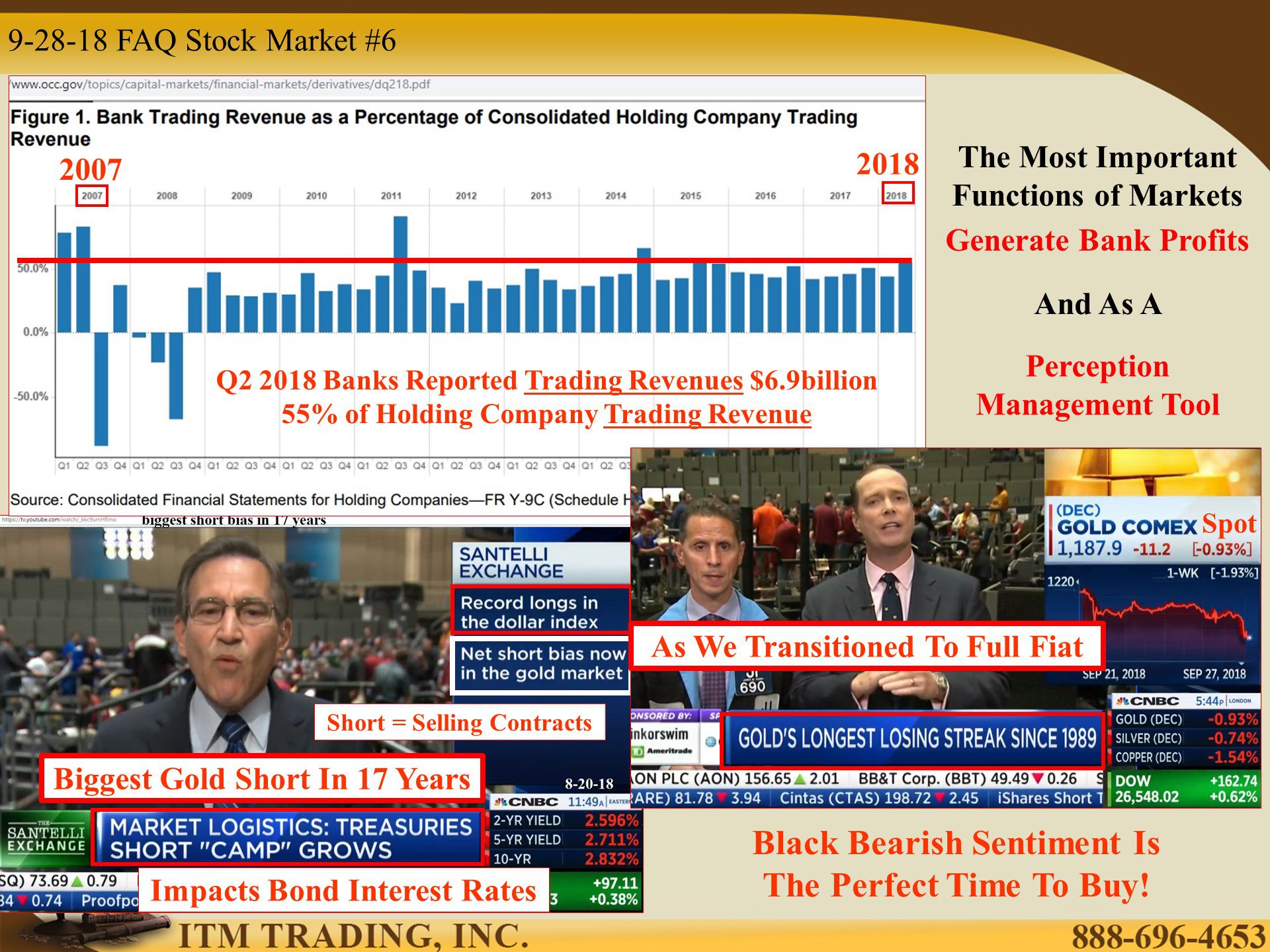

- The size of the speculative derivative bet market has exploded since it’s first implosion in 1998, but since 2008, derivatives are now heavily used in ETFs and mutual funds, as well as central banks and FDIC insured banks. This is leverage on steroids.

Since a rising gold price is an indication of a failing fiat money, Wall Street uses derivatives to control and keep individuals away from the safest assets, physical gold and silver at the same time that central banks have been voraciously accumulating gold, now controlling 10% of the physical market. JPM has accumulated the largest silver hoard in history, while selling as much derivative silver as needed to suppress the nominal price.

They know that at the end of this long term debt cycle, and all of that debt-based fiat money will have to be reset against gold. This is why they’ve been voraciously accumulating. It is simply how it’s been done over 4,800 times and I’m betting this time is not different.

https://fred.stlouisfed.org/series/LES1252881600Q

https://www.census.gov/construction/nrs/pdf/uspricemon.pdf

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://stockcharts.com/h-sc/ui

https://www.wsj.com/articles/unprofitable-firms-are-outperforming-other-growth-stocks-1537358400

https://fred.stlouisfed.org/series/DFF

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq218.pdf

https://www.occ.gov/topics/capital-markets/financial-markets/derivatives/dq218.pdf

https://stockcharts.com/freecharts/historical/marketindexes.html

https://www.goldbroker.com/charts/silver-price/vef#historical-chart

YouTube

9-28-18 FIAT MONEY WEALTH: How It Returns to Intrinsic Value by Lynette Zang

People want to believe in the current system. They are counting on that wealth for their current and future financial security. If numbers go up it makes them feel richer, even though most now have this gut feeling that something is just not quite right. I would say, TRUST YOUR GUT.

Central bankers and Wall Street know that this is the end of the debt cycle, and all of that debt-based fiat money will have to be reset against gold. That’s why they’ve been accumulating and why you should too.