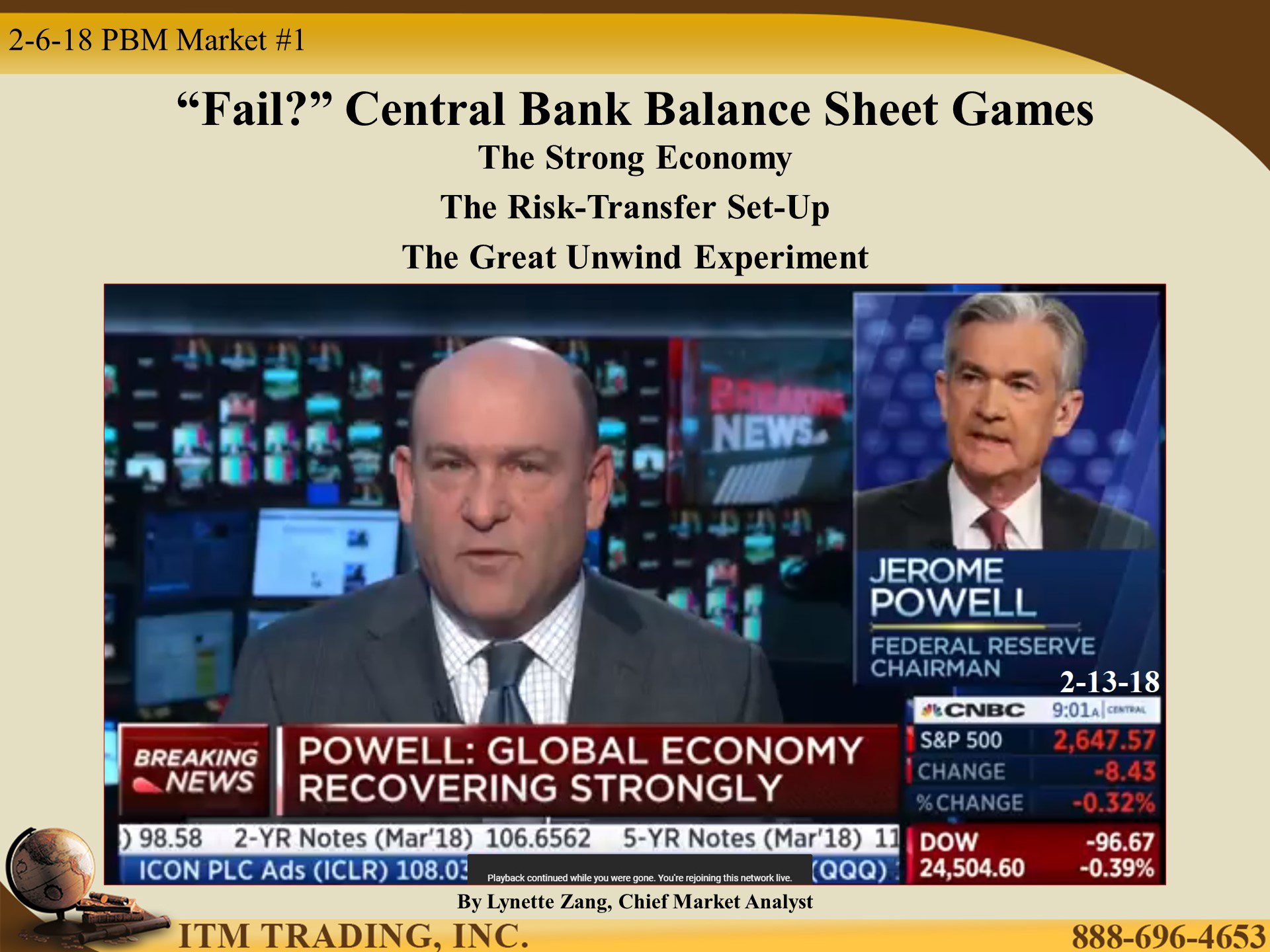

Fail? Central Bank Balance Sheet Games

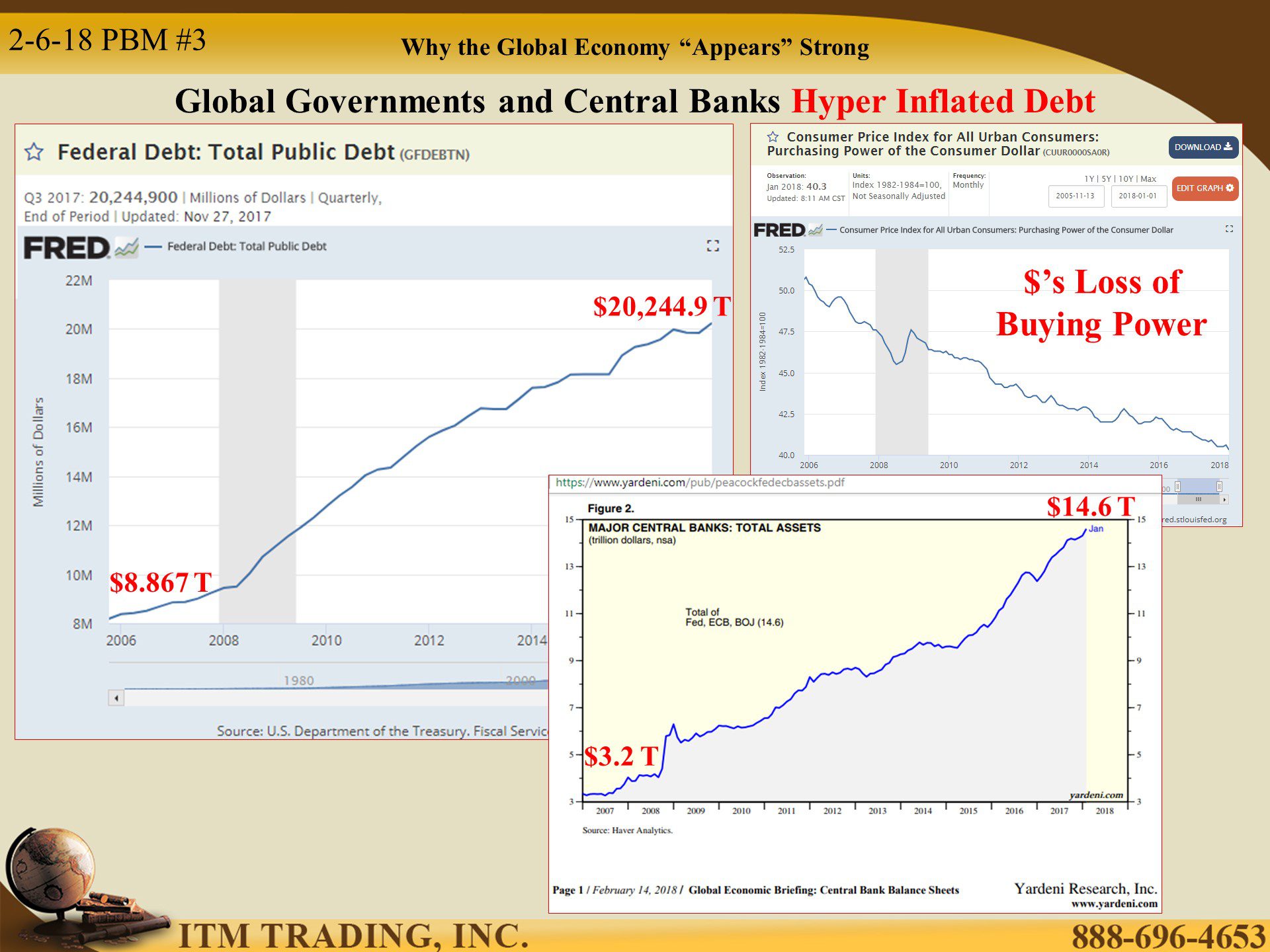

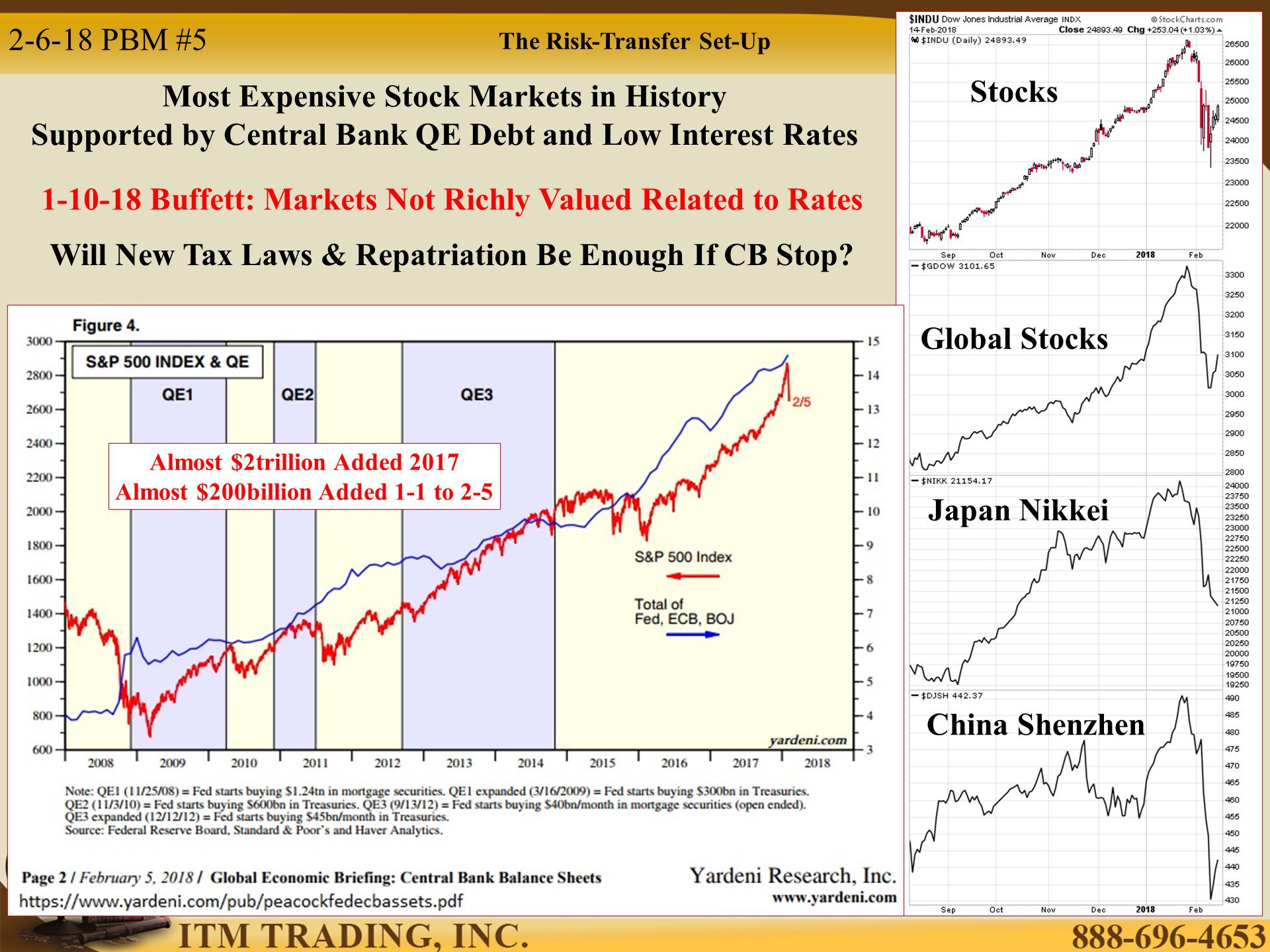

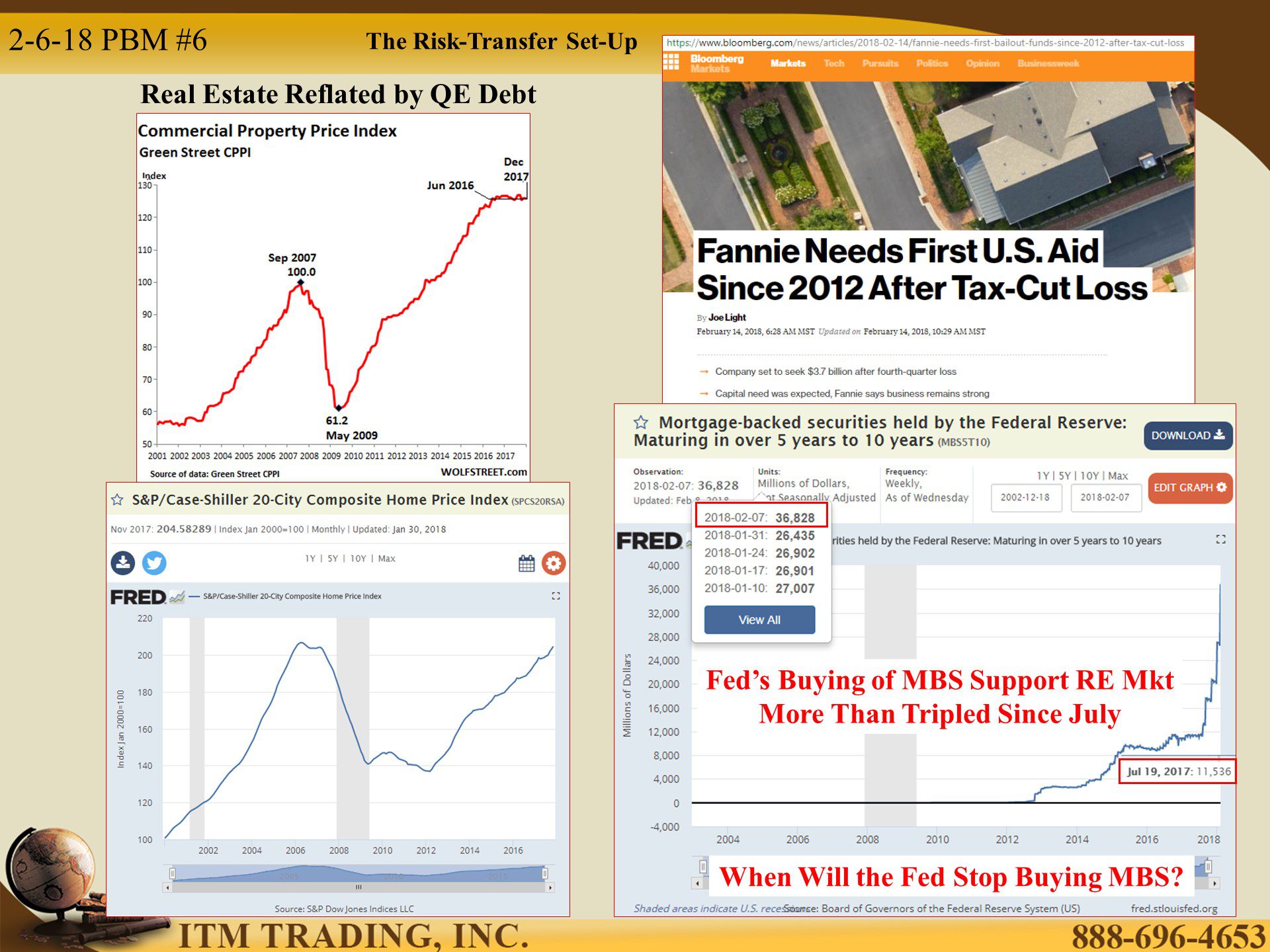

We are told that the economy is strong. With global stock markets near all-time highs and real estate prices near or better than 2006, many people believe this is true. Finally, central banks appear to be getting the inflation they’ve been calling for. Tax cuts are in place and trillions of repatriated corporate dollars flooding back to the US will certainly trickle-down benefits to the public. Happy days are here again!

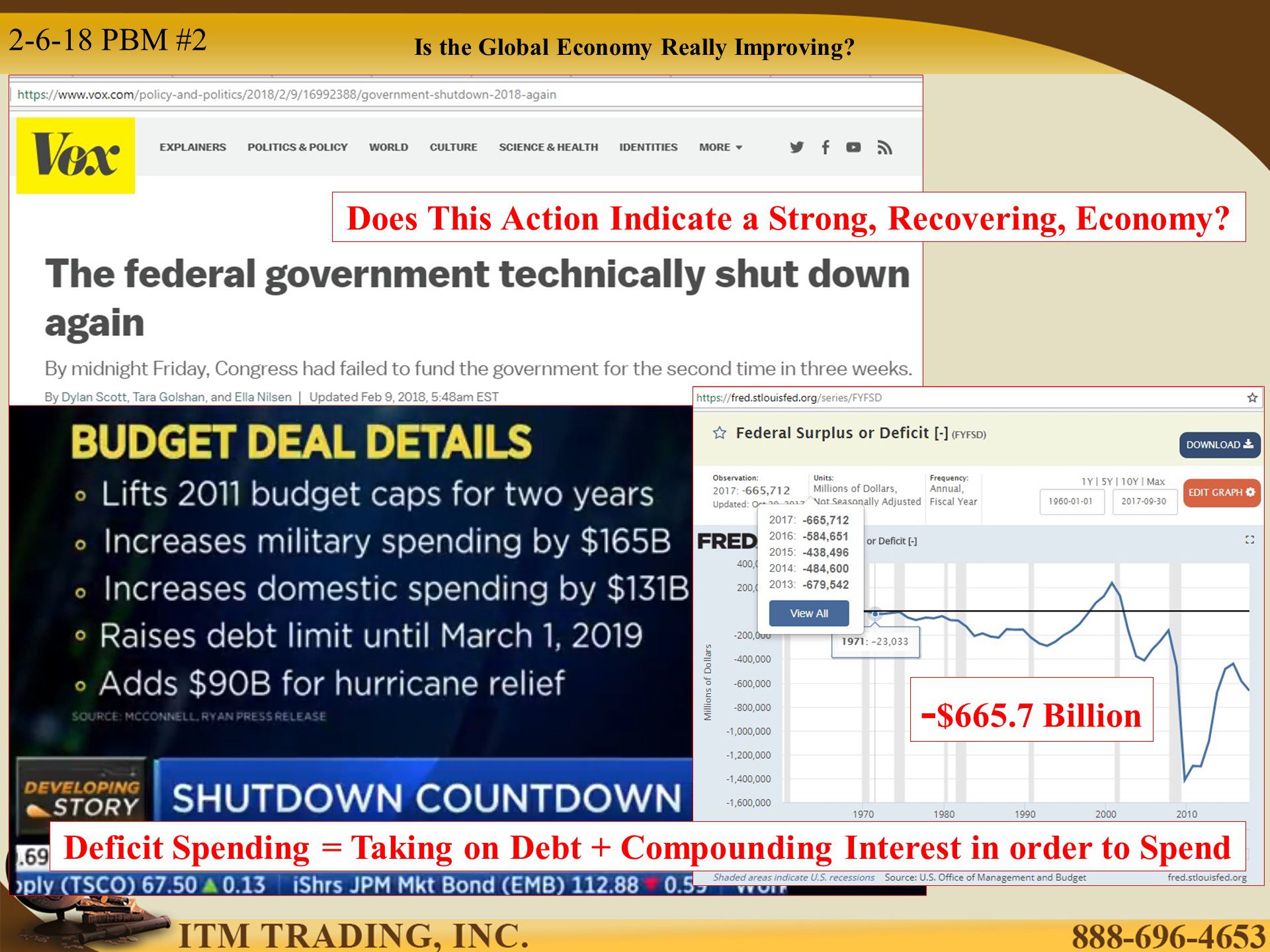

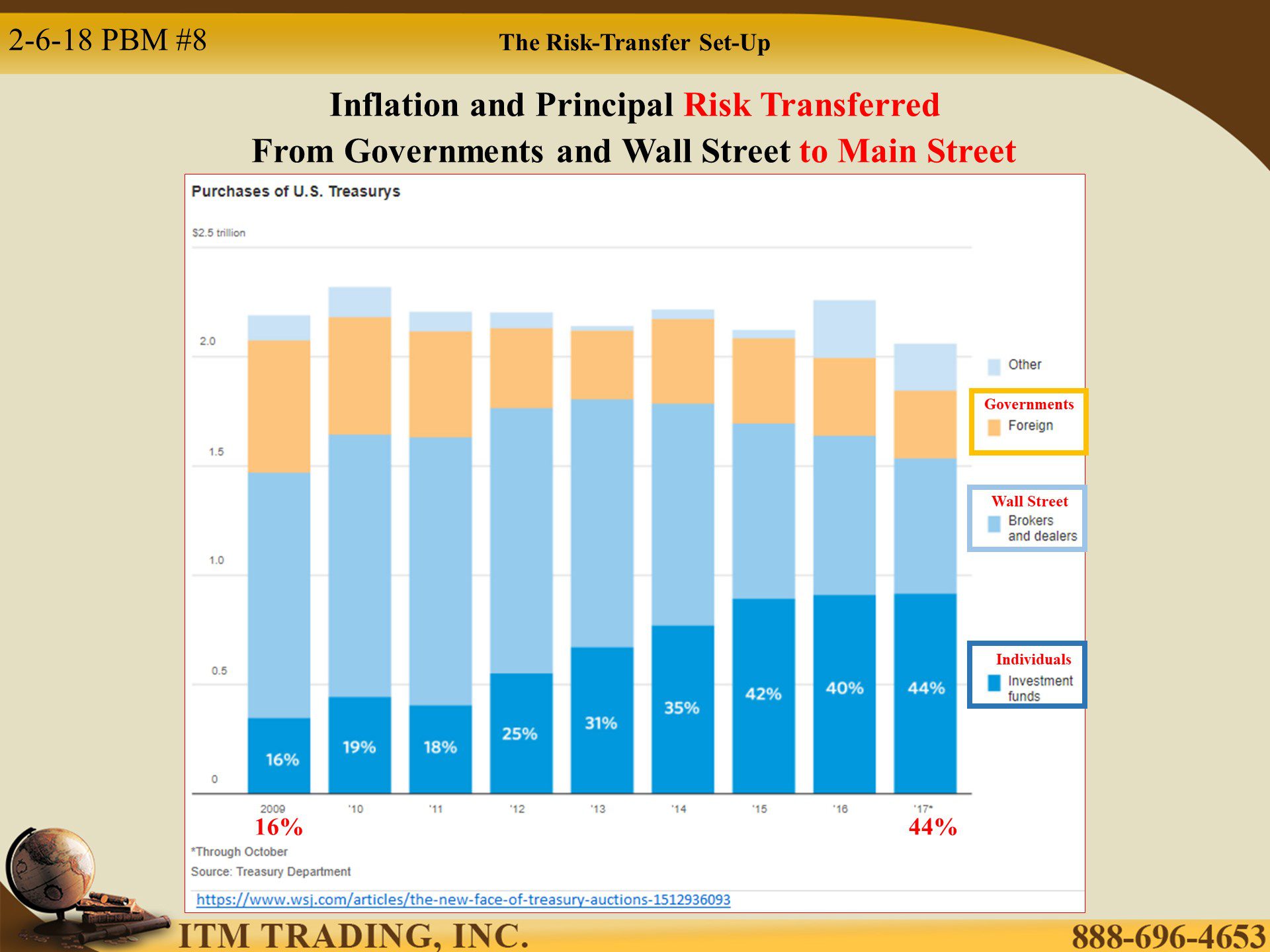

Yet we had two government shut downs (granted they were too fast for anyone to notice) in 2018 and the US government could only pass a budget deal by not capping spending for the next TWO YEARS. At the same time, the tax cuts, increases in current spending and anticipated infrastructure spending is being financed by debt and deficit spending (funding spending via debt) which is already at -$665.7Billion. What’s another trillion or two?

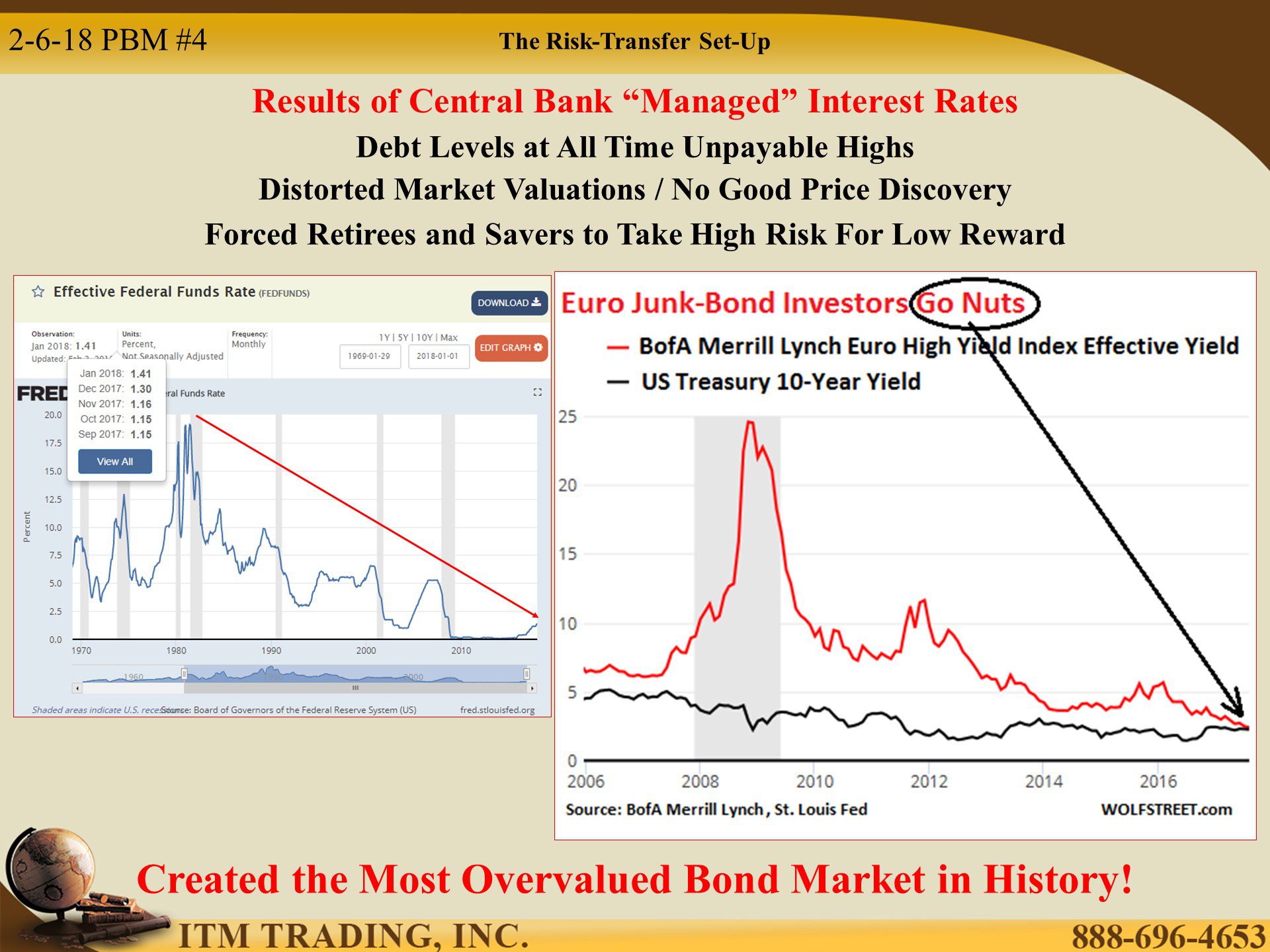

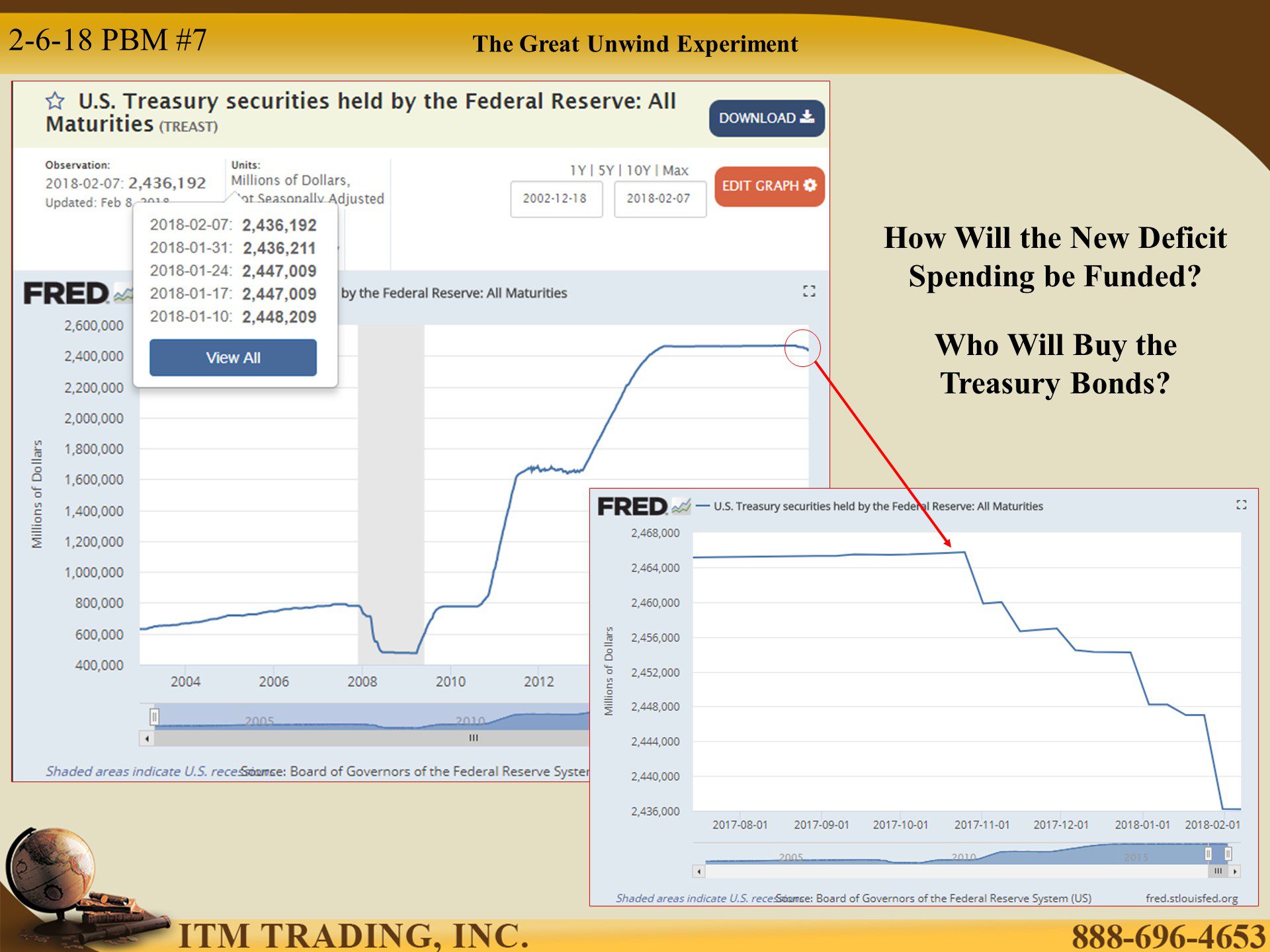

This is the environment into which the Federal Reserve is raising interest rates. Normally, central bankers raise rates to slow down borrowing and spending. This time they are doing it to have the ability to lower them again, when the next crisis hits.

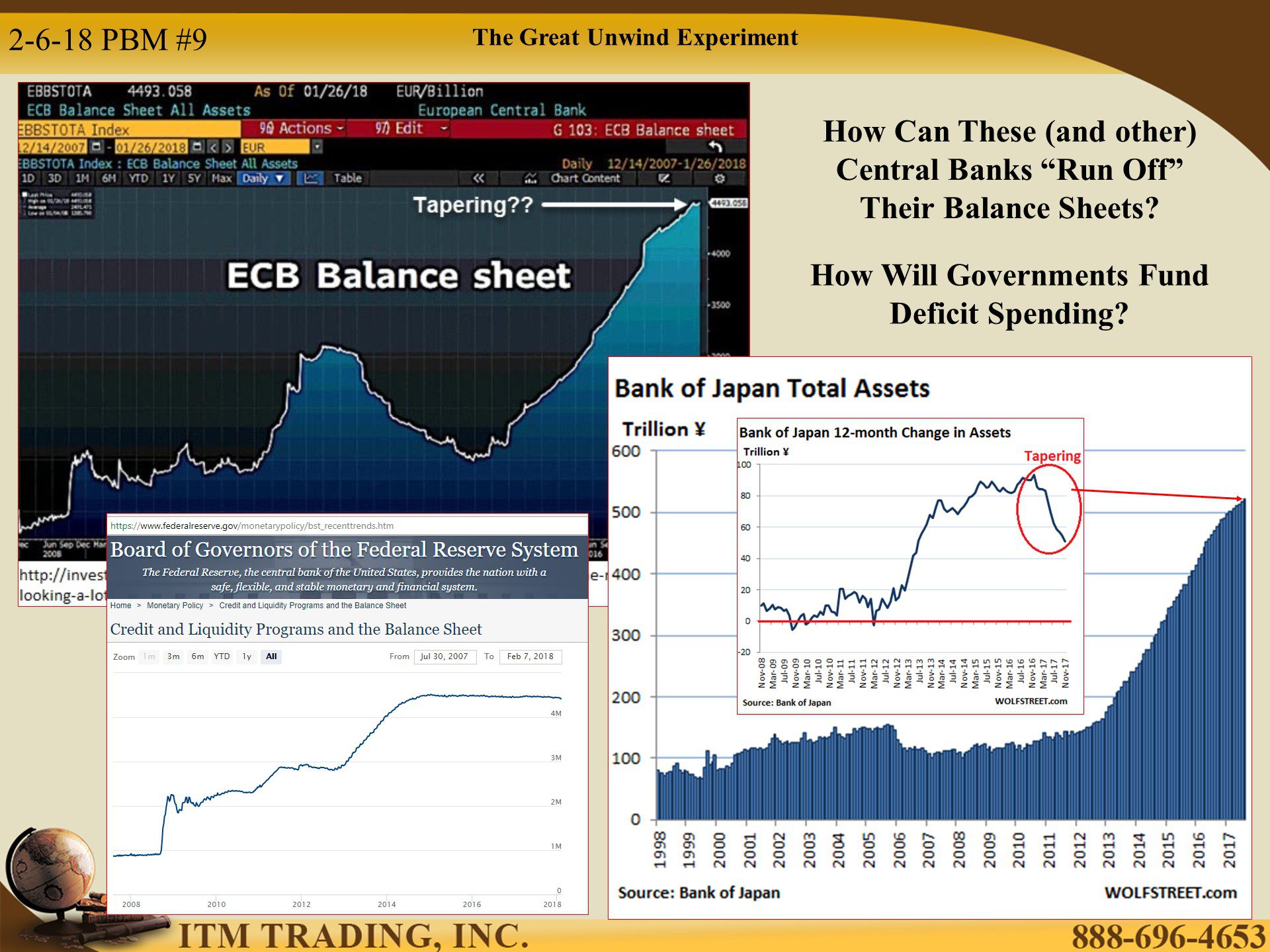

During the last crisis rates were pushed to zero (and below) and inspired debt accumulation to the highest levels. In fact, through January 2018, the Fed, ECB and BOJ accumulated $14.7Trillion and now, central bankers say, it is time to reduce their holdings of government bonds and MBSs.

The problem is that central bank debt accumulation has been supporting all these overvalued, bloated markets. If they are no longer buying, who will step in to pick up the slack? There is only so much that main street can buy through retirement plans, mutual funds, ETFs etc.

No one really knows what specifically caused the recent market sell-off. Some say it was the whiff of higher inflation caused by the highest wage increase since 2009. But that doesn’t really make much sense to me because central bankers have been spinning this as a good thing for years now. In addition, as the global stock markets dropped 10% ish, central bankers were pretty quiet.

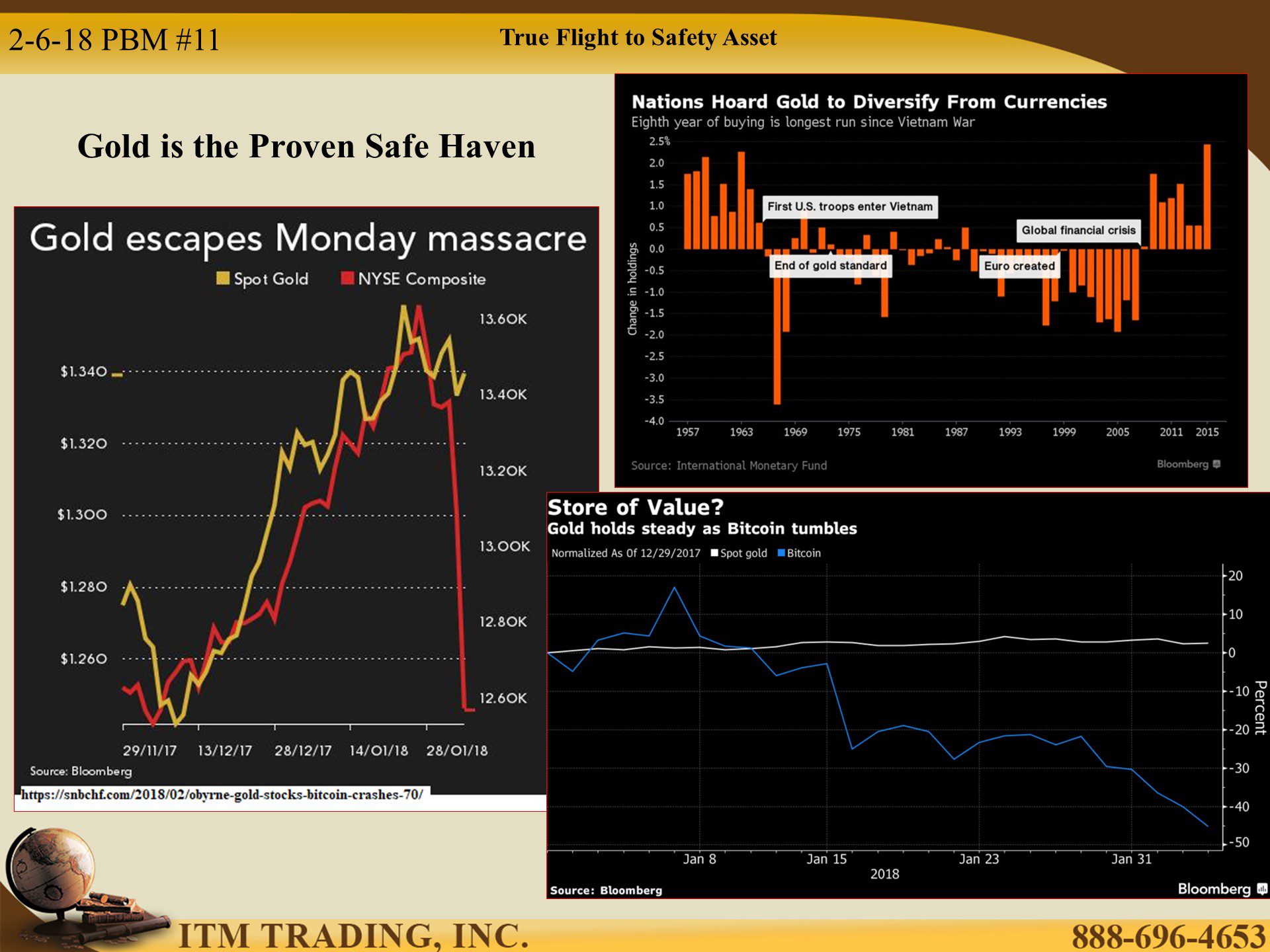

Is it possible that the recent market rout was a central bank experiment? After all, none of the standard flight to safety assets performed as they normally would. And this would be a good time to set one up with all that repatriated money coming back to support the markets.

At this writing, markets have retraced almost 2/3rds of the recent decline and all is right with the world. Wall Street wants you to buy on the dips, but I think this game is coming to an end.

The smartest guys in room on money are buying physical gold, don’t you think you should too?

Slides and Links

https://www.vox.com/policy-and-politics/2018/2/9/16992388/government-shutdown-2018-again

https://fred.stlouisfed.org/series/FYFSD

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://fred.stlouisfed.org/series/GFDEBTN?cid=5

https://fred.stlouisfed.org/series/CUUR0000SA0R

https://fred.stlouisfed.org/series/FEDFUNDS

https://www.zerohedge.com/news/2017-08-04/wtf-chart-day-draghis-markets-have-totally-gone-nuts

http://stockcharts.com/h-sc/ui

https://www.yardeni.com/pub/peacockfedecbassets.pdf

https://wolfstreet.com/2018/01/15/commercial-real-estate-prices-suffer-first-down-year-since-2009/

https://fred.stlouisfed.org/series/MBS5T10

https://fred.stlouisfed.org/series/SPCS20RSA

https://fred.stlouisfed.org/series/TREAST

https://www.wsj.com/articles/the-new-face-of-treasury-auctions-1512936093

https://seekingalpha.com/article/4129629-bank-japan-tapers-quietly-qe-party

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

https://snbchf.com/2018/02/obyrne-gold-stocks-bitcoin-crashes-70/

https://news.goldcore.com/ie/gold-blog/crypto-currency-bitcoin/