Europe’s Economy Blog

People in Europe’s Economy

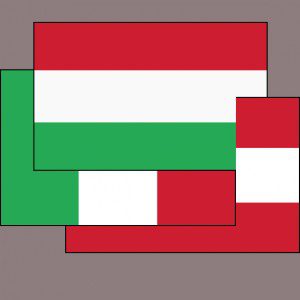

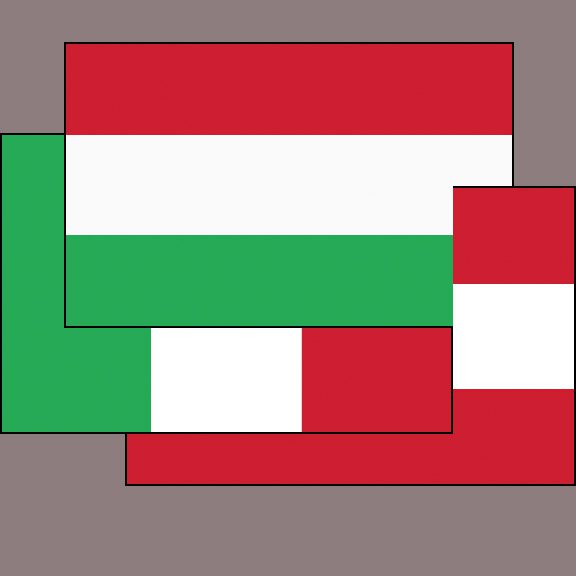

Over the years I’ve traveled throughout Europe, using local guides to explore what Europeans thought and experienced in their daily lives. I thought that an “on the ground†perspective would be helpful in understanding what is happening over there economically. Therefore I contacted some of them and asked of their experience. I chose Hungary, Italy and Austria because those countries give us an excellent cross section of experience.

From Communism to the EU

Hungary was a communist country under Russia’s rule until 20 years ago. Andrew was thrilled that Hungary was now part of the European Union and gave him the freedom to cross boarders at will. They are not part of the Euro zone and as such are on a dual currency system. All receipts in Budapest give you a choice of currencies. Had I used Euros, my cost would have been roughly 20% more. So the forint (Hungarian currency) was quite weak against the euro.

Things have not gotten better in Hungary and the new government has put in place laws that have confiscated pensions, challenge democracy and threaten the independence of the Central Bank as well as other issues that are being challenged by the EU and the IMF. Here are Andrew’s thoughts as he expressed them to me in his broken English:

“Hungary is in a very difficult period… monetary negotiations with the IMF and EU to save the economy. Everybody is worried about the foregoing of our daily life, prices and incomes/pensions.

The economy and political situation is not so easy, Hungary is part of the EU and this gives us a strong control and protection against unexpected and unwilling steps, powers of the actual right wing, conservative government.

After 20 years of changing and passed in democracy, this country has to learn how to use, how to live in a modern democracy.â€

Translation:

The yield on Hungarian 10 year debt is over 11% and their currency is in crisis. They changed the constitution and put in laws that hamper freedom of speech, transfer power away from the Central Bank to the government and confiscated private retirement plans ($14Bn). This has created a lot of uncertainty for the people of Hungary. Even though Andrew thinks this is a modern democracy, it is just the opposite. It is difficult to maintain daily life as their earned and pension incomes have been cut at the same time that prices have gone up. The political and economic turmoil has everyone on edge. The last comment is interesting since the new government is much more autocratic than democratic.

The Third Largest Economy

In Italy and Greece they recently removed elected officials and put in unelected bankers to run the country. I specifically asked my Italian friend Natale about that. Here is what he had to say:

“The situation here seems to be more and more challenging. In general it seems as if nothing changed for many people that evidently benefit of some privilege, while a bigger number of people around me lost their jobs, have had to face money problems due to the fact that everything is more expensive, electricity, gas, bread, milk, fuel, more taxes, heavy taxes on properties, on the first home as well, increasing the value of all the properties by law, to increase the taxes you pay.

For me it’s awful since I bought my first flat in 2009, in the centre of Florence, so I have very little money now and lots of debts. I’m happy about the new place but I necessarily became very conservative about money, my style of life radically changed. My only concern now is the job problem, since it is more and more difficult to keep business going on.

About the new prime minister, judgment among people is very controversial, for many people it was necessary to have technical ministers to solve the crisis problem, many people just think it is a way to let somebody do what a politician would never do, since he would never be elected again. In any case the political world is so far from the interests of common people that democracy is merely apparent here.â€

Translation: As usual the middle class pays the price of proliferate government spending. Austerity brings lower income, fewer services and higher taxes. The people are tired, scared and have little hope so they allow a take over of their democracy.

Fiscally Conservative

And from Erich in Austria, which is much more like Germany fiscally:

‘The prices in Europe went up a lot, especially for food and housing. Last year the economy was not too bad because people who have money are now buying a lot before the Euro collapses:

– cars (the best year ever)

– real estate (prices are going up a lot)

– antiques

– gold not so much anymore, because people think it is already too expensive ….

I want to keep my gold and spend the money on an apartment which I can rent out…â€

Translation: He sees the demise of the Euro dollar and the flight to tangibles. He doesn’t understand that gold is up because the fiat currency is down. Therefore, he is thinking that gold is a trade. Rather it maintains your ability to purchase the same goods and services over time. There was a time when people knew that gold was money. It still is even in Europe’s economy.