The Danger of Emerging Market US Dollar Denominated Debt by Lynette Zang

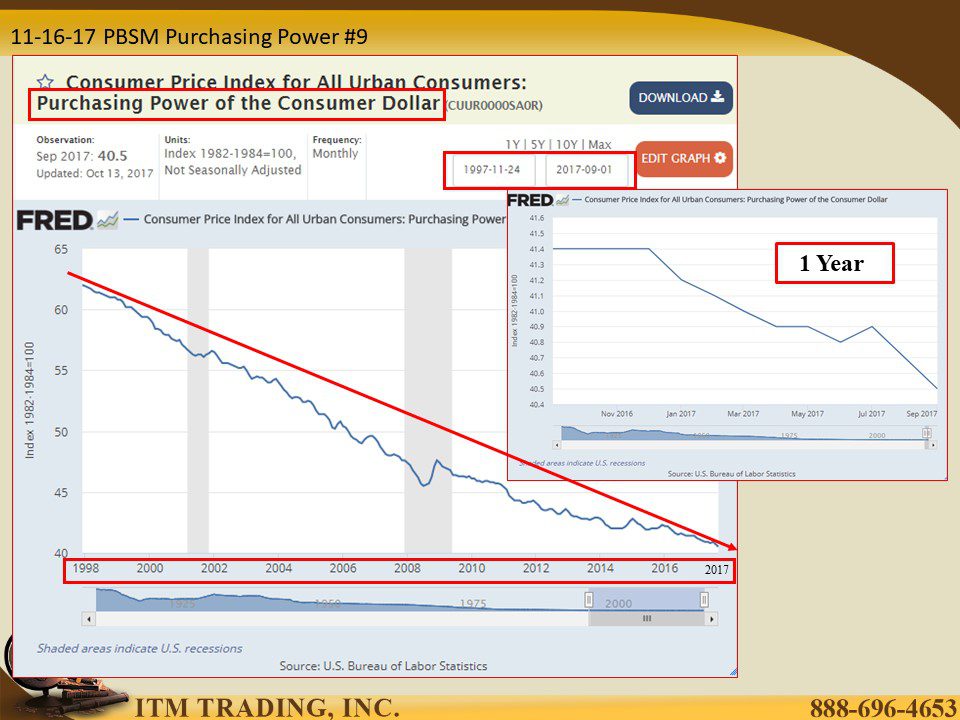

In 2007 the US dollar hit an all-time low, establishing a new lower trading range. As the 2008 crisis unfolded interest rates were also pushed to all-time lows. These events created an opportunity for global corporations to take on cheap debt in terms of cheap dollars.

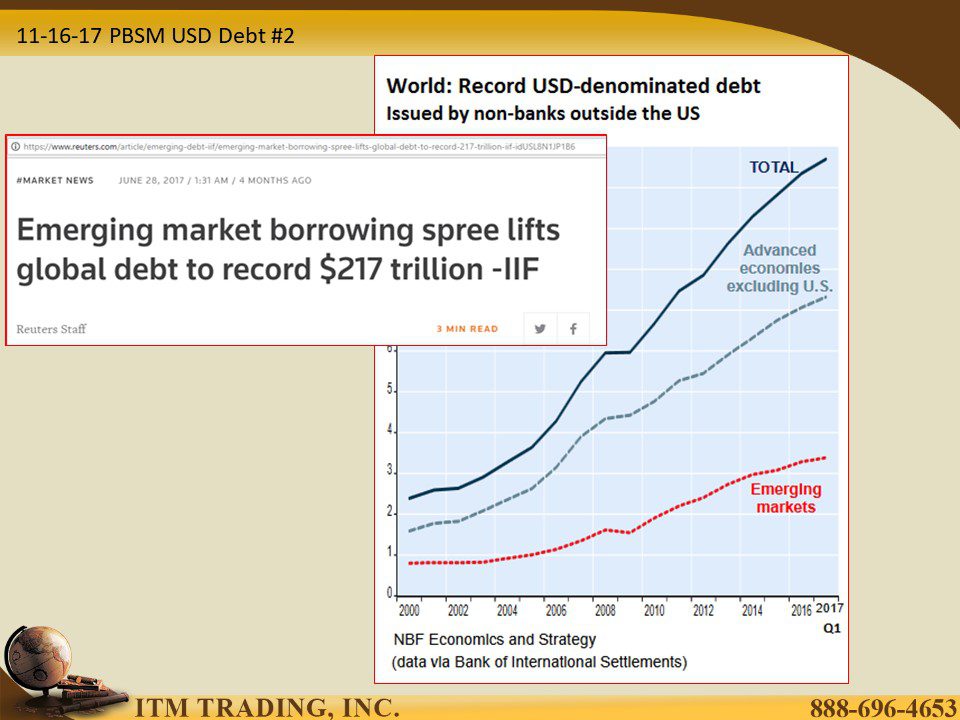

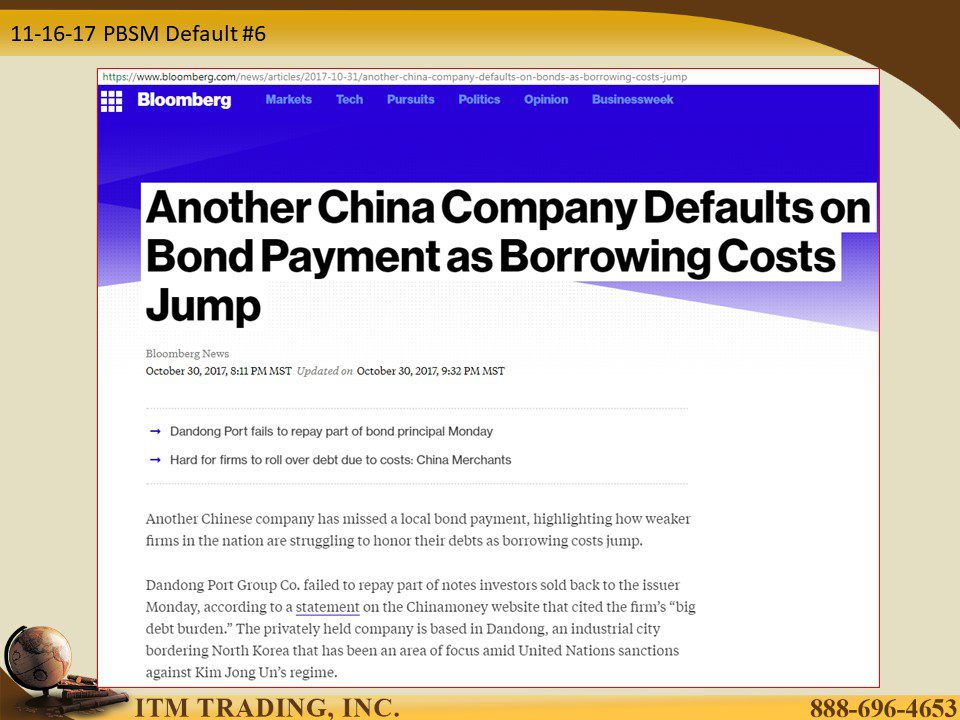

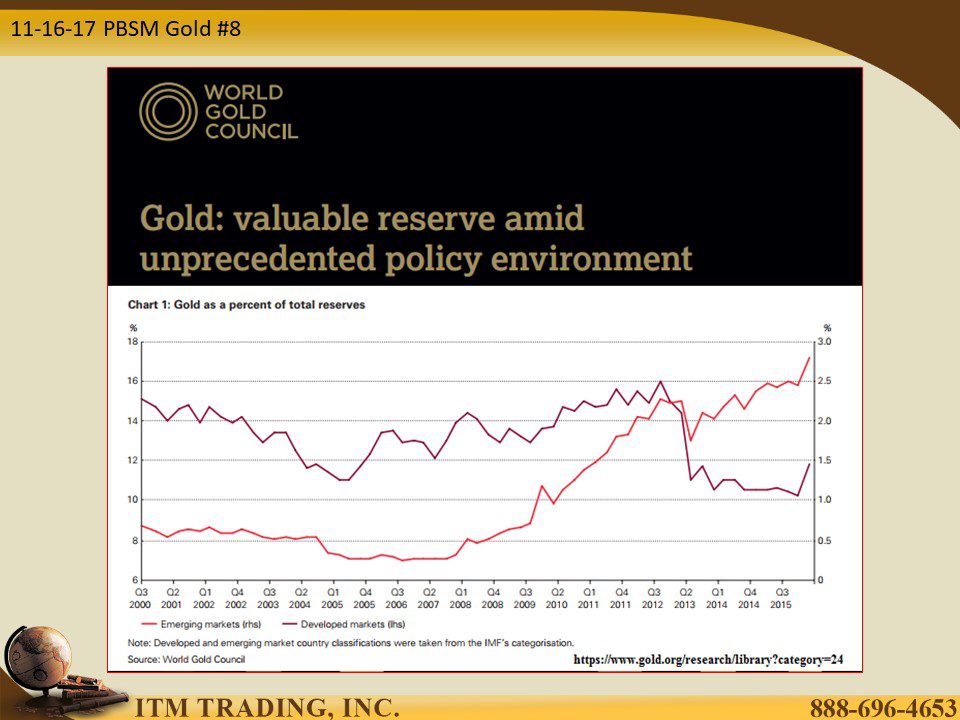

The most current figures show Emerging Markets now hold a record $217 trillion in debt with much of that denominated in USDs. These corporations, many in China, do not earn USDs so to service that debt they have to convert their currency into dollars. This is not a problem as long as the dollar remains weak and interest rates remain low. But circumstances are changing.

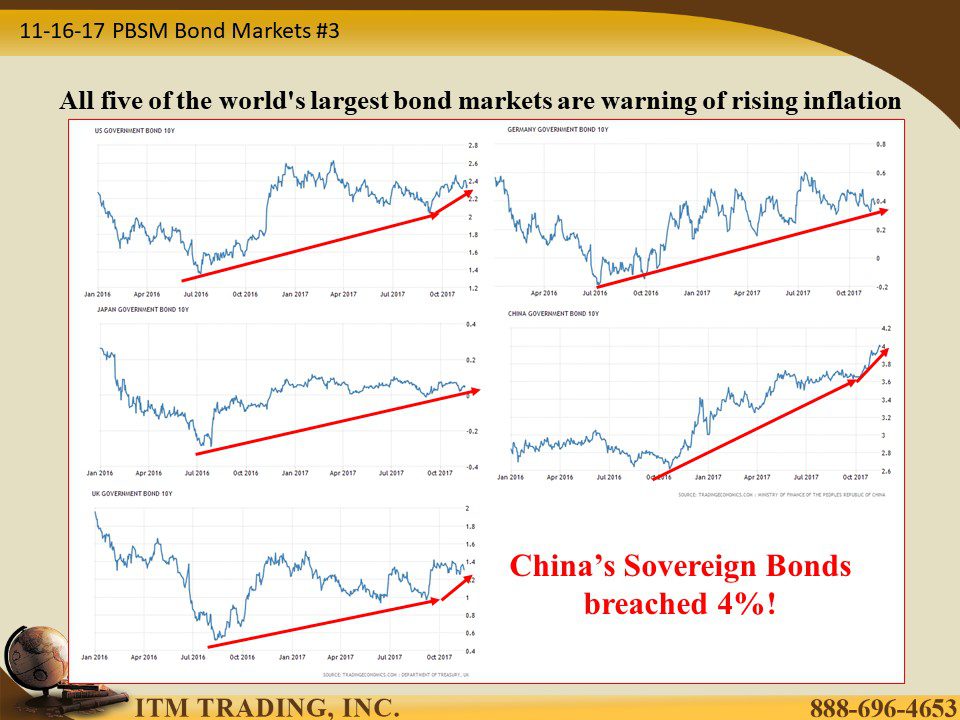

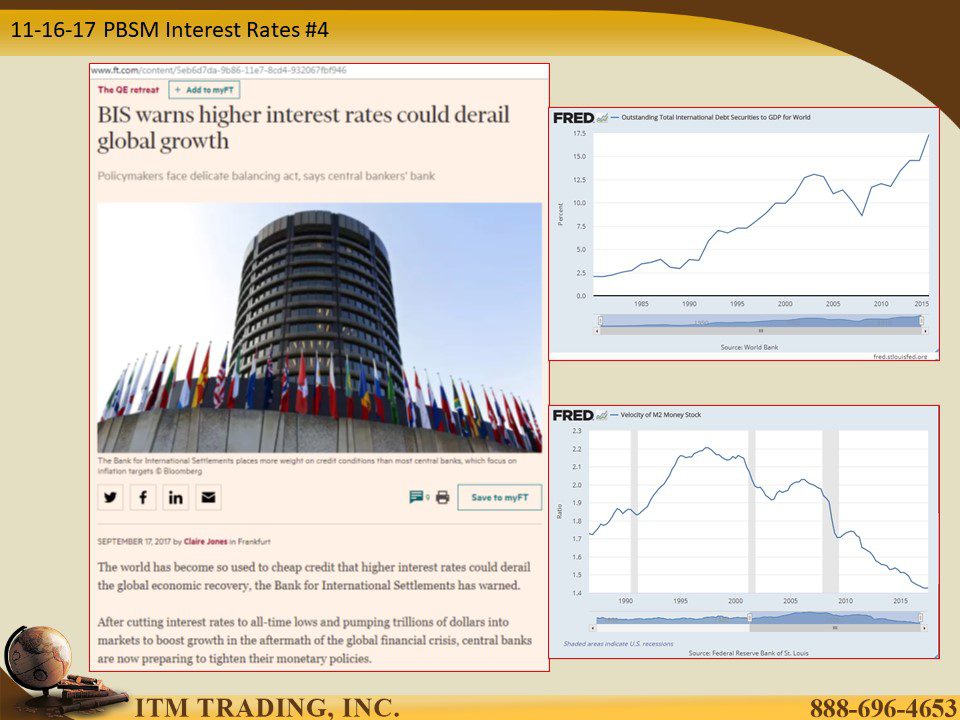

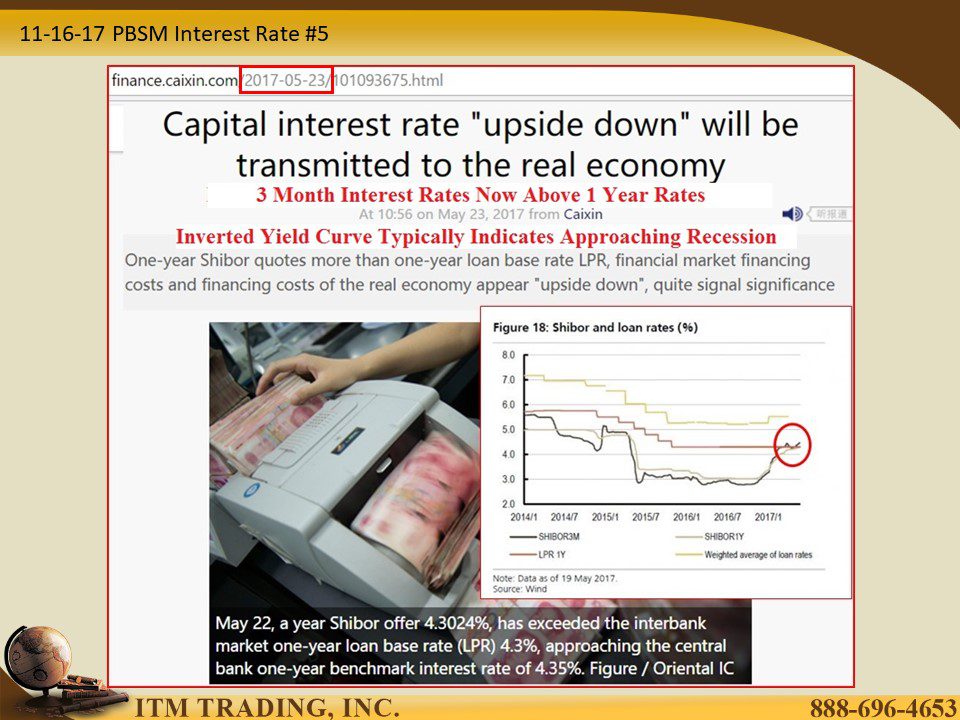

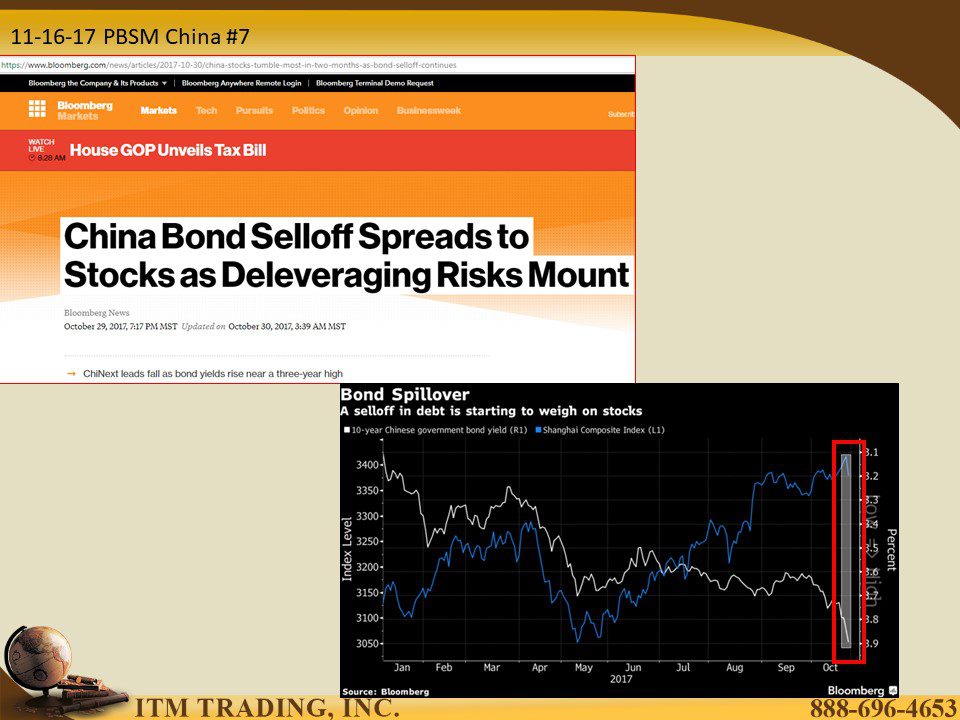

In 2015 the USD began to rise creating a new higher trading range. After bottoming in mid-2016, interest rates in the five largest bond markets also shifted higher. These two factors mean that it costs those corporations a lot more money to service and/or roll over that debt.

Why should you care? Because global fiat stock and bond markets are correlated, so what happens in emerging markets has global impact.

Slides and Links:

http://stockcharts.com/h-sc/ui

https://www.bloomberg.com/view/articles/2017-09-25/the-world-can-t-stop-borrowing-dollars

https://wolfstreet.com/2017/10/11/dedollarization-not-yet-usd-denominated-debt-outside-us/

https://tradingeconomics.com/united-kingdom/government-bond-yield

https://www.ft.com/content/5eb6d7da-9b86-11e7-8cd4-932067fbf946

https://fred.stlouisfed.org/series/DDDM071WA156NWDB

https://fred.stlouisfed.org/series/M2V