COFFEE WITH LYNETTE: GEORGE GAMMON. REAL ESTATE, RESET, GOLD

I’m happy to welcome back a very brilliant man and good friend George Gammon. He is a “Macro-addictâ€, loves gold and is a rebel capitalist! In fact he does a very popular podcast called “The Rebel Capitalist Show†as well as a fantastic YouTube channel where he conducts some great interviews as well as a live Q&A.

Last time we talked was back in early March as the Coronavirus was just starting to take over in the US but wow, a lot of things have happened since then, so we have a lot to talk about.

Coming to us from beautiful St. Barts, welcome back George, how is it in St. Barts?

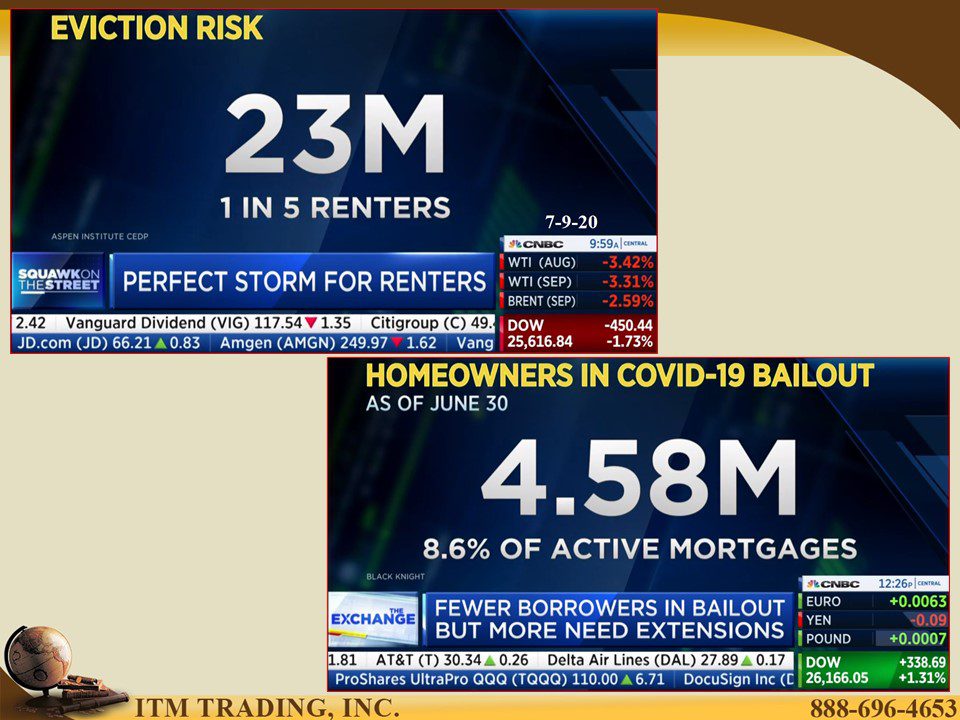

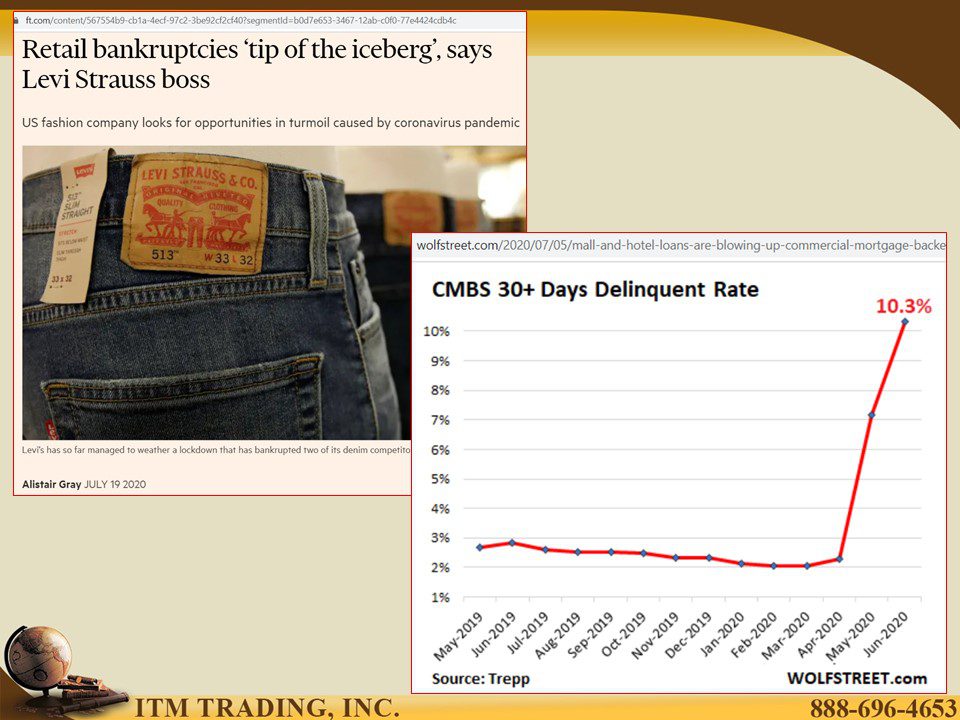

#1 Housing seems to be defying gravity and you are known as a Real Estate expert, and we are certainly hearing a lot of conflicting information, but we know that the government and government agencies, like Fannie and Freddie, have done a lot to support the real estate market. But it’s still like a big game of dominoes weather we’re looking at residential or commercial real estate.

What do you think are the most important things for people to understand about what lies ahead for first residential, then for the commercial real estate markets.

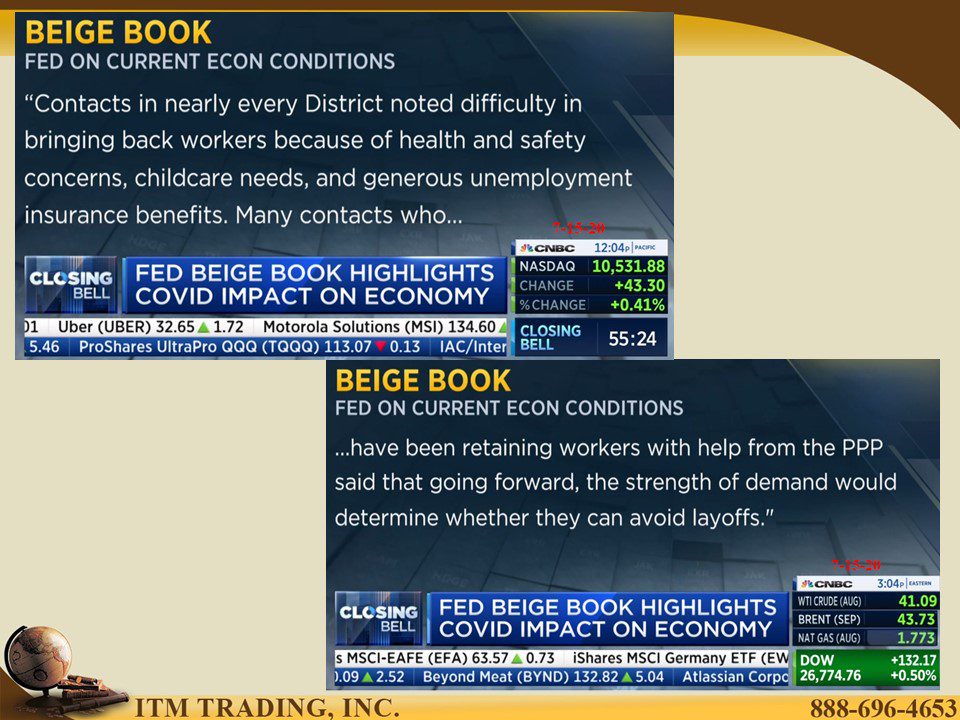

#2 The Feds Beige Book recently highlighted the covid impact on the economy and nearly every district noted difficulty in bringing back workers because of health and safety concerns, childcare needs and generous unemployment benefits enabling continued spending.

But thoses extra Unemployment benefits end late next week unless Congress extends them in some way. Some argue if they don’t extend it, that will lead to a “Demand†based recession.

At the same time Wall street markets clearly do not reflect main street driven by all this new money but also, many newbie investors rushing in as 40% of listed companies are giving investors ZERO guidance.

Seems like this could be a set up to me. What are your thoughts on the markets?

#3 I’ve been hearing more and more people talking about a “Reset†lately, In fact, that is the title of the next World Economic Forum. At that forum, global leaders will be discussing both social and financial resets.

What do you think that will look like?

#4 Both spot gold and spot silver have recently broken out. In fact spot gold is fact approaching all time nominal highs.

Slides and Links: