ZIMBABWE ISSUES GOLD COIN: Who Really Benefits?

Let’s talk about what’s happening in Zimbabwe. My guess is that some people there really wish that they had a strategy and that they had positioned into this before their currency went into deeper hyperinflation.

CHAPTERS:

0:00 Intro

1:11 Zimbabwe’s Official Inflation Rate

8:30 Central Banks Introduce Gold Coins

16:00 Zimbabwe Battling Hyperinflation

21:02 Gold Used to Hedge Against Inflation

26:00 Outro

TRANSCRIPT FROM VIDEO:

History shows us that when all confidence is lost in this guess what they have to bring in to fix it, coming up.

I’m Lynette Zang, Chief Market Analyst here at ITM Trading, a full-service, physical gold and silver dealer really specializing in custom strategies. And you know, you’ve heard me say this so many times, but I’ll betcha. Those people that live in Zimbabwe really wish that they had a strategy and that they had positioned into this before their currency went into hyperinflation, which it did God back in the mid two 2000s. And supposedly it was fixed. No, it was never fixed. They just changed the rules. But let’s talk about what’s happening in Zimbabwe.

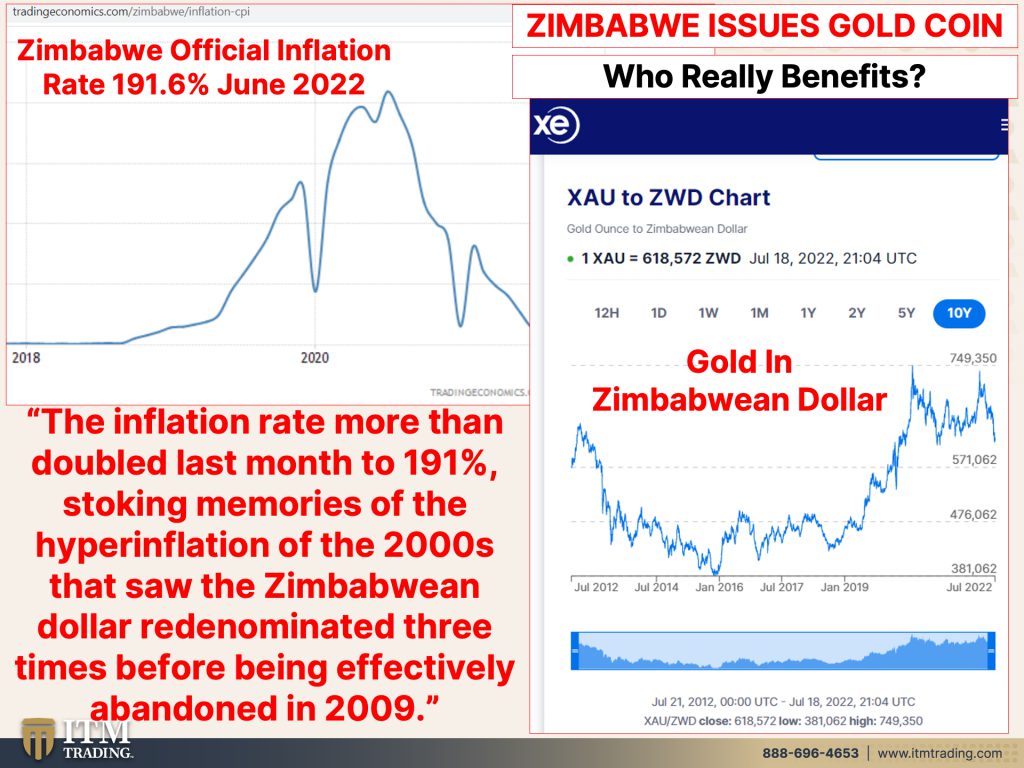

I really appreciate it when people bring things to my attention because I can’t see everything. So this is fabulous because the question is when you get to a point where hyperinflation is so rampant and they issue gold coins, who really benefits? Zimbabweans, that can’t really afford it at that point? You wanna buy it when it’s cheap, when you can and when it’s affordable. So, their inflation, well, let’s call this hyperinflation cause clearly that’s what it is. Again, is back up to almost 192% and that’s official. So we know that it’s much, much worse than that. And here’s where they had the hyperinflation before. Really have things gotten much better there? No, not really. It’s just been going on for a long time, but the inflation rate more than doubled last month to 191.6% stoking memories of the hyperinflation of the 2000s that saw the Zimbabwean dollar re-denominated three times before being effectively abandoned in 2009. Now what that means, we talk about that overnight reset all the time. When a government will take something like this, 10 trillion note and revalue it against what? Gold. So that this time though, that’s what happened back in 2009 and effectively, they were using U.S. Dollars and everything else because all confidence was lost in the Zimbabwean dollar and many people, well typically able bodied men and women would go out and pan for gold so that they could sustain themselves and their families. You don’t wanna have to go out and pan for gold when you can buy it really easily. So I wanted to show you what gold in terms of the Zimbabwean dollar looks like, like through this period, right? So two all time highs and then right now, as they’re experiencing almost 192% official inflation hyperinflation. Of course you’re seeing the spot market push down. Why? It’s really simple, a rising gold price is an indication of a failing currency and governments do not. And central banks as well. Do not want you to realize that this really has no value. Nominally, look at all those zeros, oh, here are all the zeros. Well, they were on that side too. All these zeros, 10 trillion times, zero is still zero, no purchasing power. And it’s really hard cause we’ve been trained to think of things in nominal terms, but that really doesn’t benefit at this point in time.

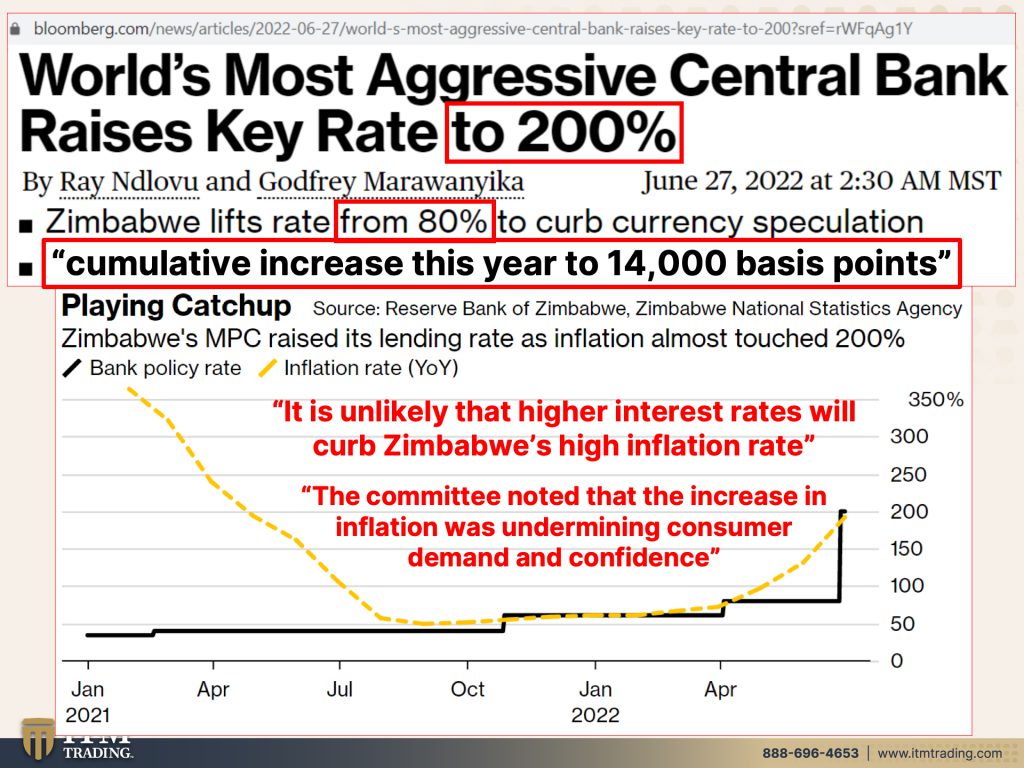

So let’s look at how that government and that central bank has been dealing with this inflation. World’s most aggressive central bank raises key rates to 200%. What is all of this talk about 75 basis point move, oh, maybe they’ll do a hundred point basis point move…it’s garbage. I don’t believe that any level of raising those interest rates is going to be able to tame the inflation this time. because they did so much of this and that is now seeping out into the normal population, into the public’s population. But they did lift the rate from 80% to 200%. Is that gonna stop the inflation? No, it’s not. Cumulative increase this year alone. Now remember here in the U.S. We’re talking about a 75 basis point move in Europe. They’re talking about a 25 to a 50 point basis move. But in Zimbabwe they’ve done 14,000 point basis move in just this year. And has it helped? No, they’re hitting official almost, you know, 200% in inflation. So, and the other part that I really wanted to point out because look, this resembles so much of what’s happening here. Yes, the numbers are higher 200 versus 8%, but you’re seeing the same kind of thing where the official bank policy rate was held way down here as inflation roared. So I’ve gotta tell you, this is the inflation rate. Did it really come down in 2021 to 50%? And what do you think that looks like when you’re going to buy anything anyway? So will this help raising the rates from 80% to 200%? I don’t think so because they don’t stop doing [central bank money printer] right. They don’t do the things that they need to, to clean up the mess that they made, cause they don’t even like to admit that their hands in the pie are what’s causing all of the problems. It is unlikely that higher interest rates will curb Zimbabwe’s high inflation rate. Okay. Let me change those words a little bit. It is unlikely that higher interest rates will curb the U.S.’s high inflation rate. It’s not gonna help. I’m sorry. I really wish that it was, but this is not the typical inflation that they are battling since 2008, the central bank has created so much money and while they were going well, look, it hasn’t created inflation. I mean your cost of living has gone up substantially since 2008, but look, it hasn’t created inflation. All that inflation was held in what they targeted for reflation stocks, bonds, interest rates. This is really important to really realize the committee noted that the increase in inflation was undermining consumer demand and confidence <laugh> ya think 200% inflation and consumer demand was a little off. It was undermining that? And oh, well why wouldn’t you have confidence? If you’re walking around, I mean, this can’t buy anything anymore, but with a 10 trillion note in there, you’re a trillion, I’m a trillionaire, but I can’t buy anything with it, but they’d rather you put your wealth and keep it inside the system. We’re gonna talk a little bit more about that in a second.

So what do they do? They increase the interest rates on deposits to inspire people, to keep their money in the banks. Among other steps announced by the central bank are an increase in deposit rates to 40% from 12.5%. Wait a minute. Inflation is basically 200%. So that means that you’re losing right by holding onto this by even depositing it and getting some interest on it at 40% with inflation running at 2%, you are a net loser, right? You don’t even realize it. So when I look at what’s happening in the U.S. And in Europe and everywhere else around the world, even with the increase in wages and all of this, but none of this is keeping up with inflation. That genie is out of the bottle and it never did.

That’s why an average wage of 9,500 in the early seventies that would comfortably support a family of four. You know, I mean now it takes two wage earners and wow. Some of the data that came in recently $250,000 a year? And you’re living paycheck to paycheck? Well really you have to realize is it that that stake is worth that much more money or that the currency is worth that much less, but what holds it together is gold. Gold protects you from that inflation. Forget the spot market that is easy to manipulate the physical market in your hand runs no political risk. And let me tell you, there’s a lot of political risk out there, but the introduction of gold coins to provide an alternative store of value. Tell me what else is, is supplying a store of value? The currency shore isn’t and U.S. Dollars are now officially in use at least for the next five years that sure isn’t, but the coins to be minted by the state owned fidelity goal, refineries LTD will be sold to the public through banking channels, whatever they can do to keep the banks in business, because that’s how they transmit policy. Zimbabweans to use gold coins for transactions and also to help reduce demand for you U.S. Dollars gives them a lot more control if they’re issuing the gold coins, because frankly, when all confidence in this is gone [fiat], this [gold] is what you, this is what countries and governments and central banks have always gone back to a hundred percent of the time to get your confidence back.

So they’re doing that to ease the demand of the high dollars. So these coins will be 22-carats and will be tradeable outside the country. Why? Because gold does not need a government to say it’s money. It is a global asset with use in every single sector of the global economy. It’s that simple. So sure you could take it anywhere and instantly have the same or similar level of purchasing power. They will also be used as security for loans and credit lines because this is stable. Now in this country, of course we don’t want you to think of gold as money or you know, anything other than an old Relic, but this or even these are used in one area, this is used everywhere. What’s more stable than that? Honestly, think about it. Zimbabwe Central Bank plans to sell gold coins to the public from July 25th. So coming up, as a store of value to stabilize the nation’s tumbling currency and offer an alternative to the U.S. Dollar, who are they really doing this for? We’re gonna talk about that in a second and I’m gonna show you how we did the same thing in this country. But the gold coins will be available for sale to the public in both local currencies. So you could use this to convert it into and U.S. Dollars and other foreign currencies at a price based on the prevailing international price of gold and the cost of production. So you saw how I showed you in the beginning. Let me go back to it and I’ll show you what I’m talking about. Okay. So you see how spot market is dropping in here. I mean, it’s still hitting a support level and all that, but it’s dropping in here. I think that is in anticipation and in preparation for the issuance of these gold coins, frankly. And we did something very similar that here in the U.S. But the 22 car gold coin will be identified by a serial number. So it’s gonna be traceable and can be easily converted into cash tradeable locally. So used as a tool of barter and internationally used to transact. So anywhere in the world. Now in 1933, remember in 1933, they took gold away from the public and we could not use it again or have access to it more than five ounces other than the way that my uncle held it, which was pre-1933 gold coins. But in 1965 magically and suddenly when it was still illegal to hold more than five ounces in this country, we issued a gold certificate again. Now, who do you think knew about that gold certificate? The guys that came up with that laws. So they couldn’t convert those certificates into physical gold at that time, cause you couldn’t hold more than five ounces of it, but that certificate could certainly trade. What did they buy that out? Oh, maybe probably some around $35 an ounce, which was the official gold price. And all you had to do was hold it until it was made legal to own gold coins again. And then the spot market took off an intra day high of 825. So when you stop and think about it in terms of Zimbabwe, you know, how many people in that country are gonna be able to even afford an ounce of gold? I think it’s kind of interesting when you think about it, we’re gonna talk just a little bit more, cause I’m not the only person that’s thought that, but what would they also wanna do? You can convert U.S. Dollars into gold coins and that stops up or takes off the market U.S. Dollars, which are also being used there now.

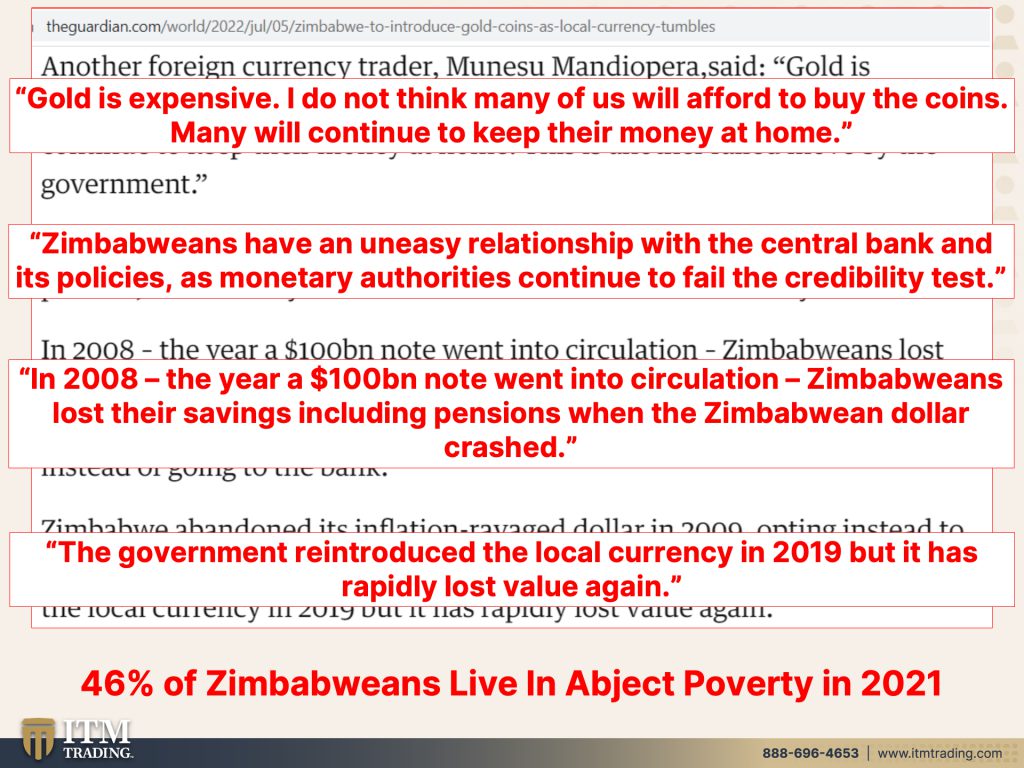

Anything to try and battle this hyperinflation that they’re going through, which honestly never really stopped. So this is a country that’s been going through hyperinflation. Well, officially, since like 2006, that’s a very long time, very long time. And so they say gold is expensive. I do not think many of us will afford to buy the coins. Many will continue to keep their money at home because they don’t trust the banking system and our confidence in our banks. I mean, this is the problem with high inflation, let alone hyperinflation, but the high inflation undermines the confidence, consumer confidence, inflation expectations, it’s perception management. That’s what they’re trying to do is manage your perception so that you move forward in a manner that benefits them. Not necessarily you. So most of the population there can’t afford this anyway, their hyperinflation has been going on for a really long time. So it’s the wealthy that’s gonna benefit from them. The wealthy Zimbabweans. Zimbabweans have an uneasy relationship with the central bank and its policies as monetary authorities continue to fail the credibility test. And that is the test that is upon the U.S. Central bank, the European central banks. So many central banks are now coming up to this credibility test. And let me tell you, they will fail it. They will fail it. They will fail it. You better protect yourself. It really is that simple. And when it comes to credibility, remember, it was in 2008 when the bank to bank the interbank lending plummeted. So it was in 2008 when banks no longer trusted other banks, 2015 with the Swiss surprise central banks, no longer trust central banks. And now just recently with the fed saying a 50 point basis, raise 50 points. And then they did 75 points. The markets no longer trust the central banks. It doesn’t mean that they’re not going to try and work together, but it means that that credibility is gone from those three areas. There’s only one area remaining and that’s the public believing that the central banks can actually do something. And I think you’re all gonna find out. We’re all gonna find out really shortly. If we haven’t already figured this out, they can’t. This inflation, they’ve lost control already. That’s why it’s so important to get ready. In 2008, the year a hundred. Well, this is a 10 trillion, but a hundred billion note went into circulation. So Zimbabweans lost their savings, including pensions. When the Zimbabwean dollar crashed, it’s still crashing. So the middle class obliterated and we’ve watched the decline in the middle class, in this country for quite some time. The government reintroduced the local currency in 2019. And we talked about it at the time, but it has rapidly lost value again, shocker, because they don’t change behavior. They just change the rules. They change the way they present it to you, but they don’t change behavior. Well, and sometimes it’s too late, even if you try and change behavior, but we aren’t there yet. 46% of Zimbabweans live in abject poverty. So again, who’s gonna benefit from the issuance of this one ounce gold coin? And remember, I didn’t say a hundred percent are in abject poverty. I don’t want anybody to be in abject poverty, whether you’re watching me or even many people that aren’t paying attention to this at all. But a lot of people will end up that way. Do what you can while you still have the opportunity. While gold is on sale, cover your assets. Get ’em covered. Get prepared with Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. Get it done. Get it done please.

Last week the finance minister said the gold coins will give you more value. Yes, because inflation does not erode its value because it is the only financial instrument or asset that runs absolutely zero counterparty risk. So yes, it’s gonna give you more value. Gold coins are used by investors internationally to hedge against inflation. I mean these are simple facts. Their major role is to act as a store of value, but also to work as a viable investment asset. Why? Because it is so severely undervalued. That’s why, it’s not, I mean, gold never really changes. An ounce of gold is an, an ounce of gold. That number that you see on this spot market. So easy to manipulate and change how you think about gold, but gold doesn’t require any government, any central bank or any market to say that it has value simply because it has the broadest base of utility. The broadest base of buyer, the value of gold has always been increasing at times the global economy has been on recession. Well, everybody’s talking about the upcoming recession now everybody is talking about it because it’s pretty darn obvious. We are between a rock and a hard place. And you know, this is what will save you gold and silver. The high demand for the U.S. Dollar in Zimbabwe, out of the frying pan into the fire, which is fueling exchange rate volatility would weaken as the public accepts the gold coins. Because quite honestly, it’s in our DNA. We’ve been trained to think of it as an old Relic, but why are central banks accumulating it as quickly as they possibly can? Because they know what they’re doing to their currencies. Zimbabwe is not alone in this. The new monetary policy intervention by the central bank would not address inflation, which is expected to continue soaring.

So what they’re really talking about here, and I get questions about this all the time, is a currency being backed by gold and convertible into it. So, oh, China’s gonna back their currency with gold. No they can’t. And Zimbabwe can’t back their currency with gold either because as soon as they do wherever that debt is, boom, it’s fixed. And it’s unpayable so it’s certainly not gonna be payable if it’s absolutely fixed because all they really do now to go into a new system is hyper-inflated away. That’s why when they reintroduce the Zimbabwean the new Zimbabwean dollar in 2019, it rapidly lost value because they didn’t put any store of value in there. That’s why they’re issuing the coins now because the wealthy are having a great impact. They wanna hold their purchasing power. And that also puts them into position to take advantage of what’s happening. And that’s part of the strategy that we utilize here at ITM Trading. Remember I’ve studied currencies and currency life cycle. Since 1987, there are repeatable patterns. I’m seeing them all over the place, all over the place. I’m seeing these patterns that are the same as before and before and before. These are historic patterns. And even though I can’t guarantee tomorrow, cause that’s way beyond my control. I can tell you for a fact that if it smells like a duck and it walks like a duck and it quacks like a duck and lay eggs like a duck, mm it’s probably a duck. So don’t tell me it’s an elephant. Don’t tell me that it’s something different. And this time is not going to be any different, cause we’re not doing anything different. Maybe we’re printing more money, etcetera, but we’re really not doing anything different. And that’s what happens when all confidence in the currency is lost. People fly to the safety of gold. That’s why they have to suppress the price because they don’t want you to buy this. Once you buy it, you’re out of their system. Don’t believe the lie. Get yourself into a proper position to not just weather this storm. But dare I say it take advantage of it.

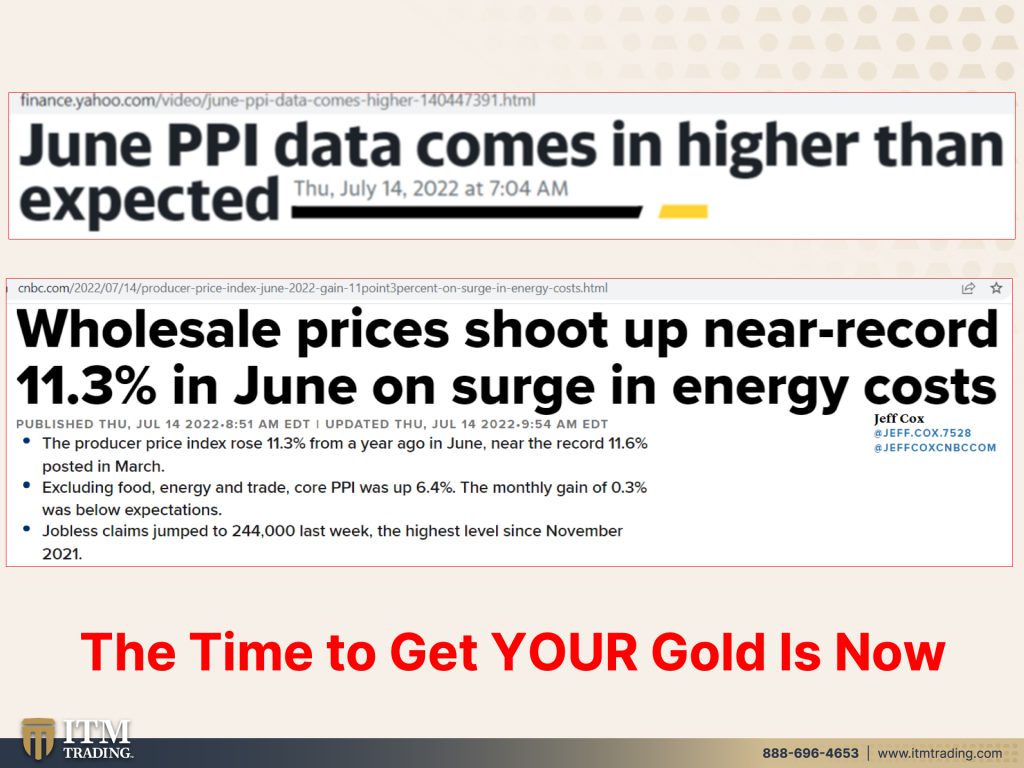

Because if you think that inflation anywhere in the world right now is going away. If you think these central banks that got us into this mess to begin with, know how to get us out? Think again, you know how they’re preparing to get themselves out of this mess and stay in control and stay and retain their power and their choices? This is what they’re doing. They’re accumulating gold. You need to be doing the same thing along with Food, Water, Energy, Security, Barterability, Wealth Preservation, Community, and Shelter. Get it done, because this inflation is only gonna get a whole lot worse. And guess what? The wholesale prices feed into inflationary numbers. The time to get your gold is now, just do it. You take possession, physical only physical only because when they do this revaluation, they take something. This Fiat money that has no intrinsic value is only used in one place. And it gets revalued. These overnight devaluations, it gets revalued against gold. That is all intrinsic value. Fiat money, good money. The choice is yours. And I’m telling you no doubt at all. No doubt. The time to get prepared is now get your gold, get your silver. If you don’t have a strategy, call us just click that calendly link below. Talk to one of our consultants, get your personal strategy in place. It’ll look similar to mine because we use my strategy as the foundation, but you have different circumstances. So all of these strategies are customized. Please get it done. What are you waiting for? No time to procrastinate. Look at all the things that are going on and swirling around you.

The time to act is now. So if you haven’t watched last week’s interview with Dr. OT and his meeting with the former fed chairman, Paul Volcker definitely do so. And share that video and share this video with everybody that you possibly can. If you have a lot of friends on Facebook or however you might use your social media, please share these links. It is critical that everybody really understands what’s going on. And if you haven’t done so already, please make sure to subscribe, leave us a comment, give us a thumbs up and help your neighbor, help your community. Understand what’s going on because a hundred bazillion percent cover your assets now and do it with gold. Do it with silver for barterability. Just get it done. Make sure it’s physical. Make sure it’s in your hands or close to where you can get it at a moment’s notice. And until next we meet, please be safe out there. Bye-bye.

SOURCES:

https://tradingeconomics.com/zimbabwe/inflation-cpi

https://www.xe.com/currencycharts/?from=XAU&to=ZWD&view=10Y

https://finance.yahoo.com/video/june-ppi-data-comes-higher-140447391.html