Why You Need Gold and Silver to Battle Inflation

To understand why Gold And Silver To Battle Inflation it is good to first understand the fiat money system we live in. To create money in a fractional reserve/fiat monetary system you must first create debt. The US government issues Treasury Bonds to be redeemed with fiat currency in U.S. dollars. Fiat currencies are supported by the ability to create more debt. Over time, all fiat currencies lose purchasing power through inflation because the more money that is created, the less value each dollar has.

Gold’s contrast with fiat currency

Because there is a finite amount of gold it tends to maintain its ability to purchase the same amount of goods and services over the long-term. And because it holds its value, governments hold it as a reserve asset against the debt they accumulate. Thus it is the primary currency metal. Over time as sovereign debt increases, the value of gold goes up in terms of fiat currencies.

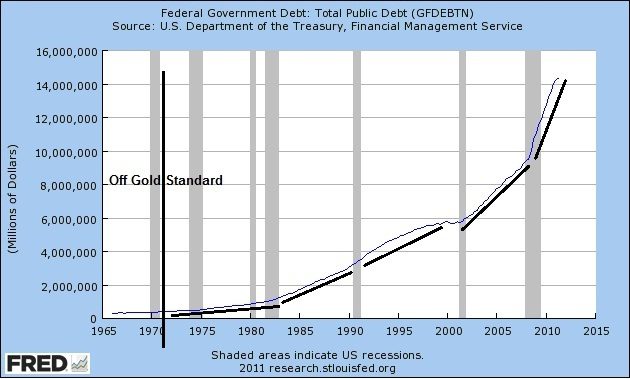

Sovereign debt in the U.S.

Consider the USA’s current debt as seen in the chart below, roughly $15.2 trillion. There are only three ways that the government can deal with this debt. They can roll it over, default on it or service it. Most governments choose to service debt through money creation.

Money out of thin air

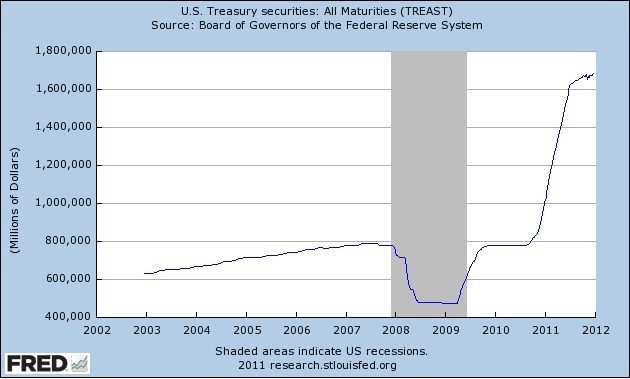

The following chart from the Federal Reserve dated 12/28/11 reflects the amount of treasury bonds accumulated by the Fed, also called Quantitative Easing. Simply put, because our government wanted to continue deficit spending, they created more debt to auction off (treasury bonds, notes or bills) and convert into dollars. The bad news was that not enough buyers showed up at the auction. So the Federal Reserve bought the treasuries themselves with dollars they created out of thin air, a signal that the government is losing the ability to create more debt.

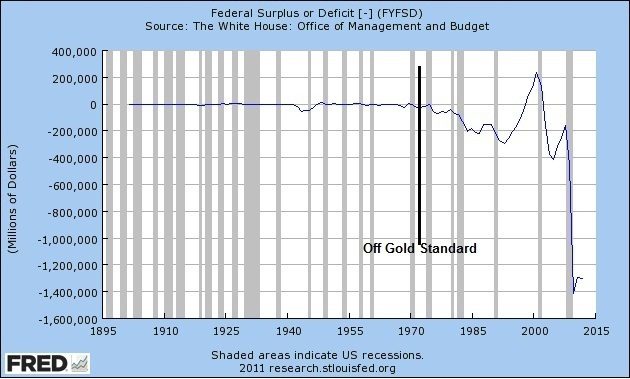

Defaulting on the debt would be ruinous. And the income from taxes is insufficient to service the current debt and government spending, sending the U.S. finances into a downward spiral as witnessed by the deficit chart below.

Living beyond our means

Going back to 1900, our dollar was tied directly to gold and that forced our government to balance the budget and live within their means. But the chart above shows that once that tie was severed in the 1970’s, government spending has consistently outpaced income.

As long as our economy grew at a reasonable rate so did the tax revenue needed to service our ever expanding deficits. But since the onset of the current credit crisis the deficits have exploded creating even more debt to service at the same time that tax receipts are hurt by high unemployment and a stalled economy.

This suggests that we will all have to pay more taxes to service the debt, but even that isn’t enough to deal with the exploding debt.

That leaves only one option: repay the debt with devalued currency. There are only two ways to do to value a currency; one is against other fiat currencies and the other is against gold. When a government devalues it does it against both.

Dollar vs. Euro

The US dollar holds the title of “The Worlds Reserve Currency.†This means that if you are a government or corporation going outside of your borders to buy oil, food etc. you must pay for those goods with US dollars. Therefore, all currencies are judged against the dollar.

The following chart shows the US Dollar versus the Euro. When the US dollar goes up the Euro dollar goes down and vice versa.

Dollar (& other currencies) vs. Gold

The following chart shows several key currencies versus gold. Clearly gold is up against every fiat currency because gold is a store of value.

How inflation robs you

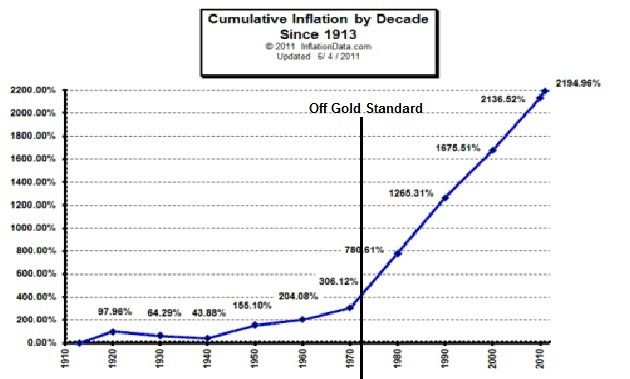

The above chart illustrates a currency race to the bottom. Remember the purchasing power of gold really never changes; it’s the number of pieces of paper that it takes to buy goods that change.

Through inflation, it takes more and more pieces of fiat paper to buy the same goods and services. Inflation is an invisible tax on your wealth. When a pound of butter suddenly costs 25% more than it used to, it’s not that the butter has increased in value; it’s that the dollar has lost 20% of its value.

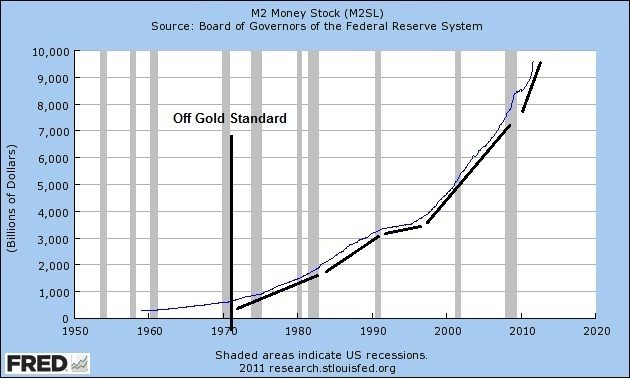

The more money that the central banks create, the more inflation robs you of your purchasing power as witnessed by the following charts on money creation and inflation.

Through inflation, the government and central banks are transferring your wealth their way in order to deal with all of the debt they are growing. This is why gold historically has gone up to heights not believed possible in terms of fiat currencies. This is why you need to own both gold and silver. Historically, the central bankers and government continually act to devalue the dollar and the only way to maintain your purchasing power is to own gold and silver to battle inflation.