Types of Debt

Video

Text

Hi I’m Lynette Zang chief market analyst here at I am trading a full-service physical precious metals brokerage house.

I’ve had a lot of people ask me about debt white so bad etc so that’s what we’re going to talk about today for one thing you need to know that there are two types of debt self liquidating debt so in other words you take on debt and maybe you expand your business the business earns more money and it pays that debt off so you can see the dead go up and then down and then non self liquidating debt and that’s the kind of debt like the government builds the bomb is loaded up it’s never going to pay for itself so those are the two types of debt now typically when you take on debt you have interest so if this is the interest rate and this is the principal value of the bond okay when interest rates go down the principal value of the bonds that are already issued go up when interest rates go up the principal value of the bond that’s already been issued those debt so that’s why interest that’s one reason why interest rates matter in this and with the current interest rates at the lowest levels historically and the debt levels is the highest.

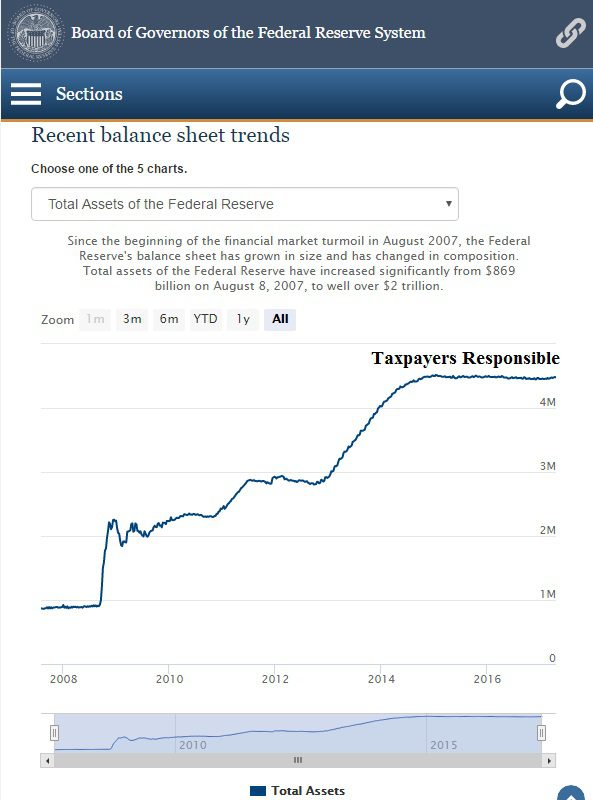

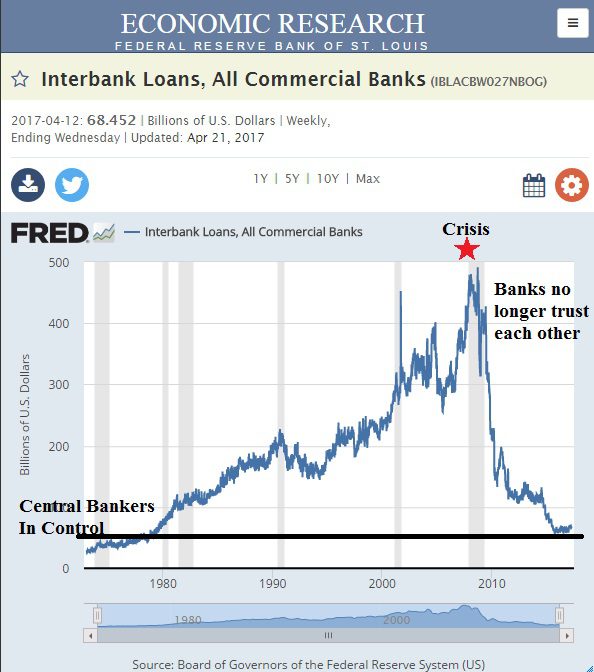

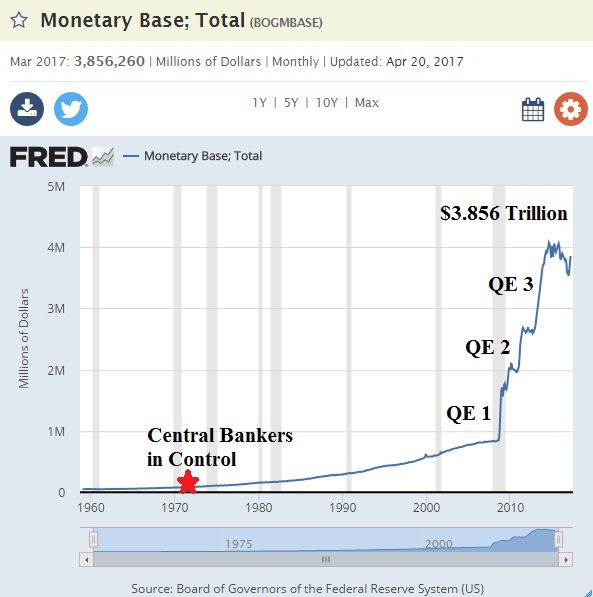

Perhaps you can see why that’s a challenge but now I’m going to walk you through this story and I’m going to start with this Federal Reserve chart on interbank lending okay so when the crisis hits you can see this is Bank loaning to each other so they feel confident that they’re going to get their money back well all of a sudden when the crisis hit you can see that the levels of bank’s loaning to each other we’re back where they were when with this whole piece just started so it’s quite clear from this you do not give a low and if you do not think you’re going to get paid thanks do not trust each other so who stepped into the for a and this is very important by the way because it supports the market so who stepped in well the Federal Reserve stepped in and rather a big way now they now say that they’re going to reduce this but we’ll see that’s another webinar for another day.

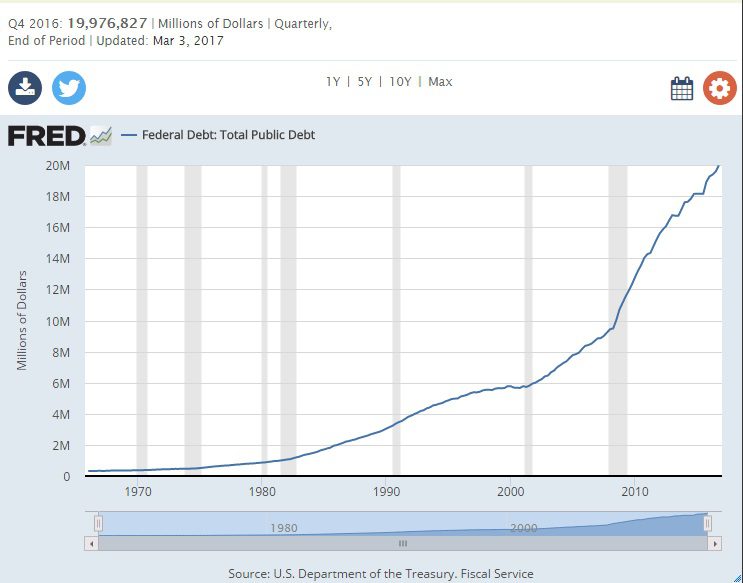

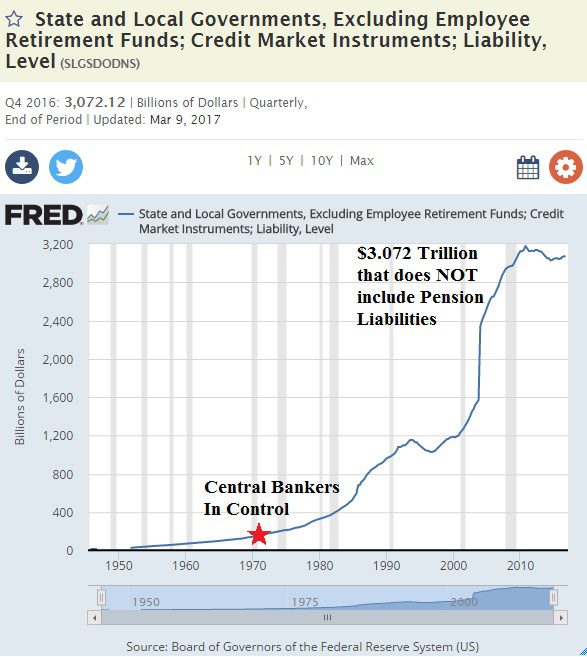

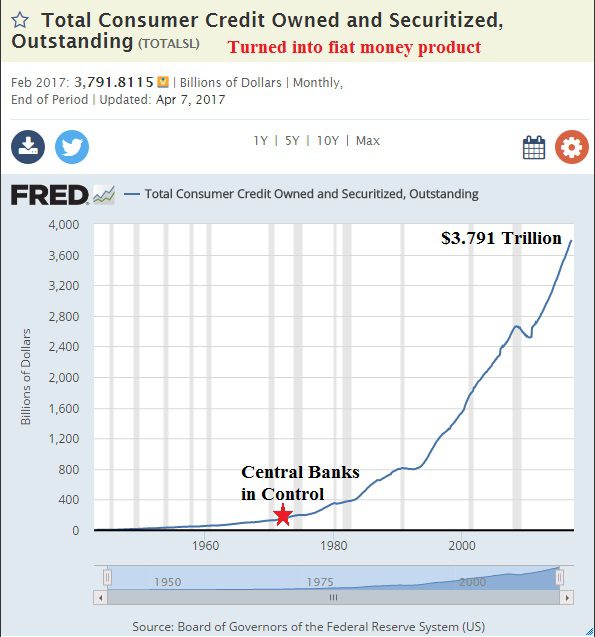

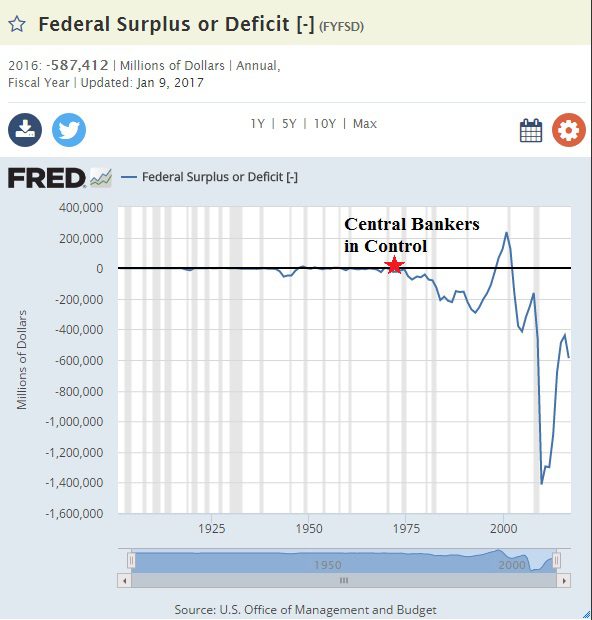

You and I as taxpayers are responsible for that debt that wasn’t enough to create enough liquidity and credit so here’s QE one this is the government buying Treasury bonds qe qe you do not see anywhere in here this pattern until you get here this is a hyperinflationary pattern and by the way this is when we went on to a full fiat money debt system and they’ll be linked so you go in and look at it now what wasn’t actually enough so when we say this is the Fed started buying the mortgage-backed securities and created even more debt wonderful in addition now by the way do you see anything going down now that would be enough this is state and local debt without retirement and pension plans in it again here’s where we went on full debt it just keeps going up they don’t intend to ever pay this debt off I don’t care what they say let’s see this is oh the federal debt and you know we hit the debt ceiling that trillion we’ll see they’ll probably raise it but again.

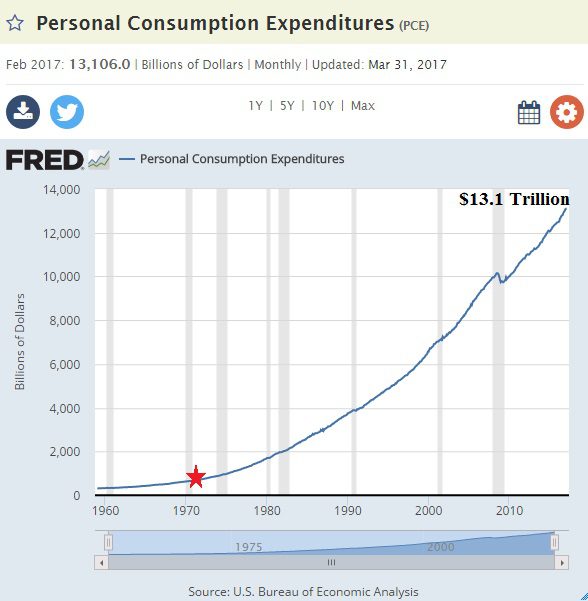

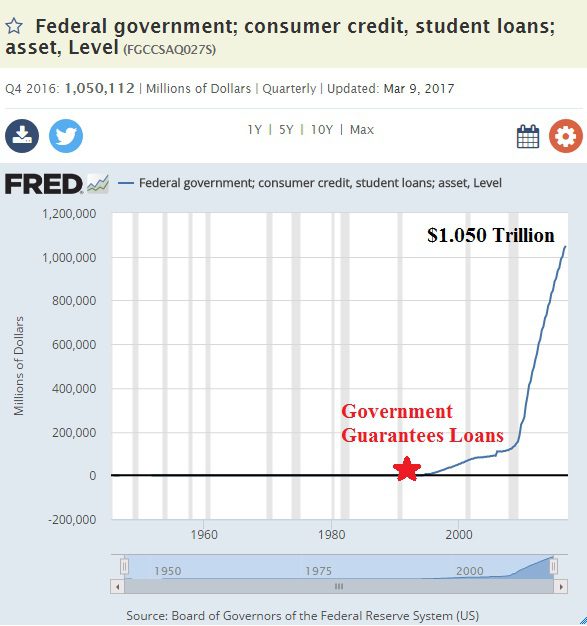

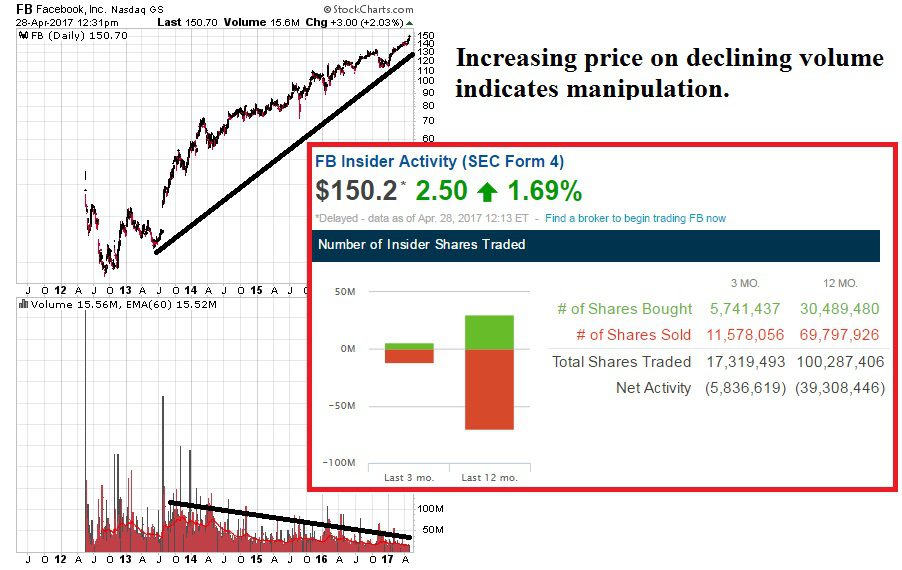

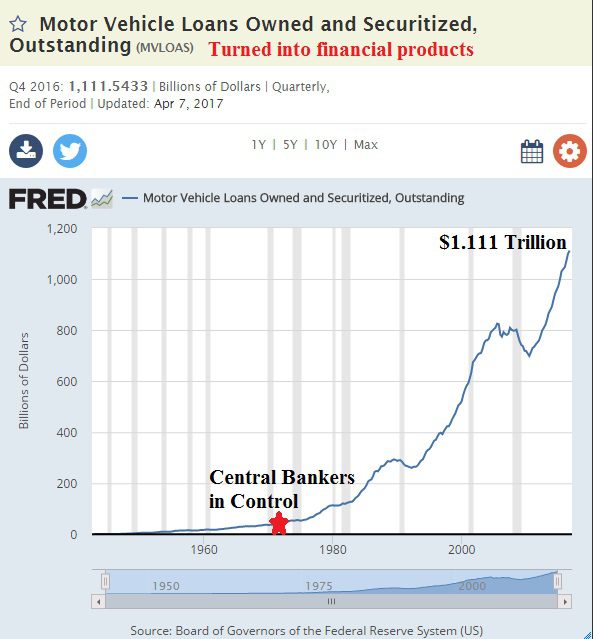

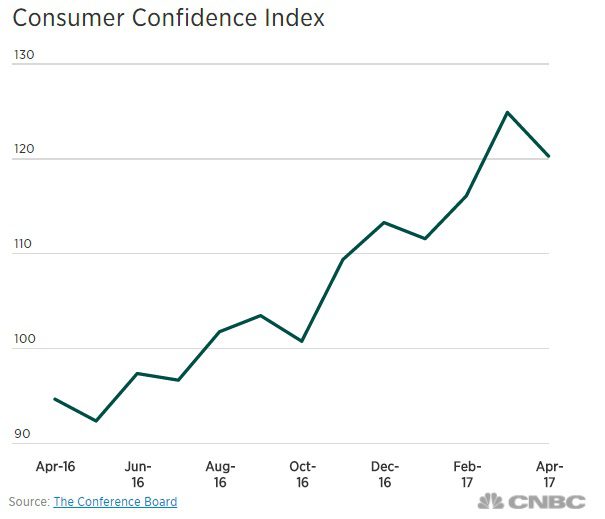

Not going down this is personal consumption debt not going down these are these are credit card debts Plus that have been turned into financial products again not going down can you see this pattern here that I’m trying to show you student loans not going down auto loans not going down okay margin debt stock market a new high so is margin of debt okay how is all of that possible why hasn’t that exploded I mean if you put it into a personal level if all you ever did was grow debt and never pay them off well at some point you’re not going to be able to pay them we’re going to talk about that in a second but this is it this is the only piece is confident in the dollar the confidence that the markets will keep going up this is the only thing that allows all of that debt to continue.

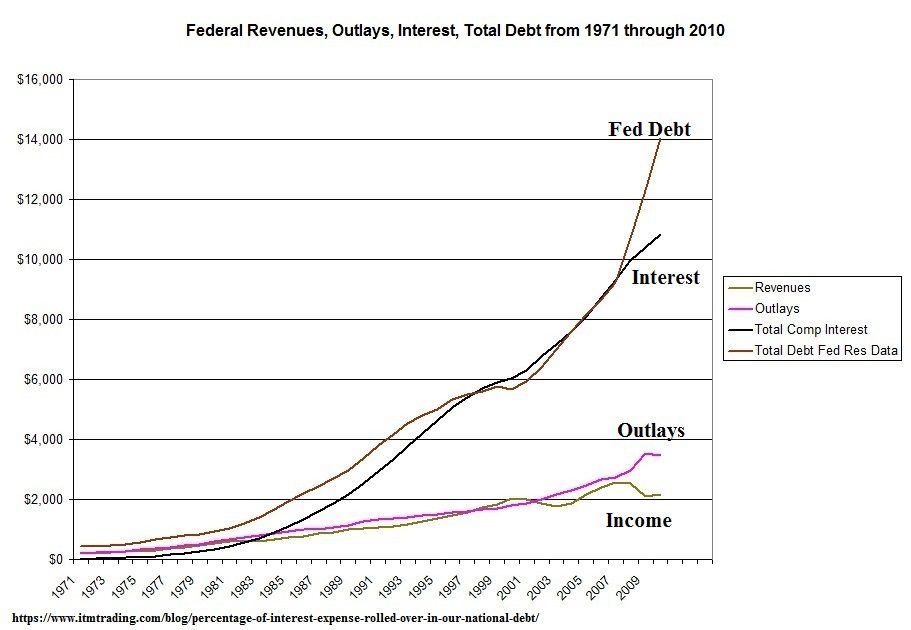

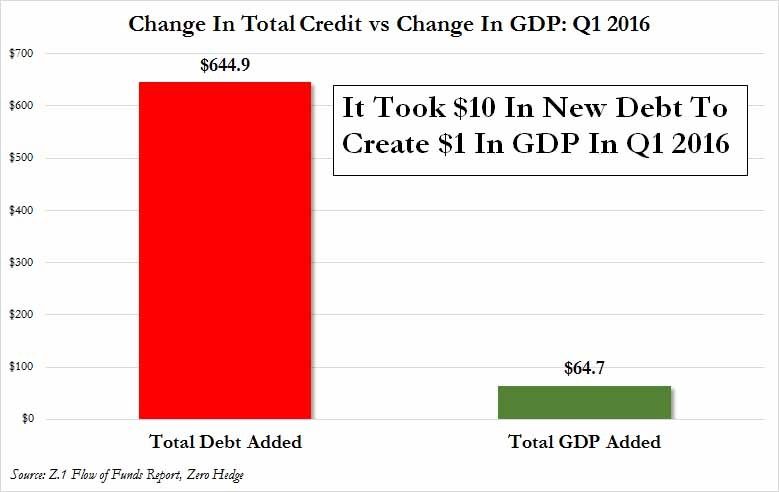

Now they say that they’re creating all of this debt and that creates all this new money to stimulate the economy so the GDP okay it took over $ in new debt to generate cents in GDP that is non self liquidating debt at some point it must be repaid but the impact of this is quite clear this is the purchasing power chart there’s only four cents left so this is the impact of all of that compounding debt and remember too it’s not just as what it’s all of the interest on that debt so even if we were to stop growing any more debt which is definitely not what they’re going to do but if it is this interest will continue to compound here is income here is outlays here’s compounding interest and there’s the debt I mean it should be pretty self-explanatory so there is an obligation to repay but once you have so much debt that those debt service payments make it more challenging to grow more to grow even more debt or stimulate your economy.

Then you have the most important chart in my opinion which is this monetary velocity chart it is worse now than it was during the Depression and that actually shows I know we just looked at that chart on consumer confidence up somewhere near its all-time high but this actually shows you that people are not spending money so all of that debt growth this is what’s supposed to be generating the income to repay that debt not happening it’s really simple not happening but this is what is the foundation of our money so this little Federal Reserve Note now I’m not going to rip up this one because this is actually I had to borrow it but I’ll tell you what you can do with that that’s what you can do with it what kind of money was the only kind of money that has no debt attached and definitely you cannot tear that up gold and silver real money physical in your possession is the opposite of all of this debt and there is even more than I could have shown you it’s the opposite of all of this debt at some point you either have to default on that debt or you have to pay it should be pretty clear we’re not paying it back what’s the other alternative so I hope that made that a little bit more clear why we’re in a very dangerous position with interest rates and all of this debt we haven’t even talked about the obligations of the promise is just that and that’s it for today.

Subscribe to us on YouTube follow us on Twitter like us on Facebook and give us a call six nine six four six five three and share this information with everybody we need to know this have a great day bye

Finding ITM Trading Online

Website – https://www.ITMTrading.com

Webinar Archive Page

https://www.itmtrading.com/blog/itm-tradings-webinar-archive/

Shop for gold and silver online

https://www.itmtrading.com/buy-gold

YouTube – https://www.youtube.com/user/itmtrading

FaceBook – https://www.facebook.com/ITMTrading/

Twitter – https://twitter.com/ITMTrading

Buying Gold Online is easy. Look at these prices!

Images